Asanka Ratnayake/Getty Images News

With the stock market having declined significantly in recent months, it seems as though a general fear has permeated most stocks. Even companies that are generating strong performance and that will likely fare well, in the long run, are experiencing material downside. Of course, these firms might ultimately see some pain if we do, indeed, head into a recession. But for businesses that are continuing to grow and better trading at fundamentally low levels counter, this could represent an extremely rare and lucrative buying opportunity. One candidate that investors who are focused on the long haul should consider is footwear, apparel, and accessories producer Deckers Outdoor Corporation (NYSE:DECK). As the market has declined, the company’s stock has also been hit. This comes in spite of rosy guidance from management and a share price that looks quite appealing at this time. Due to this, I’ve decided to retain my ‘buy’ rating on the business.

Strong Performance Continues To Be The Case

The last time I wrote an article about Deckers Outdoor was in February of this year. At that time, I saw the company in a rather favorable light. I was particularly drawn in by the attractive growth the company had generated in prior years, both on its top line and its bottom line. Relative to similar players in the market, I determined that the company was more or less fairly valued. But on an absolute basis, shares looked attractive enough to warrant attractive upside. Due to all of this, I ultimately rated the business a ‘buy’, indicating my belief that shares would experience upside greater than the general market over an extended timeframe. Since then, things have not gone exactly as I would have hoped. While the S&P 500 is down 15.4%, shares of Deckers Outdoor have dropped 16.9%.

Given this performance, one would be forgiven for thinking that the fundamental picture for the company has worsened. But that has not been the case. Instead, financial performance is stronger now than it has ever been. To be clear, when I last wrote about the firm, we only had data covering through the third quarter of its 2022 fiscal year. Today, we now have data covering that final quarter. And we also have guidance from management for the company’s 2023 fiscal year.

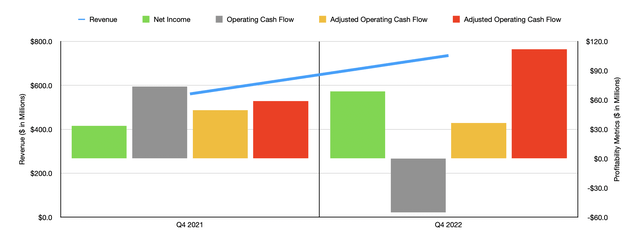

Based on the data provided, Deckers Outdoor finished the 2022 fiscal year off with a bang. Revenue in the final quarter came in at $736 million. That’s 31.1% higher than the $561.2 million generated the same quarter one year earlier. This year-over-year growth was driven largely by two key brands the company has. The really heavy lifting came from the company’s HOKA brand, which reported a 59.7% year-over-year sales increase, taking revenue from $177.5 million to $283.5 million. Sales for the UGG brand products rose a more modest but still impressive 24.7%, with revenue climbing from $300.5 million in the final quarter of 2021 to $374.6 million in the final quarter of 2022. The Koolaburra brand also reported a sales increase, but only to the tune of 2.4%. Meanwhile, the Teva and Sanuk brands both saw sales weekend, falling by 8.8% and 1.7%, respectively, year over year.

Bottom-line performance for the company was largely positive as well. Net income in the final quarter rose from $33.5 million to $68.8 million. Meanwhile, EBITDA jumped from $59 million to $111.9 million. The only weakness in profitability came from the operating cash flow side. This metric fell from $73.9 million in the final quarter of 2021 to negative $55 million the same time of 2022. Even if we adjust for changes in working capital, the picture still worsened year over year, declining from $49.7 million to $36.6 million. Despite this, management still decided to buy back additional stock for the year under its stock repurchase program. The company acquired 308,000 shares for approximately $90 million. This brought the total purchase of stock for the 2022 fiscal year to 1.04 million shares at a price of $356.7 million. That leaves $454 million currently remaining under the company’s share repurchase authorization.

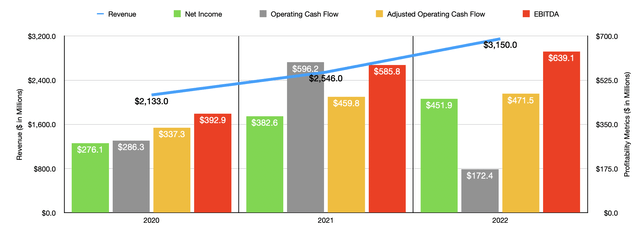

Due to the strong performance in the final quarter, the company had its best year ever. Revenue of $3.15 billion translated to a year-over-year increase of 23.7% compared to the $2.55 billion generated in the 2021 fiscal year. Net income for the company rose by 18.1% from $382.6 million to $451.9 million. Operating cash flow did decline, plummeting from $596.2 million to $172.4 million. But if we adjust for changes in working capital, it would have inched up slightly from $459.8 million to $471.5 million. Meanwhile, EBITDA for the firm rose from $585.8 million to $639.1 million.

Although investors and the market, in general, may be concerned about the 2023 fiscal year for the business, management is clearly not. At present, they currently anticipate revenue of between $3.45 billion and $3.50 billion. At the midpoint, that would translate to a year-over-year increase of 10.3%. Earnings per share should be between $17.40 and $18.25, ignoring the potential impact of share buybacks. At the midpoint, this would translate to net income of $495.3 million if this comes to fruition, it would imply an increase of 9.6% compared to the $451.9 million reported for 2022. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate that earnings should, then investors can anticipate adjusted operating cash flow of $516.8 million and EBITDA of $700.5 million.

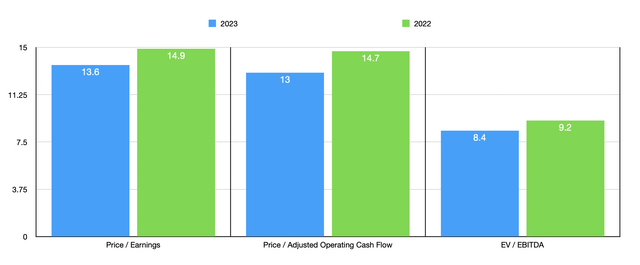

Using this data, we can easily value the business. On a price-to-earnings basis, using 2022 fiscal results, the company is trading at a multiple of 14.9. This is down from the 20 that I calculated as an estimate for 2022 fiscal results in my prior article. For 2023, this multiple looks set to drop to 13.6. The price to adjusted operating cash flow multiple for 2022 is 14.7. That’s actually up from the 12.8 in my original estimation for the company. Meanwhile, the multiple for the 2023 fiscal year is 13. And finally, we arrive at the EV to EBITDA multiple. This should come in at 8.4 for the 2023 fiscal year. That’s down from the 9.2 if we use data from 2022 and is down further from my prior 2022 estimate of 12.1.

To put the valuation of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 4.3 to a high of 39.9. And using the EV to EBITDA approach, the range was from 7.6 to 22.1. Using the 2022 figures, we see that three of the five companies are cheaper than Deckers Outdoor. Using the price to operating cash flow approach, we get a range of 6.4 to 60.9. In this case, one of the five firms is cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Deckers Outdoor | 14.9 | 14.7 | 9.2 |

| Skechers U.S.A. (SKX) | 7.3 | 60.9 | 7.6 |

| Crocs (CROX) | 4.3 | 6.4 | 8.3 |

| Steven Madden (SHOO) | 10.8 | 19.5 | 7.8 |

| Wolverwine World Wide (WWW) | 39.9 | 22.0 | 22.0 |

| Nike (NKE) | 28.2 | 28.5 | 22.1 |

Takeaway

At this point in time, I understand why the market is concerned. Having said that, management has proven time and again that the company is a quality operator that is capable of generating consistent growth. Growth this year is forecasted to be quite strong, and earnings are likely to follow suit. Shares of the business also look attractive from a pricing perspective on an absolute basis, even though they are probably more or less fairly priced compared to similar firms. Due to all of this, especially relying on management’s own guidance, I cannot help but to still rate the business a ‘buy’ at this time.

Be the first to comment