LL28

CytoDyn Inc. (OTCQB:CYDY) is a Vancouver, WA-based small cap research and development biotechnology business with a focus on the clinical development of therapeutic treatments for multiple indications. According to Stock Market MBA, it is listed as a penny stock and trades on the OTCQB under the ticker symbol (OTCQB:CYDY).

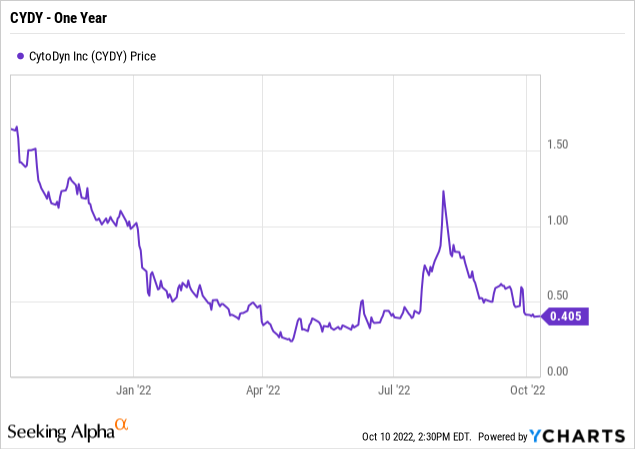

As of October 14, 2022, its share price was .44 cents, average traded volume was 1.13M shares and it has a market cap of $357.6M. The 52W high is $1.85 and the 52W low is $.2311.

Current Enterprise Value (EV) of CYDY is $401M. EV is calculated by adding the current market cap with the debt and backing out the cash and immediate cash investments. MC+Debt-Cash=EV

CYDY is amongst several stocks I have designated in my “High Risk, High Reward” Biotech Portfolio. Other stocks in this portfolio include Inovio Pharmaceuticals (INO), Agenus, Inc. (AGEN), Alpine Immune Sciences (ALPN), Crinetics Pharmaceuticals (CRNX), Relay Therapeutics (RLAY), Xenon Pharmaceuticals (XENE) and X4 Pharmaceuticals (XFOR).

I’m long in each of these based on a combination of their stories, their potential/probability of success, management execution, near term catalysts in the pipeline, a molecule’s clinical benefits and my own personal degree of risk tolerance.

Introduction

Today, I’ll explore the measures CytoDyn has taken to conduct an assessment of their business and outline the reasons why these steps are crucial in order for me to maintain my position in (OTCQB:CYDY).

CytoDyn remains within my non-revenue generating, high-risk high-reward biotech investment portfolio. In addition to CYDY being a non-revenue generating biotech investment, the company has been mired down with more than just your ‘garden variety’ biotech threats that most biotech management teams can usually resolve. My definition of garden variety biotech threats has evolved after a decade-plus years of investing in the biotechnology industry. These concerns, taken alone don’t usually spell disaster for most equities, but several in succession or in combination, may end in losses for investors.

Non-revenue biotechnology companies are particularly more vulnerable as they’re more sensitive to a number of broad threats that impact their financial stability. These threat vulnerabilities include strict regulatory oversight and scrutiny, legal entanglements, patent infringement claims, fluctuations in cash burn rates, competing clinical interests by numerous companies, changing multiples based on pipeline candidate success/failure, the lack of leverage or influence with potential suitors, the accumulation of losses that lead to increased debt, potential mismanagement and finally, bankruptcy.

The present case with CYDY; Management mistrust by investors, intense scrutiny by the SEC and DOJ, applications and filings rejected by the FDA, clinical holds, hostile takeover events initiated, continued arbitration, loss of capital, increased debt, insolvency a looming concern and valuable research time lost, never to be recovered place CYDY in a precarious situation.

So, why do I stay invested in CytoDyn? New leadership brings new strategic initiatives, the commitment to resolve issues, rebuild relationships, reshape the organization, as well as the recent shareholder approval of 350M shares to the float and finally the #1 reason why I stay invested in CYDY…the clinical safety and effectiveness of Leronlimab.

Future Development Strategy

Changes in Leadership

“What got us here today is not what will lead us into the future.” – Cyrus Arman, Board President – CYDY

Before I give my thoughts on Cyrus Arman, Ph.D., MBA and as other investors have asked in social media platforms, why did Dr. Arman choose to serve at CytoDyn with so many concerns, discussed above? Well, that question was recently answered in a webcast during a quarterly investor update.

The decision to come to CYDY was based on what he describes as his “prior experiences in the biotech industry” which have allowed him to look under the hood at hundreds and hundreds of different molecules, either from the perspective as a developer, competitor, investor or acquirer. Those diverse industry perspectives, coupled with his management background, education and industry knowledge has helped him identify what he described as the “hallmarks” to getting a clinical stage therapeutic to market.

Subsequently, after his close examination of the data on the therapeutic benefits of Leronlimab, he has concluded that Leronlimab is a “unique” therapeutic which has a clinical benefit to patients and the potential for a return to investors.

A clue as to how Dr. Arman and his efforts have been welcomed so far. This from Dr. Scott Kelly (OTCQB:CYDY) in the same webcast,

When we first began our search for a new CEO, the Board of Directors of CYDY was focused on finding a unique individual with experience in corporate strategy and development, capital markets, licensing agreements, corporate governance with a firm scientific background and the ability to be a strategic thinker. We needed someone who would not only understand the potential opportunity of Leronlimab but, would execute on this opportunity. We believe we have found that person in Dr. Arman…He has chosen Leronlimab after much due diligence. We believe Leronlimab is now in the best of hands.

One of the things that Dr. Arman and I agree with wholeheartedly is to focus and surround ourselves with the people that we believe will make Leronlimab a success with our current focus and initiatives. Under the leadership of Dr. Arman, I can tell you we believe our team has never been stronger and the work we are currently doing is placing CYDY and Leronlimab on the best possible path for success.

Also discussed in the webcast was their strategic assessment of the pipeline to determine which indications are high value opportunities and which indications are being tucked away. To do this, the Net Present Value was utilized.

Net Present Value Model

The Net Present Valuation model is a decision support tool that allows CYDY to decide whether it’s worth to take up an indication that can generate a positive return. It is a method used to determine the Net Present Value (NPV), considers the Discounted Cash Flows (DCF), by taking the ‘time value of money’ into account and translating all Future Cash Flows (FCF) into today’s money and adding up “today’s investment” with the present value of all future cash flows. By modeling these flows of money including interest rates, taxes, the weighted cost of capital (WACC) and more over a specified period of years we can calculate if the project is worth pursuing. An NPV greater than zero >0 is worth pursuing and an NPV that is calculated to be less than <0 is not worth pursuing.

This assessment, from what we learned in the webcast, was the basis for the decision making to let go of the line of COVID therapeutics and to finally leave no doubt to CytoDyn’s strategic path going forward.

Dr. Arman also provided some insight on how the rest of the bullpen will look with a focus on Colorectal Cancer (CRC), in particular the metastatic multi-satellite stable (MSS) population as this group accounts for the largest percentage of CRC patients. While achievements using multi-disciplinary approaches to treating CRC have improved the patient OS rates, there is still plenty of room for improvement and CRC remains one of the greatest unmet needs in oncology. Additionally, hormone receptor positive (HR+) and HER2 positive breast cancer are in focus. Clearly, CYDY is targeting solid tumor cancers utilizing Leronlimab based on its method of action in the micro-tumor environment and safety profile.

The strategic assessment to freeze operations in order to refocus and retool the pipeline, trim the wasteful spending, recognize the external threats to former clinical efforts and focus on the higher value opportunities as the main driver that serves to steer all future efforts, helped me make my decision to remain invested in this small high risk-high reward biotech company.

BLA Update

As outlined, the company performed a strategic review and assessment of their entire pipeline after the FDA placed a partial clinical hold on its rolling submission BLA for the HIV Multi-Drug Resistant population, as well as a full clinical hold on its Covid-19 trials until CYDY could address FDA concerns that involve a dispute with their previous Contract Research Organization (CRO), Amarex.

In dispute are concerns that the data collected by Amarex was improperly coded and not in accordance to current industry standard format. According to CEO Arman at 12:30 minutes in this webcast,

“It’s important to note that substantially, all of the data requested by the FDA to lift the clinical hold are items that Amarex was contracted by CYDY to prepare but, failed to do so.”

As a result, an external audit by a high quality independent research company has been retained by CYDY in order to audit the quality of the data collected and monitoring performed by Amarex. Once this audit is complete, CYDY can determine the feasibility of submitting the data, but only after making the determination that there is a high “probability” it could pass an FDA Good Clinical Practices audit, as part of the BLA submission. The results of the audit will determine the next steps with the BLA.

While certainty regarding the outcome of the audit remains in question, the steps taken by management are relevant to the overall strategic planning process and the future development strategy. The NPV exercise identified HIV as a high value opportunity and more details will be forthcoming after the audit.

Shareholder Approval

On August 31, 2022, the Company held a special meeting of stockholders. The meeting was held to seek shareholder approval to increase the total number of authorized shares of common stock of CYDY from 1M to 1.35M shares. The proposal was approved so, what’s next?

The company has a number of options they can exercise in order to maximize the benefit of the additional shares. While they could immediately begin to sell shares at the market, the current share price would only provide ~$140M in cash. However, an announcement of more positive details surrounding the Amarex data and more clarity on the submission of the rolling BLA and/or communication of positive response from the FDA could serve as a short term catalyst to move the share price into higher territory, at which time even touching the recent high of $1.26 could add as much as 3X the amount of cash or ~$420M. In fact, if the share price can break through several areas of resistance before getting to $1.26, it may not be necessary to dilute the full amount and CYDY can hold back shares to sell later at a much higher premium.

Furthermore, adding cash to the balance sheet can certainly attract a partner who may be willing to risk some of their own R&D capital since CYDY can take on the higher additional financial obligation. Other options include structuring Loan Facility Agreements with the options to add cash in tranches and interest only payments over a specified period of time at variable rates.

These scenarios, I believe, fits into the overall playbook in the future development strategy currently underway at CYDY.

Leronlimab

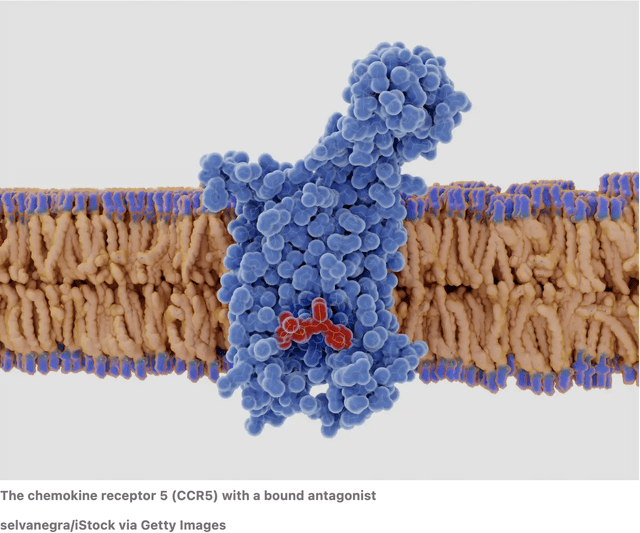

CytoDyn’s lead product candidate Leronlimab, is a humanized monoclonal antibody that targets the CCR5 receptor. The CCR5 receptor is believed to be involved in immune-mediated inflammation such as HIV and other indications such as cancer, autoimmune diseases, other inflammatory diseases, infectious diseases and more.

HIV naturally seeks out the CCR 5 receptor for entry and infection of healthy cells. Leronlimab acts like a sentry at all the entry points of the cells as it binds to the CCR5 receptor on the CD4 cells, thus interfering with HIV’s ability to enter the cell. It prevents the virus-cell binding activities at a distinct site on the CCR5 co-receptor without interfering with its other natural activities.

Investors in CYDY are familiar with the benefits of Leronlimab, a humanized monoclonal antibody that has shown an excellent safety profile and clinical benefits in several human clinical trials. The global monoclonal antibodies industry was valued at USD 105.2 Billion in 2020 and is expected to reach USD 155.2 Billion in 2028 growing at a CAGR of 6.7%, fueled by the rise in cancer with North America leading the way as the largest segment in the world.

Non-Alcoholic Steatohepatitis NASH

An Insight Partners May 2022 report forecasts the TAMS for NASH to reach $24.26 billion by 2028 from $1.63 billion in 2021; it is expected to register a CAGR of 47.1% from 2021 to 2028.

Additionally, an article in Science Direct “The Epidemiology of Non-Alcoholic Steatohepatis” adds

Non-Alcoholic Fatty Liver Disease (NAFLD) is characterized histologically into Non-Alcoholic Fatty Liver (NAFL) and Non-Alcoholic Steatohepatitis (NASH). NASH patients are at an increased risk of advanced fibrosis and cirrhosis [1]… In 2017, the lifetime costs of NASH patients in the US were estimated at $222.6 billion, and the cost of the advanced NASH population is estimated at $95.4 billion [4]. The gold standard for the diagnosis of NASH remains a liver biopsy. NASH is defined as the presence of >4% hepatic steatosis and inflammation with hepatocyte injury (ballooning), with or without fibrosis [5]. Some studies have indirectly assessed the prevalence of NASH. The prevalence of NASH among NAFLD patients who underwent a random liver biopsy was 6.67%. The prevalence of NASH among NAFLD patients with a clinical indication for a liver biopsy was 59.10%. Given these estimates, the average prevalence of NASH was estimated to be between 1.5% and 6.45%

If successful treatments for NASH are developed, it will likely come down to the need for several drugs, either as a mono-therapy to treat NASH and/or a combination of therapies that target the disease or those factors contributing to NASH, such as the inflammatory and metabolic characteristics. As such, the task currently at hand is to identify which patients are likely to respond best to which therapies with the possibility of several drugs being granted approval.

For more on NASH, readers can find useful information at the National Institute of Health (NIH) National Institute of Diabetes, Digestive and Kidney Diseases Central Repository NIDDK and LabCorp.

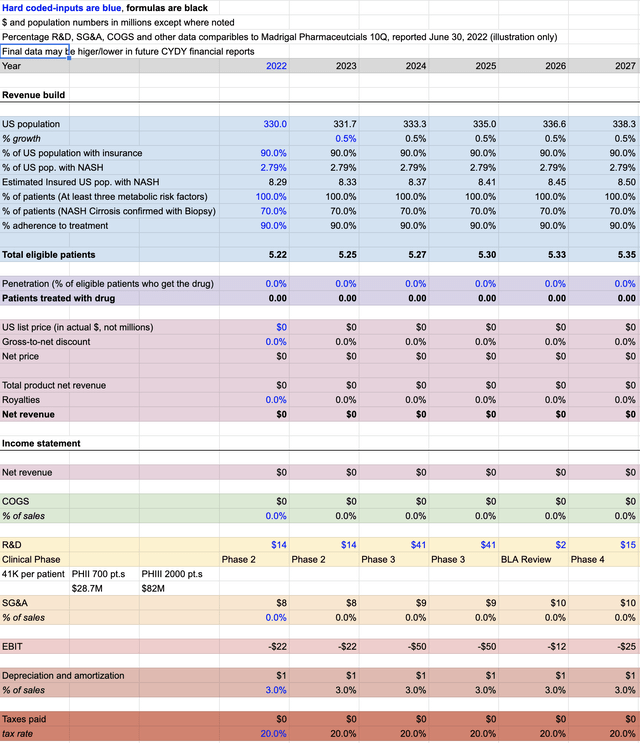

NASH – Research and Development Costs

The first graph below depicts the clinical stage phases II and III, as well as BLA filings and if necessary a PHIV trial of NASH. The R&D expenses, SG&A, COGS, taxes, royalty payments, etc. are a hefty price for NASH until any revenue is projected to realized in 2028 (see below).

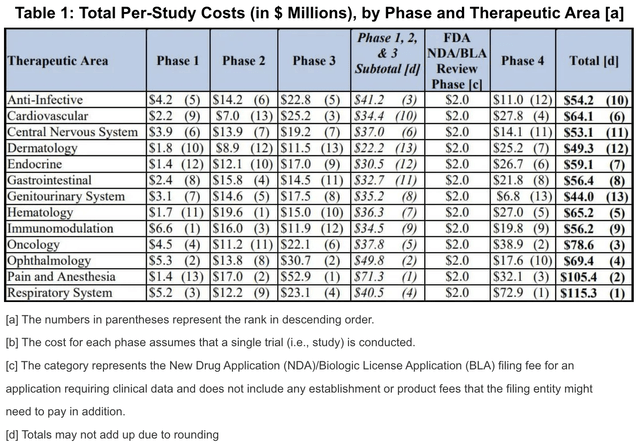

According to a 2020 study on the cost of clinical trials, reported to the US Department of Health and Human Services,

The average cost of phase I, II, and III clinical trials across therapeutic areas is around $4, $13, and $20 million respectively. Pivotal (phase 3) studies for new drugs approved by the Food and Drug Administration FDA cost a median of $41,117 per patient. Source: SOFPROMED

Here, upwards of over $127M in costs to fund operations while conducting clinical trials by CYDY is illustrated. As previously noted, the Net Present Value assessment identified NASH as having a positive NPV and the following several illustrations makes their case clear.

Note: Readers should understand these projections are more of an art than an exact science, especially when evaluating the Weighted Average Cost of Capital (WACC) of a small cap biotechnology company, their beta (volatility) and the time needed to execute on objectives.

NASH Pre-clinical Trial (SOFPROMED, MGDL Comps, 10-Q)

The graph is an illustration of basic assumptions derived from sources such as the US Census Bureau, ClinicalTrials.gov, science literature, related NASH PHII and PHIII trials with Madrigal Pharmaceuticals, and a 2018 PubMed article, “Estimation of clinical trials success rates and related parameters.”

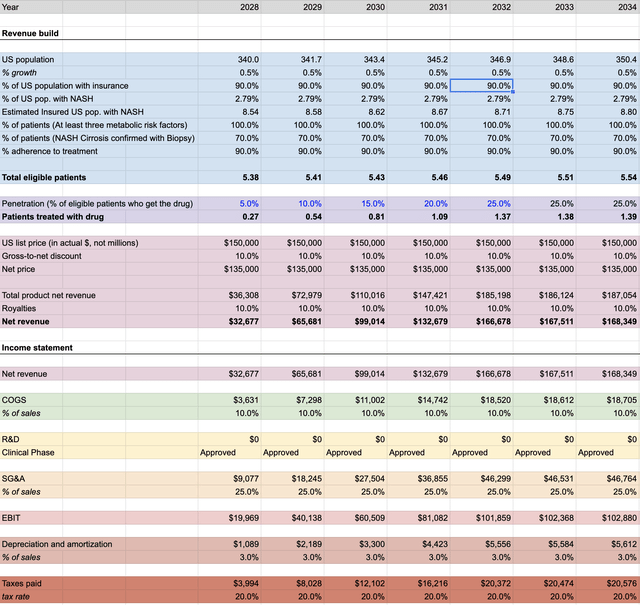

CYDY – NASH Revenue Scenario

The following graphs indicates modeling of NASH revenue from 2028-2034 and with peak market penetration at 25% in 2031 realizing there could be, as discussed in this article, multiple therapies either standalone mono-therapies or combination therapies available.

Note: As described, these figures are in millions, unless otherwise noted.

NASH Revenue Projections – CYDY (TAMS Market Data, 10-Qs, Science Literature)

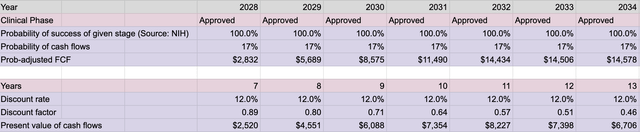

Free Cash Flow Scenario – Post Approval

FCF (Model Projections – Eberhart)

Enterprise Value

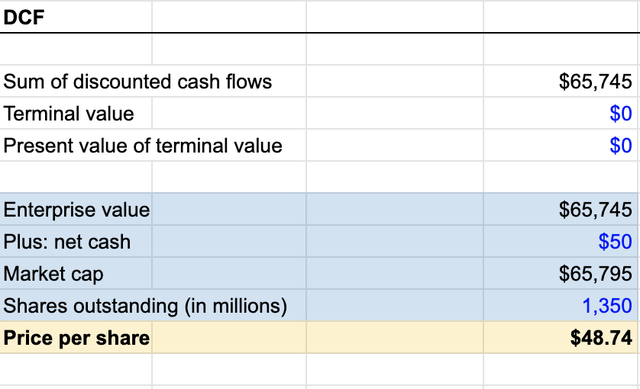

Imputing the data found throughout the available literature, as well as using Madrigal Pharmaceutical (MDGL) as a comparable for NASH related expenses indicates the potential future enterprise value worth $65.7B with only 25% peak market penetration starting in 2032 and value to the share price of $48.74.

Additionally, the market price of $150K for the treatment is not only a fair estimate, it stays within my thesis that there will likely be various forms of competition in the space and other than efficacy as a deciding factor for prescribers, insurers willing to pay for treatment must be considered when options become available.

Enterprise value (Model Projections – Eberhart)

Risks & Headwinds

The discussion of risks has been examined throughout this analysis. However, with penny stock investments, it’s prudent to cover additional potential risks. Two risks in particular, the competition in the Non-Alcoholic Steatohepatitis NASH space and the potential risk of reverse stock splits.

Competition

My first analysis of CYDY on August 24, 2022, in Seeking Alpha showcased the results of a very small study (N=72) that discussed the top line results of a small clinical trial and which was first presented at the International Liver Congress 2022. I also reported the Total Addressable Market TAM for NASH. While this was a small multi-center Phase IIa trial, CYDY announced in the August webcast that they’re moving ahead after identifying NASH as high value opportunity. While NASH, no doubt is a high value opportunity, it is also very attractive to other biotechnology industry players.

Take for instance Madrigal Pharmaceuticals. Without elaborating on the drugs Method of Action MOA in too much detail, their drug works by increasing the function of thyroid hormone beta receptors without interfering with the thyroid axis hormones. This is critical to in order to deliver the full therapeutic potential of their once daily administered drug.

This from their website,

- Topline Phase 3 data announced in January 2022, demonstrated resmetirom was safe, well-tolerated and provided statistically significant improvements in key measures of liver and cardiovascular health.

- Data from the Phase 2 study published in The Lancet, demonstrated that liver fat reduction of ≥30% with resmetirom was associated with NASH resolution and liver fibrosis reduction as measured by liver biopsy. Liver fat was measured by MRI-derived Proton Density Fat Fraction (MRI‐PDFF).

- Phase 2 results also demonstrated treatment with resmetirom lowered multiple atherogenic lipids and lipoproteins, including LDL-cholesterol, apolipoprotein B, triglycerides and lipoprotein (A) ― a key potential benefit as NASH patients have elevated cardiovascular risk.

- To date, resmetirom has demonstrated a generally favorable safety and tolerability profile including in Phase 3 studies in which over 2,000 patients have enrolled, with many treated for more than one year.

According to information obtained from the clinicaltrials.org database this pharmaceutical has already initiated two (2) additional PHIII clinical trials with their investigational drug known as MGL3196 or Resmetirom.

One trial has 2000 participants, split into three arms, with a primary endpoint to measure and assess the effectiveness of either their 80mg or 100 mg dose of MGL3196 vs placebo. Additionally, other endpoints include looking at composite long-term outcome measured by the number of patients with the onset of any of the adjudicated events, composed of cirrhosis, all-cause mortality and liver-related clinical outcomes.

Resmetirom is administrated orally and an announcement on the clinical data is expected in the near future as the primary endpoint completion date was in December 2021. MDGL has an earnings call slotted for November and investors on social media platforms believe this could be the month the findings are revealed, based on a prior history of MDGLs leadership team making these sort of catalyst like announcements during past earnings calls. Should positive findings be announced, the share price is undoubtedly set to go parabolic as it will be the first to cross the finish line for this unmet need.

Madrigal is also conducting their second PHIII trial for patients with well-compensated NASH Cirrhosis but, is not expected to be completed until November 2025, with 700 participants.

| ClinicalTrials.gov Identifier: NCT05500222 |

Clinical Trial Funding

Before they can advance to PHIII the need to fund a larger PHII clinical trial is likely and it will have a significant impact on the future development of Leronlimab’s full potential.

As MDGL was used a comparison in the revenue building models, their PHII trails for their drug candidate included 700 participants and PHIII trials with 2000. A PHII and PHIII trial, with a much larger population, will result in increased cash burns as more clinical sites will be required, start up and recruitment costs, additional research teams, data management, pass through costs and the inclusion of a Clinical Research Organization CRO as well as the inclusion of appropriate histopathological endpoints will likely become a necessary addition by the FDA.

The cost of trials, according to the website SOFPROMED varies, as shown in the chart below, but has a mean cost of roughly $41,000 per participant.

Reverse Splits and Stock Dilution

Authorization by shareholders in August gave CytoDyn the potential to increase its overall amount of shares to approximately 1.35B shares. While I highlighted in this article the advantage this approval can have to attract investment opportunities for partners, it may not come to fruition. Regardless, the need to raise cash and erode shareholder value through dilution is all but unavoidable in order to keep the doors open. If you’re new to biotech investing, this is an inevitable consequence of biotech companies and typically necessary.

However, shareholders should never stick their head in the sand and ignore the potential of a reverse stock split. There are several reasons why a company may decide to execute a reverse stock split and reduce its number of outstanding shares in the market. As I stated in other articles, this may be done to prevent being delisted, boost the company’s image and to draw more attention from analysts and Wall Street investment firms who have minimum share price limits structured into their by-laws which prevent them from owning stocks under certain limits, such as $5.00.

The good news is once a reverse split occurs and if the share price can stay above these limits, many biotech exchange-traded funds (“ETFs”) are interested in owning them as part of a broad ETF biotech portfolio. Of course, the downside is the appearance that a company is using some accounting magic to hide their financial problems.

Closing

I believe that CYDY remains attractive at this level and if you’re willing to enter the “high-risk high reward arena”, CYDY may very well be worthy of your consideration but, only as a small portion of your overall “high-risk, high reward” investment portfolio.

The Net Present Value assessment conducted by the executive team at CYDY has determined that NASH is of utmost importance and is a very high value opportunity. The revenue models prove this assessment to be accurate and worth the execution and discipline it will take from their new leadership.

While Madrigal Pharmaceuticals appears to be closing in on the finish line, there are others also in the space. MDGL is potentially on the horizon of a near term catalyst that could move the SP in a parabolic move. I have no ownership in MDGL.

Clinical trials results are a key ingredient to the process of drug development in the pipeline and the PoS used to estimate biotech valuations. Each approval or failure in a phase can drastically move the share price. Investors can see the binary nature of these trial outcomes due to the many moving parts attributed to the modeling by Wall Street, not to mention the volatility as the models price in the new information.

Finally, building a robust pipeline, establishing partnerships and creating a healthy balance sheet are essential with Wall Street analysts who apply models that project multiples on pre-revenue biotech’s.

In conclusion, CytoDyn could earn a place in the NASH market if they can overcome the headwinds and execute on all aspects of the business. Their efforts to refocus and reposition the priorities may just be the cure.

One final note: The only favor I ask is that you click the “Follow” button so I can grow my Seeking Alpha readership. This will help me, to help you. Learning and knowledge is a key to investing. It’s already difficult for the casual retail investor to find little nuggets of information behind the backdrop of high speed-high frequency investment houses that collate data and trade in milliseconds. My promise is that I will always do my best to provide you with accurate and timely information, when it is submitted to SA.

Small cap biotechnology investing is only a fraction of my overall investment portfolio which, supported by other investments, has increased my likelihood I’ll be able to maintain a comfortable retirement for the years ahead. While I do my best to present factual research, readers should understand the risks before making any investments decisions.

Be the first to comment