solidcolours/iStock via Getty Images

Published on the Value Lab 13/8/22

Deluxe (NYSE:DLX) is an interesting story as it has been trying to move away from its declining checks business for years. The cash generated from checks have been funneled into various ventures, and the First American acquisition was the latest and the most successful, changing their revenue mix into one that now is moved meaningfully by the payments business. They paid a fair bit for that growth however, and it is reflecting in their debt situation. Interest is high and growing rates are going to crimp on earnings. While growth is more constant now, be wary of debt, because debt is what can make an investor lose all their money.

A Good Q2

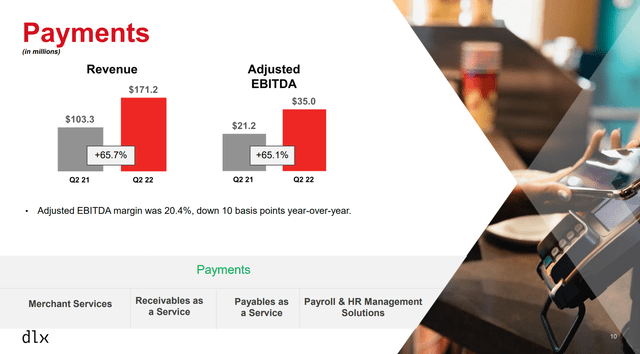

There really wasn’t much wrong with Deluxe’s Q2. Growth is there, even organic growth taking aside the impact of the First American consolidation. Excluding First American, the payments revenue increased by nearly 7%. The loser segments were in promotion, mainly due to supply chain issues which had a substantial impact on EBITDA.

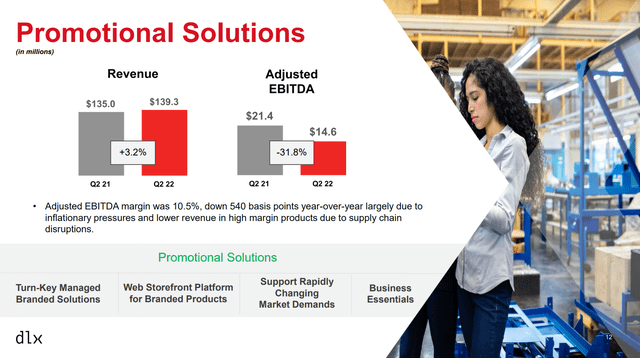

Promotional Segment (Q2 Press 2022)

The segment which focuses on things like business cards is anyway in decline, and its share of the mix is reflecting that clearly.

Most of the payments growth is coming from the First American acquisition, but as said, some of the growth is organic and the EBITDA is growing in step with the revenues, so we are not seeing any margin compression.

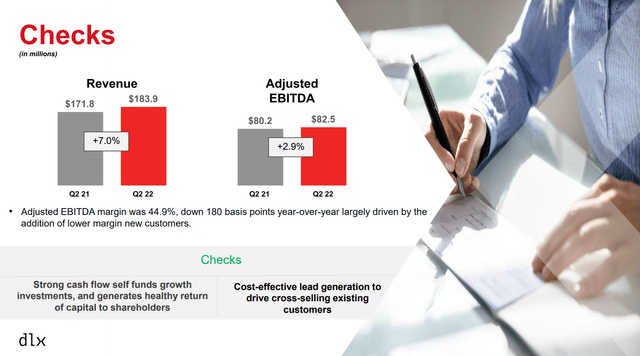

Checks actually grew this quarter and it continues to be the company’s most important segment in terms of sales but also in its EBITDA contribution. It’s because of this segment that Deluxe was able to afford the First American acquisition in cash.

Marginality is suffering, and make no mistake the business continues to decline in terms of volumes, but much like tobacco, pricing wins are keeping the cash flows growing. It still represents about 50% of the company’s EBITDA, with payments now being roughly 25%.

Conclusions

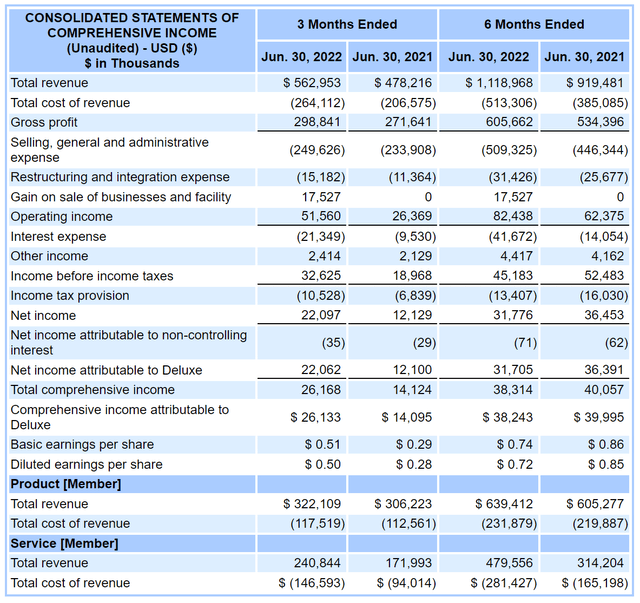

The share of more promising areas grows in the profit mix which is good, but there are some clear concerns for the business. 60% of the debt is variable rate and interest expenses are already high.

Very simply, that 60% of the debt will likely see a substantial increase in interest rate with DLX’s average rate being 3.6%. Reference rates are going up some more, and we should see at least a 2% addition to reference rates cumulatively compared to last year. Assuming a constant premium on reference rates, that means that the $55 million in interest expense will see an increase to around $95 million per year as guided by management. This is going to be quite the hit to net income, likely reducing it some 20-40% YoY despite the addition of First American.

Ultimately it is expected with the substantial leverage ratio of almost 4x. First American wasn’t cheap and now that money has gotten more expensive DLX is paying a bit of the price. Most of the debt is pretty long-term so they won’t likely need refinancing in the current environment. And they are managing the debt load, but things are looking somewhat challenging incrementally on account of leverage, despite good M&A moves longer term. We don’t see a very strong reason to move into DLX right now. With incremental macroeconomic challenges also being something that the company needs to worry about – they are absolutely not immune to macro decline neither in payments nor the checks business – that debt could magnify issues. We’d avoid currently.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment