SolStock

Exposure to agriculture

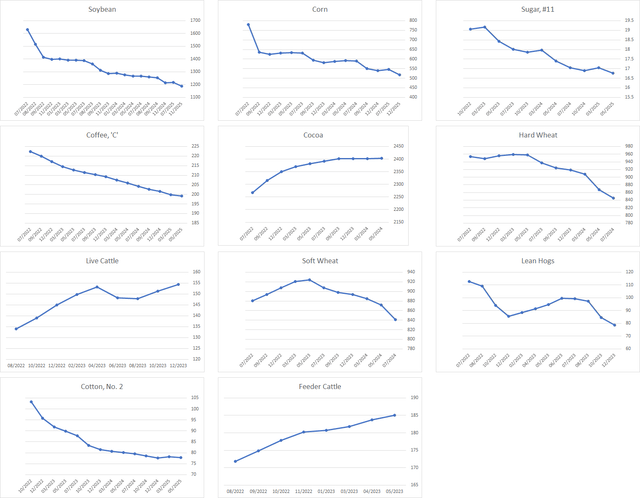

The Invesco DB Agriculture fund provides, as the name implies, exposure to a basket of agricultural commodities. This ETF exposes you to the most important agricultural commodities, by order of weight in the fund:

- Soybeans (6.85%)

- Corn (6.72%)

- Sugar #11 (5.86%)

- Arabica coffee (5.77%)

- Cocoa (4.82%)

- Hard red winter wheat (3.53%)

- Live cattle (3.46%)

- Soft red winter wheat (3.27%)

- Lean hogs (4.65%)

- Cotton #2 (1.31%)

- Feeder cattle (1.85%)

The balance of the fund is composed of cash and fixed income securities, which is necessary for the fund’s operation (margin requirements, futures roll, redemptions, etc.)

Given that the fund’s cash and investment holdings are relatively static to the sometimes wild commodity markets, an investor in this fund would likely be more concerned about the exposure to futures. As the figure below illustrates, the fund’s holdings are well-diversified and food commodities and the holdings provide exposure to a fairly equally balanced basket of food commodities.

Fund composition excluding cash and near-cash holdings (Bloomberg)

The fund seldomly holds futures with different settlement dates for the same commodity; the fund mostly holds contracts maturing fairly soon, though generally further into the future than the front month — this is usually done to strike a balance between spot exposure to the commodity while minimizing roll-over costs. At the time of writing, only livestock futures — lean hogs, live and feeder cattle — are held with more than one maturity. (August and October 2022; August and October 2022; August and September 2022, respectively.) However, this is not due to diversification along the futures curve but rather due to the fund slowly trimming soon-to-expire positions and increasing exposure to a latter maturity. It recently sold 820 August lean hogs contracts and bought 793 October contracts; it sold 834 August live cattle contracts and bought 636 October contracts; and similarly, it sold 167 August feeder cattle contracts to buy 129 September contracts.

Exposure is thus generally obtained through a substantial position in a single contract month. This contrasts with other, more targeted agricultural funds. For example, DBA currently holds 9,192 Sugar #11 contracts maturing in October 2022 while the Teucrium Sugar Fund (CANE) holds a more diversified basket of Sugar #11 for March 2023, May 2023, and March 2024.

Investors in DBA should be aware of the fund’s concentrated exposure to front-end of the futures curve for each commodity, especially if commodities are in contango.

Beware of rolling over in contango

When futures are in contango, it means that the futures’ price is greater than the spot price, which means that all else being equal, the futures price will decline to converge with the spot price as the contract approaches maturity. When a market is in contango, the futures roll-over — that is, selling the current holding and buying contracts maturing further into the future — produces losses, all else being equal.

On the other hand, if a market is in backwardation, the roll-over operation produces a profit since, all else being equal, the price of the futures rises to converge with the spot price as the contract approaches maturity.

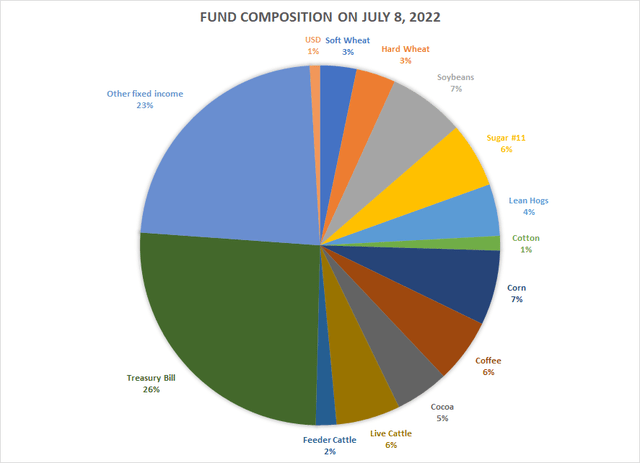

Several commodities are in backwardation, but both feeder and live cattle that the fund is currently rolling over are in contango.

Futures curves for the ETF’s commodities (Bloomberg)

The effect that contango has on the fund’s holdings is evident when one compares the roll in cattle versus hogs, which are in backwardation in the front-end of the curve. For each four August live cattle contracts, the fund was able to purchase only three October contracts, since they are more expensive. Compare this with the neat substitution of August lean hogs for October lean hogs, where the fund bought nearly 97 October contracts for every 100 August contracts it recently sold. The roll in cocoa, soft wheat, and hard wheat contracts will lead to losses, all else being equal, as the curves are also in contango, reflecting the cost of carry. Meanwhile, the roll in soybeans, corn, sugar, coffee, and cotton which are in backwardation — reflecting the premium placed on sooner delivery of the commodities given the unusually tight supply (wheat, corn, soy, coffee, cotton) or higher demand estimates (soy, sugar) — would produce gains.

Investors in DBA would be wise to keep an eye on the futures curves, as this will influence the fund’s performance.

Inflation hedge and speculative plays

Futures curves can be seen to move in two ways: parallel shifts and changes in the slope. This ETF can provide an imperfect hedge to food inflation in the short term. It may also allow investors to speculate on short-term soft commodities. However, while it can also provide an imperfect hedge in the medium term, one must be aware of the additional (hidden) costs that stem from rolling over futures in contango, which is the ‘normal’ futures curve shape. From the point of view of speculation, the fund allows investors to bet on ‘soft commodities’ with an expense ratio of 0.94%.

Because the fund is fairly well diversified across agricultural commodities which are affected by very disparate forces, from weather and politics to seasonality — think of cocoa in Ghana and Côte d’Ivoire versus soy grown in the US and Brazil — it is much less volatile than its underlying components. Nevertheless, while the fund had a relatively smooth rise from the depths of the March 2020 pandemic shock and reflecting the overall increase in the price of agricultural products, it still has exhibited volatility which may surprise some investors unaccustomed to the often wild swings in commodities. Buyer beware! Recently, over the span of just eleven days (June 16 to July 5), investors lost over 10% of their DBA holdings’ value. This is substantially less than, for example, the 25% drop in the more focused Teucrium’s Wheat Fund (WEAT) over the same time period — but nevertheless illustrates the substantial marginal value-at-risk that results from an opening position in DBA.

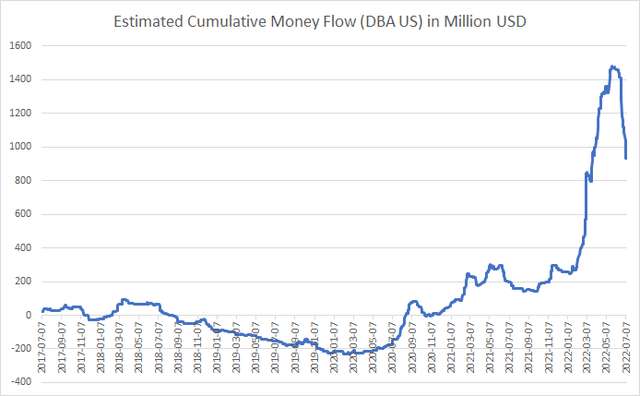

It should be noted that there has been a rush into this fund starting in 2021, which turned into a stampede when Russia’s war of aggression began in late February 2022. Now there’s also a stampede — out of the fund.

Estimated cumulative money flows into and out of the ETF (Bloomberg)

Setting up a speculative trade

Despite the recent (abnormal) volatility, in order to effectively speculate on soft commodities with DBA, buying shares is probably not a good use of your money. Unlike futures which allow investors to post collateral known as margin and control fairly large quantities of a commodity, DBA on its own does not provide much leverage. As such, despite the recent dramatic increase and decrease in commodity prices, DBA’s share price has been quite tame. In order to properly use DBA as a speculative instrument, an investor should seek to magnify the movement of his or her exposure to DBA. One way to achieve this is through the use of deep in-the-money options which have a delta close to one. These sorts of options will change in value in an approximately linear way, like normal shares; this is in contrast with the very much non-linear way that options close to the money behave. Furthermore, because of the nature of option contracts, these provide a built-in stop-loss: you can’t lose more money than you have used to purchase them. Do keep in mind that these instruments may be rather illiquid, which may prevent you from entering and exiting positions quickly. However, properly used, they allow an investor to obtain leverage to make a bet on agricultural commodities for an interesting, expected return in the money allocated to it, given the risk. To illustrate this, consider how one can purchase October call options with a strike of $16 today for about $4.60 each. These have a delta of 0.94 which will yield a day-to-day percentage change in value fairly close to DBA shares. For an outlay of $460 to purchase a single contract, one gains exposure to the price movement of approximately 94 DBA shares until October. By contrast, for the same outlay, one can purchase 22.5 shares of DBA at today’s closing price. Thus, for the same amount of money, you can set up a position which yields an implied leverage of about 4x. If DBA increases by $1, the options would increase by about the same since they’re deep in-the-money; thus, if you held the shares, you would be up $22.50 while holding the options contract you would be up by about $94. On the same outlay of $460, the former represents a return shy of 5% while the latter provides a return over 20%.

Of course, this cuts both ways.

Should you speculate using DBA?

The fund is not, in my opinion, made for a buy-and-hold strategy. It’s not an investment vehicle which provides a claim to wealth creation. Instead, DBA is a basket of near-term futures, and you must be aware of this. The diversification of the fund across different agricultural commodities is offset by the concentration in each of them. You must be aware of the effects of contango on fund performance. The diversification of the commodities in the fund is not the same as diversification across an industry: you are not eliminating idiosyncratic risk with DBA. When you purchase shares in something like the SPDR S&P Biotech ETF (XBI), each of the components of the ETF are subject to the same broad market forces and each company’s quirks (theoretically) cancel out. When you purchase DBA, you are neither betting on the weather, nor a particular commodity, nor even on global politics: you are just barely betting on the difficulty of the world to feed itself. This fund is just a basket of mostly unrelated futures whose only commonality is that they involve soft commodities. Remember: the price of cocoa in Ghana has nothing to do with the price of feeder cattle in the US, yet you’re getting exposure to both with this ETF.

While this fund may help hedge food inflation, you have to be aware of how the futures curve is shifting for each of the eleven commodities in the fund around the time that it rolls its position in the futures contracts. This is costly in time and effort, and it is an imperfect hedge for your food consumption. You are probably better off exploiting loss-leader marketing tactics by grocery stores to purchase and store discounted food (think vacuum sealing) than staking a sufficiently large position in DBA to make a difference in your budget.

As a speculative instrument, the returns it offers are not sufficiently attractive to justify the money that would get tied up. Individual investors who do not want, or cannot, operate in the futures markets would be better off speculating through derivatives on DBA in order to construct positions that provide leverage and make the potential returns worth the risk and the forgone investment opportunities. If you do this, tread carefully: although DBA’s diversification dampens the movements in each commodity to which it provides exposure, it is an agricultural commodities fund. Soft commodities are notoriously volatile and subject to wild swings for unpredictable factors affecting supply, notably the weather. This year’s wild ride should caution you.

Be the first to comment