shaunl

Danaos Corporation (NYSE:DAC) recently reported its second quarter. And what a second quarter it was. Danaos has proved that the company has, and will in the near future, continue sailing smoothly with record earnings. The company paid back nearly half a billion dollars of debt and also has begun to execute on its $100 million buyback. Danaos’ leverage is at a historic low, earnings are at a record high, and we have a dividend and a buyback, yet shares are stagnant. I smell undervaluation.

Truly Stunning Earnings

Danaos’ second quarter may have seemed, to some, as nothing special, but I believe this represents a genuinely stellar quarter and demonstration of just how far this company has come in two years. Danaos reported adjusted net income of $157.1 million, equivalent to $7.59 per share. Once adjusting this net income further for the impact of ZIM’s (ZIM) dividend, we get $140.9 million ($6.90 per share) in core net income, no paltry sum. Not that I’m sad Danaos receives such a healthy chunk of change from ZIM each quarter, either.

Danaos Corp Q2 Earnings Presentation

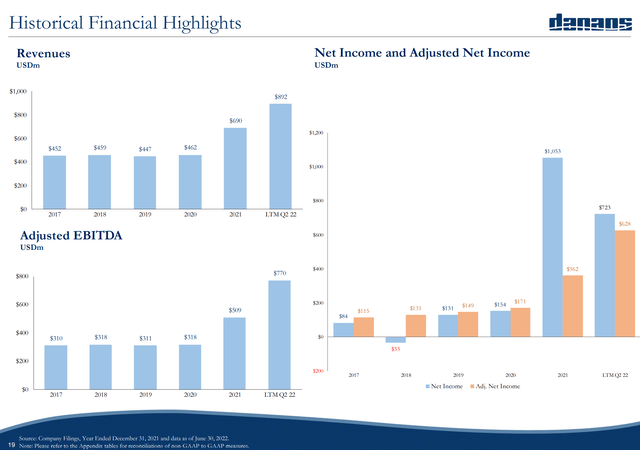

Non-adjusted EPS was a mere $0.40 per share, largely thanks to a $168.6 million decrease in the fair value of the company’s ZIM shares. Danaos’ operating revenue grew year-over-year and quarter-over-quarter; the company reported $250.9 million in operating revenue for the second quarter, compared to $103.7 million a year ago or $229.9 million last quarter. Adjusted EBITDA also increased to $192.1 million from $103.7 million a year ago.

Across the board, Danaos has nearly doubled its results from a year ago. And that’s before we even consider how much better the company’s balance sheet is looking.

Significant Balance Sheet Improvements (Once Again)

Danaos made significant repayments on its debt and leasebacks in the second quarter to the tune of $467.8 million. This was partially offset by the $130 million loan to finance the 2021 purchase of six 5,466 TEU vessels.

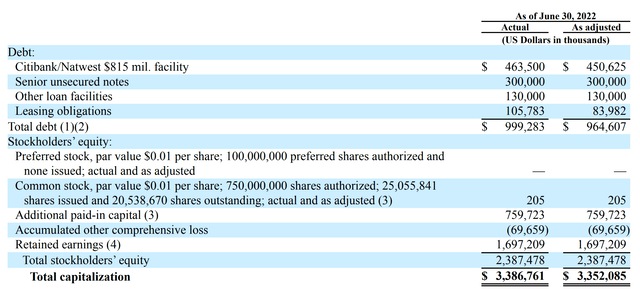

Overall, this leaves the company with historically low leverage. Its outstanding debt of $893.5 million plus leasebacks of $105.8 million for a total indebtedness of $999.3 million is significantly lower than $1,165.9 million in debt plus $237.2 million in leasebacks (a total of $1,403.1 million) a year ago. This is a reduction in total debt of nearly thirty percent over a one-year period.

And in the month since July 1, the company has further reduced its total debt to $964.6 million (as seen in the “as adjusted” column above).

This puts the company ahead of my 2019 prediction for sub-$1 billion in total debt as of year-end 2023:

At this rate, Danaos would have a remaining outstanding principal of $875.6 million in December 2023, when most of the debt matures. Given the current state of charter rates, the company will likely be able to maintain its free cash flow of more than $200 million.

[…]

Even using the company’s estimate for repayment, we still get a remaining principal of only $937.7 million in Dec 2023.

And that wasn’t accounting for the fact that the company has purchased new vessels since then, some financed by the new $130 million credit facility. Danaos has 71 vessels now, compared to 60 in mid-2021.

On top of that, Danaos now has $313.6 million in cash as of June 30. Plus 5,686,950 ZIM shares, valued at $268.6 million on June 30 and worth just over $279 million as of August 3.

Based solely on the company’s cash balance, its net debt as of June 30 was $685.7 million, though based on the company’s press release, net debt was $679.7 million. And that doesn’t even account for the $268.6 million in ZIM shares.

Overall, Danaos’ balance sheet is perhaps the cleanest it has ever been. Certainly the best I’ve seen since I began covering the company, now with debt/equity of 0.9. The company has brought its debt/equity ratio from 2.51 to sub-1 in the most recent quarter; Danaos’ debt/equity currently stands at 0.42.

Now, admittedly, the company has made clear that it may take on additional debt in the coming few years as it sees fit to pursue further fleet renewal. However, the company’s CEO, John Coustas has also made clear that it will be in a responsible manner:

Well, I think you know exactly because shipping is a cyclical industry. It’s what you really need to see is how your debt-to-EBITDA moves through the cycles. Of course now, it’s a very strong market, that we had a debt-to-EBITDA of 0.9. And actually, if we take into account also some of our other marketable securities, it’s even lower than that. But this is really now that we are at the top of the cycle and at a moment that we have not done any significant expansion. We believe that, let’s say through the weakening of the market, and our material expansion, this could go somewhere as maximum up to about three.

And that’s really the level that we want to keep, because we are very much aware that the rating that we get is directly influenced by these ratios. And we consider a very high rating as a key to our future by being able really to borrow cheaper than our competitors.

Overall, this was a fantastic quarter for Danaos’ balance sheet, and these improvements will improve cash flow and the company’s ability to maneuver down the line.

Share Repurchases Will Continue (And Danaos Pays A Dividend Now)

The big pre-earnings news for Danaos was, of course, its $100 million buyback. The company has repurchased 409,200 shares in the open market as of the end of July. Though this is certainly no October 2020 “four million shares for $31 million” buyback, nonetheless it is significant. The company has so far repurchased around 2% of its shares outstanding, with $74.9 million remaining under the authorization to be used “opportunistically.” With shares still well below their net asset value, the buyback will continue to be accretive to the company and shareholders. However, I wouldn’t expect another huge buyback program following this one for several reasons. First, Danaos has very high insider ownership, which means its float is already fairly small and management likely doesn’t want to restrict liquidity too much. Second, with pending environmental regulations, Danaos wants to make sure it is prepared for having to sell or scrap some of its older smaller vessels in the coming years. This will require more money for fleet renewal.

The third reason is the dividend. Though it is clear that the company is not going to go on binge-raising it, they have also committed to continual long-term raises.

Regarding the dividend for the time being, it remains steady and it’s going to any reevaluation of the dividend, it’s going to be definitely not earlier than 12 months from the previous rates.

Even if Danaos may be one of (if not the most) conservative Greek shipping company in terms of how it handles its balance sheet and remuneration, I think it continues to benefit the company and will permit much better long-term shareholder returns.

All Of This Points To… Continued Undervaluation

Since my valuation of Danaos in the first quarter, the company has further increased its earnings on new charters and decreased its debt load. I know firmly believe my $640 million per year EBITDA value is well-below Danaos’ current reality (heck, the company’s adjusted EBITDA for the last twelve months is $770 million.

If we take the company’s $192.1 million EBITDA for this quarter and adjust it down to $176 million by excluding the ZIM dividend, we get $704 million in annualized EBITDA. Now, this is still an underestimate for two reasons:

1. Danaos still has new charter rates set to kick on over the next year.

2. Ignoring the ZIM dividend may make for a conservative calculation as if the company were to sell all its shares, but the reality is Danaos doesn’t plan to do so any time soon and these dividends will meaningfully impact Danaos’ top line for the foreseeable future (even if rates fall and ZIM isn’t earning as much).

But for our valuation, let’s stick with $700 million (I’d rather be on the lower end). The company’s net debt is currently ~$679.7 million and its ZIM shares are worth $268.6 million, which makes its ZIM-inclusive net debt $411.1 million.

And the last number we need is shares outstanding. As of June 30, Danaos had 20,538,670 shares outstanding; after the July repurchases of 231,300 shares, Danaos now has around 20,307,370 shares outstanding (though the company’s buyback continues).

| EV/EBITDA Ratio | Share Value | Upside (from August 4 close) |

| 3 | $83 | 13% |

| 4.5 | $134.9 | 83.9% |

| 6 | $186.5 | 154% |

| 7 | $221 | 201% |

| 10 | $324 | 341.6% |

Now, I think that Danaos could well be worth every bit of $221 per share. With current ZIM-dividend-excluded EPS of $6.90 per share, $27.6 annualized, that’s only 8 times earnings.

However, a conservative valuation of the company in this time of extremely tough market sentiment would be around $134.9 per share. This is higher than my previous valuation by about $12, but I think the company has more than proved it is well worth it.

The Takeaway

Danaos’ second quarter was definitively underappreciated by the market. The company’s debt reduction has put its balance sheet in fantastic shape. Not only has Danaos reduced its debt, but it now has a comfortable cash balance and many new vessels. The company has strong and highly-visible earnings, driven by high charter rates (and the aforementioned new vessels). Oh, and 5 million ZIM shares paying dividends. Additionally, with 3/4 of its buyback remaining to repurchase severely-undervalued shares, Danaos is executing superbly. If the market can begin to recognize the true value of Danaos, the company has some well-deserved upside.

Be the first to comment