Justin Sullivan

Dell Technologies (NYSE:DELL) is no normal tech stock and that is evidenced by the fact that the stock still trades far higher than pre-pandemic levels. DELL might not generate the same growth rates of tech peers, but the company is generating strong GAAP earnings and is buying back its cheap stock. Slow growth may be the best that investors can hope for moving forward, but that may be enough to justify significant multiple expansion which on top of the double-digit earnings yield may be enough for market-beating returns. With the company releasing earnings on Monday, November 21st, the stock’s low valuation makes it worth buying ahead of the print.

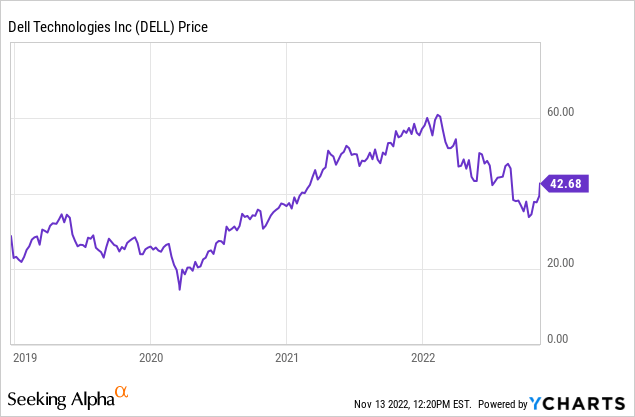

DELL Stock Price

DELL is 30% lower than all-time highs reached earlier this year but still 80% higher than pre-pandemic levels.

A lot of that strong performance has to do with tremendous progress made on reducing the debt load. I last covered DELL stock in July where I rated it a buy due to the low earnings multiple. The stock has since declined by 11%, making the value proposition even more sweet.

DELL Stock Key Metrics

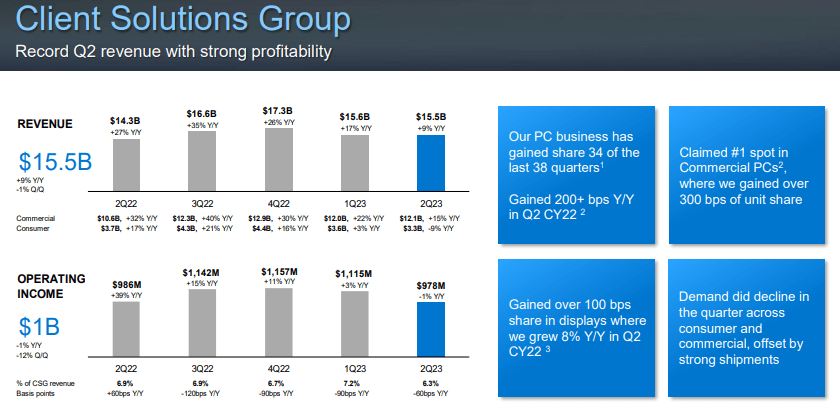

The latest quarter saw DELL show 9% overall revenue growth and 4% growth in non-GAAP operating income. That headline growth, however, did not tell the entire story. The “client solutions group” business (the PC business) showed solid 9% revenue growth but on the conference call, DELL noted that the macro-environment had deteriorated greatly since their last commentary in May but also noting that they were able to offset softening demand with higher average selling prices as well as improvements in the supply chain as it worked through inventory. The company may not benefit from that offset moving forward.

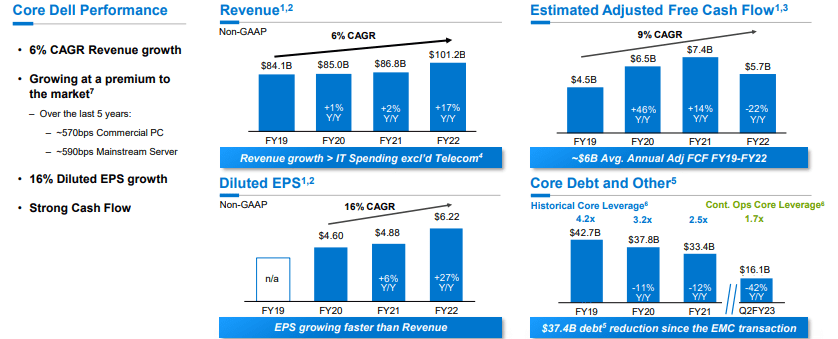

2022 Q2 Presentation

DELL has gained PC market share in 34 of the past 38 quarters and now holds the top market position in the commercial PC market.

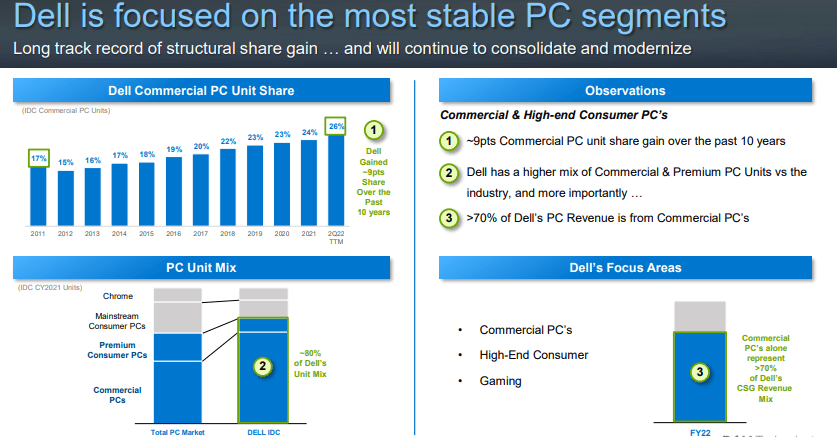

2022 Q2 Presentation

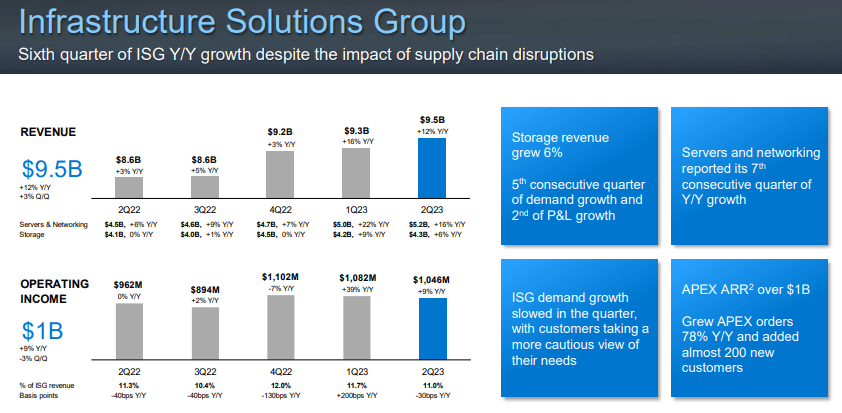

It is important to note that the “infrastructure solutions group” has been growing even faster, as this business segment carries higher margins.

2022 Q2 Presentation

While DELL has shown only 6% compounded annual growth since 2019, it has been able to reduce net debt by $37.4 billion, bringing leverage down to 1.7x debt to EBITDA.

2022 Q2 Presentation

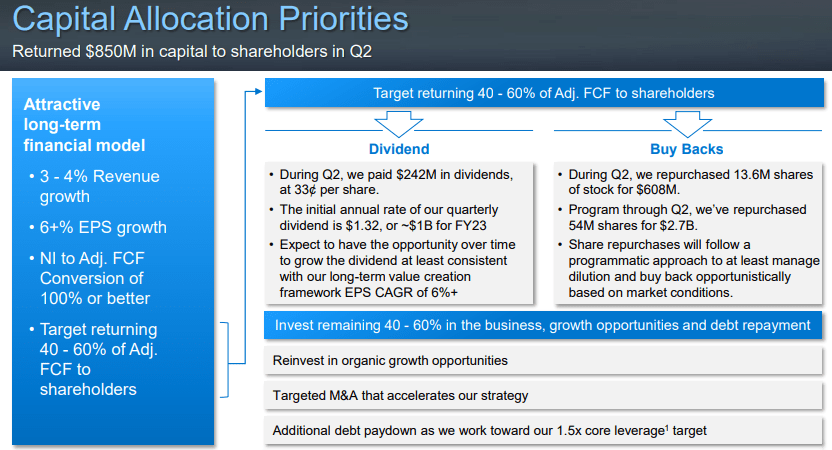

Management has made returning cash to shareholders a capital allocation priority and is paying a quarterly dividend as well as buying back stock. The company repurchased $608 million of stock in the quarter and aims to return up to 60% of free cash flow to shareholders (based on a roughly 100% conversion of net income to free cash flow).

2022 Q2 Presentation

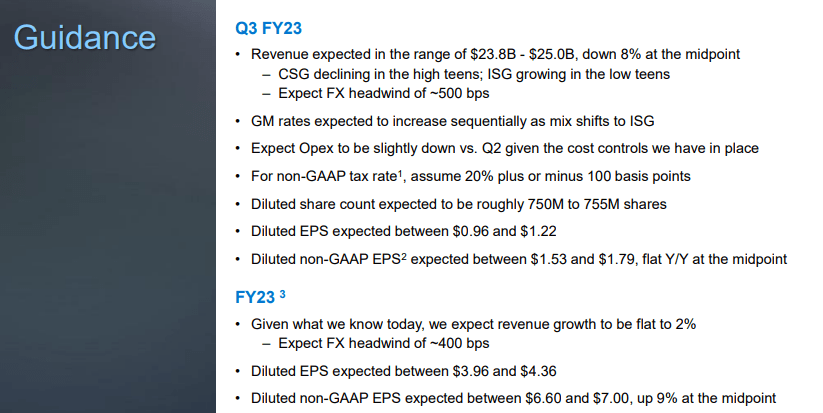

Looking ahead, DELL expects overall revenue to decline 8% YOY, reflecting continued softening demand and potential inability to offset that with higher prices. DELL does expect EPS to remain steady YOY due to both the impact of share repurchases as well as greater contribution from the aforementioned higher margin ISG business segment.

2022 Q2 Presentation

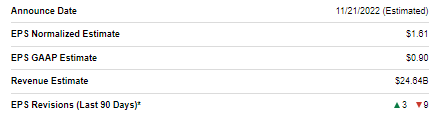

Given the slew of disappointing earnings reports across the tech sector, it isn’t surprising to see that analysts have been reducing EPS estimates over the past quarter, though consensus estimates still call for $1.61 in non-GAAP earnings, squarely between management’s guidance.

Seeking Alpha

Is DELL Stock A Buy, Sell, or Hold?

Prospective shareholders must understand that DELL is not going to provide the 20% to 30% growth rates that the typical tech stock can generate. Yet unlike the typical tech stock, DELL is producing GAAP profits and trades at a single-digit multiple of earnings.

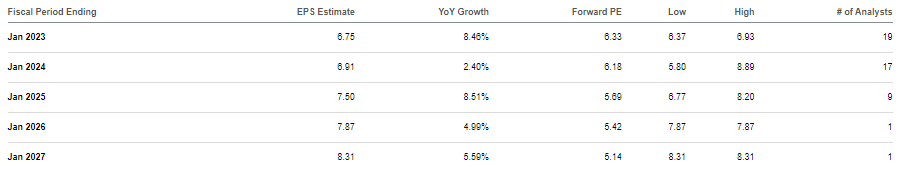

Seeking Alpha

Management expects to be able to generate 6% EPS growth over the long term based on 3% to 4% annual revenue growth. The stock trades at 6.3x earnings but management is only aiming to return up to 60% of that back to shareholders through dividends and share repurchases. That implies a shareholder yield of around 9.5% which along with the 3% to 4% top-line growth outlook should be more than enough to provide double-digit returns. But that’s assuming no multiple expansion and I suspect that the stock should re-rate over time as the company continues repurchasing stock at such an aggressive pace. Moreover, as leverage gets lower toward the target 1.5x debt to EBITDA ratio, management may have more flexibility to use retained cash for other uses. While management appears to be more focused on using excess cash for M&A, I am hoping for more aggressive share repurchases and for M&A to take place only after the stock has re-valued higher. I find it unlikely for a company buying back around 6% of its stock annually to trade at 6.3x earnings, and that sentiment increases greatly if the company bumps that up to 14% of shares outstanding annually. I could see the stock re-rating to 10x to 12x earnings, representing over 60% potential upside from multiple expansion alone. That multiple would put it more in-line with other mature tech companies like Cisco (CSCO) and Oracle (ORCL).

What are the key risks? For starters, growth might not end up being in the 3% to 4% range. The constant fear with slow-growth company is that growth eventually disappears and turns negative. Another risk is if management levers the balance sheet to fund M&A ambitions. I view the path to a multiple re-rating as hinging on lower leverage and a more aggressive share repurchase program, but a debt-fueled M&A initiative would work the opposite direction and possibly cause the stock to keep trading at discounted multiples. It is also worth mentioning the “take-under” risk due to it happening before. Specifically, there is the risk that the stock gets lower and CEO Dell tries to acquire the stock at those lower prices – to the disappointment of shareholders who purchased at higher prices.

I still find DELL buyable as a deep value play amidst the tech crash, though the aforementioned risk keep this a small position.

Be the first to comment