HT Ganzo/iStock via Getty Images

In this article we will cover the helium crisis as well as future plans of Desert Mountain Energy (OTCQX:DMEHF). First we will cover the claim jumpers challenge that DME faces and then we will look at positive events concerning the company.

Claim Jumpers

In recent PR, DME disclosed the company was under attack from claim jumpers (I’ll call them Company X). The challenge to the mineral rights was broadcast; investors displayed knee jerk reactions; this became evident in the share price. This presents investors with a question of do they buy more or do they simply sell.

Concerning this question: The best approach is to take a very non-emotional stance and ponder a most likely/least likely outcome concerning recent claiming jumping news. The most likely outcome is the case does not go anywhere or it in fact proceeds on to court with ultimately Company X losing.

Let’s assume this ends up in court with Chevelon Minerals as defendants. We can garner from the PR that DME does not consider the “attempted” lease to be valid from Company X. DME goes on to state that they had conducted “due diligence with Chevelon Minerals”. However, we see Company X saying the lease for them was valid per the PR. Now if I were a judge, the first comment I would have for Company X would be, “So you did not defend your supposed valid lease for years while DME drilled on it (spending millions), and while they also publicly announced results over the course of years?”

It is also equally doubtful that Chevelon Minerals did not inform Company X they were deficient in meeting the “material requirements”.

Assumption: Typically, with mineral leases you see clauses that say Company Q has to spend a certain amount of cash within a certain time frame in order to earn the lease rights.

We can assume Chevelon notified Company X of the deficiency and hence why they never obtained the rights to the lease. Furthermore, over the course of years, Company X did not legally stop Chevelon. If Company X actually had the lease they would have shut down Chevelon from ever allowing it to go to Desert Mountain. Hence, here we are years later (close to actual production and revenues in Q4) and now Company X wants their supposed cut. It smells of Company X trying to try to get some “go away” money.

Project Validation

In an odd manner, the challenge helps validate the project. Frivolous challenges or claim jumping are nothing new. They happen all the time and are a hinderance to the defendants as the cost to threaten or challenge is very low. A prime example would be Cypress Development (OTCQX:CYDVF) having its water rights challenged earlier this year. Additionally, years prior, Cypress had an Australian company try to pull a slick one and claim jump in Nevada. It did not end well for the claim jumpers.

Concerning claim jumpers, I often suspect some “go away money” is requested, but when faced with companies like Desert Mountain Energy (which possesses stalwart leadership), I equally suspect their answer is “pound sand”. The point is one should not be shocked by lawsuits. In an odd way they can serve to validate a project.

Devil’s Advocate Assumptions

Let’s stop and expound on this point. Let us assume for a moment that the claims of Company X have validity. Let’s also assume that the property holder failed to inform the prior company that they had lost the rights to the lease or, in fact, never managed to acquire the lease. That would lead us to assume that DME failed in its due diligence. Finally, let us assume that Company X also failed to bring any of this up in the years of property development and through the millions spent by DME. What would be the worst-case scenario?

Least Likely Outcome

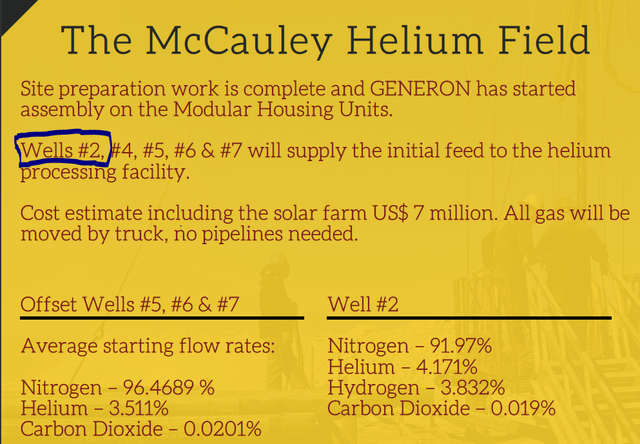

Assume the worst (and least likely) outcome happens and Desert loses the leases to the claim jumpers. How would this impact Desert? First, they might be unable to tap the helium from wells #4, 5, 6, and 7. This leaves us with the company processing helium from well #2, which we see in the below picture from the 07/06/2022 IR slide deck:

IR Side Deck (blue highlights are the authors) (Desert Mountain Energy)

A second source of revenue might be the soon to be drilled out Gunnar Dome wildcat well. Gunnar might pan out to be a future source of revenue that the production plant can process. The company hints that Gunnar Dome will be helium rich with less trace gases per the high nitrogen comments. Of course, this is assuming that they hit pay dirt with Gunnar Dome.

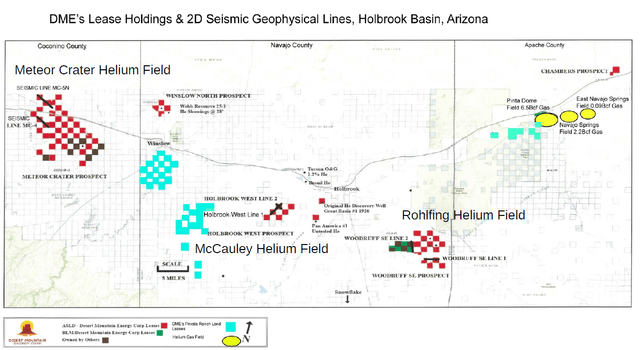

DME leases (Desert Mountain Energy)

A third source of revenue could be per a YouTube interview: Desert Mountain stated that they might process third-party helium.

Fourth the company acquired a heavy haul trucking fleet for $715,000. They are contracted out 2 years in advance.

|

Hence, we are still looking at multiple revenue streams in our worst-case event. Least Likely Summary: Worst case, Desert is still producing revenue from helium mines, third-party helium, and the trucking fleet. Lastly, in the PR DME mentioned a wild card of:

|

Helium Crisis Continues

The helium crisis continues unabated, be it low-grade helium used in party balloons or high-purity helium used in high-tech industrial use. Low-grade helium is in short supply to the point that Party City and Dollar General are helium constrained at most stores or simply out of helium altogether. This impacts kids having helium balloons at parties, but also shows us just how bad the helium shortage is on the low-purity side.

No Helium (Provided by “VeeBlue” – Used with permission)

On the high-purity side, the shortage is so intense that Harvard is shutting down equipment that relies on helium. Ponder that for a moment…Harvard, the school with deep pockets… is unwilling or unable to obtain helium for research. The reasons for the helium shortage are many and include:

1. The U.S. shutting down the 70-year-old national helium reserve in Texas which provided 27% of the domestic helium for the United States and 16% of the world’s market.

2. Russia banned the exportation of helium to non-friendly nations.

3. A Russian helium plant that was to supply 25% of the global market has not come online due to a series of mysterious explosions.

Profiting From Helium

How can we profit from this shortage? Easy, Invest in Desert Mountain Energy. Realize that for most investors helium is not something they gravitate towards investing in (but they should be).

According to Don Mosher, President of DME, crude helium (90-95% purity) has gone from $100 three years ago to $300. Now it has risen to $1,000 an mcf and that is only for low-grade helium. Higher grade helium is going for far more, but finding out the current price is very difficult as the industry remains very secretive. As a side note, DME has leases on 85,000 acres of land with a few acres directly owned.

Desert Press Release Examined

In reviewing the recent PRs, we are presented with many facts that need to be connected and explored in order to grasp the current state of affairs concerning Desert Mountain Energy and their mineral rights. I have seen much conjecture and much confusion. Let us shed some light on what is going on per the PR.

1. The plant is currently being assembled via “under construction by GENRON.” My take on this is the plant components are being built off site which is confirmed in point #2.

2. DME informs us the plant will be shipped down once completed.

3. The plant is on company-owned property and thus not subject to lease agreements.

Concerning point #3: This is a very important statement. It tells us that the physical construction of the plant should not be hindered. Thus, we should not see any plant delays. The project is still on track for a fall-winter launch.

Six-Month Company Outlook

Per an interview on the 24th of June 2022, Don Mosher gave us his six month outlook on where the company is headed:

|

Speaking of vertical integration, the company has prepaid for a drilling rig as well as having acquired a heavy haul fleet. This reduces the time the company has to wait for a drilling rig to become available, as well as reducing cost (be it from the rig or moving the rigs via the fleet).

Now realize that currently DME is not producing helium, but in Q4 the company should have its production planet operational. A period of time will be required for the company to ramp up production to optimal levels. Moving on to wells, the company has been granted two drill permits, one of which has kick off in July for a wildcat hole.

If Desert Mountain hits “pay dirt” then the stock might react as the Gunner Dome area is unproven. Then again, they might not hit anything. A second offset well is planned for “later this year” to “supply additional supply to the McCauley helium processing facility” according to DME. On a final note, the company canceled the private placement today. It had to be done to avoid any legal fallout and, frankly, it was the correct course of action. This trigged a violent and immediate blast off in stock price to the former day’s price.

Typically, when a private placement is announced you will see a stock slip as investors sell the shares to buy into the private placement. Once any lock up period is over, they sell the shares they acquired and hold the warrants. It can be a brutal process. Yet, we now see investors that sold the stock and are caught in the open. Those that happened to short are also in a pickle.

Desert Mountain Financials

Per a June 24, 2022, interview with Don Mosher (President of DME), wherein he offered that the company has about $12 million Canadian. He continued:

|

Don Mosher goes on to say concerning return on investment:

|

Granted these are estimates that Mr. Mosher points out, but it gives us a rough idea till we arrive at production. Do note 500k PER day PER well at 85-90x% margins is quite good. It should be noted that bringing the production facility online and testing of the wells may take a few quarters.

Hints of Expansion

Providing a year plus outlook, Mr. Mosher comments on future plans.

|

These Are the Times That Try Investors’ Souls

To ‘almost’ quote Thomas Paine concerning stock volatility:

|

“These are the times that try investors’ souls. The summer investor and the sunshine trader will, in this crisis, shrink from the service of their company; but he that stands it now, deserves the love and thanks of man and woman. Shorts, during a private placement, like hell, are not easily conquered; yet we have this consolation with us, that the harder the conflict, the more glorious the triumph. What we obtain too cheap, we esteem too lightly: it is dearness only that gives everything its value.” – Not quite Thomas Paine |

Having been in this game a long time, it is moments like this where you really need to thoroughly understand a company. If you do not, then it might be wise to slap the sell key and sit on the sidelines till clarity arrives. Allow the braver (if not gambler-prone) investors to assume the risk. For those of us that have studied the company in detail, this presents an opportunity for those investors that are open to unknown amounts of risk and welcome the wealth (or financial destruction) a gamble might bring.

While I think the company offers superior management, DME is not without risk. Mr. Murphy is always lurking… ready to pounce in an instant to destroy wealth. Hence, know what you are in; why you are in it; and how much risk you want to incur.

Conclusion

I’ve had quite a few conversations with well meaning but emotional investors concerning Desert Mountain Energy.

My sage advice is understand what you are investing in and do not overcommit past what you can tolerate. Mr. Market can stay irrational longer than you can stay solvent. Black Swan events can and will happen at the worst times and when you least expect it. Keep power dry or be willing to shift out of poorly-performing assets into assets you fully understand. Prepare for a long and nasty market. Yet, one day the market will improve. Those buying cheap shares month to month, in these doom and gloom periods, might do quite well with time and patience. Given DME’s project and how close to completion it is, along with the low market cap ($181 million USD) lead me to proclaim this is the best non-lithium mining company on the stock market from a risk to reward view point.

Gambler’s Corner: On the flip side, sometimes you have to roll the dice and bet hard if you have done your homework and think you are right. Of course, this approach can lead to euphoric victory or demoralizing disaster. While you can bet heavy at times, never bet so heavy it is “game over” if you lose. No matter how many times in a row you win, you will have a deep loss eventually. It is simple math. All that being said, Desert Mountain represents a very beaten up value play with a market cap of a mere $155 million USD. It is quickly becoming one of my largest positions by weight. Depending on your risk tolerances mayhap it should be in your account as well for a long-term play.

Extra: Something we wrote on DME was published here.

Be the first to comment