Eagle2308/iStock via Getty Images

Intro

The ECB surprised markets (and myself) by signaling further 50 basis points hikes in the near term, despite a mild winter recession expected for the Eurozone. Both Commerzbank (OTCPK:CRZBF) and Deutsche Bank (NYSE:DB) stand to benefit from further interest rate increases, albeit with a larger benefit for Commerzbank (thanks to DB’s exposure to asset management via asset manager DWS and M&A activity at the investment bank).

In this article I will highlight some recent developments for DB and compare the two banks at the end.

DB foreign exchange sensitivity

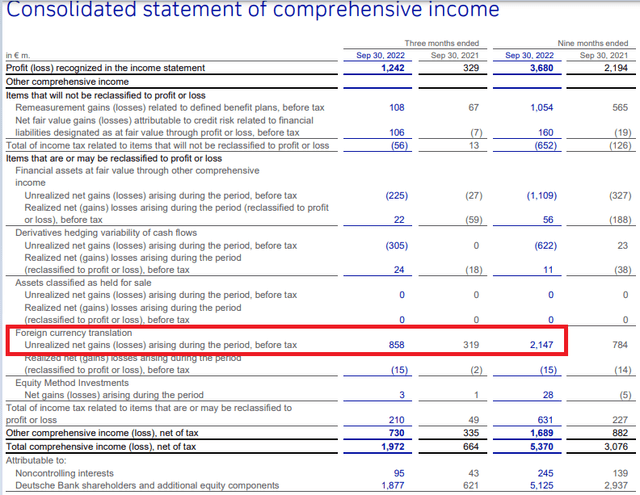

DB finished 2021 with a tangible book of 24.73 EUR/share. In Q3 2022 the indicator stood at 26.47 EUR/share, or a gain of 1.74 EUR/share. After accounting for the 1.46 EUR/share in diluted earnings in the first 9 months of the year, other comprehensive income accounts for a gain of about 0.28 EUR/share:

Foreign currency translation is one component of other comprehensive income. In the first 9 months of the year, the euro lost about 13.9% (1578 basis points) against the US dollar to end at 0.9748 US dollars per 1 EUR. Hence for DB we can deduce a rough sensitivity (before hedging, if any) of about 135 million EUR for every 100 basis points move in the EUR/US dollar exchange rate.

The average diluted share count was 2,116.1 million at the end of Q3 2022. Hence the current circa 900 basis point gain of the EUR in Q4 would entail a 1.2 billion EUR hit to tangible book, or about 0.57 EUR/share. Incidentally in Q3 diluted Deutsche Bank earnings were exactly 57 cents. All in all, currency losses will probably offset any organic earnings in Q4.

Of course, if you are measuring Deutsche Bank’s tangible book in US dollars you may take the view that the foreign exchange will double the bottom line result.

DB Post Q3 Activity

On October 17 DB completed a sale to Zurich Italy of a wealth advisory business in Italy. As per the Q3 earnings transcript, the gain is seen at about 300 million EUR.

DB, along with Rabobank, was accused of taking part in a cartel for euro-denominated government bonds. A legal provision in Q4 is unlikely but may happen sometime in 2023.

On November 9 CFO James von Moltke took part in the UBS European Conference and expressed confidence in the bank reaching its 2022 goals, namely revenue above 27 billion EUR, an 8% ROTE, and a cost/income ratio in the low seventies percent. Looking to 2023 and discussing interest rates and the repayment of targeted long-term refinancing operations (TLTRO) loans, he added:

So let’s start with 2023. The guidance we gave a couple of weeks ago was that relative to 2022, interest rates alone should support revenues by about 2 billion euros. And then that would be offset by something in the high single digits, hundred millions of euros by the year-on-year impact of no TLTRO, higher funding costs, and some of the benefits we had this year, for example, debt repurchases and so on. So the net of those things should give us something between say 1.1, 1.2 billion euros of revenues next year relative to this year.

Overall, the current target for 2023 revenues is about 28 billion EUR.

DWS 2022 Investor Day

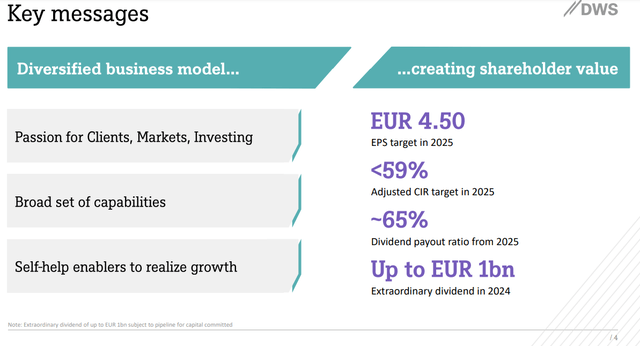

The asset manager DWS, in which DB holds a 79.5% stake, held its investor day on December 7. The new targets for 2025 (bearing in mind a current market cap of around 5.85 billion EUR and 29 EUR share price) are:

DWS 2022 Investor Day Presentation

DWS is operating in a growing industry, with assets under management set for a 6% compound annual growth rate until 2030 to 170 trillion.

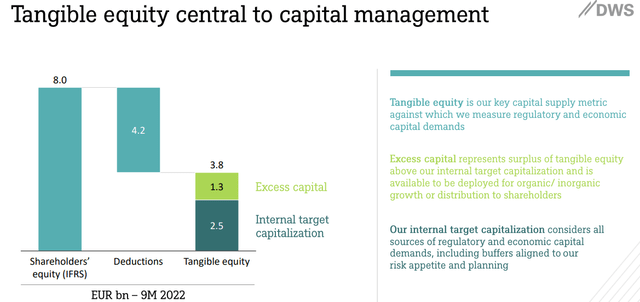

Overall, DWS is sitting on 3.8 billion EUR of tangible equity, and can deploy up to 1.3 billion EUR to growth or distributions:

DWS 2022 Investor Day Presentation

End of Q3 2022 Comparison

Looking at the key performance indicators of the two banks:

| Commerzbank | Deutsche Bank | |

| ROTE | 4.3% | 8.1% |

| Tax Rate | 43% | 24% |

| Cost/Income Ratio | 68.7% | 72.7% |

| P/Tangible book | 0.39 | 0.37 |

| CET1 Capital | 13.8% | 13.3% |

| MDA Requirement | 9.4% | 10.47% |

| MDA Buffer | 4.35% | 2.83% |

Source: Author’s calculations based on Q3 2022 company disclosures.

The high tax rate for Commerzbank was due to a CHF mortgage provision in Poland which was not tax deductible. For comparison, in H1 2022 it was only 31.3%.

Turning to the medium term, Commerzbank has a 7.3% ROTE target compared with 10% for DB. To be fair, Commerzbank’s target is really on the low side as far as European banks go. The three major French banks – Credit Agricole (OTCPK:CRARF), BNP Paribas (OTCQX:BNPQF) and Societe Generale (OTCPK:SCGLF) – have targets of 12%, 11% and 10% respectively. Overall, it is feasible Commerzbank improves on its ROTE over the long term.

Currently however, the expected medium-term ROTE shortfall would be in the 2.5% range compared to DB. Interestingly, the CET1 capital of DB is 49.2 billion EUR, below the 55.1 billion EUR in tangible shareholders’ equity. Thus an extra 2.5% ROTE in a given year should translate into about 37 basis points of additional organic CET1 generation for DB (against risk weighted assets (RWA) of about 370 billion EUR).

Overall, it should take DB a minimum 4 years (probably more if we expect lower returns in a bad year) to compensate for the 1.52% shortfall in the MDA buffer relative to Commerzbank. Also note that DB still has 24 billion EUR of RWA in its Capital Release Unit (CRU). A final wind-down of the CRU would benefit DB by 92 basis points.

Investment thesis

As Commerzbank highlighted in its Q3 2022 results presentation:

The German economy has probably been sliding into recession since September, given the slump of leading indicators. Global demand has weakened significantly and increased energy prices are burdening consumers and businesses, hence, slowing down private consumption and investment. Particularly energy-intensive companies have already cut their production.

This was also confirmed by the ECB with expectations for a winter recession in the Eurozone. Thus over the next few months, banks may experience elevated credit losses and provisions. Thanks to a stronger capital position, Commerzbank is better equipped for such developments. Furthermore, interest rate hikes should help in the very near term, although expectations remain for cuts later in 2023 and 2024.

DB will benefit from elevated and persistent interest rate volatility, given that every meeting is a live meeting and forward guidance has been significantly reduced. Deal making activity should improve in the second half of 2023 which should help the investment bank.

Both banks should offer attractive returns over the medium term, perhaps led by Commerzbank initially and DB in the longer term. Key thing to watch will be whether interest rate developments prompt a boost to Commerzbank’s ROTE target for the long term.

Personally, I will continue to roll my options positions with an upward bias.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment