The Good Brigade/DigitalVision via Getty Images

Published on the Value Lab 11/12/22

Deluxe Corporation (NYSE:DLX) delivers more growth this quarter. Interest expenses are up and putting pressure on net income, but ultimately DLX is delivering the growth that for years it promised. While there is resilience, especially with payments delivering consistent growth, checks is going through an unsustainable spurt that’s about to be lapped. DLX will start seeing declines in checks as one would expect, but it’ll still be printing cash. Overall, the multiple already reflects the expectation of checks declines, and is compelling for investors.

Q3 Review

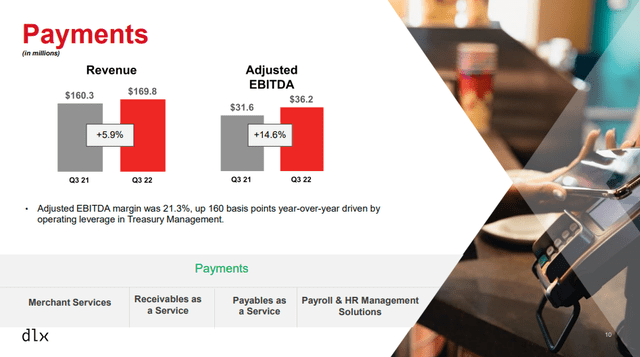

Let’s blaze through some of these key Q3 figures. Payments produces growth. By now the First American acquisition has been lapped, so this growth is mostly organic and is coming from both merchant services and treasury management volumes. It is looking pretty good despite the pressure that is supposed to be put on the goods market, shown in the slightly weaker merchant services growth compared to the other businesses.

Payments Segment (Q3 2022 Pres)

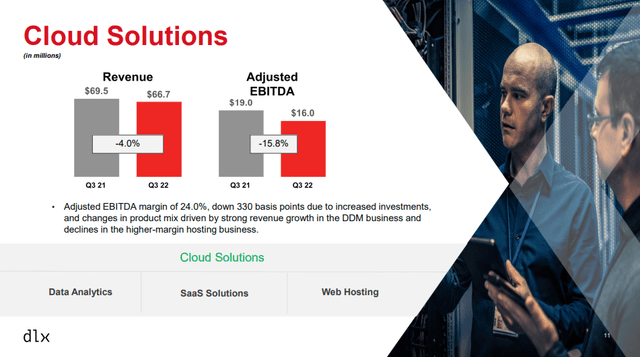

The cloud business is seeing declines in revenue, but this is because of divestments. Otherwise it is growing about 5%. DDM was the strong performer which is the digital marketing management business, and this has been growing in the mix which has had a bit of a negative margin effect. DDM growth, which is the digital marketing management business, is growing despite pressure on Deluxe’s mortgage customers, where a lessened interest in mortgages nowadays is putting pressure on campaigns in that world.

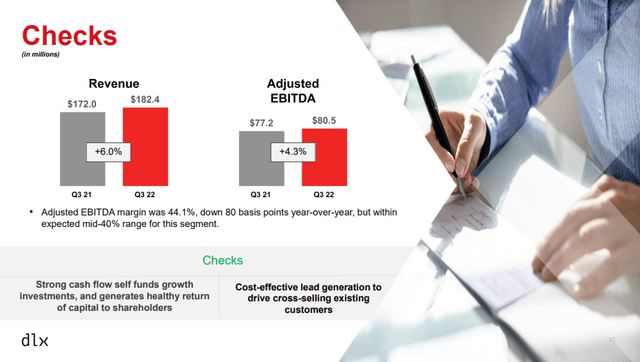

Checks, which is DLX’s legacy business, is by far the most important segment and it has seen growth thanks to major customer additions last quarter. This is an exceptional thing for a business that is otherwise in decline, and these big customer wins have only temporarily changed the profile. Things will revert to being in decline for checks soon, and there is nothing that can really be done about that except for hoping for the occasional big customer win. A secular decline in checks is absolutely priced in, but it is a low investment business and is a great cash flow contributor to give DLX the optionality to move in other directions, as they were able to do with the First American acquisition.

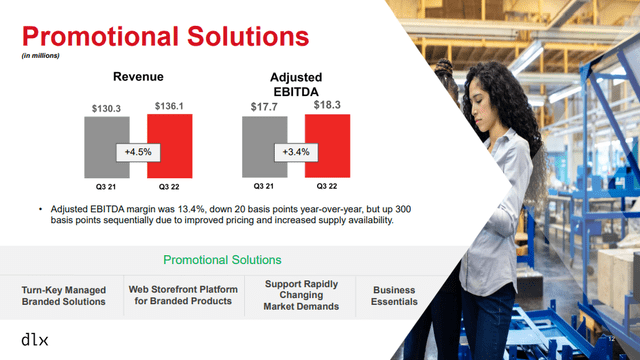

Finally there was promotional services, which actually had a 9% growth if you exclude divestments. This was going better due to increased availability of supplies for business cards etc. Meeting the pent-up demand was happening at a worse margin for the moment because of difficulties and expense in procuring supply, and margins are expected to improve sequentially here. Much of the growth here was from pricing action which preserved margins to a degree.

Promotional Solutions Segment (Q3 2022 Pres)

Bottom Line

DLX is really producing growth. About a 60:40 ratio was coming in between volume versus pricing action in producing the current growth we are seeing, which even net of divestments was positive and organic. This is a big accomplishment for a company that had been long struggling to produce growth results for investors. Checks are of course coming in positive these quarters are there are no illusions about the sustainability of that growth – it’s not sustainable at all and once the big new customer wins are lapped this segment will resume its modest declines.

Nonetheless, DLX has profoundly changed its profile in particular with the First American acquisition which puts 36% of their revenue in a growing and attractive camp.

However, the First American acquisition did bloat their debt, so while adjusted EBITDA grew comprehensively for the company by 2% net of divestments, the net income fell by about 10% on the substantial variable rate debt resetting into higher rates.

Nonetheless, this interest expense isn’t decimating margins, they’re not up more than 15-20%. Things still look very solid and the multiple pretty compelling on a stabilising picture for DLX. The EV/EBITDA multiple lies at 6.3x, which is a very mature multiple despite stemmed declines from checks thanks to payments, and the PE multiple is only 12.5x despite the contraction in earnings coming from higher interest expenses and a more levered capital structure. In order to confidently take on Deluxe, investors must be confident that the current recession is garden variety. The CPI data as it stands seems to indicate that the inflation is possible to deal with. However, the Michigan survey does indicate risks of wage-price spiraling, so investors need to understand that the Fed is going to tighten some more, probably more than anyone expects right now. This would increase pressure on DLX’s PE. Nonetheless, there’s a margin of safety and we see resilience in its businesses with room for some improvement in margins as pricing measures fully take hold.

Be the first to comment