kali9/E+ via Getty Images

Initiating Coverage

We are adding Dave & Buster’s (NASDAQ:PLAY) to our coverage universe, as we believe that this company could provide great exposure for investors looking to profit off of a strong U.S. consumer spend and/or general entertainment spend. The company has bounced back strong from the depths of the pandemic lows, and in recent quarters, the company has posted strong results, which now has surpassed certain metrics from pre-pandemic 2019 levels. Though valuation remains attractive, there remains some growth concerns, and we would like to see clearer path to top line growth and commitment to shareholder value.

Company Overview

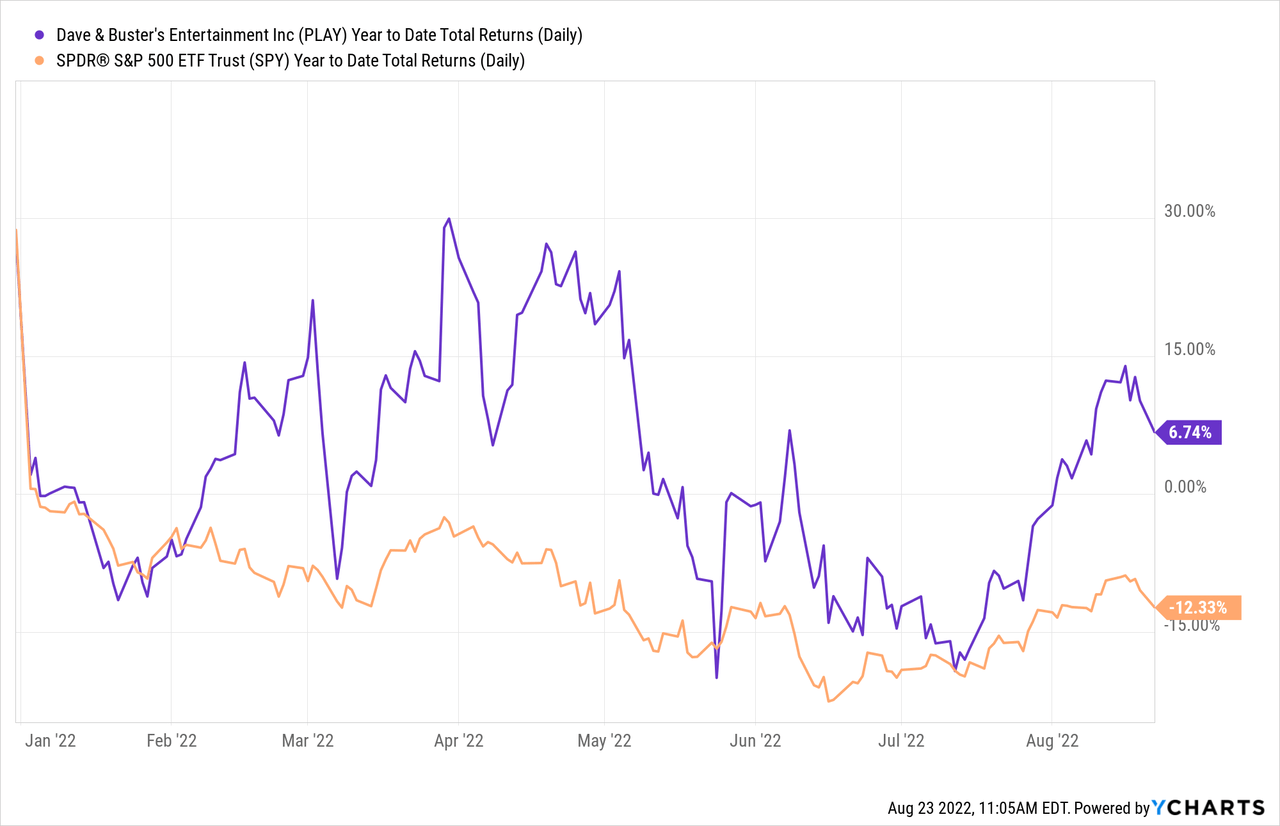

Dave & Buster’s is an American restaurant and entertainment business that has more than 140 locations in the United States. The company operates full-service restaurants that also have an arcade component, providing a full family entertainment experience for American families. This American household name has been a go-to destination for many families, as the combination of restaurant, bar, arcades, and other entertainment facilities creates great night out options for all kinds of parties of all age levels. Dave & Buster’s has provided strong returns YTD, returning 6.74% YTD compared to the S&P 500’s return of -12.33%.

Post-Pandemic Comeback

Dave & Buster’s has been a victim of pandemic-related lockdowns and policies, as U.S. consumers were shuttered from going out during the depths of the pandemic. However, in its most recent quarterly results, the company has reported great financial performance, reporting key metrics that are higher than the ones reported in the same period in 2019 before the pandemic. Some key highlights from the earnings presentation include:

- Revenue increased 24.1% from the first quarter of 2019 to a record $451.1 million compared with $265.3 million in the first quarter of 2021 and $363.6 million in the first quarter of 2019

- Total comparable sales increased 10.9% compared with the same period in 2019

- Net income totaled a record $67.0 million, or $1.35 per diluted share, compared with net income of $19.6 million, or $0.40 per diluted share in the first quarter of 2021 and net income of $42.4 million, or $1.13 per diluted share in the first quarter of 2019

In summary, both the top line and bottom line came in higher than the results reported in a comparable quarter in 2019. Total comparable sales have increased by 11% over the same time frame, which shows that the company has come back to its original long-term growth trajectory. These results should ease any worry related to the long-term decline in the restaurant/entertainment industry as a result of the pandemic.

Attractively Valued For A Reason?

Currently, Dave & Buster’s trades at around ~12.1x P/E of next year’s estimates, which is lower than the P/E range of 14.1x P/E and 32.6x P/E between 2015 and 2019. Compared to the historic multiple, Dave & Buster’s is attractively valued, and at the lower range of its multiples. The low market multiple could be an indicator that the market feels uncertainty toward the sustainability of Dave & Buster’s recent performance, as well as general market fear of potential deterioration of the U.S. economy as consumption slows down from inflation and tightening monetary policy. There remain questions related to how the business will adapt to any major recessionary scenario, and how strong the company’s finances are. Regardless, from a long-term point of view, the low multiple makes this stock attractively valued, and should be of importance for investors.

Innovation Risk

We believe that there are numerous risks facing Dave & Buster’s despite the recent financial performance. First and foremost, though the direct impact from the pandemic lockdown has subsided, the long-term implications to the business model remains unclear. The pandemic has largely accelerated the digitization of the economy, especially in culture and entertainment. Consumers are now better aware of other entertainment options, and companies have been offering digital entertainment experiences that will continue to persist into the future. Since Dave & Buster’s remains a classic brick-and-mortar store experience, we believe that the shift in U.S. consumption toward digital experiences could meaningfully impact the company’s bottom line for the long-term. We would feel more comfortable owning the stock if we see management invest more in the innovation of the business.

Conclusion

Dave & Buster’s is a stock to keep an eye out for as it is a great way for investors to gain exposure to a strong U.S. economy and high consumer spend. We believe that the company’s recent financial performance shows that the worst is behind the company and we believe that the stock is trading at multiples near its historical lows. However, we believe there are a few questions related to the health of U.S. economy and the digital shift in entertainment that we believe the company’s management should provide more light on. Nevertheless, we will continue to track any developments, and we will provide an update to the recommendation based on those developments.

Be the first to comment