bymuratdeniz

Thesis

Devon Energy Corporation (NYSE:DVN) stock has underperformed the S&P 500 (SPX) (SP500) since we encouraged investors to cut exposure before the release of its FQ3 earnings card.

Accordingly, DVN notched a price change of nearly -13%, relative to SPX’s price gain of 6.2% since our previous article. In addition, the leading independent E&P company posted a Q3 release with forward guidance that some analysts considered “soft” on the call. Coupled with a lowered variable dividend for Q3, investors are justifiably concerned about the sustainability of its dividend strategy.

Our analysis suggests that investors need to be prepared for further normalization in its topline and earnings growth through FY24. Moreover, the underlying energy markets have weakened further in Q4, likely impacting Devon Energy’s average realized prices moving ahead. Also, the company does not expect its production levels to increase significantly in FY23. As such, Devon remains susceptible to underlying energy market volatility if the market anticipates further de-rating is necessary to reflect worse recessionary risks.

We believe the risks of a significant downturn intensified with the robust employment report last Friday. Furthermore, relatively optimistic oil and gas industry analysts’ estimates have likely not captured the full extent of a significant downturn. Therefore, Devon Energy investors are reminded that there could be further earnings compression risks if the market anticipates additional downside risks is appropriate due to a more hawkish Fed through FY24.

DVN last traded at an NTM Core P/E of 7.5x, ahead of its broad oil & gas peers’ median of 5.9x. However, it remains below the S&P 500 E&P peers’ forward P/E of 8.3x, suggesting a valuation discount against its direct peers.

Hence, DVN’s valuation doesn’t seem to be aggressively configured at the current levels. We also gleaned that its price action has been consolidating after its recent pullback. In addition, its momentum has also entered oversold levels, suggesting buyers have returned to stanch further downside.

Hence, we believe it’s appropriate for us to move to the sidelines at these levels to assess the consolidation zone further.

Revising from Sell to Hold.

DVN: Clear Normalization In Its Critical Upstream Segments

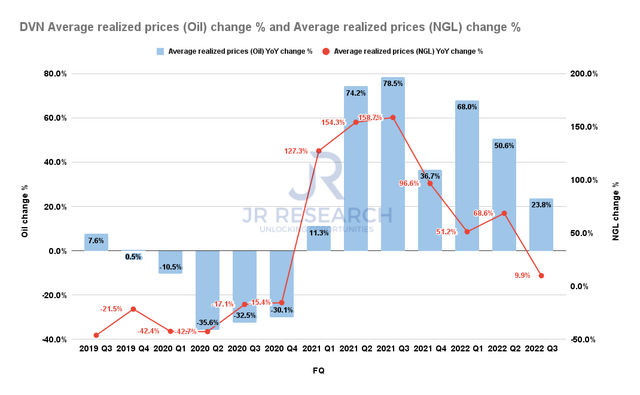

Devon Energy Average realized prices (Oil & NGL) change % (Company filings)

We cautioned previously that investors need to expect further moderation in its operating metrics as it laps tougher comps.

Hence, investors should not be surprised that its Oil segment’s average price growth slowed to nearly 23.8% YoY, down from Q2’s 50.6% uptick. In addition, its NGL average prize growth moderated to just 9.9% in FQ3.

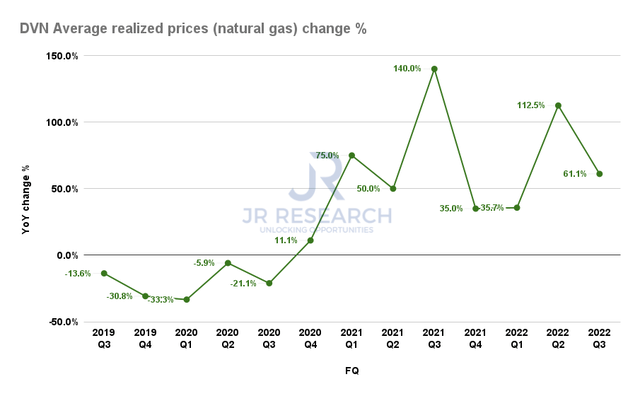

Devon Energy Average realized prices (Natural gas) change % (Company filings)

DVN’s natural gas segment produced an average price growth of nearly 62% in FQ3, driven by the surge in NYMEX futures (NG1:COM). However, that spike has mostly been digested, even though it remains above its October lows.

Moreover, NG1’s current price of $7.22 remains below its Q3 benchmark price of $8.2. Our assessment suggests that a further spike toward its August/September highs is unlikely, even as Europe works out its price caps framework. Energy research firm TPH&Co. also warned investors about a further slide in 2023, as it articulated:

We may be early as there is still plenty of potential winter weather ahead, but under a normal weather scenario over the next 18 months, we continue to see significant downside risk to natural gas prices. Our view is that gap needs to collapse toward $3 or less in the second half of 2023, to effectively shut down supply growth in the first half of 2024, before you get LNG kicking in heading into 2025. – Barron’s

Is DVN Stock A Buy, Sell, Or Hold?

With price normalization headwinds across its upstream assets, Street analysts were likely looking for more robust guidance in FY23. However, management’s commentary of “volumes in the upcoming year are likely to be in the bottom half of our targeted growth range of 0% to 5%” suggests that DVN remains vulnerable to a steeper fall in the underlying energy markets.

In a recent S&P 500 ETF (VOO) article, we also discussed why an increasingly hawkish Fed could be troubling for the market. Therefore, last week’s robust employment report has reignited our concerns that the Fed could be forced to keep rates at restrictive levels for longer than the market had anticipated.

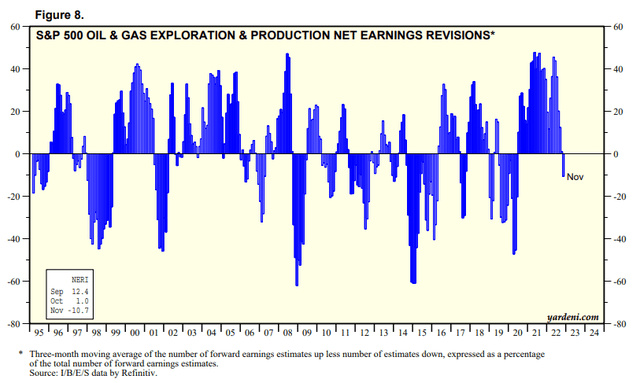

S&P 500 E&P industry net earnings revisions % (Yardeni Research, Refinitiv)

Consequently, we believe the relatively optimistic earnings forecasts of E&P industry analysts have further downside risks not baked in if the market anticipates a more considerable downturn. Hence, we urge investors to consider their allocation carefully if they are assessing whether to buy the recent pullback.

Notwithstanding, DVN has moved into oversold zones, with consolidation taking place. Hence, we parse it’s appropriate to move to the sidelines at these levels.

Revising from Sell to Hold for now.

Be the first to comment