KanawatTH

The major German financial institution, Deutsche Bank (DB), is predicting a stock market crash of 25% in 2023.

The primary headwind that the bank’s research team sees dragging down markets is the Federal Reserve’s and European Central Bank’s aggressive interest rate hiking. This applies mainly to the big hikes already carried out in 2022 but also to the remainder of hikes yet to come, however many there will be.

These hikes are done for a good reason, of course, which is to dampen demand in order to bring down inflation. The Fed and ECB are “absolutely committed” to lowering inflation, says Deutsche Bank, but “it will not be possible to do so without at least moderate economic downturns in the U.S. and Europe, and significant increases in unemployment.”

The German bank cites the interesting fact that, since the 1960s, “any time trending inflation has declined by 2 percentage points or more, such a decline has been accompanied or induced by a rise in unemployment of at least 2 percentage points.”

In other words, the historical record attests that bringing down inflation will almost certainly push unemployment rates up in the process.

During the roughly 40-year span from 1980 to 2020, as interest rates dropped lower and lower, all major economies around the world took on incrementally higher levels of debt. As long as the trend of interest rate movements is still downward, this process of leveraging up for the sake of growth can continue.

But with a spike in interest rates, heavily indebted economies start to get into trouble. First, borrowers with floating rate debt feel the pinch of higher interest expenses. Then borrowers with a lot of near-term debt maturities feel it as they have to refinance loans at higher rates. Eventually, everyone with debt gets squeezed – unless rates drop before their loans mature.

Deutsche Bank sees the current spike in rates as more than enough to cause some significant damage to the global economy, and that should ultimately result in a stock market crash next year.

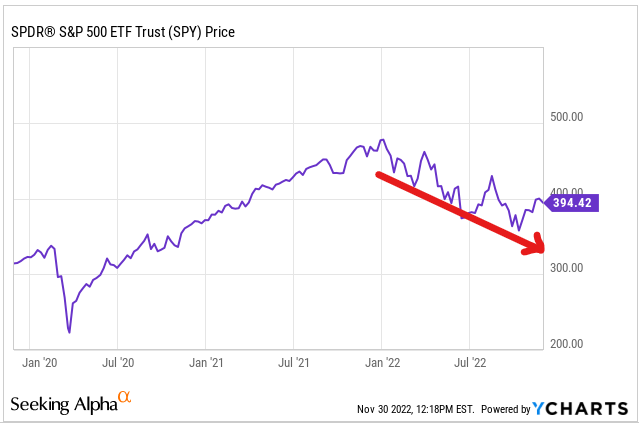

YCharts

Deutsche Bank assumes that the market will rally a little higher from here in the next quarter or two before the recession hits in earnest. At that point, around the middle of 2023, the bank expects the S&P 500 (SPY) to drop another 25%, which would put the index at around 3,075 at its bottom.

That is about 22% below where the SPY trades today.

Also keep in mind that the SPY is already down about 17.5% from its peak at the very beginning of 2022 of about 4,777. So, if the market dropped to 3,075, that would imply a peak to trough decline of slightly over 35%.

Now, for the despondent, take heart! Deutsche Bank does not foresee this stock market crash lasting very long. In fact, they believe that it will be followed by a V-shaped recovery in stock prices such that the broad market index should finish 2023 at around the same level as where it starts – roughly flat.

Morgan Stanley’s (MS) chief equity strategist and investment officer, Mike Wilson, recently came out with his own bearish call for the stock market. Wilson sees the S&P 500 dropping 20-25% in the next 3-6 months before recovering to around its current level of 3,900 by year-end, although his bear case is 3,600 (8% downside) and his bull case is 4,200 (7% upside).

What will drive this selloff in stocks? Two primary things:

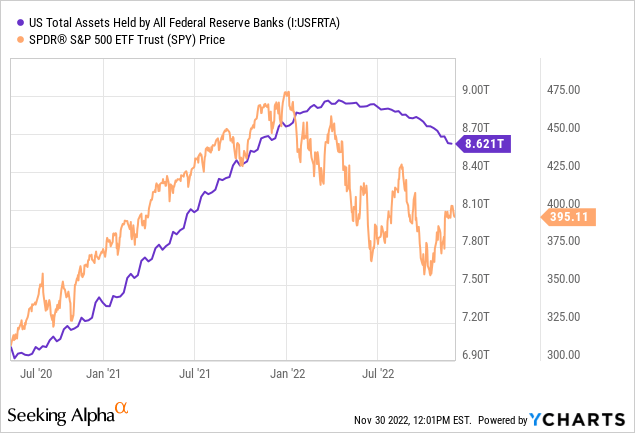

- Shrinking of the Fed’s balance sheet

- Downward earnings revisions

After peaking at around $9 trillion in the Spring of 2022, the Fed’s balance sheet has steadily shrunk since then as the central bank sells off assets like Treasuries and mortgage-backed securities. This adds upward pressure to interest rates and saps liquidity from markets.

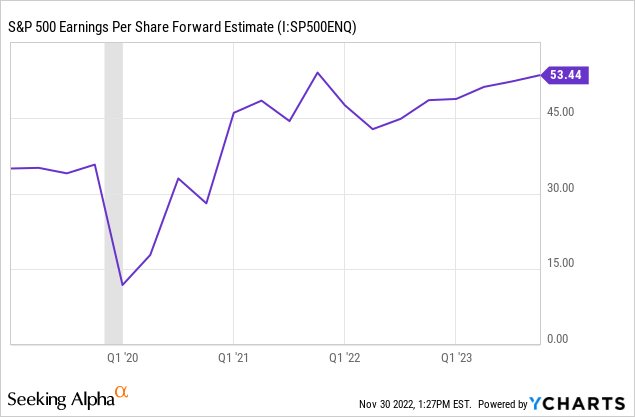

Moreover, Wilson thinks that forward estimates of S&P 500 earnings are far too optimistic and will have to be revised downward as analysts price in the impact of an oncoming recession.

These two factors should combine to produce maximum bearishness during the first quarter of 2023, says Wilson.

Now, how much credence should we give these calls for a stock market crash in early- or mid-2023? We don’t know. The truth is that no one has a crystal ball, including us.

But we do believe there is enough evidence of oncoming economic hardship that investors should tread cautiously in their allocation decisions until some clarity on the outlook is reached.

With that in mind, let’s look at two recession-resistant dividend stocks to consider buying today.

Avient Corporation (AVNT)

AVNT is a global industry leader in the production of formulants and special polymer materials and chemicals. These are intermediate products that go into a huge variety of goods in many different industries.

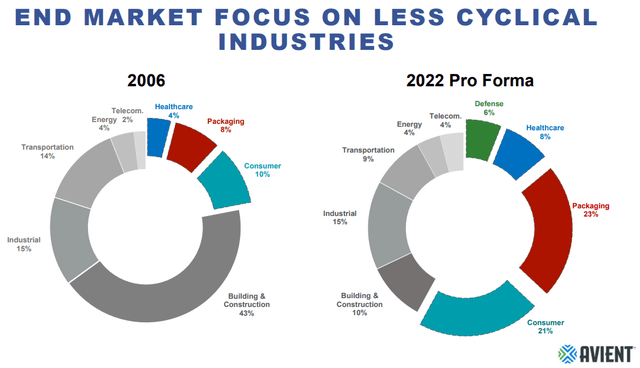

Over the last 15 years, AVNT’s management has made a concerted effort to shift toward customers/end-use products in less cyclical industries like consumer staples, packaging, healthcare, and defense. Today, these four industries make up 58% of AVNT’s business.

Management has positioned the company such that it should be able to consistently grow at least a few percentage points faster than GDP growth.

The business has also made a concerted effort to gain exposure to growth sectors of the economy such as in sustainability, such as light-weighting and energy-efficient materials.

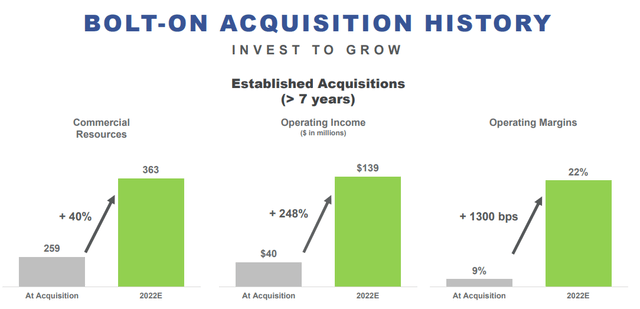

Moreover, AVNT has a very respectable history of integrating acquisitions into its portfolio and significantly increasing both sales and margins at these acquired businesses in the years after absorbing them.

AVNT just recently completed its acquisition of Dyneema, which should give the company the chance to grow the segment of its portfolio in defense industry products.

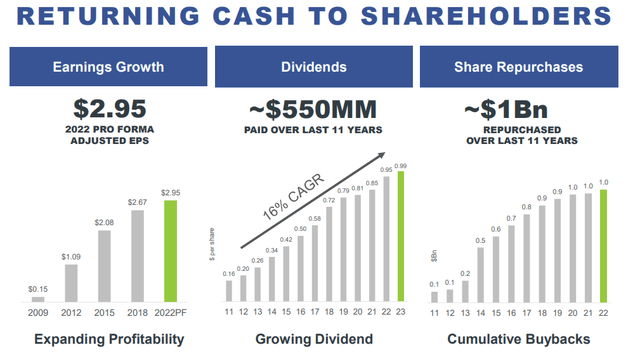

Though AVNT’s business is somewhat cyclical (despite efforts to make it increasingly less cyclical), the company has managed to grow EPS impressively over the last decade or so. Additionally, the company has been a rapid dividend grower as well as an opportunist repurchaser of its own shares.

Right now, AVNT’s stock price has suffered a pullback for two main reasons:

- 45% of its debt is floating rate, which is a big headwind during a rising rate environment.

- Doing business outside the United States exposes the company to foreign exchange risk, which has

Year-to-date, EPS is down 3% YoY, but if you adjust for foreign exchange, EPS is up 5%. Likewise, reported sales are up only 1% while they are up 9% ex-FX, and adjusted EBITDA is up 8% on a reported basis but 18% ex-FX.

The good news is that the USD index, measuring the dollar against a basket of other currencies, is down about 7% from its high in early October. This may signify that the long stretch of USD strengthening has come to an end and reversed course. This would relieve pressure on AVNT’s reported sales and earnings numbers.

With a nearly 40% pullback in AVNT’s stock price this year, the industry leader in formulants and industrial materials looks like a buy for long-term investors. While still susceptible to recessionary pressures, AVNT is one of the most recession-resistant names in its space.

W. P. Carey Inc. (WPC)

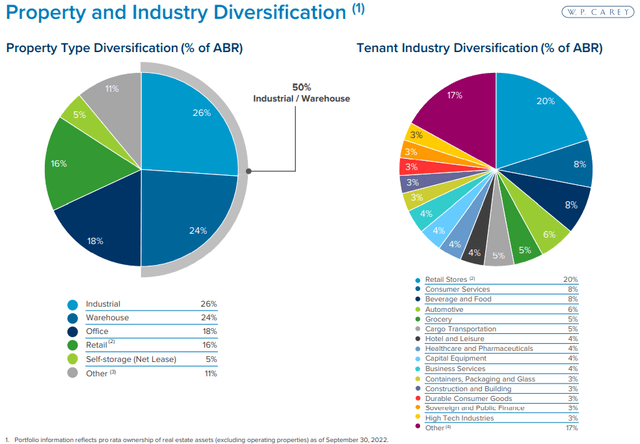

WPC is a diversified, cross-continental net lease REIT with over 1,400 triple-net leased properties as well as 84 internally operated self-storage properties. While management likely won’t continue to operate these self-storage properties in-house but will rather seek to sell them or transition them to net lease properties with third-party operators, these properties have performed quite well this year in terms of both occupancy and rent growth.

Around 65% of WPC’s portfolio is located in the United States, with the remaining 35% mostly in Northern and Western Europe.

WPC’s property portfolio is among the most recession-resistant in the net lease space, with half of its portfolio in industrial properties, split roughly evenly between manufacturing and warehousing.

Though WPC does not specifically focus on investment grade tenants, the REIT’s focus on essential retail and mission-critical industrial and office properties has served it well through previous downturns. During the COVID-19 lockdowns, for instance, WPC’s rent collection rate never fell below 95%, which was much higher than most of its peers.

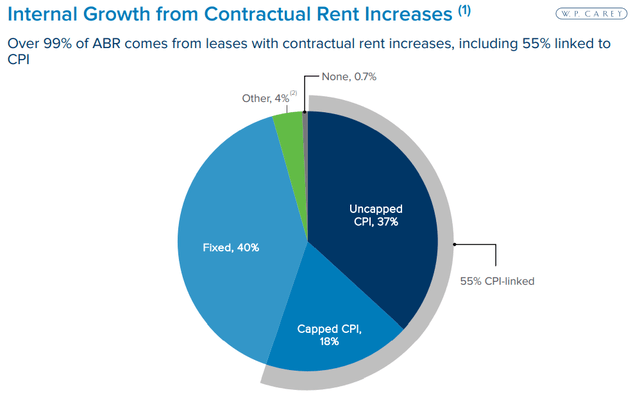

Another point on which WPC can boast is its unique inclusion of CPI-based rent escalators in its internally crafted lease form.

Unlike most net lease REITs, with fixed escalators of 1-2% whether inflation is running hot or cold, WPC’s CPI-based escalators have pushed up rents as inflation has gone higher and higher. WPC showed same-store rent growth of 3.4% in the third quarter, a number that has gone higher each quarter of the year.

WPC also enjoys a strong, BBB-rated balance sheet with net debt to EBITDA of 5.6x and a weighted average interest rate of 3.0%, thanks largely to being overweight in Euro-denominated debt. The REIT also enjoys strong fixed charge coverage of 5.8x.

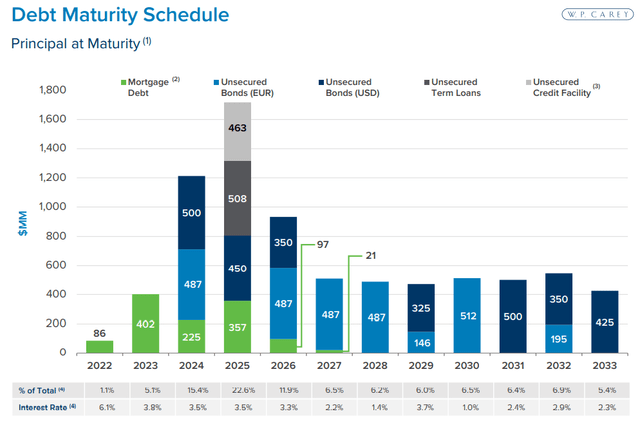

A relatively small ~$400 million of loans are maturing in 2023, all of it in mortgages, compared to ~$7.9 billion in total debt.

Though rates are prohibitively high for bond issuance right now, WPC has plenty of liquidity with which to pay off or selectively refinance these expiring mortgages.

WPC currently trades at around a 15x AFFO multiple. That may be a fair value if interest rates remain as high as they are today. But if a recession does come in 2023, we think it will bring interest rates down. After all, recessions have an excellent track record of causing interest rates to drop in their wake.

If interest rates roughly halve from their current levels in the next year or two, we think WPC is worth closer to 17x or 17.5x AFFO, which would give the REIT an additional 15% upside on top of its generous 5.4% dividend yield.

Bottom Line

Though we cannot predict what is going to happen in the future, it’s impossible to ignore the increasing number of pundits calling for a recession and stock market crash of 20-25% or more next year. Thus, we think it would be prudent for the average dividend investor to allocate their finite investable capital prudently in this environment.

We view AVNT and WPC as two interesting and recession-resistant options for investors to consider today.

Be the first to comment