Scharfsinn86

While the focus of Desert Mountain Energy (OTCQX:DMEHF) is mining helium, they also have hydrogen deposits. These hydrogen deposits are frankly overlooked and often ignored.

I theorize that the hydrogen aspect of the company will become very profitable and very important. With time, we should see additional announcements and deals concerning hydrogen.

Due to the length of this research, we will be publishing two back-to-back articles in which we explore hydrogen and helium. Realize that this article has been in the works for over a month. Hopefully, you find it actionable.

Hydrogen and Helium Outline

In what I consider a bid to speed up hydrogen production timeframes, DME has paired up with hydrogen miner Beam Earth. This allows DME to concentrate on helium mining. Meanwhile, in Gotham, the Federal government has not been idle.

The Inflation Reduction Act contains clauses that positively impact Desert Mountain Energy. These clauses include credits for the production of clean hydrogen.

Inflation Reduction Act and Hydrogen Credits Will Boost Desert Mountain Energy

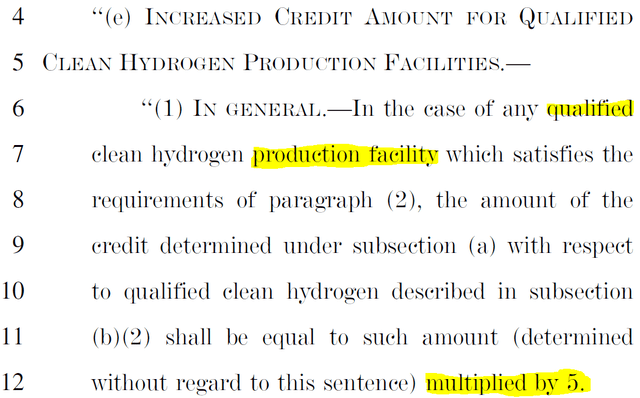

Federal legislation can have a profound impact on companies. DME and Beam Earth stand to benefit from hydrogen credits included in the legislation of the Inflation Reduction Act. Concerning hydrogen, we see the following in the text of the act.

Inflation Reduction Act (ewp.senate) |

Various percentages are laid out (in the form of credits) along with requirements on how the hydrogen is produced; where it is produced; and how much carbon it produces. Let us look at the details.

1. The hydrogen has to be produced in the U.S. or a possession of the U.S. DME meets these requirements as their hydrogen is located in Arizona.

Inflation Reduction Act (epw.senate) |

2. A credit for using renewable resources is offered. DME plans to use solar power for helium and hydrogen production.

Inflation Reduction Act (ewp.senate) |

3. Some flavors of hydrogen produce carbon. The Inflation Reduction Act addresses this. Simply storing the carbon to obtain the tax credit will be difficult. This will hinder some CO2 producing hydrogen facilities. Basically, companies are not able to net both credits. This is a non-issue for DME as they will mine white hydrogen with its little to neutral carbon footprint (as opposed to some flavors of blue hydrogen). We will cover the colors of hydrogen in a bit.

Hydrogen Credits (Inflation Reduction Act) |

4. Concerning hydrogen credits, a maximum of 0.60 cents (times 5x if all conditions are met, for a total of $3.00) is offered; the credits come in various percentages depending on how clean your hydrogen is. Also noted: The bill provides adjustments for inflation.

Additionally, remember you have the solar energy credits to add as well. Total hydrogen credits are $3.00 (if DME meets all the carbon requirements) + $X amount for solar. Let’s take a guess and say 0.50 cents for solar. Hence the total could be $3.50 in combined credits. Key word here is “could”.

Hydrogen Credits (Inflation Reduction Act) |

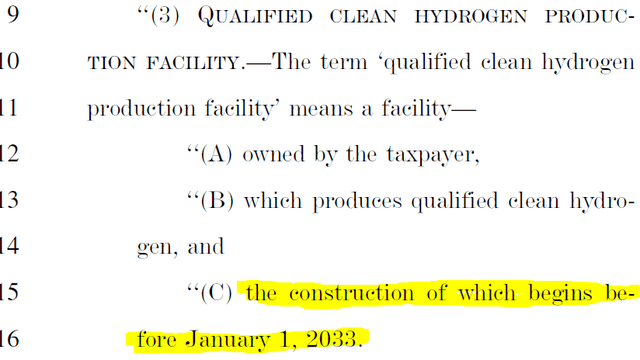

5. The hydrogen facility is authorized for the credit for 10 years from the date that it starts construction. This becomes invalid should the hydrogen production facility start construction after January 1st, 2033.

Hydrogen Production Facility (Inflation Reduction Act) |

The takeaway concerning hydrogen and DME is they could potentially net $3 dollars per kilogram (along with an unknown amount of credit for utilizing solar) on top of what they net from selling hydrogen.

Hydrogen Is Like Ice Cream; Know Your Flavors

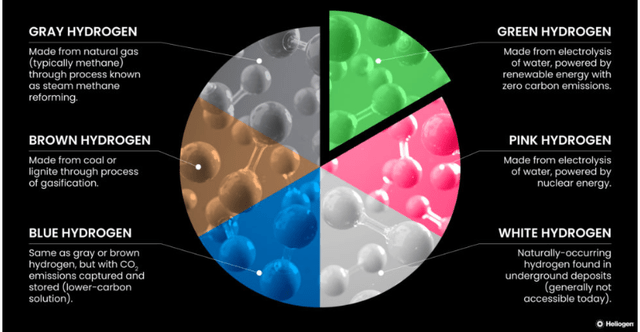

Before we continue, it is important to recognize that different methods of producing hydrogen exist. This is critical from the prospect of obtaining government assistance. The Inflation Reduction Act covers hydrogen, but only certain types will get Federal assistance. It is imperative to acknowledge which types will receive credits.

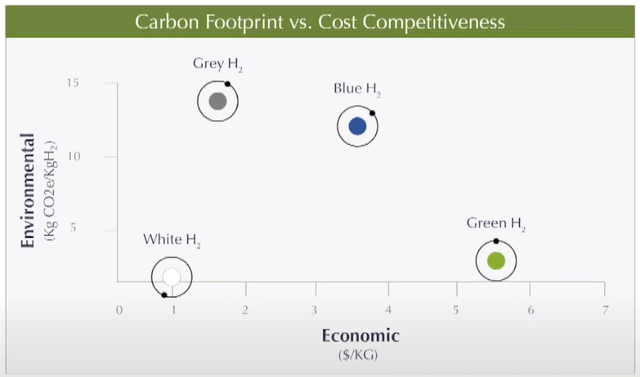

Hydrogen is colorless and odorless, yet it has been given color code names to quickly tell people how it is produced; how expensive it is to produce; and how much carbon it creates. (Hold Control and the + key to zoom in, Ctr and – to zoom out if you want to expand, reduce the picture)

Types of Hydrogen (Heliogen)

And for a more detailed look.

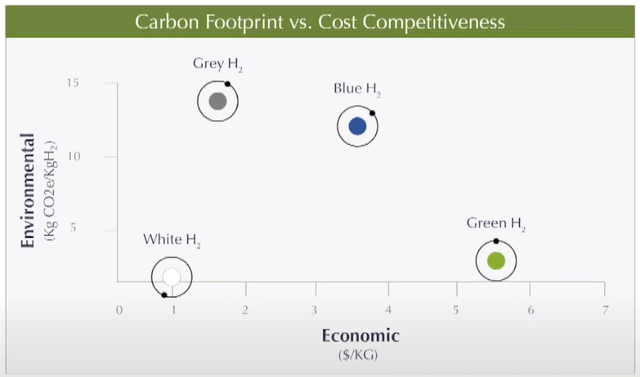

Concerning the CO2 output and cost per KG to produce:

Hydrogen Production Economics (Beam Earth) |

As you can see, green hydrogen (low in carbon output) is very expensive to produce. White hydrogen, which DME has access to, provides low to no carbon and is low cost. Factor in DME could receive solar credits and hydrogen credits on top of selling the hydrogen and, well, you get the picture.

DME Plus Hydrogen Equals An Explosive Path to Success

I have covered the helium aspect of DME in great detail in past articles; one overlooked portion of the company has been the hydrogen fields. The hydrogen fields are often a side note (much like neon or ultra-rare helium aka Helium-3 that the company might possess in commercial quantities).

DME is ever changing, the companies focus has been helium, but now we see a second potential product open up. Hydrogen is moving forward via the Beam Earth partnership, but how does one tap into hydrogen? How does one transport and sell it?

In a recent interview, Mr. Rohlfing discussed converting hydrogen and nitrogen to ammonia. Realize that ammonia is a key ingredient in making fertilizer, but ammonia also allows for easy transport and one can always break up ammonia back into hydrogen/nitrogen once they reach the intended location.

|

It is very interesting that Mr. Rohlfing is talking about ammonia and then we factor in the quote “when we work with hydrogen”. I view this as a reference to the Beam Earth partnership. That is reading a little into it (but that is my prerogative).

Ammonia: Fuel, Transportation, Storage Medium

If a market is not close to you, then you could convert the nitrogen-hydrogen to ammonia, transport it to an existing market, and break it down or use it as fuel. Sustainable-carbon.org describes this process:

|

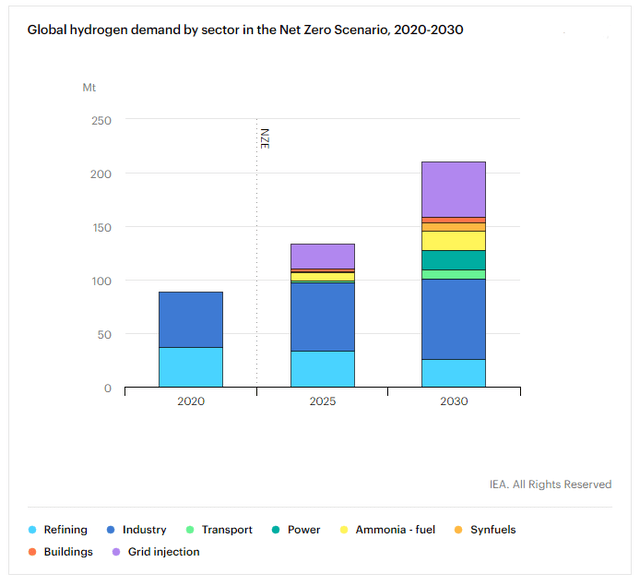

Looking at Iea.org, we see a 2020-2030 estimation on hydrogen demand. Note the ammonia-fuel in yellow and the amount going to power the grid.

IEA 2020-2030 Hydrogen Demand (IEA)

Mr. Rohlfing is not the only one looking to convert hydrogen to ammonia in order to transport it. The Canadians are also looking to export hydrogen to Germany in the form of ammonia. Per Cbc.ca:

|

“Prime Minister Justin Trudeau and German Chancellor Olaf Scholz signed what they called a “joint declaration of intent” that calls on the two countries to invest in hydrogen, establish a “transatlantic Canada-Germany supply corridor” and start exporting hydrogen by 2025. Trudeau called it a historic moment.” “Under the agreement, Canada will export wind-generated hydrogen to Germany as that country looks to move away from Russian imports.” “The agreement, which Trudeau called the “Canada-Germany hydrogen alliance,” was signed in a town where a company plans to build a large plant to convert wind energy to hydrogen and export ammonia to Europe.” |

Per Beam Earth board member Michael Hart, concerning white hydrogen which DME possesses:

|

Beam Earth and Ammonia

If we look to the Natural Hydrogen Worldwide Summit conference notes, we can see DME partner Beam Earth discuss ammonia as well.

|

What an interesting statement! Use white natural hydrogen for fertilizer AND you get up to 2% helium as a biproduct. It makes me wonder just where Beam Earth has operations and how that might factor into statements concerning expansion and DME.

Mr. Pierre Levin discusses Brazil (at the 6 min mark) and how white hydrogen could help them concerning fertilizers:

|

Could these be the “jurisdictions” that DME CEO Robert Rohlfing spoke of, (besides the statements talking about looking at other states)? Mayhap or mayhap not. Time will tell. Till then we are just looking at hints and fragmented pieces in an attempt to put together the puzzle.

Beam Earth – Hydrogen Costs

Beam Earth CTO Pierre Levin breaks down the $/KG of hydrogen produced. We can see that some hydrogen produces much CO2. Just to reinforce, other types like green hydrogen are too expensive. White hydrogen comes in super cheap and produces almost no CO2.

Hydrogen Production Economics (Beam Earth) |

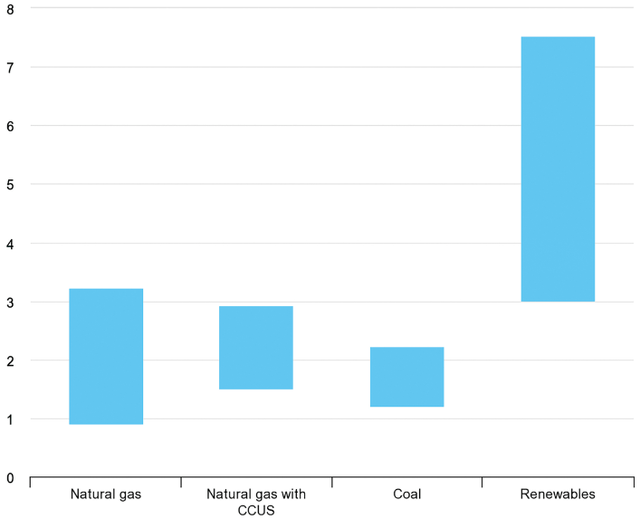

Looking at how various types of hydrogen become costly to produce, we need to consider the inputs used to create it. While this chart is from 2018, it does give us a rough idea.

Costs to produce hydrogen – 2018 (iea.org) |

Conclusion of Hydrogen Analysis

One might venture that DME pushes forth with its main focus of helium, while the Beam Earth potential partnership focuses on hydrogen and all of the various products that can be made from it.

Given the massive credits that the inflation reduction act brings for hydrogen (combined with a fertilizer shortage due to energy costs soaring in Europe and the conflict in Ukraine) I think DME offers an intriguing play for an investor that does not mind taking on risk.

Remember, winter is coming to Europe and being energy dependent upon Russia, is not a relationship they relish. Hence, I would not be surprised one bit if we see a DME-Beam Earth joint venture to tap hydrogen and sell it to domestic or even foreign markets given the price. However, this is a plan that may take some time to reach maturity, if ever. In our follow up article we will discuss DME and helium along with expanding the risk section. Stay tuned.

Be the first to comment