Nicholas Smith

Investment thesis

A strong bull market in soft commodities, which looks set to be sustained for the foreseeable future, has been a catalyst for most stocks related to agribusiness. Deere (NYSE:DE) has been no exception, given that it is up by about 16% YTD, while the overall stock indices are actually down by roughly the same amount for the same period.

Deere & Company financial metrics (Seeking Alpha)

While some bullishness is justified, a closer look at the net effect that the current commodities boom market is having should give investors reason to pause and reassess the potential risk/reward ratio. Farmers may have a hard time buying machinery going forward, while Deere may also be faced with a significant profit squeeze due to higher input prices.

Deere performed well in the past few quarters

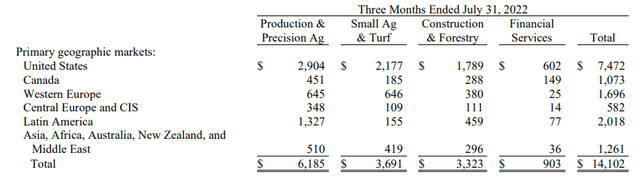

For the latest quarter, Deere saw an increase in its revenues by 22% compared with the same quarter from a year ago. Net income came in at $1.88 billion, on revenues of $14.1 billion, adding up to a profit margin of 13.3%. Based on these numbers, there seems no evidence so far that Deere is experiencing a slowdown in demand, but there are reasons to believe that this might change going forward.

Interest expenses did go up to $296 million for the latest quarter, from $244 million in the third quarter of 2021. Interest payments were equal to 2.1% of revenues, which is by no means a bad situation. I generally tend to worry once it exceeds 5% for most companies. Long-term debt of $32.13 billion is not a massive burden, since it is less than revenues for the first nine months of this year, which came in at $37.04 billion. There has been no significant reduction in the debt in the past year, which does raise questions in regard to future debt-servicing costs, assuming that interest rates are set to remain high for the foreseeable future. Debt reduction during strong economic times is a sign of strong company performance. The fact that Deere did not make any inroads in this regard is perhaps not the best sign for the future of its financial reports and other metrics.

High agricultural commodity prices may not help farmers, given rising input costs, therefore Deere may experience lower demand going forward.

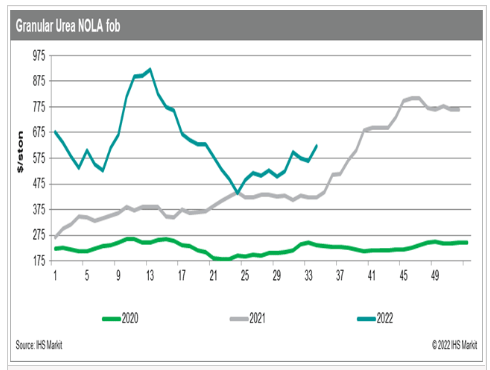

Logic would dictate that since soft commodities prices such as the price of corn, wheat soybean, eggs, milk or meat are all up, farmers must be doing well. The problem is that some input prices, like for instance nitrogen fertilizers are up by a higher proportion than that of agro commodities.

Progressive Farmer

The price of diesel is also up significantly, which together with fertilizer costs makes up the bulk of the input costs of the typical mechanized commercial farm. Higher farm commodities prices may help some with covering for the rise in some of these input costs, but it may not be enough to make up for the whole increase in costs. Fertilizer costs seem to have increased by about 300% compared with 2020, while agro commodity prices such as wheat or corn only increased by about 50% on average. Diesel prices have also doubled.

We should keep in mind that many farmers face other rising costs as well. Interest on debt is going up. For instance, if some farmers take out short-term credit lines to finance their operations in-between harvests, chances are that they will pay more interest on that debt. If some of them may be looking to renew their equipment, a loan might not come as cheap as it used to in the past decade. Many farmers may choose to do their best to prolong the life of their existing equipment. Those looking to expand their operations might put off those plans as well. This is just not a good time to be taking on debt, given rising interest rates.

It is still unclear to what extent these factors may affect Deere sales in coming quarters & years. One thing that is beyond doubt is that there is at least as much downside to the current commodities price inflation environment for this company as there is upside from those higher prices. It is more than likely that when one adds it all up, it is a net negative for the longer term. We should also keep in mind that input costs are also going up for Deere. The price of steel, aluminum, and plastics are all up. Transport costs are up as well. Some of these costs can be passed on to consumers, but there is very limited room in that regard, given the precarious situation that its potential customers find themselves in.

Deere sales outside of North America face a wide variety of risks.

John Deere

As we can see, Deere sales are increasingly international. Europe in particular is a significant market for its machinery. While North American farmers are faced with high input prices, European farmers are faced with those same high input price increases or often higher, while they also face a great deal of uncertainty going forward. With the continent’s fertilizer industry shutting down, it is unclear to what extent they may have fertilizer for their croplands available at all, at any price going forward. The same issue arises with diesel for their machinery. The Russian oil embargo that the EU decided on is set to happen in less than a month, and the diesel embargo in less than three months. Of course, Deere also stopped all sales of its equipment to Russia & Belarus. With recent history as a guide, it probably lost those markets permanently to local producers as well as foreign competitors. Europe might be the most problematic market for Deere going forward.

In much of the rest of the world, Deere is facing some of the same problems we see in North America & Europe, in addition to a number of other challenges, such as rising Chinese competitors. They may not be a threat to the North American or European markets, but in other places such as South America, Asia, and elsewhere, it may find that more and more it has to contend with this rising trend of increasingly fierce competition in the agro machinery space.

Investment implications

Bucking the broader market trend, Deere stock is up about 16% YTD. It is partially due to some decent financial results, but also partially due to an overall bullish sentiment towards the wider agro sector. As I pointed out in the article, not all companies and industries related to agriculture may necessarily thrive within the current environment. There is more to it than just the higher price of agricultural products that we are seeing. In the particular case of Deere & Company, its main customer base, namely farmers are arguably seeing more hardship from spiraling prices of crucial inputs such as fertilizers and fuel than they are seeing in terms of benefits from higher agricultural commodity prices. The global economic and other trends and factors do not bode well for Deere in terms of global market share either. With these factors in mind, it seems that this stock has arguably more downside risk going forward than it does in terms of upside potential. It is a solid company, but not necessarily priced at the right stock price level, given what we know about market fundamentals going forward.

Be the first to comment