We Are

The iM DBi Managed Futures Strategy ETF (NYSEARCA:DBMF) is an actively-managed, multi-asset class, long-short futures ETF. Asset allocations are approximately equivalent to those of the average futures hedge fund, and so is performance. DBFM has significantly outperformed its peers since inception, with much lower risk, volatility, and losses during downturns. Outperformance was due to savvy positioning and sizing, especially during bear markets. Future performance is strongly dependent on future positions, which might not necessarily be as strong and effective as those in the past, but current signs are encouraging.

In my opinion, DBMF’s outstanding performance track-record makes the fund a buy. As performance is strongly dependent on the future success of the fund’s investment strategy, I would keep position sizes small, so as to minimize risk.

DBMF – Overview and Analysis

DBMF is a multi-asset class, long-short, futures and forwards ETF. Those three characteristics tell us everything we need to know about the fund. Let’s have a closer look at each.

Futures and Forwards

DBMF invests in futures and forwards, derivative contracts with explicit characteristics and payment profiles. In simple terms, futures contracts are standardized legal agreements to buy or sell a particular commodity at a predetermined future price and date. Forwards are similar, but less standardized. From what I’ve seen, DBMF mostly uses futures, so I’ll be referring to these exclusively from now on.

Futures can be used to speculate and profit from asset price movements. As an example, equity bulls can buy S&P 500 futures at today’s (relatively) low prices, and see strong capital gains as equity prices rise. Same process and logic for other asset classes and sentiment.

Futures are leveraged financial investments, as they can be bought on margin / with only a small initial investment. Leverage magnifies potential gains and losses, and is particularly harmful during severe market downturns. DBMF’s positions are leveraged, but not excessively so, so risks and potential losses are within reasonable parameters.

In short, DBMF uses futures to speculate and potentially profit from asset price movements.

Multi-Asset Class

DBMF uses futures to speculate on asset price movements on a wide assortment of asset classes. These include equities, fixed income, currencies, and commodities.

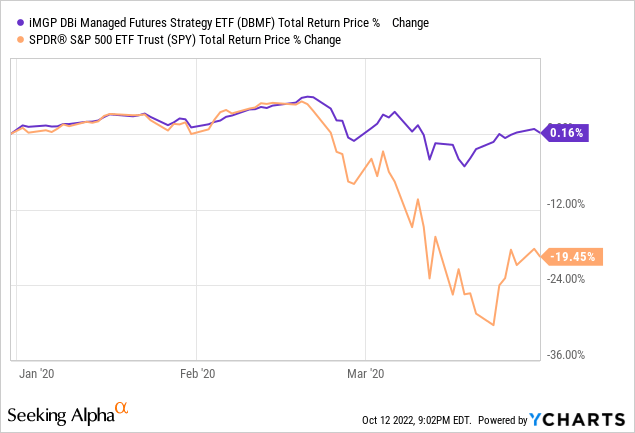

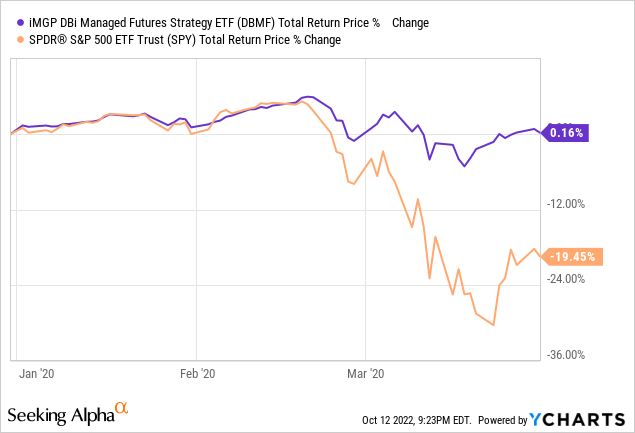

Asset class diversification serves to reduce risk and volatility, and means fund performance is not strongly dependent on the performance on any one specific asset class. This is particularly important in regards to equities: the fund will not necessarily go down during an equity bear market, as it invests in other asset classes besides equities. This is a significant benefit for investors, especially those looking to diversify and de-risk their portfolios. As an example, the fund was flat during 1Q2020, the onset of the coronavirus pandemic, due to a significant allocation to gold, one of the few asset classes with positive returns during said time period.

Asset class diversification also increases complexity, and makes it somewhat difficult to analyse and understand the fund. As an example, it was not immediately obvious to me why the fund had performed so well in early 2020, as the fund had investments in many different asset classes, each with an impact on performance. This is a minor issue all things considered, but still important to consider.

Long-Short

DBMF employs both long and short futures positions. Direction depends on the estimated current asset allocation of a selected pool of the largest commodity trading advisor hedge funds, or hedge funds which use futures to construct their portfolios. In simple terms, if hedge funds are long equities, then DBMF is long equities. If instead hedge funds are short equities, then DBMF is short equities. Same process applies for other asset classes. Positions are rebalanced monthly.

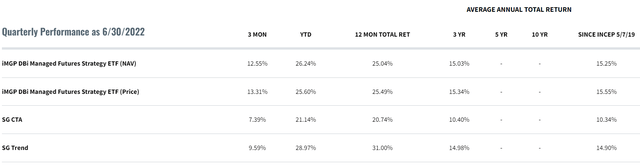

Hedge funds report their holdings with a lag, so DBMF employs a (proprietary) model to estimate underlying asset allocations based on futures market data and public hedge fund performance. The method is not perfect, so asset allocations do not necessarily / exactly reflect hedge fund allocations. These differences have led the fund to outperform relative to most comparable hedge funds by 5% per year since inception, as per fund data. Outperformance is long-lived, but not consistent, due to elevated market volatility these past few months.

DBMF

As DBMF is a multi-asset class long-short fund, returns could be positive or negative during any conceivable market scenario, depending on positioning.

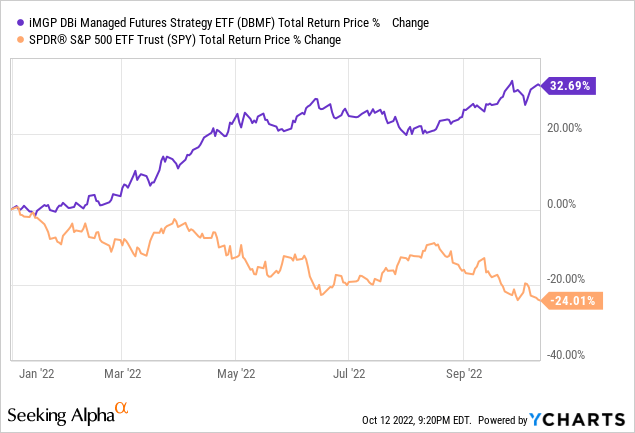

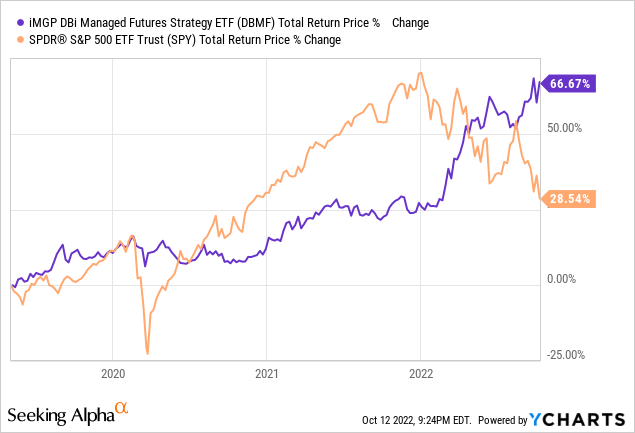

The fund could post significant returns during a bear market, if it is net short / short the relevant asset classes. This has been the case YTD, during which DBMF has posted outstanding 33% returns even as most asset classes are down, due to being short equities and treasuries, and being long oil.

The fund could be flat during a bear market, if it is net flat, or with certain specific combinations of long / short position. This was the case during 1Q2020, in which the fund’s long gold, equity, and treasury positions mostly canceled each other out.

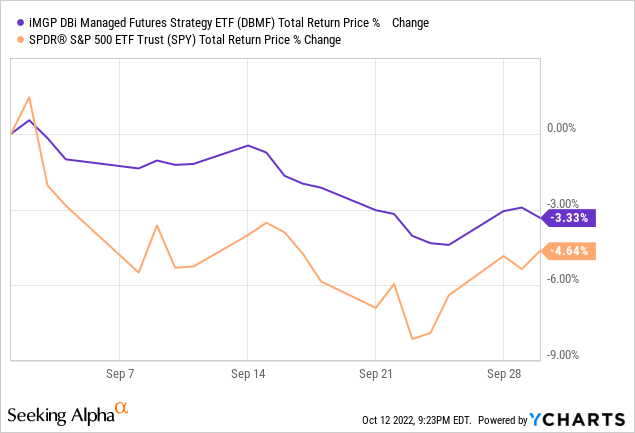

The fund could be down during a bear market, if it is net long, although this has yet to happen, at least for a large / relevant period of time. DBMF was down in September 2020, during which equities posted some losses, but that was only one month, so is not a particularly relevant example.

Same logic as above applies to bull markets, and other relevant market conditions: fund performance varies, depending on positioning. Positioning itself is dependent on the fund’s investment strategy, which attempts to mirror hedge fund asset allocations.

In general terms, the fund’s positioning and investment strategy have been outstanding since inception. DBMF has significantly outperformed relative to the S&P 500 for the same, and at a reduced level of risk and volatility. Outperformance was particularly strong during 1Q2020 and YTD, the two most recent downturns. So, the fund has outperformed since inception and during all recent downturns, an incredibly strong performance track-record.

DBMF’s future returns are dependent on future positioning, which might not necessarily be as strong and effective as it has been in the past. DBMF has outperformed YTD as hedge funds went short equities and treasuries during the same, and the strategy worked / markets crashed soon after. There are no guarantees that hedge funds will correctly time the market in the next downturn. Hedge funds have a disastrous long-term performance track-record, just ask Buffett, recent results notwithstanding. In my opinion, and considering long-term hedge fund performance, the fund’s performance track-record would be materially weaker if it were older. Recent performance is obviously strong, but not incredibly representative of expected long-term returns.

In my opinion, the fact that DBMF’s strategy has worked so well in the past has to count for something, but I would not simply extrapolate past performance into the future. As mentioned previously, future performance is dependent on future positioning. The fact that positioning has been so strong in the past definitely points towards strong positioning in the future, but there are no guarantees that this will be the case.

DBMF – Current Holdings

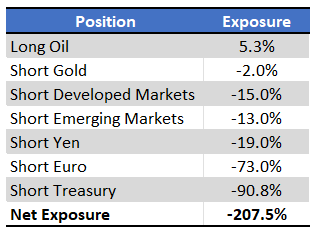

Finally, a quick look at the fund’s current holdings.

DBMF is currently net short, with significant short positions in the euro, yen, and treasuries. These and other short positions have performed exceedingly well YTD, but could underperform if asset prices start to recover. Exposures are over 100%, as the fund is leveraged.

DBMF

DBMF’s holdings are subject to change, so I would not put too much emphasis on the holdings above.

Conclusion

In my opinion, DBMF’s outstanding performance track-record makes the fund a buy. As performance is strongly dependent on the future success of the fund’s investment strategy, I would keep position sizes small, so as to minimize risk.

Be the first to comment