Spencer Platt

Introduction

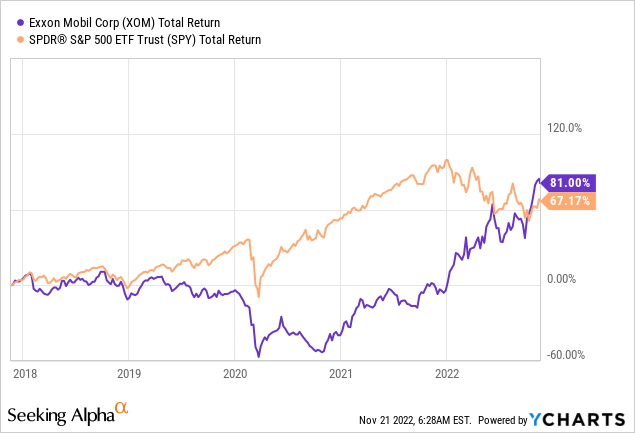

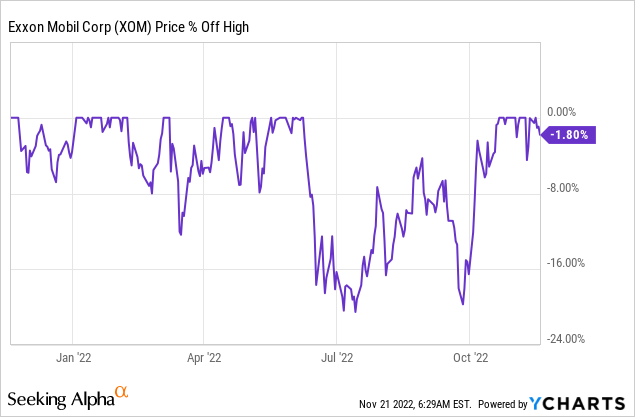

Energy has been the cornerstone of my research since 2020 when the oil implosion and changes in government policies caused the supply situation to change dramatically. As a result, I made Exxon Mobil (NYSE:XOM) my largest energy stock as it combines its high-quality and diversified energy assets and its focus on sustainable growth in shareholder distributions. Nonetheless, as much fun (and profitable) as the bull case has been, it is important to reassess the situation, given that XOM is again trading at record prices, outperforming the S&P 500 by 100 basis points this year.

The risk/reward sure hasn’t improved, as the bull case is now mainstream. However, I do believe that investments in energy stocks continue to be important as the supply and demand situation isn’t improving. Inflation won’t fade anytime soon, and if the stock market goes sideways on a long-term basis, investors in energy will be in a terrific place.

In this article, we’ll discuss all that and why I will continue to buy XOM stock.

The Bigger Picture: Risks & Opportunities

In August, I wrote an article titled Exxon Mobil: The Most Serious Bull Case Ever. The bull case was – and still is – based on global pressure on fossil fuel supply. The push for net zero has created a truly hostile environment for fossil fuel companies as progressive governments want drilling to end, ESG-focused companies like insurers are exiting the business, and customers are looking for ways to diversify energy input.

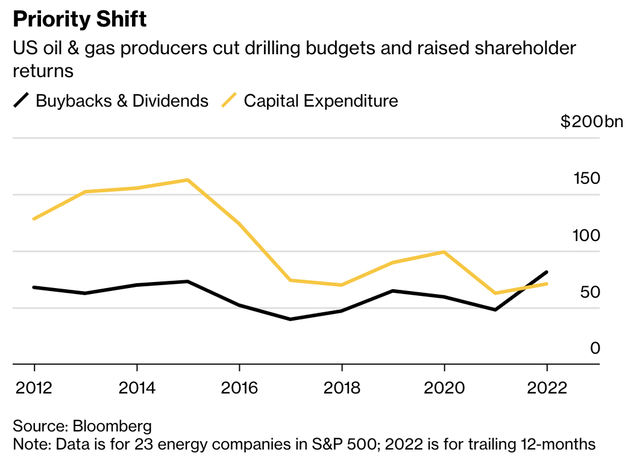

It has created an environment where fossil fuel companies have shifted their priorities from growing production to growing free cash flow.

Going into this year, the 23 energy companies in the S&P 500 spent more capital on buybacks and dividends than capital expenditures.

This has multiple reasons. A few key reasons are related to each other.

- By maintaining production, companies generate more free cash flow. This improves their balance sheets and allows them to eventually boost dividends and buybacks.

- Moreover, if this happens on a bigger scale, the oil supply remains tight, preventing oil prices from imploding as we witnessed in 2015 and 2020.

- This not only benefits investors but also protects companies in the industry. After all, if oil prices crash again, none of the shaky players should expect to be rescued.

I’ve found that funding in the industry is terrible. A quote from last year perfectly shows why companies rather focus on free cash flow than increasing industry risks.

“Private equity has been decimated in this downturn,” said Wil VanLoh, head of Quantum Energy Partners, one of the largest PE investors in the shale patch. “The total quantum of money available out there to private companies has shrunk and is going to stay much, much smaller.”

Now scores of oil producers are “dying on the vine,” said Ben Dell, managing partner at rival Kimmeridge, as they are left without the regular cash infusions to bankroll the capital spending needed to keep on drilling.

That’s bad. Yet it gets worse.

Last month, Munich Re, the world’s largest reinsurance company decided that it wants to ditch fossil fuels.

Munich Re, the world’s largest reinsurer, on Thursday announced stricter policies for investing in and underwriting oil and gas projects, drawing praise from environmental activists.

The German reinsurer said on its website that as of April 2023 it would not invest or insure projects involving new oil and gas fields or new midstream oil infrastructure.

When I say that this is bad, or when I go with anti-climate activist titles, I don’t do that to cheer on the fossil fuel industry or to pump my holdings. I’m genuinely concerned for the future of affordable energy. Affordable energy is what drives economic growth. It’s what lifts people out of poverty. Coal fueled the industrial revolution. Oil fueled the modern economic world. Natural gas helps us to reduce emissions without giving up on affordable and reliable energy – technically speaking.

I’m obviously in favor to reduce emissions as I wrote in a recent article, covering nuclear energy stocks. However, we need to be aware that oil and gas aren’t our enemies. They are the energy sources that will stay with us. We need to combine them with new energy sources to transition.

Killing oil and gas isn’t an energy transition. It’s an economic transition from rich to poor.

Let me give you a few numbers. As I wrote in an article earlier this month, the numbers showing the current situation are horrible.

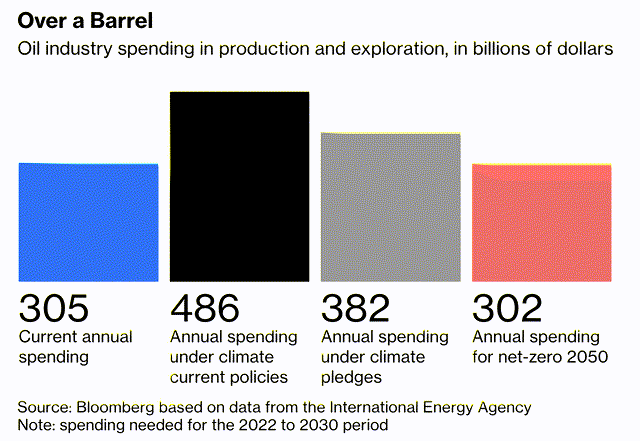

Last year, oil companies spent $305 billion on oil exploration and production. The international Energy Agency estimates that spending needs to be at least $466 billion between 2022 and 2030 to meet the world’s oil needs. That’s based on current climate pledges.

But wait, it gets worse. Even if big oil were to follow net zero pledges, it would have to grow spending by 25% to meet 2030 demand.

Think about that for a second. Oil and gas companies are spending less on production than current climate pledges dictate.

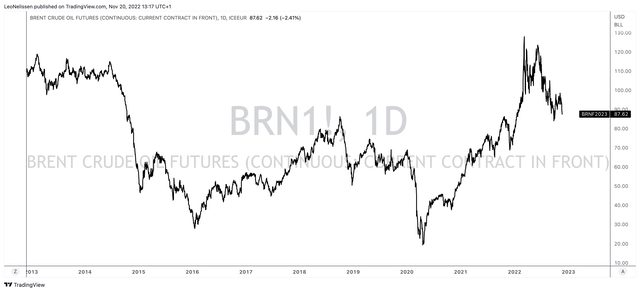

Hence, despite an almost 100% recession probability in the US, Chinese lockdowns, imploding economic growth in Europe, and terrible consumer spending around the globe, ICE Brent oil is trading just barely below $90 per barrel. If the supply situation were normal, I believe oil would have been at least $20-$30 lower.

So, what about OPEC?

OPEC – High Demand, Slow Supply Growth

OPEC has stepped in this year, cutting its output to combat volatile oil prices. This month, Saudi Arabia cut its exports by about 430 thousand barrels per day, which translates to a 6% decline.

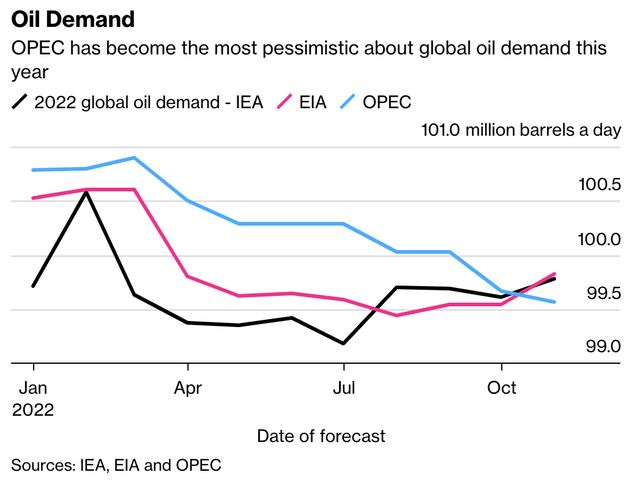

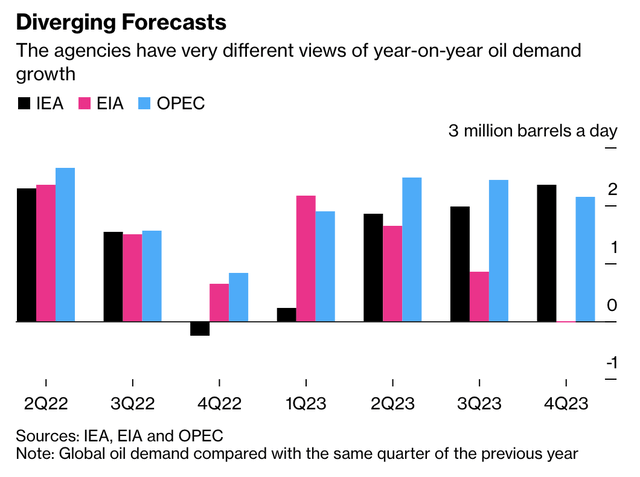

OPEC’s actions are no surprise as it has become home to the most pessimistic oil demand outlook. While both the IEA and the EIA expect an upswing in demand, OPEC nations expect a demand decline.

Bloomberg (IEA, EIA, OPEC data)

OPEC is likely reacting as global growth indicators continue to decline. Europe’s energy crisis is weighing on economic output, China is still sticking to its zero-COVID policy, and the US is about to enter a recession.

What’s interesting is that OPEC is way more positive when it comes to the fourth quarter and the year that lies ahead. The EIA and OPEC see a growth of about 750,000 barrels a day in the fourth quarter, rising to roughly 2 million barrels per day in the first three months of the upcoming year.

As I wrote earlier this month, OPEC doesn’t only believe that demand will come close to 110 million barrels per day in 2023 (13% consumption growth), it believes that this level will hold for a decade. That’s much more bullish for oil than any estimate betting that net zero will harm demand.

I agree with this as net-zero is not able to do damage to oil demand. Hence, given the movement to reduce output in a world of sustained demand growth, we’re running into dangerous issues. According to OPEC:

OPEC Secretary-General Haitham Al Ghais reiterated the warning given at last year’s climate talks that a complete break with hydrocarbons is “potentially dangerous to a world that will continue to be thirsty for all energy sources.”

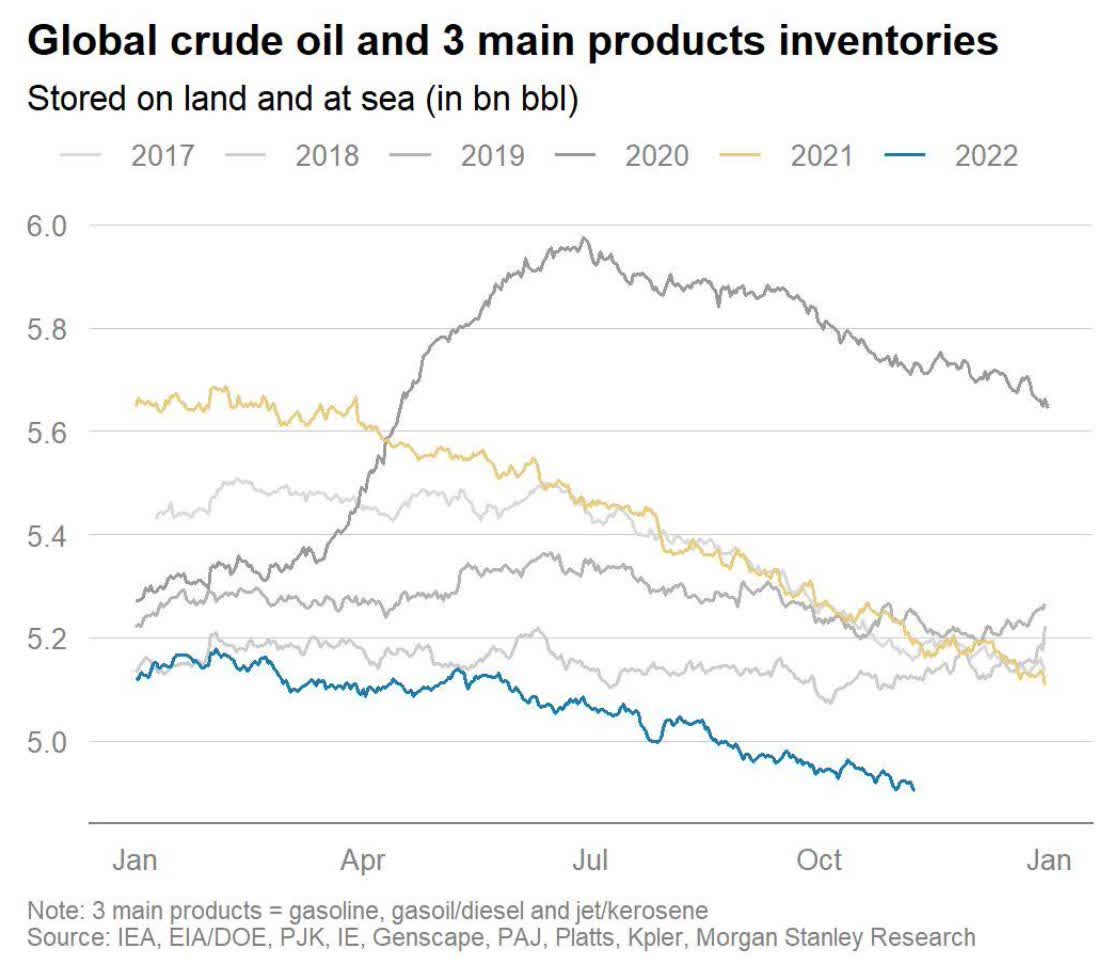

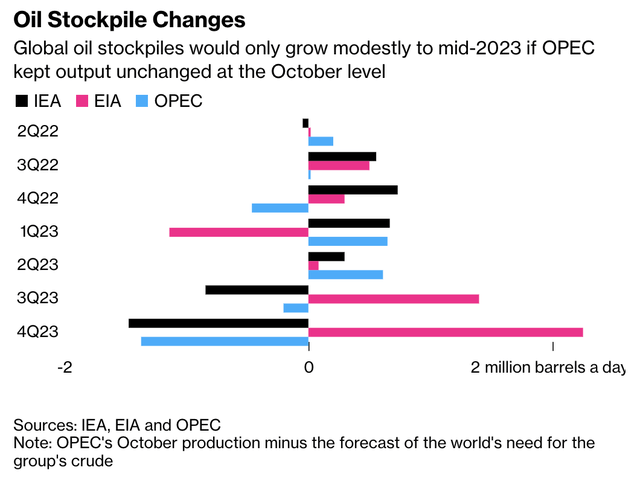

It is, therefore, no surprise that OPEC believes that global oil stockpiles will start to contract sharply in the second half of the upcoming year – based on October output levels.

Lower inventories are a reason to buy oil equities. However, the bull case gets even stronger if we consider that inventories are at extremely low levels.

Morgan Stanley

On December 4, there’s a new 23-nation OPEC+ meeting in Vienna, Austria, to discuss production policy for early 2023.

Now, the question is, what does all of this mean for Exxon Mobil?

A Quick Look Back

I have invested roughly a fifth of my net worth in energy stocks. These investments are long-term.

I am not trading energy markets as I believe in the power of holding energy stocks on a long-term basis.

Not only do I like the income (I also need it for tax purposes), but I believe that there is an elevated risk that the stock market isn’t going anywhere for the next few years.

In a recent article, covering Apple (AAPL), I highlighted the risk of elevated inflation on the stock market. Especially in light of supply-side-driven inflation.

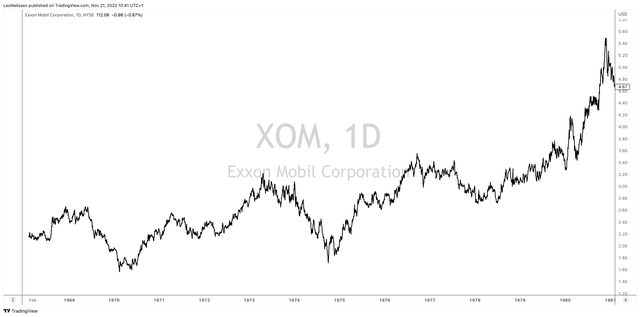

The risk is that inflation isn’t coming down as fast as the market may expect, causing us to get a scenario comparable to the 1970s and 1980s, where supply-side-driven inflation caused the Fed to initiate a few aggressive hiking cycles. It caused economic growth to fluctuate.

Until inflation eased in the early 1980s, stocks went sideways for more than 20 years. I am not saying that this will happen again, however, I believe the risks of a prolonged sideways trend are very high.

While Exxon Mobil was very volatile during this period, it provided investors with capital gains and dividends.

I’m not going all-in on high-yield investments, but I did decide to buy a bit more high-yield than I usually do. This includes hard (value) assets like oil and gas, real estate, railroads, and pretty much everything I would have bought anyway.

Moreover, given energy policies and the impact on inflation, I believe that investors need to own energy stocks. Investors shouldn’t go overweight, but owning high-quality energy assets is pretty much mandatory in this global net-zero environment.

However, that still doesn’t mean we need to buy Exxon at any price.

What About Exxon?

I started buying Exxon in the low $30s when it felt very wrong to buy oil. Now, the exact opposite is happening. Investors aren’t speculating whether XOM may or may not cut its dividend (like they did in 2020), but discussing record-breaking earnings.

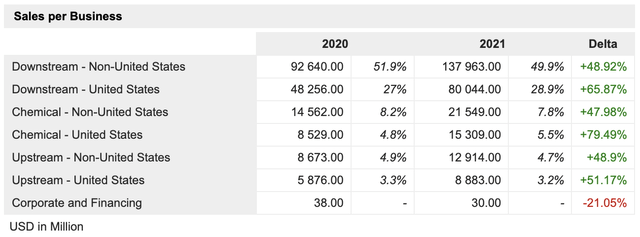

In its third quarter, the company generated $112.1 billion in revenue, a surge of 51.9% versus the prior-year quarter. It was also $9.1 billion higher than expected, which is a truly remarkable number.

The company had more tailwinds than just tight oil supply, as a big part of its sales come from downstream operations.

Not only did the company benefit from oil supply tightness, and high European natural gas prices (also supply related), but the company benefited from very high refining margins, boosted by high global diesel demand (flat demand growth in the US).

In its 3Q22 investor presentation, the company slammed counterproductive European investment decisions, which reduced oil and gas production by 700 thousand barrels per day (oil equivalent), while refining capacity is down 500 thousand barrels compared to 2018.

In 3Q22, the company had global refinery throughput of 4.2 million barrels per day, the best result since 2008.

In the first quarter of 2023, the company will bring the Beaumont refinery expansion online, adding another 250,000 barrels per day to its capacity.

The company also produced 3.7 million barrels of oil equivalent in the quarter. This included 560 thousand barrels of oil equivalent in the Permian Basin, which the company uses to grow onshore oil production. Production in Guyana hit 360 thousand barrels of oil equivalent per day.

Exxon also started to produce LNG from Mozambique’s Coral South floating LNG development, benefiting from the global rush for LNG.

The company is also on track to maintain highly profitable operations and consistent (low) oil production growth.

According to CEO Darren Woods:

We continue to expect total upstream production of 3.7 million oil equivalent barrels per day for the year. Looking longer term, we remain on track to grow low-cost production and meet our 2027 plan, with more than 90% of our Upstream investments, generating over 10% returns at $35 per barrel.

Moreover, and this matters to dividend investors, the company generated $24.4 billion in operating cash flow in the third quarter. CapEx was roughly $5.1 billion, allowing the company to reduce debt by $1.2 billion, and distribute $8.2 billion to shareholders through dividends ($3.7 billion) and buybacks.

Exxon ended the quarter with $30.5 billion in cash. The company has a net debt-to-capital ratio of just 7%, allowing it to withstand macro and geopolitical volatility.

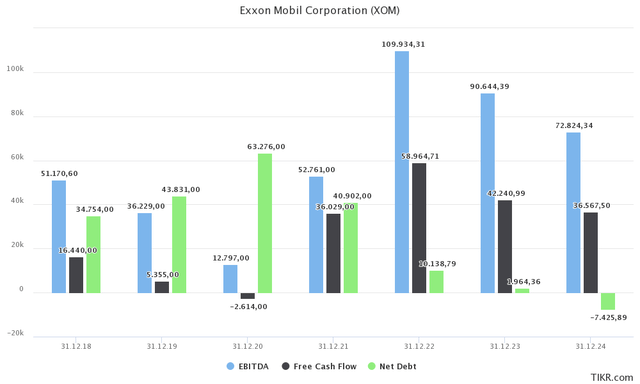

Looking at the bigger picture, even moderating oil prices are likely to result in negative net debt after 2023. Free cash flow is expected to remain above 2021 levels for the foreseeable future. My personal view is that analysts remain too pessimistic as I believe that both EBITDA and free cash flow will beat estimates by a wide margin in 2023 and 2024, as I do not believe in a steep (and lasting) moderation of oil prices.

Now, before we dive into the risk/reward, let me say a few things regarding the dividend, as that is a key reason for people to own XOM. It’s also a cornerstone of my thesis for the aforementioned reasons.

What About The Exxon Dividend?

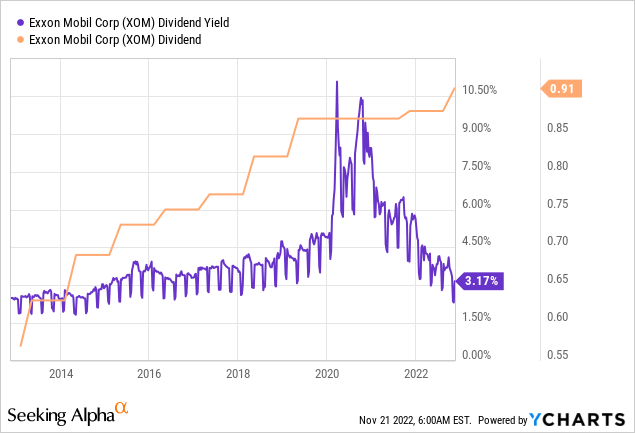

Let’s start with the absolute worst part of this section. The company currently yields just 3.2%. This comes after its most recent hike of 3.4% to $0.91 per share per quarter on October 28, 2022.

The yield has now come down to pre-pandemic levels.

If you were to buy a dividend stock like Devon Energy (DVN) or Pioneer Natural Resources (PXD), you would get a yield close to 10% as both companies distribute most of their free cash flow to shareholders.

In 2021, XOM hiked by 1.1%, which means investors haven’t really benefited from the surge in oil prices – at least now from an income point of view.

The company knows its dividend is important.

We’re obviously focused on having a competitive, sustainable, growing dividend over time. We know how important it is to shareholders and roughly 40% of our shareholders are consumers, and we know those people are very much focused on the dividend.

Exxon is different. The company is not committing to a high dividend because Exxon does not engage in VARIABLE dividends like some of its peers. Let’s say the company doubled its dividend. That would be financially feasible. However, the next oil crash would force the company to cut its dividend. That’s not a situation Exxon wants to encounter after hiking its dividend for 40 consecutive years in 2022.

Exxon rewards its investors differently. Exxon is working on a $30 billion buyback program through 2023, resulting in a potential share count decline of more than 6% using its current market cap of $462 billion.

That money doesn’t end up in your pockets, yet it supports the stock price.

Dividend growth will likely accelerate as well thanks to the healthy balance sheet. However, I would not expect any wild dividend growth rates.

Exxon is a top 3 position of mine, and I have to say that I’m fine with this strategy. I’m in it for the long term. Exxon is more than an upstream company. It evolves with the industry and will continue to be a reliable source of income. If you want much higher income, I would make the case for variable dividend payers like the two I just mentioned.

Unfortunately, the 3.2% yield doesn’t help the risk/reward.

The Exxon Valuation

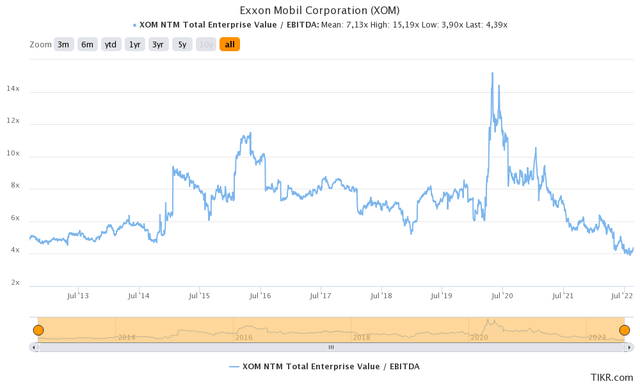

Exxon is trading at 5.4x 2023E EBITDA of $90.6 billion. That’s based on its $487.3 billion enterprise value, consisting of its $461.6 billion market cap, $2.0 billion in 2023E net debt, $16.8 billion in pension-related obligations, and $6.9 billion in minority interest.

The mid-cycle EV/EBITDA (forward) multiple is roughly 7, which I believe is a fair value.

This would imply that the company is still roughly 30% undervalued. On a long-term basis, I believe that Exxon will outperform the market. Free cash flow is high, debt is quickly being reduced, and shareholder distributions are expected to accelerate.

With that said, here’s what I would do.

Is XOM Stock A Buy, Sell, Or Hold?

This is a tricky question for one main reason: we’re dealing with different timeframes. On a short-term horizon, I believe that Exxon is a hold. Global economic growth is rapidly declining, causing demand destruction to impact the supply/demand imbalance in favor of lower oil prices.

However, for 2023, I remain very bullish. Especially once the Fed pivots, demand expectations are likely to come up. This could come at the same time when China starts to ease its zero-COVID policy, putting even more pressure on already very low inventories.

Hence, my strategy is to wait for a bit more weakness in the industry before I add more oil exposure to my portfolio. Exxon has a history of dropping 10% on a regular basis. It also makes the dividend yield a bit more attractive, which I believe is quite important for income-oriented investors.

I’m trying to use these sell-offs in my favor, as short-term economic conditions can provide us with buying opportunities.

On a long-term basis, I believe that Exxon is a must-own due to its ability to deliver value in what could be a prolonged sideways trend for the market.

(Dis)agree? Let me know in the comments!

Be the first to comment