Khanchit Khirisutchalual/iStock via Getty Images

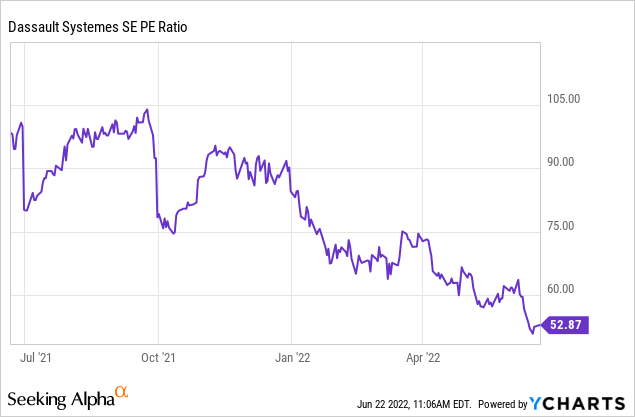

Dassault Systemes’ (OTCPK:DASTY) latest capital markets day event was largely status quo, providing investors a good refresher of the company’s market position and growth opportunities in its core markets. However, the quantitative element was disappointing, as Dassault not only refrained from updating its medium-term financial goals but also kept the EUR1.20/share fiscal 2024 EPS target despite the FX tailwinds. The lack of a guidance upgrade also contrasted with the overarching message that demand was resilient with no signs of a slowdown across its businesses. Coupled with the risk of a guidance reset due to the upcoming SaaS/cloud migration, I feel the c. 53x P/E valuation leaves shares vulnerable to considerable de-rating risk ahead.

A Closer Look at the Multi-Year Growth Plan

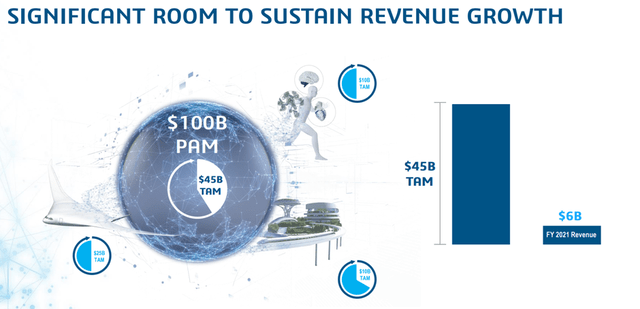

Dassault kicked off this year’s CMD with some positive new updates to its TAM (“total addressable market”) and PAM (“potential addressable market”) opportunities for its sectors. Notably, the Manufacturing Industries TAM has expanded to $25 billion (from $24 billion prior), Life Sciences & Healthcare to $10 billion (from $8 billion prior), while Infrastructure & Cities stands at $10 billion (from $9 billion prior). In total, the company is addressing a $45 billion TAM (vs. the $41 billion outlined at the 2020 CMD), although the PAM remains unchanged at $100 billion. Assuming the TAM assumptions hold, the company has plenty of room for longer-term revenue growth – relative to c. $6 billion of revenues today, the top-line would need to grow approximately eight times to reach the current TAM estimate (or half of the PAM).

Source: Dassault Capital Markets Day 2022 Presentation Slides

Somewhat disappointingly, the fiscal 2024 EPS target of EUR1.20/share was maintained (recall this was previously set at the 2020 CMD) despite delivering a c. 10% CAGR (constant currency terms) and cash conversion of 90+% in recent years. Furthermore, the EUR1.20/share target was based on considerably different FX assumptions relative to today’s 1.04 EUR/USD rate and EUR/JPY of 140. While the JPY rate is a revenue and profit headwind (EUR/JPY of 125 prior), the shift in the USD rate, arguably the more influential of the two, has been a tailwind for Dassault (vs. 1.20 EUR/USD prior) and should have lifted EPS. Also notable was the absence of any updated revenue growth estimates, with the 2020 CMD number maintained in line with the fiscal 2012-2021 growth of c. 10%. As the fiscal 2012-2021 period benefited from an acquisition spree (most notably the c. EUR5 billion Medidata deal in fiscal 2019), however, underlying organic growth is likely lower and could result in downside without similar M&A support.

Cloud Targets Reiterated, but Downside Risks Remain

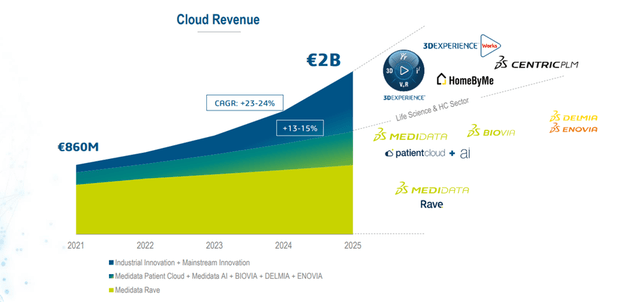

With c. 80% of software revenue currently recurring due to the increasing Medidata contribution, the cloud looks set to be an increasingly important part of the longer-term Dassault growth story. In line with this view, management reiterated its c. EUR2 billion fiscal 2025 cloud revenue target at its CMD – a 23-24% revenue CAGR relative to the c. EUR 860 million generated in fiscal 2021 and implying a one-third contribution to software revenue. This seems ambitious, even considering Medidata Rave’s industry leadership, as Dassault’s Life Sciences & Healthcare cloud revenue growth would have to reach an implied 13-15% CAGR. As such, Dassault will likely need support from the adoption of 3DEXPERIENCE on the cloud, Centric PLM, and HomeByMe to achieve its cloud target.

Source: Dassault Capital Markets Day 2022 Presentation Slides

Margins could be a more pressing issue, however, as software gross margins have declined alongside the ramp-up in cloud revenues. On-premise support and subscription revenues have also delivered muted growth in recent quarters, suggesting migration effects are already weighing on the numbers. Considering key European software peer Siemens (OTCPK:SIEGY) suffered setbacks to its top-line growth, margins, and FCF while undergoing a similar shift to SaaS (albeit more aggressively), I see near-term headwinds ahead.

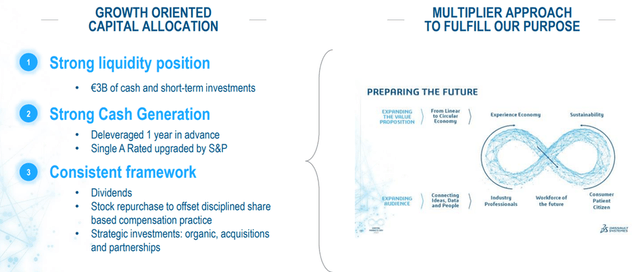

Fortress Balance Sheet and Cash Generation Supports M&A-Led Growth Potential

One of the best qualities of the Dassault model is its ability to generate strong cash flow. Also notable is the improved cash conversion at 90+% over the last few years, which has allowed the company to hit its deleveraging targets one year ahead of schedule. And with c. EUR3 billion of cash and short-term investments on its balance sheet, management has room to acquire more assets to supplement its organic investments – a key element of the growth story thus far. Based on its TAM analysis, potential M&A will likely be focused on adjacent opportunities in the c. $20 billion infrastructure end-market over Life Sciences (c. $10 billion market size). Accretive acquisitions here should also prove useful in increasing the company’s share of the infrastructure market, which remains lower than in Life Sciences. Any transformational M&A would be a positive catalyst but considering management’s reservation on discussing the topic of acquisitions at this year’s CMD (compared to earlier in the year and in prior CMD events), my base case is for any deal still being some way off.

Source: Dassault Capital Markets Day 2022 Presentation Slides

Final Take

There is little doubting Dassault’s conviction in its medium-term outlook, however, questions remain around near-term profitability as we enter a potential recession in the upcoming quarters. Furthermore, Dassault seems to have embedded little conservatism in its cloud guidance, which implies accelerating growth ahead. Coupled with the below-par cloud growth in Q1 ’22, I have doubts about the achievability of the €2 billion target organically. While Dassault could rely on more acquisitions to bridge the gap, the risk of a guidance reset remains material in the likely event its SaaS/cloud migration suffers hiccups. Overall, I like the resilient fundamentals and proven track record of execution but the elevated c. 53x P/E valuation in a world of rising yields keeps me on hold.

Be the first to comment