saengsuriya13/iStock via Getty Images

Investment thesis

DaVita’s (NYSE:DVA) recent performance highlights its exposure to regulatory risk and its limitations as a business to proactively generate growth. However, we expect to see a recovery YoY into FY12/2023 driven primarily by normalizing conditions and current valuations look cheap with the shares trading on PER FY12/2023 at 8.2x and a free cash flow yield of 16.3%. We rate the shares as a buy.

Quick primer

DaVita operates the second largest dialysis center network in the US with 200k patients, a close second to market leader Fresenius Medical Care (FMS). It has nationwide coverage and operates having close relationships with local physicians who act as patient referrers. Berkshire Hathaway (BRK.A) (BRK.B) is the top shareholder with a 38.16% stake.

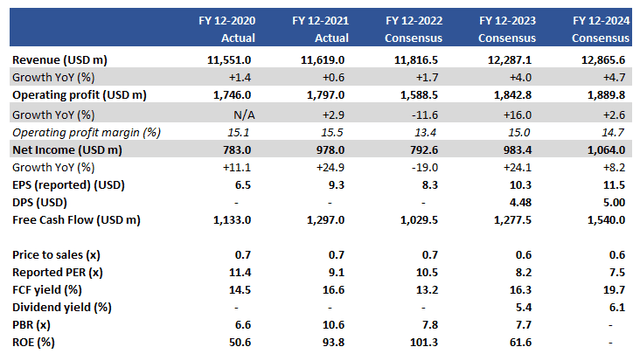

Key financials (including consensus forecasts)

Key financials (including consensus forecasts) (Company, Refinitiv)

Our objectives

We want to re-assess our thesis on DaVita, considering the price action over the last 2 years, recent results and news flow, and consensus outlook into FY12/2023.

Not so defensive after all

DaVita’s perceived defensive strengths as the number 2 kidney dialysis player in the US market have yielded mixed results for shareholders over the last 2 years. The shares are flat on an absolute basis during this period, and the business model has shown itself to be vulnerable in the following manner.

Firstly, despite providing an essential medical service DaVita has been affected by cost inflation which it cannot effectively pass on. A challenging labor market together with inflationary pressures pushes down margins, and despite economies of scale management is not expecting cost-saving measures to have a full-run benefit until 2025. With multi-year contracts in place with commercial insurers, any positive rate hike impact will be delayed at best.

Secondly, we believe the Supreme Court ruling against the company for end-stage renal disease treatment payer reimbursements highlights the high regulatory risk profile of the business. Our conclusion is that DaVita has essentially no control over what appears to be a secular decline in commercial insurance payors. This will have a direct negative impact on the company’s operations going forwards.

With cost pressures expected to be sustained and DaVita not in a position to actively drum up demand for its services, there is not much in terms of proactive management that the company can execute in order to drive growth (except for M&A). DaVita is limited in its capacity to control its destiny, but there are some signs to show there will be some respite ahead.

Low hurdles to come

Q1 FY2022 results demonstrated that current earnings visibility is low. Treatment volumes are expected to be close to flat YoY for the full year and the mix is not expected to improve in the short term. However, there were negative one-off circumstances that should help DaVita improve its performance YoY.

Seasonality is set to become more favorable with more treatment days returning YoY. COVID19 has continued to be a headwind resulting in lower treatment volume as well as a higher than expected mortality rate – this should begin to normalize into FY12/2023.

Management has stated that 2022 is a ‘transition year’ with an improving outlook YoY. There are positive elements from falling contribution to ballot initiatives in California and progress in the Integrated Kidney Care (IKC) business. We believe that unless the overall business environment does not deteriorate significantly, DaVita is on course to operate in a more cordial environment into FY12/2023. We believe this is what consensus estimates (see Key Financials above) are also pricing in.

Capital allocation

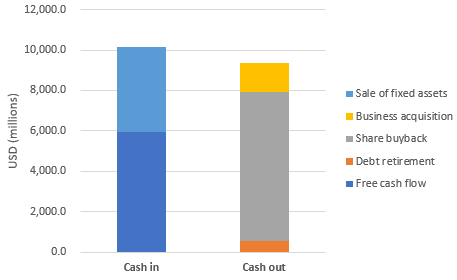

We previously estimated that DaVita would find it more challenging to continue conducting share buybacks. However, it would appear that in actuality, one thing that investors can be fairly certain about is management’s propensity to sustainably conduct share buybacks. In Q1 2022 the company bought back 2.1 million shares, and an additional 800,000 shares at the time of Q1 2022 reporting.

Over the last 5 years, the company has spent the majority of free cash flow generated plus funds from fixed asset sales on buybacks. How sustainable this will be is still open to debate, but it is positive to note that the company has also managed to begin paying down its debt. We view this positively as buybacks are not being conducted at the cost of an ever-increasing debt pile.

Capital allocation (cumulative) over the last 5 years

Capital allocation (cumulative) over the last 5 years (Company, Refinitiv)

Valuation

On consensus estimates the shares are trading on PER FY12/2023 8.2x and a free cash flow yield of 16.3%. These valuations are cheap in our view, even when considering any valuation discount that may be warranted from regulatory risk.

It is worth noting that despite no comment from the company, there are currently street estimates for dividends to be paid from FY12/2023. We cannot find any evidence to support this form of shareholder return but believe any change in policy here would be a positive catalyst for the shares.

Risks

Upside risk in the short term comes from stronger than expected volumes of dialysis treatments, a better mix of commercial insurance versus Medicare, and a greater shift to patients on Medicare Advantage who need more tailored care.

Downside risk comes from cost pressures being higher and more sustained than expected, particularly for staffing expenses. There is also continued rate pressure for Medicare and Medicaid Advantage, with the Center for Medicare and Medicare Advantage (CMS) pointing to lower-than-expected rate increases from FY2022 for dialysis treatment.

Conclusion

We believe that DaVita has visible limitations in what it can proactively manage to grow its business and generate free cash flow, making it a relatively unattractive business model. However, we believe that current valuations are cheap, the negative issues have been priced in and the earnings outlook is one of recovery. We do not view the business as being driven by attractive secular growth themes, but the shares look undervalued. We now rate the shares as a buy.

Be the first to comment