damedeeso

Investment Thesis

Datadog (NASDAQ:DDOG) operates an industry-leading cloud-native observability platform that provides unified, real-time observability of its customers’ entire technology stack. It was founded with the goal of breaking down silos between a businesses’ operations and its developers, since these two departments were often struggling to communicate and did not always see the same data.

Datadog May 2022 Investor Presentation

Datadog has seen rapid growth over the past few years, and shareholders have been duly rewarded. Yet as all investors have been seeing, 2020 and 2021 were very friendly to technology businesses, whereas the current macroeconomic fragilities have proven challenging for many former high-fliers.

So now that Datadog has reported its Q2’22 results, how well is this company performing in a macroeconomic environment full of uncertainty?

Earnings Overview

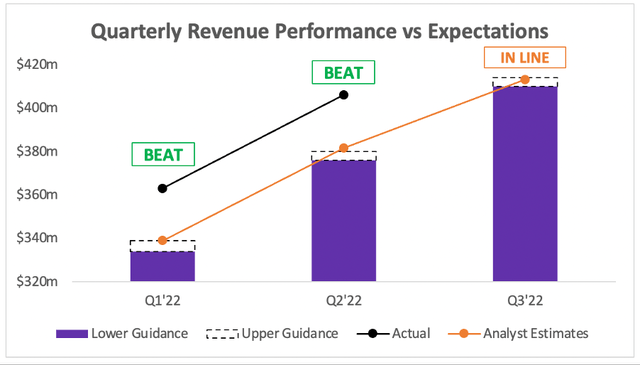

Investors in Datadog have been treated to consistently big beats on revenue, and the company continues its run of form with another huge top-line beat. Datadog reported revenue of $406m, smashing analysts’ estimates of $382m and surpassing the company’s own guidance of $376-$380m; so, business as usual for this top dog.

Investing.com / Datadog / Excel

The outlook for Q3’22 revenues of $410-$414m was in line with analysts’ estimates of $413m. Whilst this implies quite a sequential slowdown, don’t be surprised to see Datadog go and smash these earnings by ~$20m+ when Q3’22 comes around.

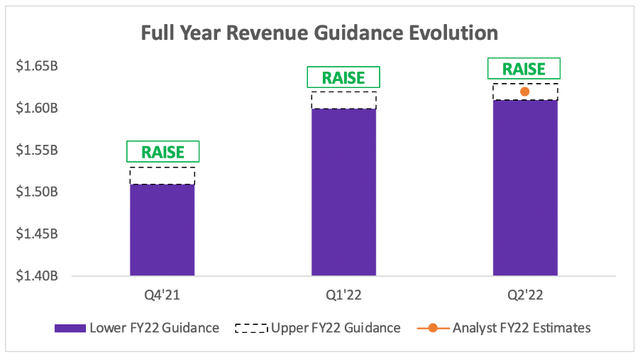

The company also raised its full year revenue guidance, but this was not as positive as investors would’ve hoped for. We can see below that in Q1’22, Datadog raised its full year outlook by ~5.9% at the mid-point compared to Q4’21, whereas in the current quarter it ‘only’ raised guidance by ~0.6% at the mid-point.

Seeking Alpha / Datadog / Excel

Clearly Datadog hasn’t been shy about substantially raising guidance in the past, so I am concerned that the company is guiding for a slowdown in the second half of this year. It experienced growth of 78% YoY in H1’22, and so the current FY revenue projection implies growth of just 43% YoY in H2’22. This is perhaps the first warning sign that even SaaS companies such as Datadog are not immune to fears of a recession.

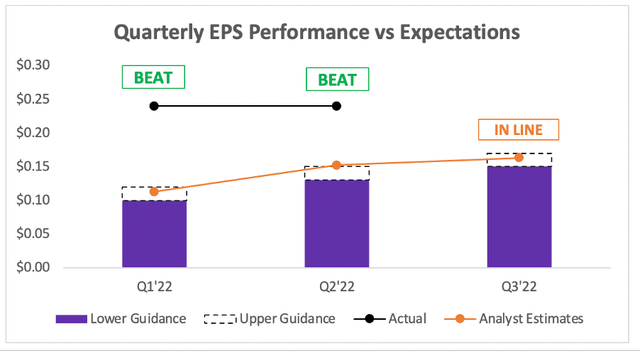

Turning to the bottom line now, and Datadog delivered another solid beat on adjusted EPS, reporting $0.24 vs analysts’ expectation of $0.15 & also beating its own guidance of $0.13-$0.15. The guidance for EPS in Q3’22 was in line with analysts’ estimates of $0.16, but as we can see below this company has a habit of guiding for easily beatable EPS estimates – I would expect the same next quarter.

Investing.com / Datadog / Excel

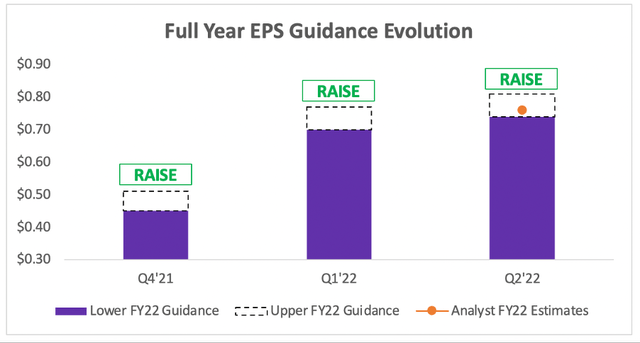

In terms of full year EPS guidance, it’s the same story as revenue; a big raise from Q4’21 to Q1’22, and a lot more caution taken from Q1’22 to Q2’22. I do personally think Datadog might just be leaving itself room to beat guidance substantially once again, but also that management is concerned about the macro environment.

Seeking Alpha / Datadog / Excel

There’s a lot of green in the charts above, and I think that Datadog investors should be very happy with the financial results delivered this quarter. The guidance is good, and anyone who has invested in Datadog for any length of time will be expecting the company’s Q3 results to come in far above its guidance.

In the current financials, there are no signs of recessionary pains being felt by this company; the question now is whether or not Datadog management is intentionally sandbagging Q3 and full year guidance, or if they truly feel like the pain is going to hit them later in the year.

Customer Overview & Product Expansions

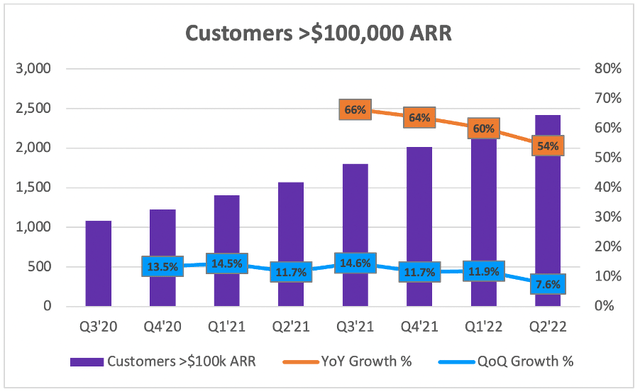

There are some other signs of a slowdown for Datadog in the quarter, specifically when we look at customers with more than $100k in ARR (annualize revenue run-rate).

Now don’t get me wrong; to increase large customer numbers by 54% YoY despite a challenging economic environment is incredibly strong – that fact should not be ignored.

But, what also should not be ignored is clear signs of deceleration over the past 4 quarters. We saw YoY growth of 66% back in Q3’21, and that YoY growth rate has been falling quarter after quarter. Furthermore, when we look at the sequential gain of 7.6% QoQ, this is the first time the QoQ change has hit single digits in the 2 years that I have included above. These customer trends should maybe make investors wary of expecting a big guidance beat from Datadog in Q3; this trend does imply that there could be a slowdown underway, and perhaps the big beat that investors have come to expect will not come to pass.

Yet this slowdown is driven by temporary macroeconomic headwinds, and Datadog still operates a platform that should be relatively recession-proof when compared to industries such as advertising. It’s perhaps not as recession-proof as, say, AWS or cybersecurity, but it has still become an integral part of the day-to-day running of businesses – and it will be hard for companies to cut back on their spend with Datadog.

It is also continuing to roll out new products, which is so important for a SaaS company – you already have all those customers in your network, and it’s pretty easy to integrate new solutions, so you better be upselling! The company announced the launch of Observability Pipelines this quarter, which enables organizations to take greater control of their data so they can affordably manage and scale observability, whilst also announcing a new auditing tool.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Datadog is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

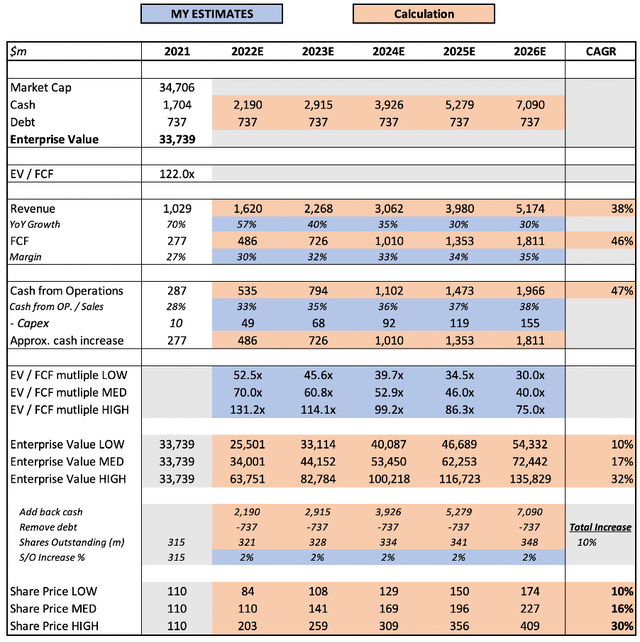

I have outlined details of my assumptions in a previous article, so will only talk about changes – but, turns out, there aren’t many! I have only updated the enterprise value figures, and I have also reduced the final EV / FCF multiple slightly due to a valuation pullback that could potentially be prolonged; I believe that my assumptions for the rest of the model are still appropriate.

Taking all this into account, I believe Datadog shares to be capable of achieving a 16% CAGR through to 2026 in my mid-range scenario.

Investment Thesis: On Track With Minor Concerns

All in all, my investment thesis for Datadog remains on track. Growth is still extremely strong, the company is continuing to roll out new products, and the number of customers spending >$100k with the company continues to expand. The only slight concern would be a potential slowdown, yet I believe this to be driven by macroeconomic factors that should pass over time – leaving Datadog free to reach its long-term potential.

Given all this, I am lowering my rating on Datadog from a ‘Strong Buy’ to a ‘Buy’.

Be the first to comment