guvendemir

Introduction

In times of economic uncertainty and increasing geopolitical tensions, portfolio diversification pays off once again. It’s important to allocate a certain percentage to non-cyclical or even anti-cyclical sectors, and defense companies come to mind in this context. They provide industrial exposure, but with an insignificant cyclicality.

But with the first anniversary of the war in Ukraine approaching, isn’t it a bit late to consider adding defense companies to the portfolio? After all, shares of Lockheed Martin (NYSE:LMT), the company behind the F-35 fighter jet, have risen more than 30% since the November 2021 low – hardly surprising given growing demand from NATO members like Germany, as well as neutral Switzerland.

As a dyed-in-the-wool value investor, I’m very careful not to overpay for my long-term holdings, so in principle I’m wary of adding to my position in light of the “good” news. The much smaller and underfollowed defense contractor Huntington Ingalls Industries (NYSE:HII) (“HII” since April 2022), lagged Lockheed by more than 10 percentage points over the same period, largely due to its focus on military ships and related technology, which do not play an important role in the current conflict or in strengthening Western Europe’s land and air defenses. Conversely, fear of possible escalation in Taiwan could lead to increased demand for assault ships, aircraft carriers, and related technology, from which HII would benefit enormously.

Therefore, it seems prudent to ask whether it is time to buy HII (and potentially sell Lockheed) to either enter the defense space at a more reasonable valuation or adjust one’s holdings to be ready for emerging threats. As an income-oriented investor, I will focus on the qualities of the two companies as dividend stocks and also offer my opinion on the companies’ operations, profitability and balance sheet quality.

LMT and HII –Overview And Key Risks

I have already covered Lockheed in a comparative analysis with Raytheon Technologies (RTX), so I will only briefly discuss the company here. LMT is best known for its F-35 fighter jet platform, and the program will continue through 2070, guaranteeing reliable sales and service-related revenue. The F-35 program accounted for about a quarter of LMT’s net sales in 2021 (p. 85, 2021 10-K). Other well-known programs include the C-130 Hercules, the F-16 Fighting Falcon, and the F-22 Raptor. The corresponding revenues are reported in the Aeronautics segment (40% of 2021 sales). Lockheed has also owned Sikorsky Aircraft since 2015, through which it manufactures and sells the UH-60 Black Hawk and SH-60 Seahawk, for example. Helicopter-related sales are reported in the Rotary and Mission Systems segment (25% of 2021 sales), which also includes integrated warfare systems and sensors, C6ISR (Command, Control, Communications, Computers, Cyber-Defense and Combative Systems) programs and more. Missiles and Fire Control (17% of 2021 sales) includes, for example, the PAC-3 (Patriot Advanced Capability-3) and THAAD (Terminal High Altitude Area Defense) programs, the MLRS (Multiple Launch Rocket System), Hellfire missiles, and fire control systems for Boeing’s (BA) AH-64 Apache helicopter. Through the Space segment (18% of 2021 sales), Lockheed offers for example hypersonic strike and human and robotic exploration technologies. Aerojet Rocketdyne (AJRD), which LMT planned to acquire in late 2020 but was later rejected due to FTC objections, would most likely have become a part of the Space segment or the Missiles and Fire Control segment due to its focus on missile, hypersonic, and electric propulsive systems. As an aside, the sixth largest defense contractor in the U.S., L3Harris Technologies (see my analysis from last week), recently announced its acquisition of AJRD, positioning itself as an increasingly important defense contractor.

Although HII is the largest military shipbuilding company in the U.S., it’s only about 14% the size of Lockheed in terms of 2021 net sales ($9.5 billion vs. $67.0 billion). The company was only formed in 2011 through a spin-off from Northrop Grumman and currently has three reportable segments. Ingalls ($2.5 billion sales in 2021) and Newport News ($5.7 billion sales) represent the company’s non-nuclear and nuclear ship businesses, respectively, both including repair and maintenance businesses. Unmanned systems, nuclear and environmental services as well as a variety of professional services are reported through the Technical Solutions segment ($1.5 billion sales).

Non-nuclear ships include various large deck amphibious assault ships (LHAs) and amphibious transport dock ships (LPDs). Most recently delivered examples include LHA 7 Tripoli, LPD 27 Portland and LPD 28 Fort Lauderdale. HII also constructs Arleigh Burke class guided missile destroyers, such as USS Jack H. Lucas (Flight III) which completed builder’s trials in December 2022, and National Security Cutters (NSCs) like NSC 9, which was delivered to the U.S. Coast Guard in 2020. Of note, competitor General Dynamics (GD), through Bath Iron Works, is also capable of constructing Arleigh Burke class destroyers for the U.S. Navy. Bath Iron Works also constructed USS Zumwalt, the lead ship of the Zumwalt class, which itself was succeeded by the Arleigh Burke class Flight III (see above).

HII’s Newport News segment is likely best known for the Navy nuclear aircraft carriers (CVNs) it constructs, such as the Gerald R. Ford class of aircraft carriers. HII also performs refueling and complex overhaul or inactivation tasks for nuclear aircraft carriers. Nuclear-powered submarines include the Virginia Class (SSN 774) and Columbia Class (SSBN 826), and HII has a teaming agreement with GD’s subsidiary Electric Boat Corp. to build both classes of submarines.

HII’s focus on shipbuilding understandably means that the company’s projects are much more long term in nature. For example, HII was awarded CVN 78 and 79 back in 2009, and CVN 78 (USS Gerald R. Ford) did not start on its first deployment until the fourth quarter of 2022. Therefore, it is easy to understand why HII’s backlog is much larger, relatively speaking, than LMT’s. At the end of 2021, HII’s backlog of $48.5 billion represented nearly seven times its total revenue for the year, while LMT’s backlog of $136 billion represented only 2.4 times the company’s total 2021 sales. According to today’s full-year earnings release, Lockheed’s backlog increased 11% year-over-year to $150 billion, which in principle is a welcome development and a sign of strong demand. However, it should be remembered that Lockheed delivered one less F-35 than a year ago, and deliveries attributable to government helicopter programs (-4 YoY) and international helicopter programs (-8 YoY) also are lower than a year ago due to supply chain and other issues. Going forward, investors should also keep an eye on the recently announced halt to F-35 acceptance flights and deliveries. Originally, and before the engine issue was discovered, management expected delivery of 148 F-35s in 2022 (see earnings call transcript).

Taken together, Lockheed’s focus is on air and ground warfare, while HII, along with General Dynamics, dominates the naval sector. Lockheed is much more diversified – in part because of its considerable size (nearly seven times HII’s sales) – and much more agile because of its shorter project cycles. Of course, both companies are quite capital intensive, while at the same time, revenue visibility is quite good, but there is of course the risk of cost overruns. Major defects could have a significant impact on both companies’ reputation as defense contractors. However, I do believe that this risk is more relevant for Lockheed because of its shorter product cycles.

As both companies are defense contractors whose main customers are the U.S. Department of Defense and other national agencies, they are naturally dependent on the U.S. defense budget. However, given the ongoing conflict in Ukraine and an increasing trend toward deglobalization and protectionism, defense companies should continue to do well. Federal debt does play a role in theory, and defense spending cuts have been mooted, but I frankly doubt the U.S. will put its top position on the line, especially at a time of growing global tensions. While international business is insignificant to HII, about a quarter of Lockheed’s sales are to international governments, so there is a risk that revenues could drop significantly if overseas alliances fracture. Other risks relevant to LMT and HII include supply chain disruptions (both manufacture highly complex units) and labor issues. However, in my opinion, these risks are clearly visible at the moment and therefore reflected in share prices.

How Do LMT And HII Compare In Terms Of Growth And Profitability?

Since 2011, the year HII was spun out of NOC, the company has grown its adjusted operating profit by an average of more than 12% per year (Figure 1), faster than Lockheed’s still very respectable 10% (Figure 2). The difference is understandable given that Lockheed is a much larger company with a more diverse customer base. It also should be noted that HII’s earnings are much more spotty, as is its free cash flow. Both companies are currently feeling the effects of supply chain disruptions, labor shortages and other pandemic-related fallout effects, and as a result LMT reported free cash flow of $6.1 billion for 2022, down from $7.7 billion a year ago (excluding adjustments for working capital movements and stock-based compensation expenses). The company forecasts stagnant free cash flow for 2023, which is hardly surprising given industry-wide and ongoing challenges. Figure 1 and Figure 2 also show analyst estimates for LMT and HII earnings through 2025, but I would not over-interpret these numbers due to rather low forecast accuracy over the past decade.

Figure 1: FAST Graphs plot for Huntington Ingalls Industries stock [HII] (obtained with permission from www.fastgraphs.com) Figure 2: FAST Graphs plot for Lockheed Martin stock [LMT] (obtained with permission from www.fastgraphs.com)![FAST Graphs plot for Huntington Ingalls Industries stock [HII]](https://static.seekingalpha.com/uploads/2023/1/24/49694823-16745819062486553.png)

![FAST Graphs plot for Lockheed Martin stock [LMT]](https://static.seekingalpha.com/uploads/2023/1/24/49694823-16745868561681871.png)

In terms of profitability, Lockheed is significantly stronger than Huntington, based on both operating margin (about 12% vs. 8%) and free cash flow margin (about 10% vs. 5%, FCF normalized for working capital movements and adjusted for stock-based compensation expense, nFCF). Therefore, it is hardly surprising that Lockheed’s return on invested capital (ROIC) of about 20% is much better than Huntington’s (about 9%), suggesting that the company is the better long-term choice from a shareholder return perspective. When normalized free cash flow (i.e., cash return on invested capital, CROIC) is taken into account, HII is occasionally unable to earn its capital asset pricing model- (CAPM) derived cost of equity (COE) and therefore not a good investment from this perspective. Of course, weak CROIC can be improved over time, but in this context, it seems worth noting that HII is much more capital intensive than LMT, with a capex ratio of about 40% versus 20% of nOCF. Clearly, the company’s operational focus is taking its toll on profitability.

As an aside, and as my regular readers know, I am rather skeptical about the use of CAPM-derived COEs. While such values “accurately” take into account the risk-free interest rate and the respective stock’s volatility, they do not take into account other factors such as balance sheet quality, economic moat, etc. The fact that the CAPM-derived COE for HII (currently 6.3%) is lower than LMT’s (currently 7.1%) defies common sense, as LMT is a much larger, better diversified and financially stronger company (see below). Personally, I believe COEs of 9% and 8% for HII and LMT are reasonable given the current interest rate environment and LMT’s superior position.

Which Of The Two Has The Stronger Balance Sheet?

Rating agency Moody’s assigned Lockheed Martin and HII senior unsecured ratings of A3 (A- S&P equivalent) and Baa3 (BBB- S&P equivalent), respectively, both with a stable outlook. The difference in ratings is easily understood by looking at Huntington’s debt levels. In the hypothetical case that the company suspends dividends and share repurchases, it would need about six to seven years of normalized free cash flow (currently about $500 million annually) to pay down all financial debt. Including pension-related and other long-term liabilities, the ratio rises to nearly 11 years. At Lockheed, leverage is much more modest, with notional repayment terms for debt and all long-term liabilities of 1.7 years and 2.2 years of nFCF (about $7 billion annually), respectively.

At the same time, Huntington Ingalls is more sensitive to rising interest rates (see maturity profile in Figure 3), but of course pension-related obligations also should be considered. As of the end of the third quarter of 2022 and the fourth quarter of 2022, HII and LMT reported pension and other post-retirement obligations equal to approximately 10% of total assets. However, LMT periodically reduces its exposure to pension obligations by acquiring group annuity contracts, as I have discussed in this article. For example, in 2022 and according to the quarterly and full-year update released today, LMT took a $1.5 billion pension settlement charge and reduced its unfunded pension liabilities by more than 30%, or $2.8 billion, year-over-year – of course, fair value adjustments do also play a role.

Figure 3: Debt maturity profiles of Lockheed Martin [LMT] and Huntington Ingalls Industries [HII], as of year-end 2021; note that $1.6 billion maturing between 2023 and 2041 are not detailed in LMT’s 10-K and therefore represented as fractional amounts over the years (own work, based on the companies’ 2021 10-Ks)![Debt maturity profiles of Lockheed Martin [LMT] and Huntington Ingalls Industries [HII], as of year-end 2021; note that $1.6 billion maturing between 2023 and 2041 are not detailed in LMT's 10-K and therefore represented as fractional amounts over the years](https://static.seekingalpha.com/uploads/2023/1/24/49694823-1674582081184989.png)

HII’ interest coverage ratio is logically also weaker than LMT’s due to its higher capital intensity and higher debt, with around seven times pre-interest normalized free cash flow vs. 13 times. However, given Huntington’s focus on very long-term projects, the weaker interest coverage ratio is not a concern in my view, although it will certainly decline as the company refinances its maturing debt and assuming interest rates remain at elevated levels for an extended period. At the same time, it is important to keep an eye on the (theoretical) risk of cost overruns.

Finally, it is also worth looking at share buybacks. Lockheed just reported that it repurchased $7.9 billion of stock during 2022, up from $4.1 billion in 2021, and has seen its diluted share count decline 27% since the first quarter of 2011. At the same time, earnings per share increased 37% due to the share repurchases. Given the still very high-quality balance sheet, LMT continues to operate from a position of strength and I would not term the buybacks as “financial engineering.” During the same period, HII repurchased 18% of the weighted average diluted shares outstanding in the first quarter of 2011, resulting in a 22% increase in EPS over the last decade. The company has also engaged in share repurchases in recent years, but given its weaker balance sheet and profitability, repurchasing only $141 million worth of shares since the beginning of 2021 hardly seems surprising.

Qualities Of LMT And HII As Dividend Growth Stocks

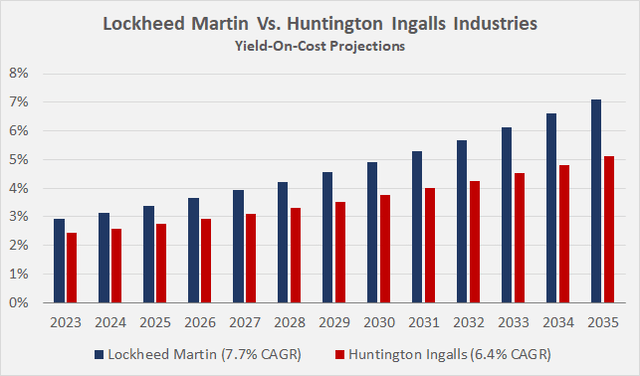

Both companies seem very committed to their dividends, having increased their payouts to shareholders also in 2020. This, of course, shows that both companies were largely unaffected by the lockdown measures that year due to their status as defense contractors with de facto nil commercial exposure. Lockheed and Huntington have increased their dividends for 20 and 11 consecutive years, respectively, but it should be remembered that HII was only spun out of NOC in 2011. NOC’s dividend history is comparable to LMT’s, with 19 consecutive years of increases. LMT’s and HII’s payout ratios are quite similar at around 40% of nFCF, suggesting ample room for growth. Over the past decade, dividend growth has slowed for both companies, but is still very reasonable. HII’s nine-year compound annual growth rateis 22.5% and 6.4% over the past three years, while Lockheed’s nine-year CAGR of 9.5% compares more favorably to its three-year CAGR of 7.7%.

Lockheed Martin strikes me as the better investment from a dividend perspective for several reasons. Although the stock has outperformed HII recently, it still has a higher dividend yield of currently 2.7% vs. 2.3%. Since payout ratios are fairly similar, backlogs are strong, and cash flow visibility is good, companies should be able to maintain their near-term dividend growth rates. However, given HII’s much higher leverage and BBB- rating, I can imagine the company prioritizing debt repayment over cash returns to shareholders, so I would not bet on ultra-positive dividend growth surprises. If the two companies maintain their three-year CAGRs, investors in LMT will outpace the current yield of long-term government bonds in 2026 or 2027, while investors in HII will need more patience until around 2030 or 2031 (Figure 4).

Figure 4: Yield-on-cost projections for Lockheed Martin and Huntington Ingalls Industries (own work, based on the companies’ three-year dividend CAGRs and most recent quarterly dividend)

Valuation And Verdict – Is It A Good Idea To Sell LMT And Buy HII?

From a long-term investor’s perspective, both companies are fundamentally sound and have wide economic moats. HII and LMT are heavily dependent on the U.S. defense budget, but this is not necessarily a disadvantage – especially during times of rising geopolitical tensions and bleak economic outlook. Both develop and produce equipment that is essential to national security and to maintaining the U.S.’s status as the global superpower. On closer examination, however, Lockheed is the superior company. It’s much more profitable, better diversified, and committed to projects with faster turnaround. At the same time, it also benefits from long-term maintenance and service contracts. LMT’s balance sheet is rock solid, and the amount of unfunded pension liabilities is gradually declining, both in absolute and relative terms.

But what about LMT’s excellent performance since the end of 2021? Is it advisable to sell Lockheed and buy HII? LMT is benefiting greatly from increasing defense spending in Europe, and that is hard to overlook and therefore priced into the stock. Moreover, if the situation in Taiwan escalates, HII should benefit from increased demand, which also should help the company’s currently weak profitability.

Such a trade has its justification in theory, but I personally am not a big fan of “political speculation” due to the uncertainties involved. It should also be kept in mind that HII will likely have a much harder time managing a surge in demand than Lockheed, due to its much smaller size and capacity. The turnaround time of a fighter jet is considerably less than that of an aircraft carrier, an assault ship, or a nuclear submarine.

While I concede that LMT is far from cheap, with an adjusted operating earnings-based P/E ratio of 20 according to FAST Graphs (Figure 2, above), I simply do not think the valuation gap is large enough to justify such a speculative venture. I think a P/E of 15 for HII (Figure 1, above) is quite reasonable, largely because of its smaller size, higher capital intensity, and focus on longer-term projects, even though its profits grew faster than Lockheed’s over the past decade. From a normalized free cash flow perspective, the two stocks are similarly valued, with a yield of about 5.7%. Huntington’s current dividend yield of 2.3% compares quite favorably to its five-year average yield of 1.9%, slightly better than the spread between Lockheed’s current yield of 2.7% and its five-year average yield of 2.45%. Morningstar currently considers both LMT and HII to be fairly valued (fair value estimates of $437 and $220, respectively), although it should be noted that the valuation of the latter is based only on a quantitative model. Seeking Alpha attests a slight valuation discount to HII (Table 1) compared to LMT (Table 2), but again, I think the discount is justified.

Table 1: Valuation metrics for Huntington Ingalls Industries stock [HII] (obtained from Seeking Alpha) Table 2: Valuation metrics for Lockheed Martin stock [LMT] (obtained from Seeking Alpha)![Valuation metrics for Huntington Ingalls Industries stock [HII]](https://static.seekingalpha.com/uploads/2023/1/24/49694823-16745823130730689.png)

![Valuation metrics for Lockheed Martin stock [LMT]](https://static.seekingalpha.com/uploads/2023/1/24/49694823-16745822767374535.png)

In conclusion, I believe that short-term speculation based on growing tensions between China and Taiwan is quite risky and even unrewarding an endeavor. Both LMT and HII are classic long-term investments, and I prefer to view such companies as reliable dividend payers. Considering potential tax implications and the currently rather uninteresting valuation gap between the two companies (especially from a free cash flow perspective), I certainly won’t consider selling my position in Lockheed. The future outlook is bright, near-term headwinds will abate, and I expect dividend growth that outpaces inflation to continue. I do not want to be misunderstood – HII does not seem like a bad investment considering it operates in a duopoly and management is very shareholder friendly. However, the capital intensity, focus on very long-term projects, weak profitability, and substandard balance sheet leave me uninterested as an owner of Lockheed.

Given that I bought a first tranche of L3Harris Technologies (LHX) yesterday (see my recent announcement), which has significant exposure to assault ship and submarine electronics, sensors, etc., I believe that my defense portfolio is sufficiently diversified, even without a pure-play military shipbuilder like HII. I own Lockheed Martin for its status as a prime defense contractor and Raytheon Technologies (RTX) for its balanced portfolio that also gives me exposure to commercial aerospace.

Thank you very much for taking the time to read my article. How did you like it, my style of presentation, the level of detail? If there is anything you’d like me to improve or expand upon in future articles, do let me know in the comments section below.

Be the first to comment