Alex Wong/Getty Images News

Thesis

Deere & Co (NYSE:DE) benefitted from the agriculture boom in 2022, which was amongst others provoked by the war in Ukraine. But at a one-year forward P/E of about x14 and a P/B of about x2.5, DE stock is still trading relatively cheap. Investors should consider that the agriculture boom, contrary to the energy boom, is likely sustainable and should bolster Deere’s financials well into 2023 and 2024. Moreover, new product initiatives in sustainable and digital farming should likely support a multi-year growth story (remember that Cathy Wood’s ARKX fund has invested). Personally, I value Deere & Co at $437.65/share. My calculation is supported by a residual earnings model anchored on analyst consensus EPS.

For reference, Deere stock has lost less than 1% YTD, versus a loss of about 22% for the S&P 500 (SPX).

About Deere & Co.

Deere & Co is the world’s largest manufacturer and vendor of agricultural machinery. The company designs, develops, manufactures and markets leading producers of equipment for agriculture, construction and forestry industry, and recently has also ventured in road-building equipment through the acquisition of the German brand Wirtgen. That said, Deere owns more than 5 brands, including notable names such as Hagie, Mazzotti, Blue River technology and Harvest Profit.

Deere operates four key segments: 1) production and precision agriculture, which accounts for more than 35% of total sales; 2) the small agriculture and turf segment, which is responsible for about 25% of total sales; 3) the construction and forestry segment with another 25% of sales; and 4) the financial services segment with less than 10% of revenues. Geographically, Deere sells worldwide, but generates more than 60% of revenues in the U.S. Europe accounts for 20% and ROW for the remainder.

Structural Tailwinds

In my opinion, there are two major structural tailwinds for Deere’s business growth: food price inflation and climate change. After almost half a decade of falling agricultural market prices (from 2016 to 2020), food price inflation is back. And while restrictive monetary policy can dampen demand for many consumer goods, the need for basic food remains independent from interest rate levels.

Food inflation is not merely a function of the Russia-Ukraine war, but also a function of a structural supply shortage. Notably, in 2022, more than 800 million people do not have enough to eat. And with another two billion people expected to be born by 2050, the World Resources Institute estimates a 56% food gap between the crop calories produced in 2010 and the crop calories needed in 2050. The resulting potential tailwind for Deere is obvious.

Moreover, I argue that climate change is another structural tailwind for the agriculture industry. The global food system is responsible for a third of man-made greenhouse gas emissions. And the hidden costs associated with the food industry are estimated at US$4.8 trillion. According, as ESG trends are accelerating, Deere’s equipment and other technology solutions will play a key role to transition towards more sustainable food ecosystem.

Strong Fundamentals

Given elevated crop prices, which were amongst others caused by the Ukraine-war induced “food shortage,” Deere has seen an enormous tailwind. On August 19, Deere reported earnings for the June quarter and announced, in my opinion, strong results. Net income for the period between April to end of June increased by 22% year-over-year to $14.1 billion. Net income increase by 13% year-over-year to $1.88 billion. Operating costs were much higher than what I personally would have anticipated. In that context, the company argued as follows:

our results reflected higher costs and production inefficiencies driven by the difficult supply-chain situation.

CEO John C May commented:

Looking ahead, we believe favorable conditions will continue into 2023 based on the strong response we have experienced to early-order programs…

… We are working closely with our factories and suppliers to meet higher levels of customer demand next year. Additionally, we are confident the company’s smart industrial strategy and leap ambitions will continue unlocking new value for customers through Deere’s advanced technologies and solutions

Long term, I believe that accelerating adoption of precision technologies, connectivity and automation in the agriculture industry will support expanding revenue topline and profitability margins for Deere.

Target Price Estimation

To estimate a stock’s fair implied share price, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

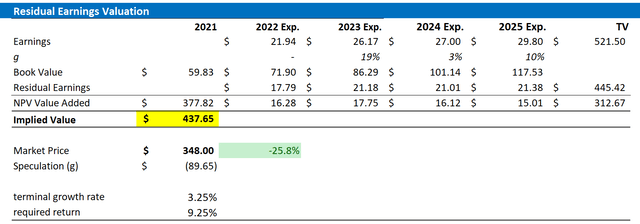

With regard to my Deere stock valuation, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on DE’s cost of equity at 9.25% (Reference Bloomberg Terminal).

- For the terminal growth rate after 2025, I apply 3.25%, which is arguably very conservative (about one percentage point higher than estimated nominal global GDP growth).

Given these assumptions, I calculate a base-case target price for Deere stock of $437.65/share (more than 25% upside).

Analyst Consensus Estimates; Author’s Calculation

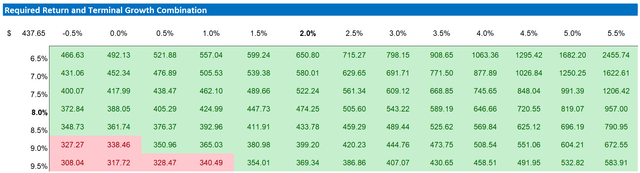

Notably, my bullish price target is not a reflection of a specific combination of growth and cost of capital. In fact, please find below a sensitivity analysis that supports different assumptions.

Analyst Consensus Estimates; Author’s Calculation

Risks

First, as a manufacturing company, Deere remains vulnerable to cost inflation (raw materials and labor), which could pressure the company’s profit margins. Second, a more challenging macro-economic backdrop, e.g., recession, could negatively impact the ability and willingness of farmers to invest in new equipment. Third, investors should consider that the sentiment towards stocks remains depressed, and given multiple macro-economic headwinds DE stock may experience volatility even though the company’s fundamentals remain unchanged. Finally, there is also the risk that, if other quality companies sell-off significantly, the relative equity valuation for Deere could become stretched versus the relative market – which could force a repricing at lower multiples.

Conclusion

I am bullish on Deere, as I believe the company is well positioned to benefit from structural tailwinds, most notably price inflation, population growth and climate change. Moreover, Deere’s relative strong performance year to date – both with regards to fundamentals and share price performance – has highlighted that the company can deliver also in a depressed macro-economic backdrop. Personally, I believe that Deere should be valued at about $437.65/share, which would imply more than 25% upside.

Be the first to comment