imaginima/iStock via Getty Images

Investment Thesis:

Should Deutsche Telekom AG (OTCQX:DTEGY) continue to see growth in ARPU across the United States and a continued increase in market share through T-Mobile in subsequent quarters, then I take the view that price could continue to see upside from here.

In a previous article back in late April, I made the argument that Deutsche Telekom could see significant upside going forward as a result of continued growth in overall revenue as well as growth in postpaid mobile subscribers in the United States.

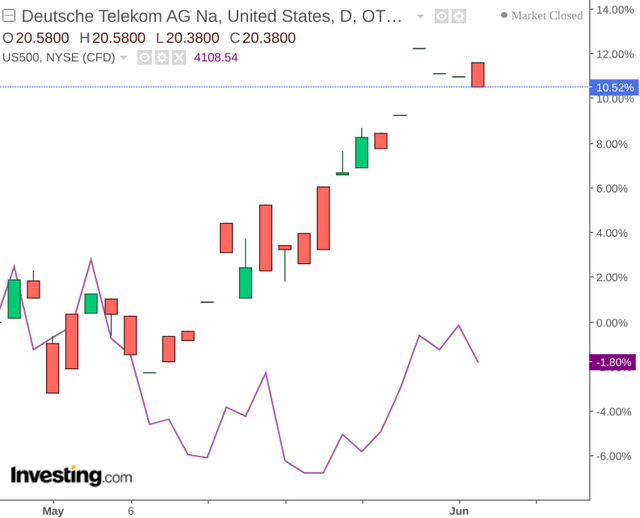

Since then, we have seen the stock grow by over 10%, while the S&P 500 has fallen by 1.8%:

The purpose of this article is to analyze whether growth could be set to continue from here, and also examine the company’s U.S. growth prospects in more detail.

Churn and ARPU Trends

Two of the most important metrics for a telecommunications company is 1) churn – or the rate at which the company loses customers, and 2) ARPU – or average revenue per user.

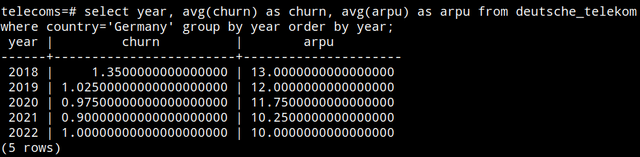

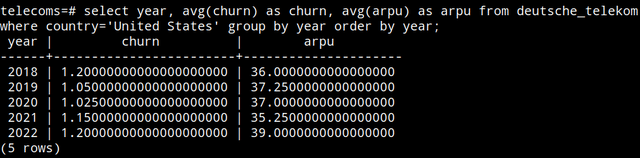

In this regard, I decided to analyze the trends in churn and ARPU for Deutsche Telekom across Germany and the United States – the company’s two largest geographies by revenue. Specifically, I decided to average the quarterly data for churn and ARPU from 2018 to 2022 by year for both Germany and the United States to determine the overall trajectory for these two metrics. The average monthly churn figure was used for the German market. As average monthly churn was provided separately for postpaid and prepaid services – it was decided to use the postpaid figure given the relatively greater importance of the postpaid market as a contribution to overall revenue.

The churn and ARPU figures were sourced from the presentation backups as available under the company’s financial results from 2018 to the present (note that while 2022 results were included, only first quarter data is available to date). SQL was then used to average churn and ARPU results by year across each country. Here are the results for the German market:

Quarterly churn and ARPU figures sourced from Deutsche Telekom Presentation Backups from 2018 to the present. Yearly aggregate figures calculated using SQL.

Here are the results for the United States market:

Quarterly churn and ARPU figures sourced from Deutsche Telekom Presentation Backups from 2018 to the present. Yearly aggregate figures calculated using SQL.

When looking at trends across the two markets (notwithstanding that 2022 only represents data for the first quarter), we can see that churn across the German market has been falling over the past five years, i.e. there are less customers cancelling subscriptions with the company on a percentage basis. However, we can also see that the average revenue per user has been falling.

Across the United States market, churn rose back to 1.20% in the first quarter of 2022 – which brings churn back to the average seen in 2018 despite churn rates having fallen up to 2020. However, ARPU for the first quarter of 2022 was significantly higher than that seen in previous years.

Looking Forward

From looking at the above trends, we can see that the German market shows a decrease in churn – indicating growing customer loyalty. However, average revenue per user has also been dropping, showing a slight decline in growth potential across the German market.

Across the United States, while churn has been rising once again – the average revenue per user remains substantially higher. While Deutsche Telekom faces more competition and less of a dominant presence in the U.S. market – the profitability potential of this market seems to be much higher than that of Germany on the basis of ARPU.

As such, future growth potential for Deutsche Telekom as a whole is likely to be significantly dependent on the degree to which the company can expand in the United States.

With Deutsche Telekom having raised its stake in T-Mobile (TMUS) to 48.4% as of April, this significantly strengthens the company’s ownership that has seen significant growth – and overtook AT&T (T) in Q2 2020 to become the second largest wireless provider in the United States.

Additionally, it is also reported that the company is also set to overtake AT&T in the number of retail stores held across the United States. From this standpoint, T-Mobile’s growth significantly strengthens Deutsche Telekom’s presence in the United States. While we have seen a slight increase in churn since 2020 – I would not view this as an overly large concern provided that average revenue per user continues to grow and Deutsche Telekom continues to capture a larger share of the U.S. market through the growth of T-Mobile.

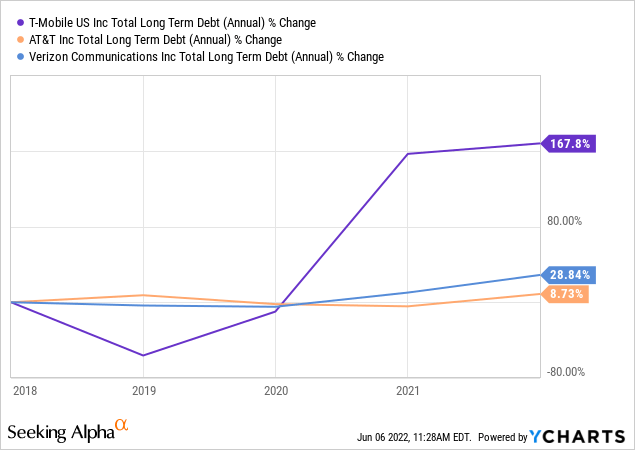

Of course, any company faces potential risks and Deutsche Telekom is not an exception. For one, we can see that over the past five years – the long-term debt of T-Mobile has grown by a large margin compared to AT&T (T) and Verizon (VZ).

ycharts.com

While T-Mobile’s growth in the United States has been impressive – there is always the risk that high debt levels put investors off the stock and impede the company’s ability to expand over the longer-term – which in turn would affect the ability of Deutsche Telekom to increase its share of the U.S. market through the merger.

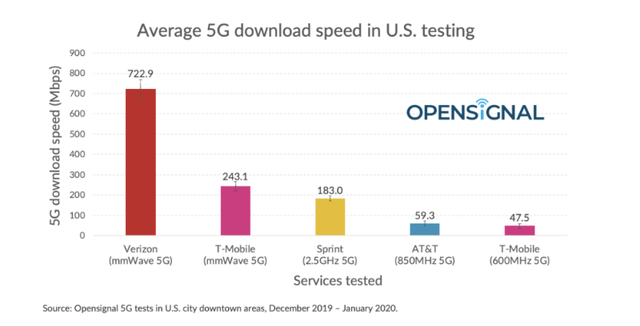

Additionally, competition in the 5G space across the United States is set to increase going forward. While T-Mobile has been bolstering its 5G capabilities, we can see that T-Mobile had the lowest download speed at 47.5 Mbps according to Opensignal 5G tests.

From this standpoint, while Deutsche Telekom has strong potential to bolster its revenue growth through its merger with T-Mobile in the United States – the company does face some challenges which could place pressure on growth potential going forward.

Conclusion

To conclude, Deutsche Telekom is a company that has a strong opportunity for growth in the United States. While the merger with T-Mobile has allowed for significant expansion in this regard – time will tell whether the company can thrive in an increasingly competitive environment.

Should Deutsche Telekom continue to see growth in ARPU across the United States and a continued increase in market share through T-Mobile in subsequent quarters, then I take the view that price could continue to see upside from here.

Be the first to comment