Tzido/iStock via Getty Images

Investment thesis

Deutsche Borse Group (OTCPK:DBOEY) is the company behind the DAX index and the Xetra stock exchange, which many German investors are familiar with. Losing much money with the stock in the next few years is unlikely in my view. But, the valuation is too high, which makes the potential yield appear too low. However, for investors who want to park their money safely and are satisfied with a low dividend yield, the stock may be worth a second look.

The business model

Deutsche Börse is the German counterpart to Nasdaq (NDAQ) or London Stock Exchange (OTCPK:LDNXF). It operates major stock exchanges such as the Frankfurt Stock Exchange, Xetra, and Tradegate. In addition to the traditional transaction business, the pre-trading business provides customers with all the necessary information in advance of a trade, such as analysis tools. The Post-Trading Business ensures smooth settlement and custody of securities. A subdivision of this is called Clearstream and is responsible for the settlement and custody of securities and ensures, among other things, that dividend payments are made to the relevant shareholders on the record date.

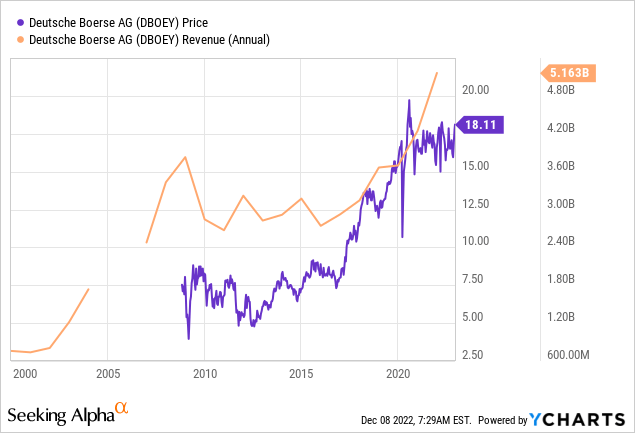

The stock is one of the most successful German shares of the last 20 years. Even today, Germany is still a country with a relatively low proportion of shareholders, but this has risen sharply in recent decades, from which the company has been able to profit greatly.

Revenue distribution

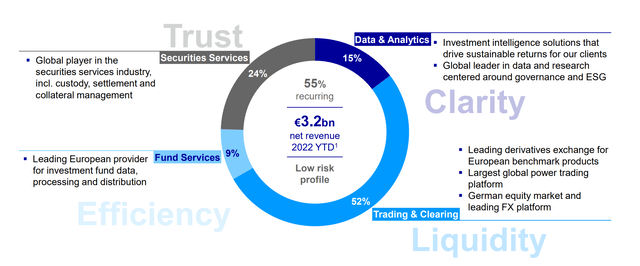

Net revenue 2022 YTD is €3.2B, and 55% is recurring revenue. 52% comes from the trading & clearing segment. 24% from Securities Services. 15% Data & Analytics and 9% Fund Services.

Overall, all areas are scalable and not very capital-intensive. For this reason, the shares of stock exchanges are similar to software companies. In addition, there is more trading in volatile times, which generally benefits stock exchange companies. Therefore, it is not surprising that this group of stocks has performed great over the past years.

Recent results & financials

In the third quarter of 2022, revenue increased 30% YoY to €1.09B, and earnings per share rose by 24% to €2.15. Both results exceeded analysts’ estimates. The company makes a distinction between structural and cyclical sales growth. The structural growth comes from new product innovations, for example, in the areas of index and analytics business, ESG, or fixed-income trading. Cyclical growth results from factors that cannot be directly influenced, such as high volatility in the market and the recent higher demand for currency- and inflation-hedged financial products. Structural growth has been 6% per year since 2019. Cyclical growth is only 1% per year. But this will be much better this year than in previous years, according to the company. It should benefit from higher volatility and rising interest rates.

Higher volatility in 2022 has already compensated the cyclical net revenue decline in 2021. With higher interest rates, we now expect increasing cyclical net revenue and modest upside to expectations. Key areas of cyclical benefits include:

- Interest rates: fixed income derivatives (Trading & Clearing)

- net interest income (Securities Services)

- Volatility: index derivatives (Trading & Clearing)

The “Trading and Clearing” and “Securities Services” segments grew particularly strongly, by 31 and 38 percent, respectively. Trading and Clearing” accounted for 52 percent of revenue and comprises securities trading and the settlement of investment instruments. The “Securities Services” segment includes the custody of these instruments and services for securities financing and the associated security management.

“Data and Analytics” contributed 15 percent of total revenue and grew 30 percent in the third quarter. This is the fastest growing area since 2019 and includes the most recurring revenue in percentage terms, currently at 94%.

Management raises forecasts

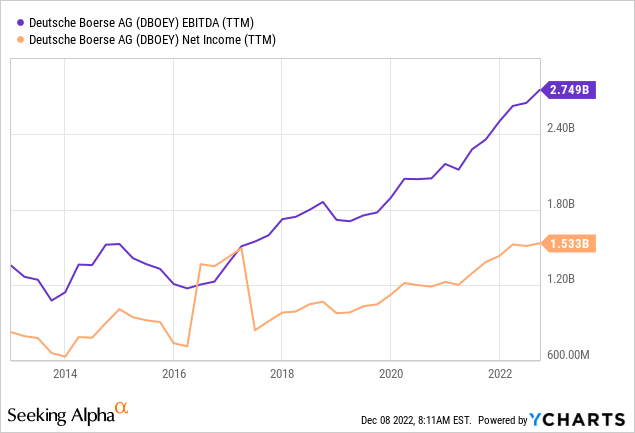

Due to the high volatility in the financial markets, the company adjusted its forecast for the 2022 financial year upward following the solid third quarter. The forecast for total revenue was raised from €3.8B to €4.1B, and EBITDA from €2.2B to €2.3B. Viewed over a more extended period, the development is very positive.

Dividend

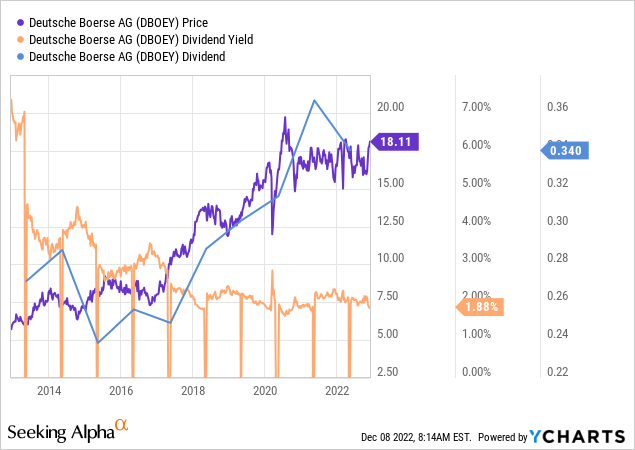

The following graph looks a bit chaotic at first sight because there are a few errors in it (the swings to zero for the dividend yield). But what you can see here is relatively simple. The dividend in Dollar or Euro has been rising for years, albeit rather slowly, but since the share price is growing even faster, the dividend yield is now only 1.88%. In 2015, it was 4%.

Valuation

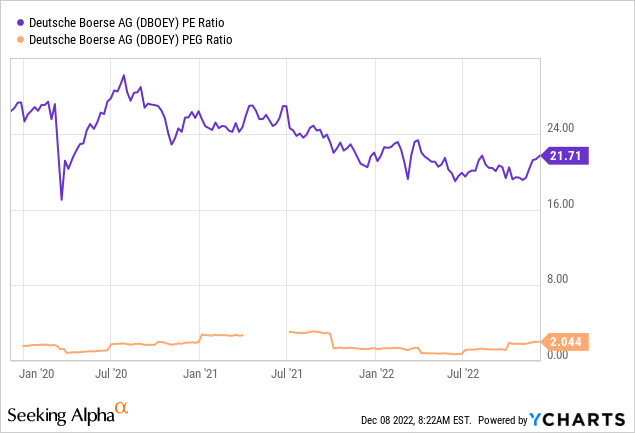

This raises the question of valuation because such a pattern is often seen when shares become more and more expensive over time, and the P/E ratio outruns the EPS. The company is currently valued at an enterprise value of $39.5B. The market cap is $33.3B, and the total debt is $5.1B.

The P/E ratio will be 21 to 23 this year, depending on the last quarter’s results. For next year, management estimates growth at 10%.

This results in a P/E to growth ratio (PEG ratio) of more than two, which is rather expensive. Very cheap would be a PEG ratio below one. Generalizing the PEG ratio is difficult because you always have to consider other long-term factors. Since the dividend yield here is low and the long-term growth potential is difficult to assess, a PEG ratio of 2 is rather expensive.

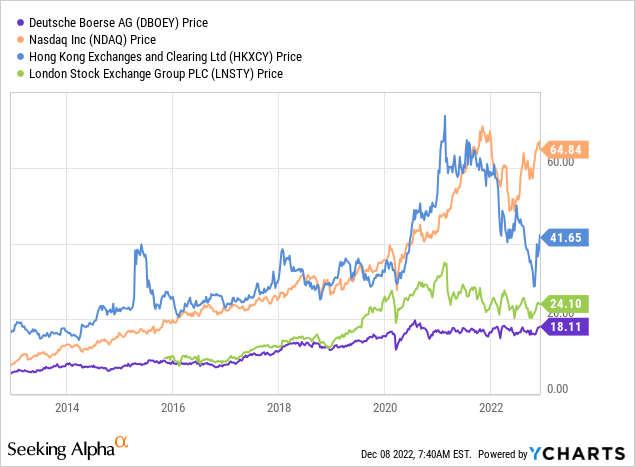

I find it remarkable how strongly the stock has held up since a lot of money has flowed out of European and German stock markets. The German benchmark index is trading at a P/E ratio of under 10. But we see this pattern also with other shares of stock exchanges. These seem to get a higher P/E ratio attributed by the market generally.

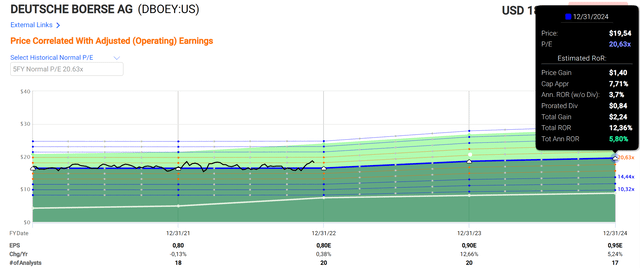

According to Fastgraphs, the long-term average P/E ratio is 20.6, and if the stock were to return to this average at the end of 2024, an annual return of 5.8% would be expected.

Risks

More than 50% of the turnover still comes from how much is ultimately traded. Therefore, one of the most significant risks is that, in the long term, trading on German or European exchanges will decline. On the one hand, this can come from private investors who contribute a part but probably mainly from institutional investors who want to invest their money elsewhere. However, there is a lower limit here, as some government institutional investors have to invest their money in German government bonds, for example. However, as far as I know, there is no way to find out what percentage of the company’s revenue comes from such institutional investors.

There is also a risk that sales just stagnate. Then there is no reason the stock should trade at a P/E ratio of over 20 and would likely experience a general revaluation.

Another risk is that the company’s offerings are not unrivaled, but there are numerous exchanges in Europe. Euronext or London stock exchange are only two examples. But also in Germany, there are other stock exchanges such as the Munich Stock Exchange or Lang & Schwarz.

Conclusion

The stock has performed exceptionally well over the last 20 years and will probably be able to expand its business in the coming years further. In the longer term, however, it is difficult to assess the potential for increasing revenue. Given this, the valuation is too high, and the dividend yield too low. However, if you want to park your money safely or are satisfied with only average annual returns, you should be fine here because of the high percentage of recurring income. If I owned the shares, I would sell and invest my money where the potential is higher.

Be the first to comment