ANNVIPS

Introduction

Quotes of Deckers Outdoor Corporation (NYSE:DECK) continue to look confident -4% YTD. Despite macro headwinds, declining real income and high inflation, the company continues to show strong revenue growth. In addition, effective management of operating expenses allows the company to maintain a stable level of operating profitability.

Short survey of Q2 results

On October 27, the company released financial results for the 2nd quarter of 2022, which ended on September 30, 2022. The company published better-than-expected results, but the published guidance turned out to be slightly lower than investors’ expectations, which put slight pressure on the company’s quotes.

The company’s revenue grew by 21%, wholesale net sales increased by 16.7%, Direct-to-Consumer (DTC) net sales increased by 35.3%. Sales growth continues both in the domestic and international markets, where growth was 20% and 24.4% respectively.

I would note that the gross margin fell from 50.8% to 48.2%, which, in my opinion, looks like a fairly strong result against the backdrop of rising inflation and a decrease in real consumer incomes.

In addition, the share of SG&A expenses (% of revenue) increased from 33.1% to 33.6%, which, in my opinion, indicates the ability of management to effectively control operating expenses.

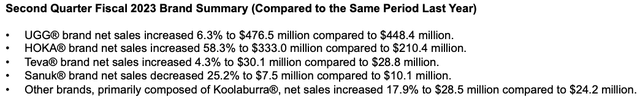

Revenue by brand

In terms of evaluating revenue segments, it is worth highlighting the sports brand “HOKA”, which has an impact on sales growth, demonstrating an increase of 58.3%. It is important to understand that next quarter the UGG brand will be the top priority as the next quarter is the peak season for the brand.

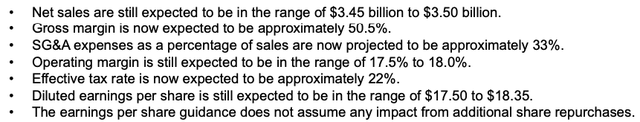

Guidance

Despite the fact that the company’s guidance in terms of revenue turned out to be slightly lower than market expectations, I would note that the company sees a stable level of gross margin, which is especially important in the current macro-economic conditions. In addition, the share of spending on SG&A (% of revenue) will be at the level of 33%, which is in line with historical data. I like that the company is able to offset the increase in operating costs due to high inflation.

Projections

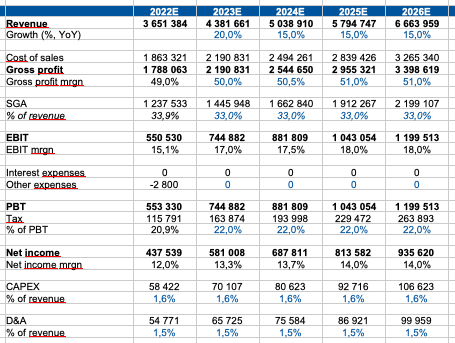

Gross margin

Based on historical data and management’s statements, I assume a gross margin of 50% in the coming quarters (slightly below official guidance). Next, I model a gradual improvement to 51% by 2026.

SG&A

In my model, I assume a stable level of operating expenses at the level of 33% until 2026 in accordance with historical trends and management statements. I believe that the company will be able to successfully raise prices for the end consumer and effectively manage operating costs.

Revenue growth

I am modeling revenue growth to continue at 20% in the coming quarters and slow down to 15% until 2026 on the back of last year’s baseline growth.

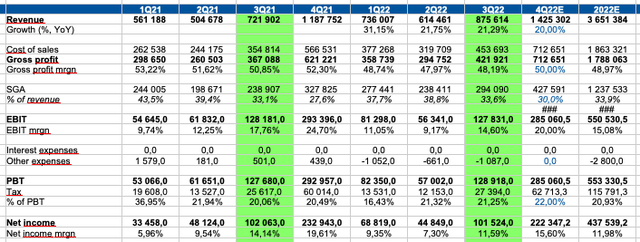

Quarterly projections:

Yearly projections:

Personal calculations

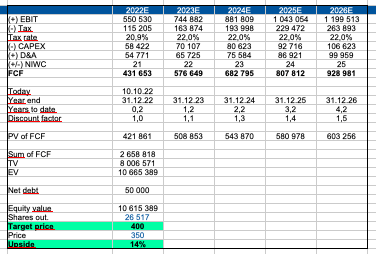

Valuation

To assess the fair value of a company, I believe that it is necessary to use the DCF model and analyze multiples. For starters, I prefer the DCF model because:

- The company operates in a stable market

- I can make assumptions about future growth rates based on my own forecasts, historical data and management statements

- I can make assumptions about the future level of operating margin based on macro trends

For evaluation, I use the following inputs:

WACC: 10.8%

Terminal growth rate: 3%

Personal calculations

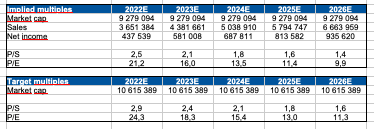

Multiples

Below are my calculations of current and forward major multiples for the company. We see that the company continues to trade quite expensive.

Personal calculations

Drivers

Revenue

Strong trading trends in the upcoming season could support the UGG brand, which could have a positive impact on revenue dynamics.

Macro

Declining inflation, rising consumer confidence and rising real incomes may have a positive impact on consumer spending dynamics in the discretionary segment.

Margin

Increasing end-user prices and managing operating costs effectively can help a company maintain a stable operating margin.

Risks

Macro

Continued tightening of monetary policy, rising interest rates, declining real incomes and declining consumer confidence could impact consumer spending in the discretionary segment, which could have a negative impact on the company’s top line.

Margin

Rising operating costs and a slowdown in revenue growth could put pressure on operating margins.

Conclusion

At the moment, I have a positive view on the company’s shares. The company is able to show revenue growth and price growth in its main markets, and we are also facing the peak season for the main UGG brand. Also, management is able to effectively manage operating expenses, which, in my personal opinion, is especially important in the current macro situation. Based on the company’s updated guidance, according to my DCF model, the fair share price is $400 with an upside potential of 14%.

Be the first to comment