Milko/E+ via Getty Images

Intro

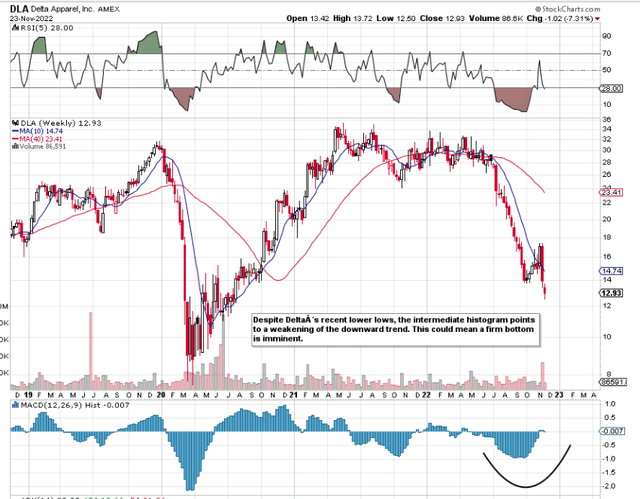

If we pull up an intermediate chart of Delta Apparel, Inc. (NYSE:DLA), we can see that the sustained pattern of lower lows that we have witnessed in this calendar year accelerated to the downside in July of this year. Shares of DLA finally managed to bottom in October of this year before turning over once more aggressively to the downside post the announcement of the company’s fourth-quarter earnings numbers. The change of trend then resulted in shares making a lower low. Shares of Delta now trade at approximately $13 a share which is very close to their 52-week lows.

What is interesting (and despite the recent carnage) however is that Delta’s intermediate histogram has bounced back into positive territory. This indicator plots the difference between two distinct moving averages but its real value is its ability to bring to light trend changes that may be occurring. Suffice it to say, the longer Delta’s intermediate histogram can remain in positive territory, the more likely that a firm bottom should take place over the near term (Or it may already be in).

If a firm bottom is on the horizon in Delta Apparel, we should be seeing signs of a turnaround in the company’s fundamentals. Bottoms invariably form when the respective company’s valuation and profitability trends stack up for investors in an attractive risk/reward manner.

Delta Apparel Technical Chart (Stockcharts.com)

Struggling Profitability

Delta is just off the back of reporting its fourth-quarter numbers. Here we can compare the company’s annual trends as well as how trends turned out in Q4 compared to the same period of 12 months prior. Topline sales almost hit $485 million in fiscal 2022 with gross profit hitting $108.8 million. Both of these key metrics grew over fiscal 2021 which is encouraging. Further down the income statement, we see a slight contraction in operating profit (EBIT of $29.9 million compared to $31.1 million in the previous year) and a drop of approximately $600k in net profit. (Just under a 3% contraction to $19.7 million). All in all, these numbers were better than expected given the bearish technicals discussed earlier.

From a fourth-quarter standpoint, however, we see the expected deterioration of the financials. Although marginal sales growth was still eked out in the quarter, gross profit dropped by almost $5 million and SG&A costs rose by over $2 million. These trends impacted the company’s net earnings for the quarter, which came in negative due to the above-mentioned higher costs (EPS of -$0.04 per share).

Suffice it to say, the 18.7% gross margin print in Q4 brought down the annual gross margin to a reduced 22.43% level which is worrying in itself. Why? Because Delta was already behind the eight ball with respect to its margins coming into this fiscal year. Now with a bloated inventory in no small part to the spike in the price of Cotton in the Summer, higher costs, and growing debt, you can bet that investors are pricing in the ramifications of Delta’s lower margins as we head into fiscal 2023. In an environment of higher cotton prices, production levels will have to subside to reflect the change in demand. This is the last thing management wants at the moment as it knows robust sales growth is needed to override those cost issues on the income statement.

Suffice it to say, Delta at present is caught between a rock and a hard place. It needs to grow sales in order to increase earnings but it cannot do it at present due to the company’s inventory position and elevated current liabilities. In fact, Delta’s current inventory position ($248.5 million) comes in at almost three times its market cap ($89 million) so production is expected to moderate for some time in fiscal 2023 in order to get that inventory back in alignment.

In the Salt Life Group segment, management reported growth in both top-line sales as well as gross margins in Q4. Unfortunately, though, this segment only brought in $14 million of the company’s overall $115.5 million in sales in the quarter. The Delta Group (comprising 88% of sales in the quarter) is still where it is at in this company despite the very impressive 50%+ gross margins the Salt Life Group reported in Q4.

Valuation & Balance Sheet

Therefore, with the possibility of reporting negative earnings for some time, we need to see if the company’s valuation is low enough to justify this new paradigm. At present, shares trade with a trailing sales multiple of 0.19 and a trailing book multiple of 0.49. Although interest-bearing debt has risen in recent times, book-value growth has been there to meet it. Worryingly though, cash-flow generation has been very weak in recent quarters with the company actually going through $6.7 million of operating cash flow in the recent fourth quarter.

If we look at the last four quarters, for example, revenues have remained more or less flat but net profit is down over $7 million. The inability to generate continuous cash flow means the balance sheet simply has to suffer as a result. Delta’s cash balance has now been whittled down to $300k and with the above-mentioned inventory having risen significantly in recent quarters, cash-flow generation has taken priority over profitability for the time being. Cash flow can be generated by either taking on more debt or bringing down that inventory as fast as possible. The company at this stage has chosen the latter which is most likely the favored choice from a long-term standpoint.

Conclusion

Therefore, to sum up, the fact that some of Delta’s factories will not be running at full capacity next year tells us a story in itself. High working capital commitments (money tied up) along with depressed earnings means that the company has to literally one step back before it can hopefully take two forward. Management talked up the success in the likes of DTG2Go, and Salt Life & the improving fundamentals in the Retail Direct & Global Brands channels but investors (The Market) need to see some type of signal that sustained bottom-line profitability is on the way. Once that happens, a strong rally can ensue. We look forward to continued coverage.

Be the first to comment