JHVEPhoto

Dave & Buster’s (NASDAQ:PLAY) shares have been a relatively strong performer thus far in 2022 with shares off less than 10% which compares favorably to the Russell 2000 Index/ETF (IWM) which has declined over 20%. Dave & Buster’s has produced record results as consumers flock to its restaurants following the pandemic. In addition, Dave & Buster’s significantly increased its footprint when it acquired Main Event, a similar entertainment/restaurant concept earlier this year.

In acquiring Main Event, Dave & Buster’s took on $835 million in debt. While results are strong and the valuation is inexpensive at less than 6x current EBITDA, I have decided not to buy shares as I do not believe current profitability levels (which are far above pre-pandemic levels) are sustainable. In addition, Dave & Buster’s has more financial leverage than I’m comfortable with, particularly as we approach an economic downturn.

Current Results

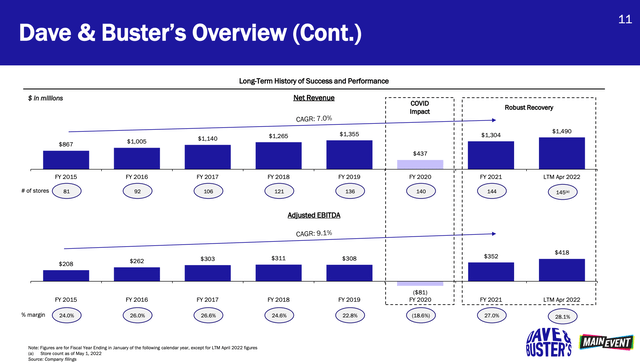

As you can see, Dave & Buster’s (standalone) has been on fire for the past 18-24 months as results have far exceeded pre-pandemic levels.

Dave & Buster’s (standalone) Historicals (Investor Presentation)

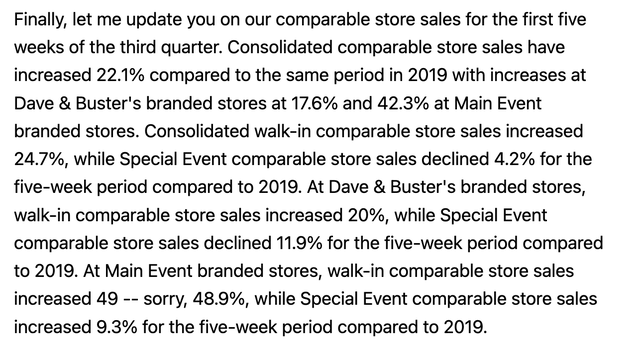

2Q saw a continuation of strong trends with comparable store sales up 5.7% (and nearly 10% versus 2019). On the 2Q earnings call, management noted that strong trends continued into the first 5 weeks of Q3.

Strong results continue into 3Q (2Q22 Transcript (Seeking Alpha))

Main Event Transaction

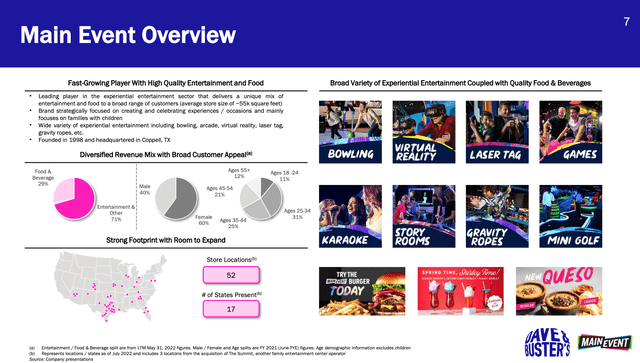

Main Event Overview (Investor Presentation)

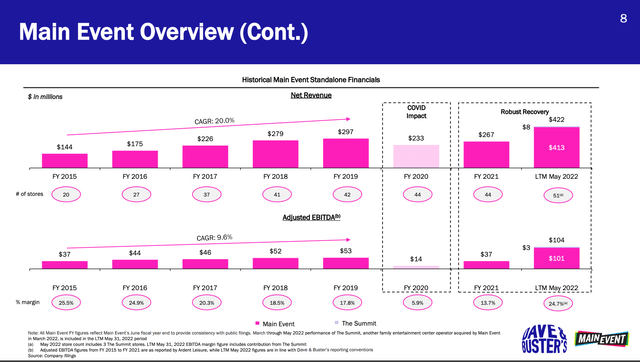

In June, Dave & Buster’s purchased Main Event, an entertainment/dining concept with 52 locations throughout the US, for $835 million. The transaction price equates to ~8x current EBITDA and was funded entirely with debt. Similar to Dave & Buster’s, Main Event has enjoyed record results – as shown below, adjusted EBITDA has doubled from pre-pandemic levels.

Main Event Historical Performance (Investor Presentation)

While the logic of bringing these two businesses together makes sense, I question the sustainability of Main Event’s profitability – similar to Dave & Buster’s the business appears to be running well above trend due to pent-up post-pandemic demand. If I apply historical profitability levels (2018-2019 EBITDA/location) to the current base of locations, Main Event would be earning $66 million in EBITDA which means that the acquisition multiple would be 12.6x EBITDA.

Balance Sheet

Dave & Buster’s funded the acquisition of Main Event with a variable rate term loan (2029 maturity).

Term Loan (Dave & Buster’s 10-Q)

Prior to the transaction, Dave & Buster’s had a very clean balance sheet (<1x net debt to EBITDA). After acquiring Main Event, the balance sheet still looks decent on current results with net debt/EBITDA of ~2.1x. However, I am not convinced that current results are sustainable. If the combined business produces results more akin to 2019 (using EBITDA per store), total EBITDA would be ~$420 million (-19% from current levels) and net debt to EBITDA would be 2.7x.

While 2.7x alone is not concerning, I would highlight that:

1/ Beyond debt service commitments, Dave & Buster’s does not own its real estate and has material lease obligations. In total Dave & Buster’s has annual fixed lease obligations of $192 million per year.

2/ 2019 results still reflect a strong economy. In a recession, results could be worse than 2019. Dave & Buster’s has significant operating leverage with a large component of fixed costs. This means that a hit to revenue will have a magnified impact on operating profit. I suspect EBITDA could come in 30% below 2019 levels should we have a harsh recession – in this case, Net Debt to EBITDA would approach 4x.

Valuation

Below I lay out the valuation looking at a few different scenarios:

|

Price |

36.5 |

A |

|

Shares o/s |

49 |

B |

|

Market Cap |

1788.5 |

C=A*B |

|

Net Debt |

1125 |

D |

|

Enterprise Value |

2913.5 |

E=C+D |

|

2022e EBITDA |

522 |

F |

|

2019a Pro forma EBITDA |

420 |

G* |

|

Estimated ‘Stress’ Case |

300 |

H |

|

*Pro-Forma for Main Event Adjusted for # of locations |

||

|

EV/2022e EBITDA |

5.6 |

|

|

EV/2019a Pro forma EBITDA |

6.9 |

|

|

EV/Stress Case |

9.7 |

There is no denying that Dave & Buster’s shares are cheap on current results. If this level of profitability proves to be sustainable, shares should do quite well over the next few years. Using an 8x EV/EBITDA multiple, the stock would have over 70% upside.

Should profitability revert back to historical norms (2019 levels), the same 8x EV/EBITDA multiple suggests 20-25% upside.

In the event that a recession leads to per store EBITDA falling 30% below 2019 levels, and using the same 8x EV/EBITDA multiple, shares would have 30% downside.

Conclusion

Given that I believe current results reflect pent-up post-pandemic demand and are not sustainable, my expectation is that 2019 (adjusted for store numbers) is a normalized level of profitability. While shares still appear to have modest upside, I’ve decided to pass given my concerns about operational and financial leverage as the economy weakens.

Be the first to comment