Sviatlana Barchan/iStock via Getty Images

In short, small-cap stock Destination XL Group, Inc (NASDAQ:DXLG), a men’s apparel retail company, has gone from nearly bankrupt in 2020 to heading into its second-consecutive profitable year after experiencing back-to-back losses for almost a decade.

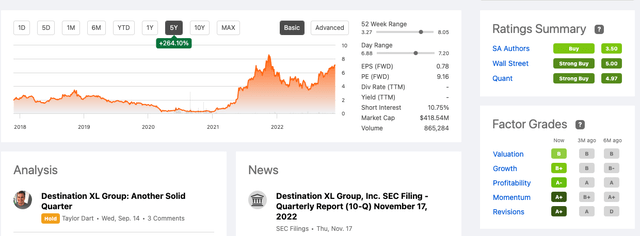

Five-year stock overview (SeekingAlpha.com)

Harvey Kanter, a retail and leadership expert, was appointed CEO and president in 2019 and is the head of this turnaround. He accepted taking on the challenge of a long-term loss-making company and was shortly after that delivered with the COVID-19 pandemic as the cherry on top of an already uphill battle. His leadership team showed resilience through tough times and has brought an impressive upward trend in the top and bottom-line performance of the company over the last two years. He is crucial to why this company is evolving and will continue on its upward-trending performance. Although the stock price is historically high, we should be cautious of the impact of inflation on purchasing power. The P/E ratio of 5.7 is well below the retail industry average and indicates that the stock is still undervalued. Investors may want to take a bullish stance on this company.

Overview

DXLG was founded in 1976 and was previously known as Casual Male Retail Group, Inc. It focuses on clothing and shoes for big and tall men in the USA and Canada. The company has 283 retail and outlet stores, an online webshop and a mobile application.

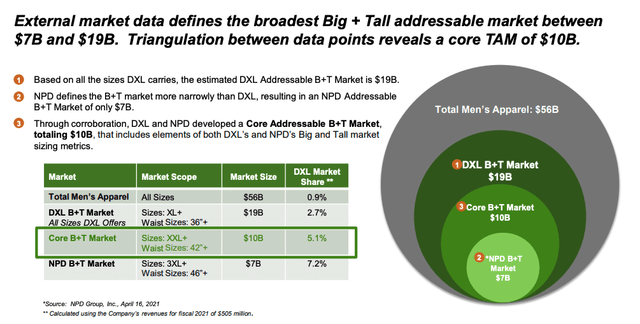

Target Market (Investor Presentation 2022)

As DXLG is predominately available in a retail store format, it was heavily impacted by the pandemic in 2020, and the company had to make some hard cost-cutting decisions and negotiated leases. However, it has come out of the dark since 2021 with record-breaking sales numbers. One of the critical competitive advantages for DXLG is that it focuses on fit for big and tall customers through consumer research and digital strategies. The company wants to grow its sales by increasing the number of customers, improving the retention rate and creating new distribution channels. Although this quarter we still see that stores account for about 70% of total sales. It has invested heavily in the customer data platform to achieve growth in more diverse channels.

CEO Harvey Kanter has recently agreed to extend his position for another three years. He has thirty years of retail experience and previous leadership positions in prior companies. He successfully navigated the company out of the pandemic and into profitability. Furthermore, he bought new faces and strategies for branding, marketing and online activities. The XL and tall retail industry are worth $10 billion. A well-operated business still has a lot of upside potential in this market if we look at the addressable market in the image below. Furthermore, it is a part of the retail industry assortment that often gets neglected or minimised, giving DXLG an edge over more general retail clothing providers.

Addressable Market (SeekingAlpha.com)

Financials and Valuation

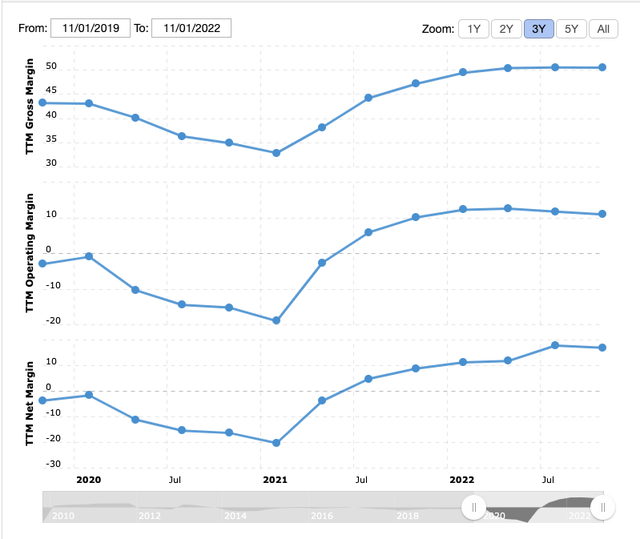

The company has made impressive ground over the last two years after many years in the red. When analysing a retail company, there are several factors to consider. Financials are important, and it is good to see the gross margin and earnings trends. Furthermore, we would ideally like to see a growing increase in sales numbers relative to the stores available. It is essential to see what is happening on the inventory front. Store growth increased by 8.7% year on year, and the company is seeing a gross margin of 50%. Below we can see that the net margin has increased from negative 3.68% to 16.94% over the last three years.

The company has seen a 30% improvement in inventory turnover and ended Q3 at $106.8 million.

If we look at the company’s cash situation, it ended this last quarter with $23.5 million in free cash flow and no debt. The company is reinvesting a portion of this cash into customer-facing technological advancements. Capital is also being directed to store expansion, entering untapped areas in various parts of the country.

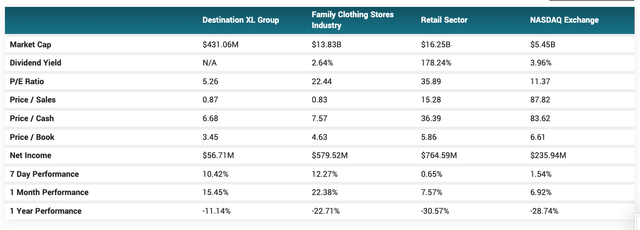

If we compare DXLG to the retail industry average performance, we can see that its price-to-earnings ratio of 5.26 is well below the industry average of 35.89, indicating that the company may be undervalued. It also has a price-to-sales ratio of 0.87, meaning that investors are paying less than what the company makes in revenue, which is a positive indicator of potential future value. The company has less net income than its peers. However, it also has a much smaller market cap relative to the hefty billion-dollar players and is currently very cheap to purchase.

Valuation relative to Retail Industry (Marketbeat.com)

Risks

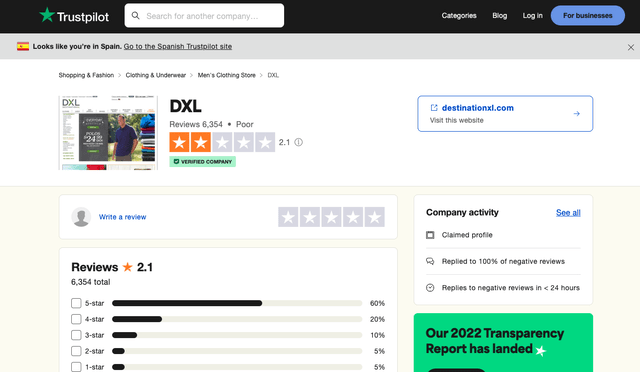

The competitive and changing nature of the market leads to deep discounts, changes in customer behaviour, and ultimately breaking the profitability margin to continue to attract new and existing customers. This year the company has been less impacted by discounts. However, it has affected the company in the past. With inflation rates on the rise and customers thinking more consciously about their spending behaviour, pricing battles could eat into margins in the future. Another issue is that the company works with many channels and only sometimes controls the entire sales cycle. Looking at online reviews, we see that DXLG needs a better customer satisfaction score.

Customer reviews (Trustpilot.com)

It has had a wholesale partnership with Amazon, which accounted for $5.4 million of total sales in 2021 and $16.6 million in 2020, and was heavily impacted due to supply chain disruption and the impact on margins. These partnerships can again impact the end customer experience and opinions.

Final Thoughts

The future looks promising for this retail company that has come out of the dark and is better positioned to focus on growing rather than cutting costs. In a competitive industry, however, the company stands out by focusing on big and tall men and ensuring fit and a wide range of available offerings to meet consumers’ diverse needs. Furthermore, management is future looking by heavily investing in technological advancements and growing various sales channels. The company has a CEO that has made a significant impact on the better of the company. Although the stock price is historically high, it is still undervalued and has room to grow if we look at the valuation compared to the general retail market. For this reason, investors may be interested in taking a bullish stance on this company.

Be the first to comment