fstop123/E+ via Getty Images

Before 2022, the housing market was booming as rates were near all-time-lows, causing a rush of home-buying and immense price increases. On an average annual basis, realtors were selling homes at the fastest pace ever. Homebuilders were starting new projects at the highest rate since the mid-2000s. This situation has reversed during the first half of 2022 as average mortgage rates double from around 3% to roughly 6%. Today, the property market is stalling, and prices have begun to fall in specific cities across the U.S. Homebuilder stocks, such as D.R. Horton (NYSE:DHI), have slid dramatically as many investors brace for a hard landing in the construction market.

I issued a warning on D.R. Horton in April in “D.R. Horton: ‘Value Trap’ Potential As Rising Mortgage Rates Shock The Market.” The stock has slid around 9% since then, and it has become far more apparent that the U.S. housing market is entering a bear market. At the very least, the excess gains from the ultra-low-rate period over the past three years seem to be unwinding. That said, D.R. Horton has an extremely low forward “P/E” of 4X with high historical earnings growth, making it a very attractive target to many investors. Of course, the homebuilding market is highly cyclical, and the rapid pace of mortgage rate increases may throw a wrench into the cycle.

To me, there are two key questions we must consider. Firstly, can D.R. Horton offload its inventory while prices remain high? Secondly, is D.R. Horton making appropriate plans to weather a problematic storm by reducing future development projects and raising cash. In my view, D.R. Horton, and home builders in general, would be wise to “take their money and run,” given the rapid shift in the housing market’s fundamentals. History tells us that it is often better to leave some money off the table than to be the bagholder, as losses are often asymmetric to profits. This risk is increasing since home construction costs are rising while prices are likely to decline. Overall, I remain cautious and relatively bearish on D.R. Horton as the company does not appear to be positioned well in the changing environment.

A Fresh Look At the U.S. Housing Market

The U.S. property market has never experienced such a rapid relative increase in mortgage rates. This factor creates added complexity as the real estate market lags behind financial markets. For example, people often decide to buy or sell a home based on trends and mortgage rates from months before the sale date. Homebuilders make development plans based on current fundamentals, but those fundamentals often change dramatically after two years when construction is completed.

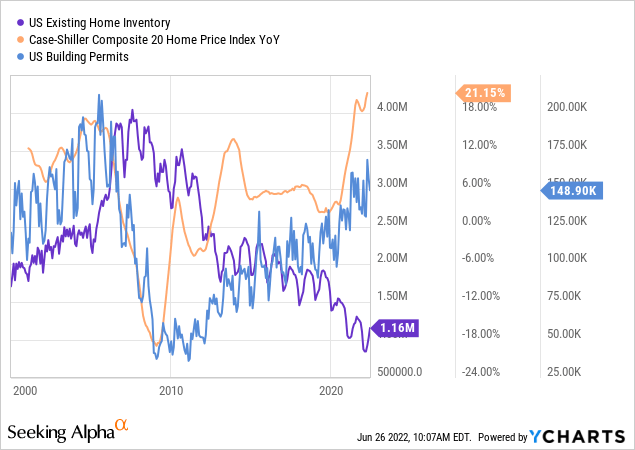

Accordingly, with mortgage rates moving from extreme lows to (relative) extreme highs, some areas of the housing market still appear to be booming while others are shuttering. Home affordability and pending home sales are crashing, but average home prices rose last month. In the short run, home prices track inventory levels more than affordability. For now, inventories remain near all-time-lows. See below:

Low inventories and strong home price growth are great for homebuilders in the near term. Most builders are still planning as if the goldilocks period will continue as building permits remain near cycle highs. To complicate factors, the ongoing shortage of building materials has caused average single-family home materials costs to increase by an average of 42% from 2018 to 2021. Labor costs (due to the shortage of skilled construction workers) and, more recently, energy prices are also contributing to increasing homebuilder costs and, more importantly, completion times.

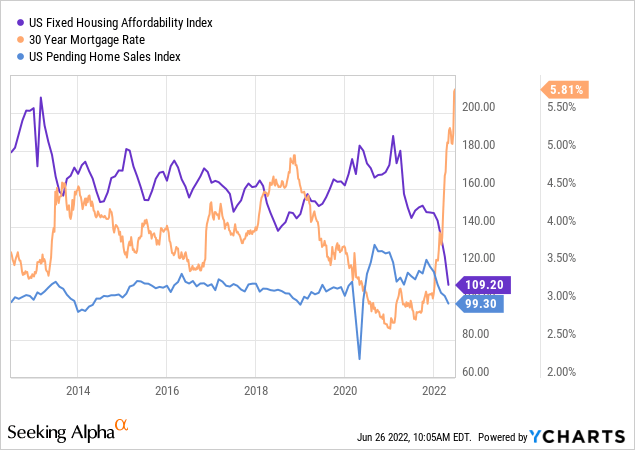

As the market turns over, builders may need to race to bring their developments to market before prices crash. Indeed, while prices are high, price data, inventories, and even permits are primarily driven by lagging factors. If we look at leading factors, such as mortgage rates, affordability, and pending home sales, it is clear that the U.S. housing market is slowing. See below:

The level of all-cash buyers remains high at nearly 25%, so many of today’s buyers are likely those who recently sold during the frothy market. Eventually, that source of buyers will dry up, and, with home affordability at an all-time low, it will be tough for new homebuyers to enter the market. Significantly, 62% of D.R. Horton’s product offerings are on homes priced under $350K, meaning they are catering to new homebuyers. When rates were extremely low, the new buyer segment was the strongest; however, it will likely quickly become the weakest as mortgage lenders cannot lend nearly as much with rates as they are now.

Overall, it is apparent that the U.S. housing market is slowing. While prices are still elevated, pending sales are plummeting at the fastest pace since 2020 and are now around decade lows. Mortgage rates have continued to rise at an unrelenting pace, so given the lag time between rates and pending sales, it seems likely that sales will decline much further. Eventually, likely by the end of summer, inventory levels will begin to reverse higher as cash buyers and investor demand dry up since new buyers are largely priced-out. Again, with mortgage rates moving as fast as they are, I expect we will see a significant acceleration in the slowdown over the coming months. In order to stay afloat, D.R. Horton and its peers will need to reassess their plans to fortify their ability to weather the storm.

D.R. Horton Continues To Double Down

During D.R Horton’s late April earnings call, the company remained very optimistic regarding the property market’s future. The few comments made regarding mortgage rates related to “continued strength despite the rise in mortgage rates.” Of course, we must consider that mortgage rates were still near record lows during the first three months of 2022. Further, while many see Lennar’s (LEN) strong Q2 sales as a sign of hope, we must also consider the lagging nature of home sales.

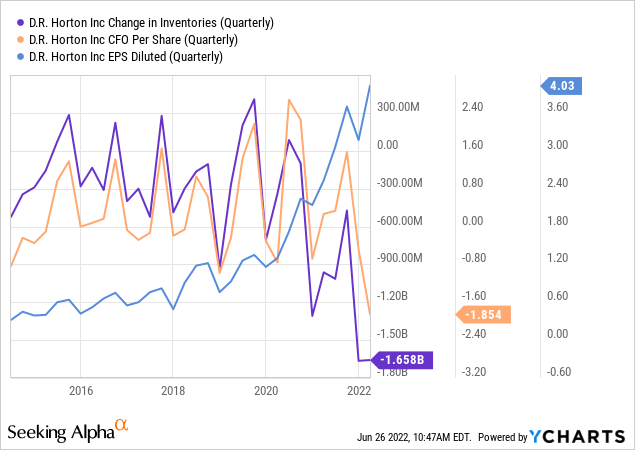

For example, D.R. Horton has posted robust quarterly EPS in the $3 to $4 range over the past year. However, the company’s operating cash flows per share have plummeted deeply into negative territory. This means that, after reinvesting into new projects, D.R. Horton is not generating any cash, with most going to new projects. See below:

From October 2021 to March 2022, D.R. Horton had a net income of $1.73B. Of that, ~$1.3B went to “increase in construction in progress and finished homes” (10-Q pg. 7). In other words, the bulk of the company’s income is going back into new construction projects. In general, this is a good practice if we firmly believe the property market’s future will be as strong if not stronger than its present. Further, in many instances, homes are sold before construction is completed. This factor has created issues as D.R. Horton’s construction cycle time has risen due to supply chain shortages, creating a backlog and increasing contract cancellation rates (10-Q pg 40 to 41).

Thus far, cancelation rates have not risen dramatically (16% last quarter), but with mortgage rates surging and pending sales crashing, contract cancelations are likely to increase. The company’s order backlog has declined slightly as well as its supply shortage issues. That said, it still appears the firm is in a difficult position if the market rolls over, with the bulk of its capital being at risk, mainly due to its exposure to the new homebuyer market.

The Bottom Line

In my view, it does not serve the company or investors to act as if the housing market will remain strong despite record low affordability, crashing pending home sales, and all-time-low homebuyer sentiment. Further, it does not serve investors to convince themselves the property market’s fundamentals are more robust than the data overwhelmingly suggests. In my opinion, cognitive dissonance reigns over today’s financial markets, likely leaving many “holding the bag” as it becomes increasingly heavy. Often, this can cause investors to not fully realize potential impending business issues until it is too late.

That said, there are a few key differences between today’s homebuilding market and the mid-2000s. Like most builders, D.R. Horton is operating at far lower leverage, with total liabilities-to-assets around 35% (compared to 60%+ fourteen years ago). D.R. Horton and its peers continue to expand construction projects despite declining fundamentals, but not nearly to the same extent as they had then. With mortgage rates at 6% and prices at record highs, home affordability is slightly worse than in the 2000s bubble; however, affordability has not been so low long enough that many owners are overextended and at high risk of foreclosure.

On the surface, D.R. Horton appears cheap, mainly due to its low TTM “P/E” and strong earnings outlook. However, in my view, its earnings outlook is likely to continue to deteriorate, and I highly doubt it will achieve an EPS of $17.18 this year as analysts currently expect. Based on the recent declines in pending sales, it seems home prices may begin to return toward pre-pandemic levels, if not lower (if the economy slows). That said, inventories are so low that it may take some time for this to occur (perhaps more than a year). Still, once the supply of cash buyers dries up, I expect inventories and prices to shift much more rapidly due to lending constraints.

Overall, I would be surprised if the company has positive earnings a year from today. As such, while the stock is not necessarily highly overvalued, I would not buy DHI today since growing uncertainty may bring it considerably lower. For now, I am slightly bearish on DHI but would not bet against the stock. Over the past two decades, DHI’s price has generally bounced as it reached its book value, so I would be more bullish at a price of $51 (1.1X of its book value).

Be the first to comment