zhengzaishuru

Introduction

Bear markets aren’t fun. As most readers know, I have almost invested almost my entire net worth in (long-term) investments. Seeing markets drop more than 20% this year isn’t that great, to put it mildly. However, I’m far from depressed as steep drawdowns offer tremendous opportunities. The best long-term investments are the ones where people buy fantastic companies way below “fair” value. That doesn’t usually happen in bull markets. Just like at the gym, there’s no gain without pain. As markets are again in free fall, I believe it’s time to (re)visit some of the investments that carry tremendous long-term value. Devon Energy (NYSE:DVN) is one of them. This low-cost oil producer and dividend darling was up more than 40% from the July lows when the market started to price in a hard landing, causing the stock to drop more than 20% in less than 20 trading days. In this article, I walk you through my thoughts as I make the case for investments in what is quickly turning into one of the market’s most hated sectors again.

So, bear with me!

What Happened To Oil?

I’m bullish on oil on a long-term basis. I’ve covered that in dozens of articles over the past 2 years. For example, earlier this month, I made the case that the “FANG” stocks of the next decade are stocks like Diamondback Energy (FANG).

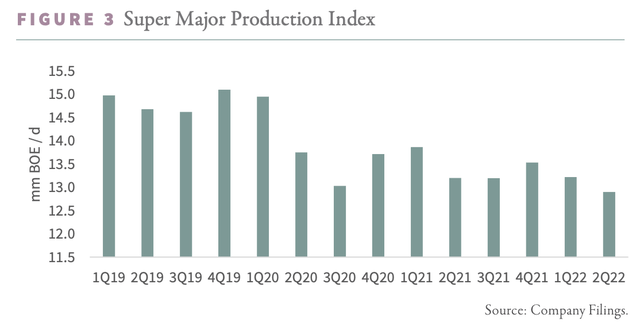

Essentially, my bull case was (and still is) based on subdued supply growth in a world where demand for oil isn’t going anywhere. If anything, oil demand is expected to grow on a long-term basis as emerging markets need reliable and affordable energy to grow their middle class. That’s where oil, gas, and coal come in. Meanwhile, large companies are reducing investments in production as some are pressured by activist investors while others simply aren’t willing to increase supply to risk a steep decrease in oil prices.

Goehring & Rozencwajg

After all, if oil crashes again, none of them expect to receive any mercy from governments and banks as long as headlines like the one below keep popping up:

The Hill

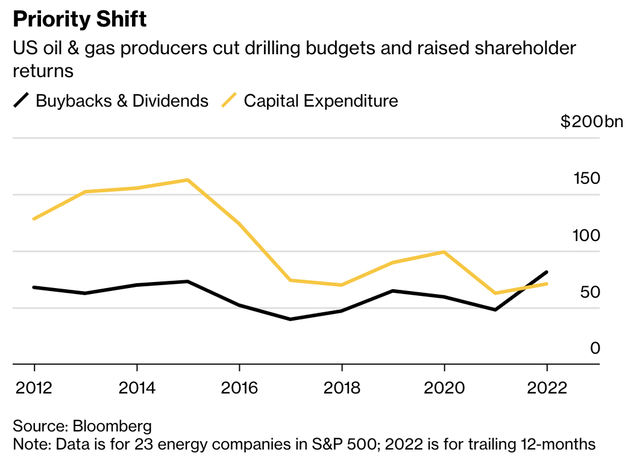

As a result, the S&P 500’s 23 energy companies started this year by prioritizing buybacks and dividends over capital expenditures. That’s truly impressive and confirmation of pretty much everything we have discussed over the past two years.

Bloomberg

Essentially, what we’re seeing is that governments, non-government organizations, and corporations all want to get rid of oil. Hence, oil companies are now not increasing production knowing they are creating a situation where subdued supply growth will cause prices to rise. I wouldn’t say that this is price gauging. It’s smart and it will bite most net-zero policies in the [you know where].

With that said, oil did very well this year. NYMEX crude oil (that’s WTI) made it to $125 per barrel on two separate occasions. Once when Russia invaded Ukraine and once more when the demand/supply imbalance continued to work its magic.

TradingView (NYMEX Crude Oil)

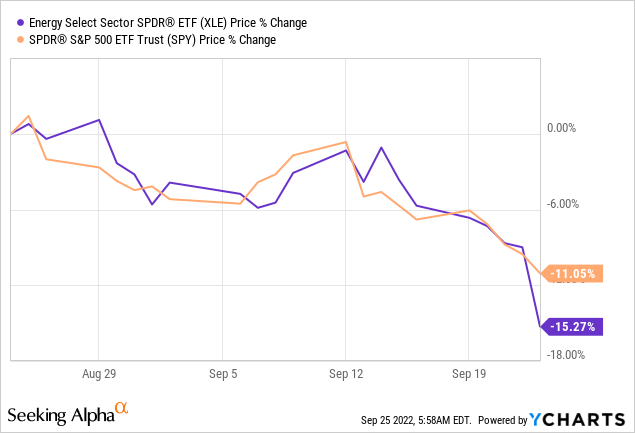

Unfortunately, since then, oil has fallen back to less than $80 per barrel. It led to energy leading the S&P 500 lower as the sector underperformed the broader market by roughly 420 basis points over the past four weeks.

What we are now seeing is that investors have shifted their focus from the supply side to the demand side. Thanks to a very hawkish Federal Reserve (and European Central Bank, and Bank of England – among others), investors are afraid of a so-called “hard landing” where the Fed is unable to bring down inflation without causing the market to suffer.

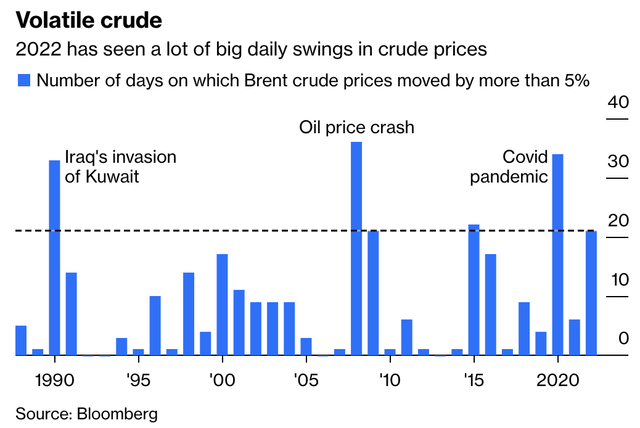

It’s also causing volatility to reach levels that have only been reached during unusual sell-offs as the chart below shows.

Bloomberg

After the Fed hike, I wrote an in-depth article on the matter if you’re interested.

According to Jerome Powell at Jackson Hole (via Wells Fargo):

Restoring price stability will likely require maintaining a restrictive policy stance for some time.

Reducing inflation is likely to require a sustained period of below-trend growth.

Essentially, the Fed is now aggressively hiking into an economic slowing cycle as it cannot impact the root cause of inflation: supply. Hence, it pressures demand to get the job done. The market believes that this will work. However, the market knows it will be messy. Hence, the market tanked.

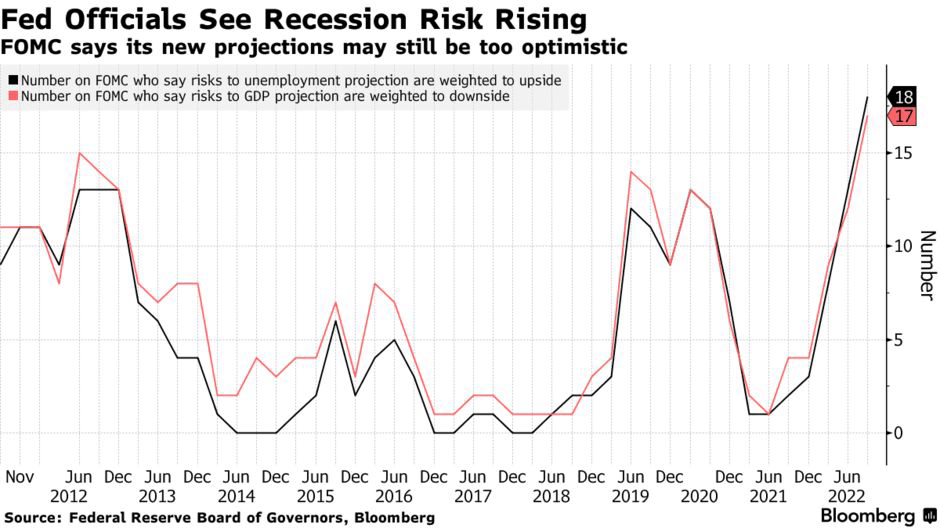

Note that even the Fed knows that the economy is weakening as it adjusted its unemployment guidance as well.

Bloomberg

This matters for two reasons. Reason one is that I have invested close to 20% of my net worth in energy. Reason two is that I have been bullish for a long time as I already briefly mentioned.

Despite headwinds, I do not believe that the bull case has weakened. If anything, it probably got stronger.

Oil Isn’t Dead

If this were a boxing match, we would have the following risks (bullish for oil) in one corner (as summarized by Bloomberg):

Yes, global oil stockpiles are low after huge draws last year, when OPEC+ oil producers failed to raise output fast enough to match recovering demand. Yes, years of underinvestment in new oil production capacity, both inside and outside OPEC, have diminished spare capacity to a sliver. Yes, sanctions on some Russian oil exports could take millions of barrels a day of crude off the market in December, followed by millions more of refined products early next year.

In the other corner, we have demand fears.

While I do not disagree that oil deserves to be lower when the Fed is playing a very dangerous game, I believe these developments are bullish. In prior cycles, lower demand did not meet constrained supply, record low inventories, sanctions on major oil producers, and OPEC’s willingness to reduce output. At least not combined.

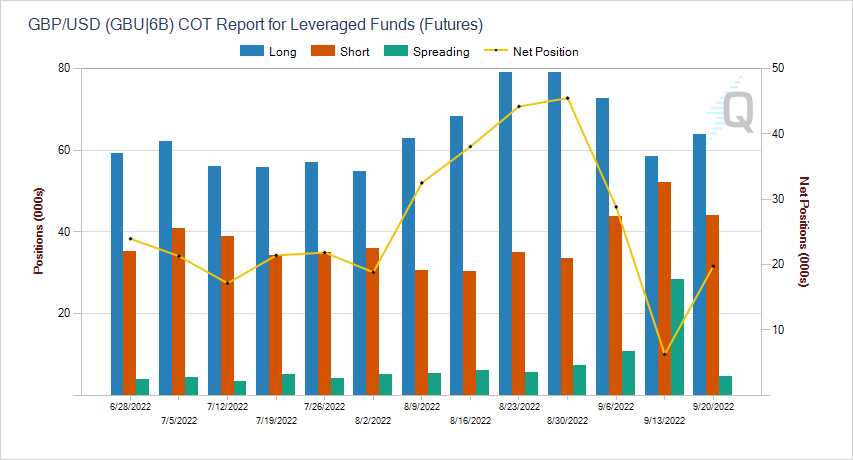

Hence, “smart money” is betting on a comeback of oil as the headline below suggests.

Bloomberg

The (expected) oil rebound is based on low inventories and sustained demand, which are expected to more than offset global slowdown fears.

JPMorgan (JPM) expects Brent oil to reach $101 in the fourth quarter. Goldman Sachs (GS) sees $125 oil. Morgan Stanley (MS) is a bit less aggressive but still sees $95.

What’s interesting is that “smart money” investors have cut their long positions in oil (in this case, WTI) to roughly 200 thousand contracts. That’s close to the pandemic lows and the lowest level since 2012.

CME Group

Moreover, total shorts remain subdued as smart money isn’t willing to bet on further falling prices given the strong bull case that can strike at any moment, pushing oil prices (much) higher.

The experts use the same arguments that we’ve used in the past. Especially in light of the ongoing energy crisis, we could see a gas-to-oil switch, increasing demand even further:

That could mean oil markets remaining in an “unsustainable deficit” at current prices, said Nikhil Bhandari, Goldman Sachs’ co-head of APAC natural resources and clean energy research. Higher consumption would come from more travel activity as well as increased gas-to-oil switching, he said.

Moreover:

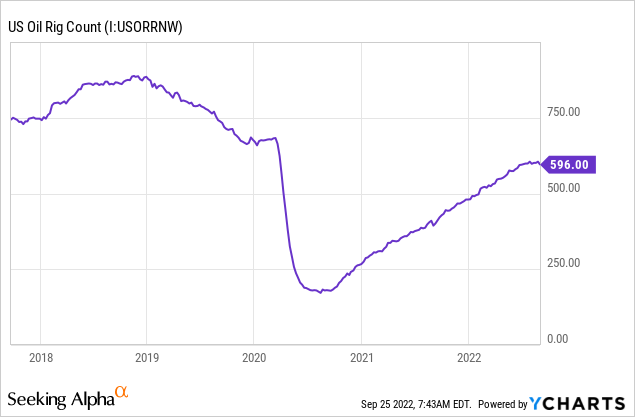

There have been “years of underinvestment,” said Parsley Ong, head of Asian energy and chemicals at JPMorgan. “In the US, we aren’t seeing rig counts high enough to offset natural decline rates — drilled-but-uncompleted wells are at the lowest since 2014 — while OPEC spare capacity is very thin.”

The supply constraints meant that as the world came out of the pandemic-induced slump, reserves were drawn down to feed growing oil appetite. That means the market doesn’t have a buffer to absorb much further growth.

The evidence can be seen below. Not only does the rig count in the US remain well below its prior highs, but we’re also seeing declining numbers again.

Moreover, the problem isn’t just oil. The US is facing a natural gas shortage according to Irina Slav, from Oilprice.com.

Natural gas demand is high as I wrote in a recent article. It’s rising even faster as Europe needs to desperately maintain some kind of gas flow after Russia more or less cut all natural gas exports.

According to Irina:

The Permian contributes another 12 percent of the U.S. total gas output, and the rig count in the Permian has been down for two weeks in a row, according to the latest data. Less drilling means less associated gas to add to the national total.

Meanwhile, on the demand side, electricity generation in the United States is seen reaching a record high this year, Kemp noted in his column, driven by the post-pandemic economic rebound. A hotter summer also contributed. A cold winter would certainly push gas consumption even higher.

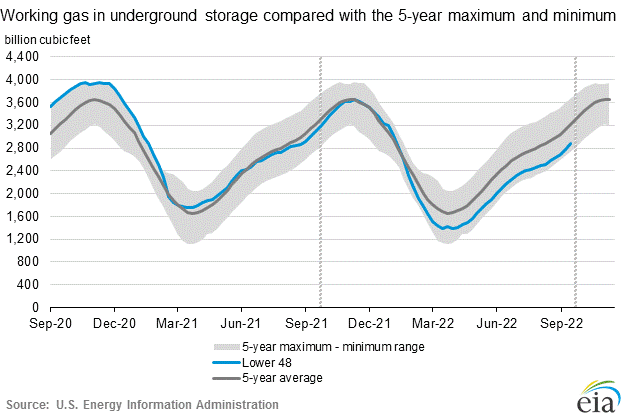

Looking at the weekly natural gas storage chart provided by the EIA, we see that inventories are indeed quite low. Note that the storage levels started to disconnect from the average in early 2022 when Russia invaded Ukraine, causing the need for exports to accelerate.

EIA

Moreover, in this situation, China is shifting from natural gas to coal as it deals with a slowing economy. It prefers cheap coal in that situation. If demand comes back in China as well, I think the supply side will see even more pressure.

On top of that, the capacity of the US to export natural gas is steadily rising. With three new projects starting construction in early 2024, the export capacity will hit 20 billion cubic feet per day in early 2026.

EIA

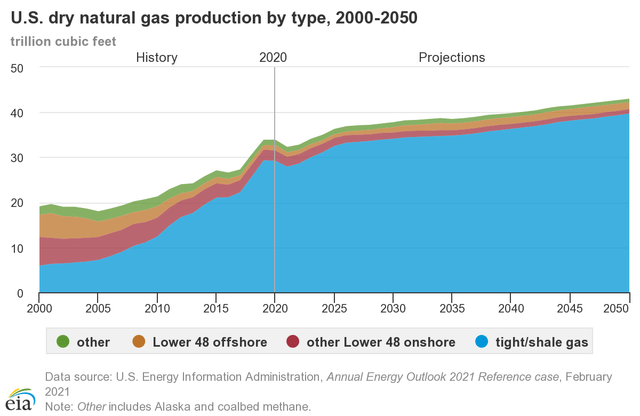

This happens in a scenario where the production growth of natural gas is well-beyond its peak. Between the early 2000s and the pandemic, natural gas production rose from 20 trillion cubic feet to almost 35 trillion cubic feet. This surge was almost entirely caused by production growth through unconventional measures (the shale revolution).

EIA

Here’s what that means for Devon Energy.

Devon Energy Offers New Opportunities

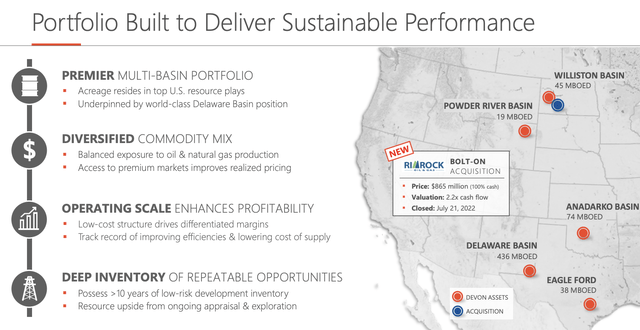

This oil giant with a market cap of $37.8 billion incorporates everything that makes an oil company an attractive investment. Both as a trading vehicle and a long-term income play.

Devon Energy

The company produces both oil and natural gas. In 2Q22, the company produced 616 thousand BOE (barrels of oil equivalent) per day. Roughly half of that came from oil. The recent Eagle Ford Bolt-On acquisition does not change that as roughly half of that production comes from oil.

Production growth is expected to remain flat.

According to the company:

We will continue to prioritize free cash flow and per share financial growth, not the pursuit of top-line volume growth.

It’s also very important that we buy a company that can withstand low oil prices. This strategy kills two birds with one stone as it also makes sure (in most cases) that free cash flow is very high when oil prices are high.

Devon Energy is free cash flow breakeven at $30 WTI as I wrote in my prior article. Unless I’m forgetting something, I believe this is the lowest breakeven price of any company I have covered – ever.

Moreover, the company has hedged only 20% of its production. Not only is the company able to do that because of low breakevens, it also got a lot of support for this decision from investors. According to Bloomberg earlier this year:

“It has been overwhelmingly the request of our investors,” Devon Chief Executive Officer Rick Muncrief said in a recent interview at Bloomberg News headquarters in New York when asked about the decision to hedge less. “We have a stronger balance sheet than we’ve ever had, and we have more and more investors that want exposure to the commodity price.”

As a result, high free cash flow ends up in investors’ pockets. The company’s cash flow priorities are (in this order):

- Fixed + variable dividend

- Share repurchases

- Balance sheet health

As of June 30, the company has a net debt to EBITDAX ratio of a mere 0.4x, no major debt maturities above $600 million, and $6.5 billion in available liquidity. $3.5 billion of that is cash. The rest is available under its credit facility.

Essentially, Devon can pay high double-digit dividends. However, and this is very important, variable dividends will dominate. Unlike your well-known dividend aristocrats that raise dividends on an annual basis, DVN dividends will reflect the price of oil. If oil prices are “high”, the dividend will be high. If oil comes down, the dividend will be lower as well.

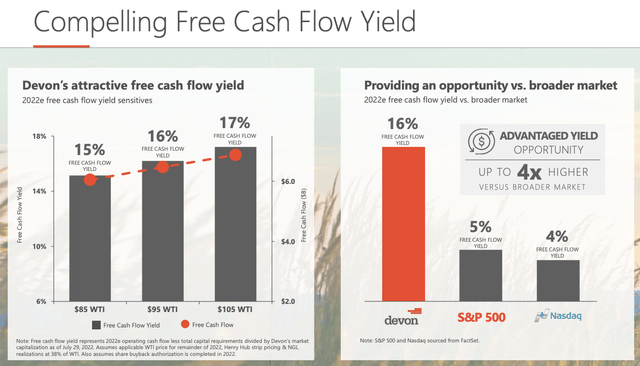

The chart below shows the expected free cash flow yield based on various oil prices and the closing stock price on July 29. The current stock price is 8% lower. So, the implied free cash flow yield for people who buy current prices will be HIGHER than the chart below suggests.

At $105 WTI, the implied free cash flow yield is 17%. That’s truly remarkable. For people buying the current price, it’s higher than 18.3%.

Devon Energy

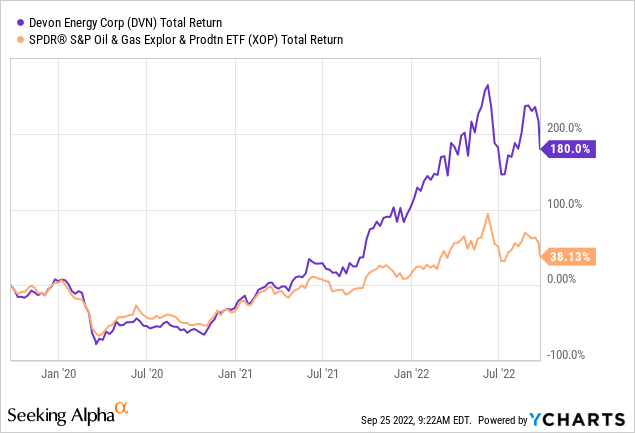

As a result, the company has outperformed its peers by a very wide margin compared to pre-pandemic levels. I expect that to continue for many years to come. Both to the upside and the downside.

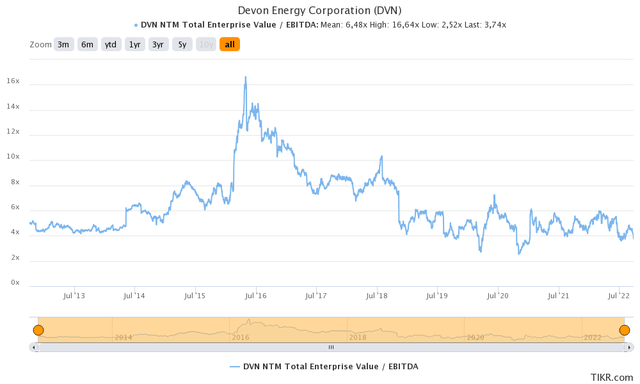

Valuation-wise, the company remains very attractive. DVN is trading at 4.0x 2023E EBITDA of $10.3 billion based on its $41.0 billion implied enterprise value. This enterprise value consists of its $37.8 billion market cap, $2.6 billion in expected net debt, and $570 million worth of pension-related liabilities and minority interest.

TIKR

I believe that even a 6x NMT EBITDA valuation would be fair.

In my prior article, I also wrote that if the bull case for oil continues to unfold, we could see DVN shares double. After all, its ability to generate free cash flow is ridiculously strong, which is not fairly represented by EV/EBITDA multiples.

Takeaway

The market is tanking. Investors are dumping cyclical stocks to de-risk their portfolios as the Federal Reserve is expected to do a number on the economy in order to get inflation under control. While de-risking is certainly not the worst move as economic growth slows, I am starting to like the risk/reward of a lot of companies. One of them is Devon, which I believe is the best energy company money can buy. The company has:

- Roughly 50/50 oil and natural gas production in low-cost basins.

- A low breakeven price, protecting the company against falling oil prices and allowing it to generate high free cash flow.

- A rock-solid balance sheet allowing the company to withstand high-interest periods and recessions, and to use free cash for shareholder distributions instead of debt reduction.

- A wonderful valuation as the market has panic-sold pretty much everything.

- A strong secular tailwind consisting of subdued supply growth and a huge natural gas bull market.

Moreover, I believe that the current sell-off is making supply growth even more unlikely as we’re once again seeing how much damage an economic growth scare can do to oil and gas.

However, as bullish as I am, please be aware that oil is volatile. Regardless of whether you buy DVN stock for income, long-term gains, or both, please do not buy too much volatility if you cannot handle it.

I have close to 20% energy exposure, and I have to say that’s as volatile as I’m willing to make my portfolio.

Other than that, I think we’re once again dealing with a great opportunity to buy a stock capable of delivering high (outperforming) capital gains and high income.

(Dis)agree? Let me know in the comments!

Be the first to comment