Maksim Safaniuk/iStock Editorial via Getty Images

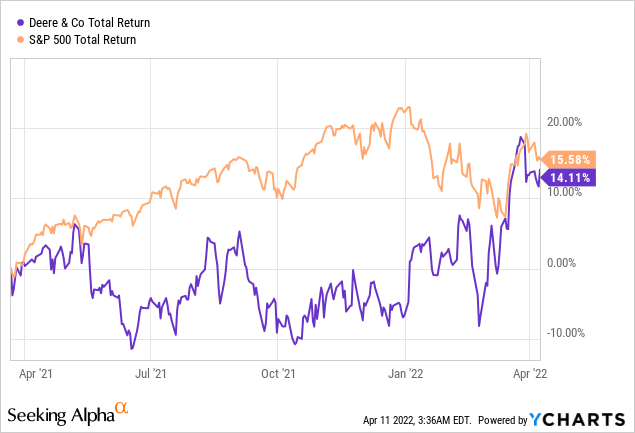

Deere & Company (NYSE:NYSE:DE) continued to underperform the broader market for most of the past year, but managed to close the performance gap versus the S&P 500 largely due to recent geopolitical events.

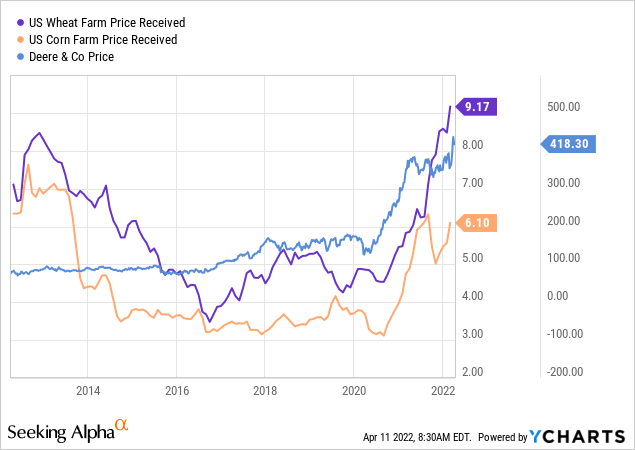

Soaring prices of corn, wheat, soybeans and other agricultural commodities fuelled speculations that the current cycle in agriculture will continue for the time being.

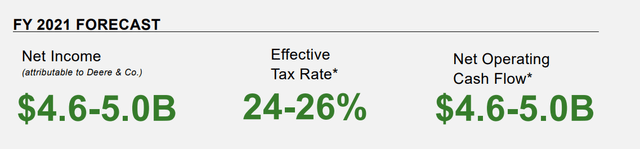

In the meantime, if we ignore the recent rally in share price brought by those speculations, Deere was already showing signs of weakness. At the time when I first covered the company in March of last year, the management had the following guidance for fiscal year 2021.

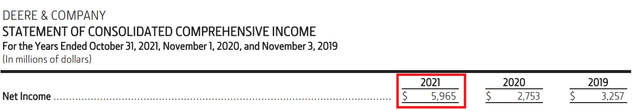

Net income for the year, however, came in at nearly $6bn which made 2021 the strongest year on record.

As we saw above, however, the share price remained flat during the course of 2021 as this cyclical uptick in earnings was already priced in. As a business operating in a capital intensive and yet cyclical industry, capacity utilization matters a great deal for Deere. That is why margins benefit a great deal during market peaks when demand is robust.

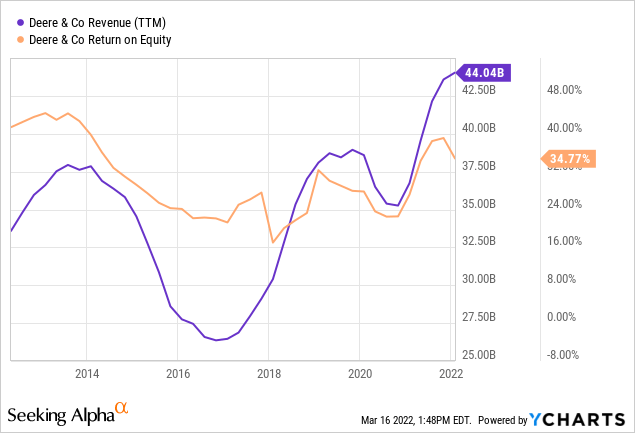

Having said that, it is worth mentioning that even though sales reached a peak during the past year, return on equity has already turned north.

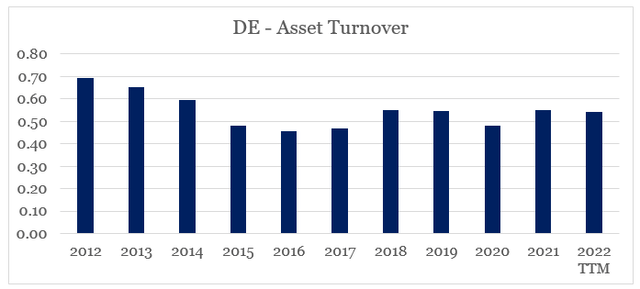

Total asset turnover has been relatively flat since 2015 and thus did not play a major role in trend we saw above.

prepared by the author, using data from Seeking Alpha

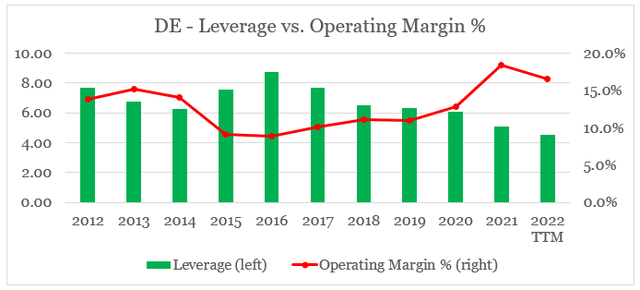

Leverage, on the other hand, has been consistently coming down in recent years and thus offsetting the improving profitability since 2016.

prepared by the author, using data from Seeking Alpha

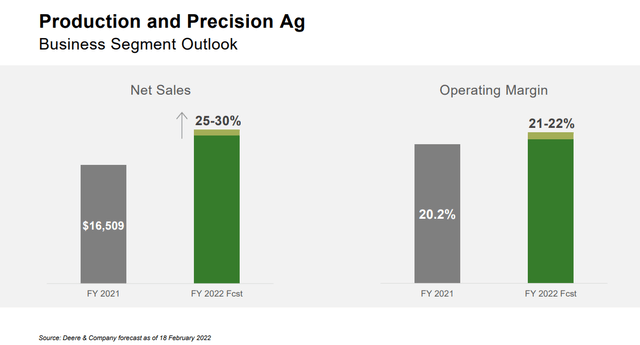

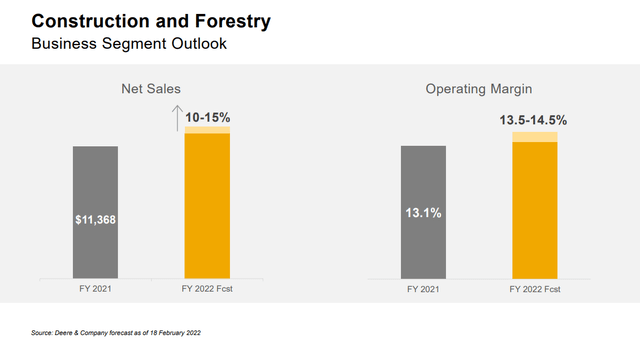

Nevertheless, Deere’s management appears confident that profitability in Production and Precision Ag and Construction and Forestry segments should improve during fiscal year 2022.

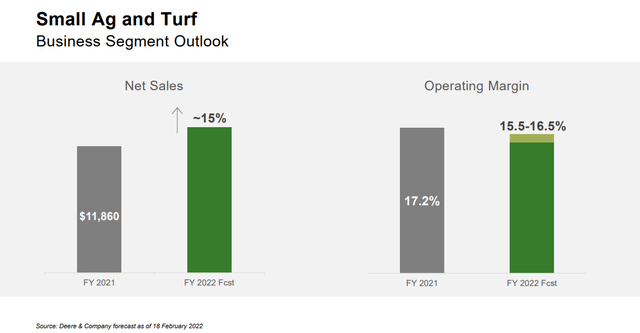

Small Ag and Turf, on the other hand, is likely to perform worse in terms of profitability.

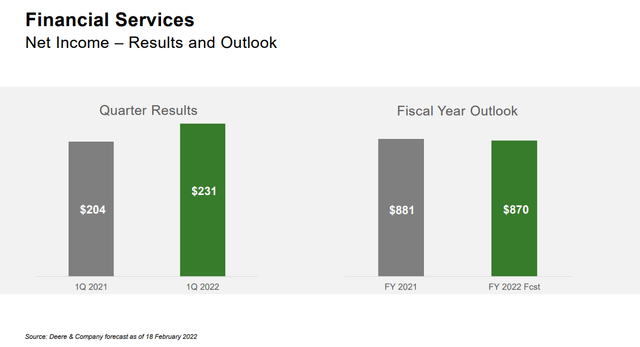

While the outlook for the financial services is also slightly worse than 2021, the overall guidance for 2022 is currently based on even higher sales and margin improvements.

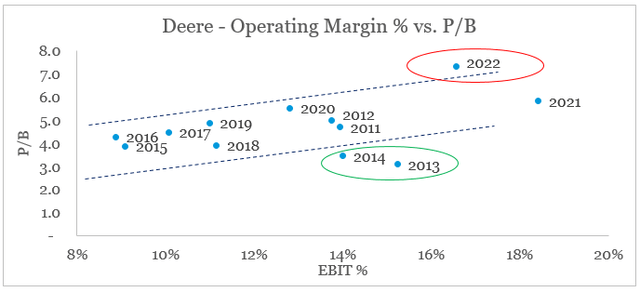

While this might be a reason for shareholders to rejoice, the current valuation seems to be already pricing in a big jump in operating margins (see below).

prepared by the author, using data from Seeking Alpha

The Free Cash Flow Perspective

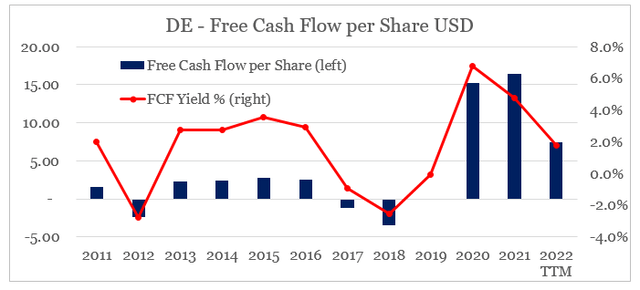

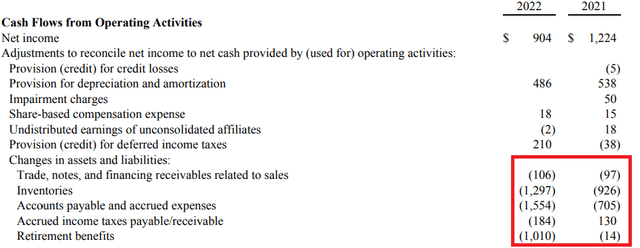

Back in March of last year, I warned that the level of free cash flow is unsustainable due to temporary working capital tailwinds.

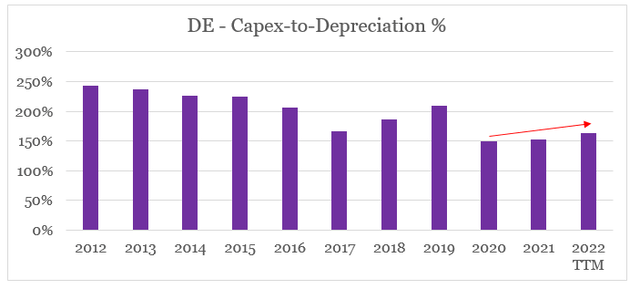

This significant increase in free cash flow, however, is unlikely to persist over the coming years as it was also driven by around $2bn of working capital tailwind and a significant reduction in Capital Expenditure relative to Depreciation expense.

Source: Seeking Alpha

As expected, both the level of working capital and capex to depreciation ratio are now beginning to normalize and with that Deere’s free cash flow per share is likely to be lower in 2022.

prepared by the author, using data from Seeking Alpha

For the past twelve month period, the company’s free cash flow yield of 1.8% is already significantly lower than the highs of 2020 and 2021.

prepared by the author, using data from Seeking Alpha

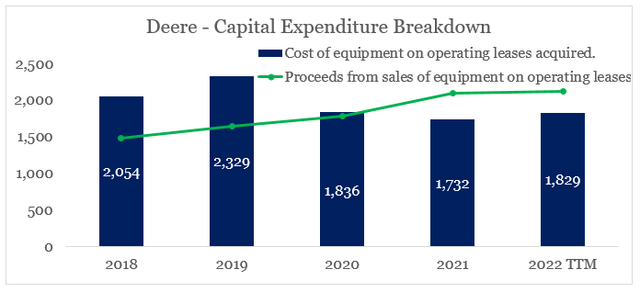

We should note, however, that the capital expenditure used to calculate free cash flow above includes purchases of equipment on operating leases. If we exclude this cash outflow of $1.8bn over the past 12 month period, the total free cash flow comes at $4.1bn ($13.3 on a per share basis). This results in a free cash flow yield of 3.2%.

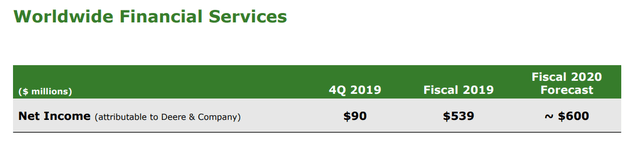

Such an adjustment would also require us to take into account profits made from Deere’s financial services segment, which was contributing around $539m to the company’s bottom line prior to the pandemic.

Deere Q4 2019 Earnings Presentation

Rising prices of second hand equipment then led to a significantly higher profits in 2021 that are expected to persist in 2022.

We could see the impact on Deere’s cash flow by comparing the cost of equipment on operating leases acquired falling sharply in 2020, while the proceeds from sales of equipment on operating leases increasing considerably.

prepared by the author, using data from Deere Annual Reports

Overall this provided yet another tailwind for Deere’s cash flow position that is unlikely to persist over the long-term.

Don’t Forget That Deere Is a Cyclical Business

Even though the narrative of autonomous tractors is getting many investors excited, we should not forget that Deere is still a highly cyclical business that is heavily dependent on commodity prices. That is why the company’s share price is closely linked to prices of major agricultural commodities.

But things are not as simple as Deere’s sales are reliant on the well-being of the farmers, which benefit from the rising agricultural commodity prices but at the same time are faced with many other rising costs.

On top of the rising fuel and wage costs, farmers are also facing record high fertilizer prices.

Seeking Alpha

That is why, net farm income is now forecasted to decrease sharply in 2022.

Net farm income, a broad measure of profits, is forecast to have increased by $23.9 billion (25.1 percent) in 2021 relative to 2020 and is forecast to decrease by $5.4 billion (4.5 percent) in 2022 relative to 2021. Forecast at $113.7 billion in 2022, net farm income would be 15.2 percent above its 2001–20 average of $98.7 billion when prior years are adjusted for inflation. In inflation-adjusted 2022 dollars, net farm income is forecast to decrease by $9.7 billion (7.9 percent) in 2022 from 2021.

Source: ers.usda.gov

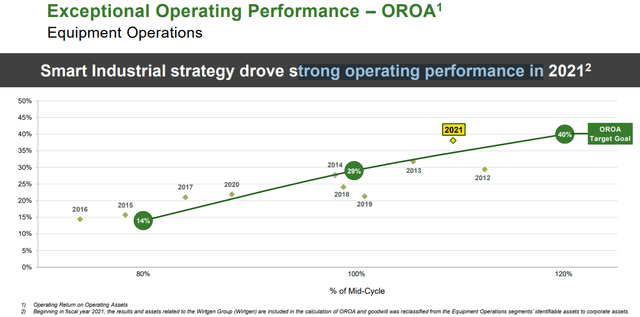

Needless to say that such an event will have an adverse impact on Deere’s return on operating assets, which is currently at peak levels.

Conclusion

Although Deere’s brand name is unmatched in the agricultural machinery space, the unprecedented rally in the company’s share price during 2020 and early 2021 has created significant risks for shareholders. The current valuation is already pricing in a yet another strong year and allows little to no room for worse than expected outcome. Moreover, rising fuel and fertilizer prices are expected to have significant adverse effect on farmers, which could scale down equipment upgrades in the coming years.

Be the first to comment