Bulgac/E+ via Getty Images

Cytodyn (OTCQB:CYDY) has undergone some major changes since my last article. Primarily, the company made changes to the CEO position and the company’s board of directors. In addition, the company appears to have secured finances to keep the lights on for the time being. Other than that, the company has gone into complete silence, which is a stark contrast to the company’s previous practices. Investors are waiting for updates on several key items including the status of Leronlimab’s BLA resubmission, Amarex litigation, COVID-19 trials, and NASH data, just to name a few. The lack of communication has crushed the share price and has many investors wondering if the company is simply winding down operations ahead of a potential bankruptcy filing or simply trying to lay low while under investigation. On one hand, I understand the company’s efforts to wipe the slate clean as possible… on the other hand, I am eager to see overdue updates on these vital programs.

I intend to update investors on some of the recent events and provide my opinion on how they might impact the company going forward. In addition, I discuss some of the potential scenarios and how I plan to manage my position while we wait.

Company Updates: End Of An Era

Back on January 25th, CytoDyn announced that “the Board of Directors terminated the employment of Nader Z. Pourhassan, Ph.D., as President and CEO of the Company and he is no longer a member of the Board of Directors.” The company’s CFO, Antonio Migliarese, is taking over as interim president as the board searches for a permanent CEO. In addition, the company announced their CMO, Scott A. Kelly, M.D, is stepping down from being Chairman of the Board but will stay on the Board of Directors. The board also elected Tanya Durkee Urbach as Chairman of the Board, “who has experience in corporate governance, corporate finance, business growth, and securities litigation, compliance and regulatory issues.”

Since this announcement, the company has essentially gone silent, with only SEC filings that reveal the company is handling legal and financial matters. This is basically a stark contrast to the Nader Pourhassan era, which was filled with regular press releases and presentations that updated their investors on the company’s ongoing efforts, progress, and plans for the future. Most importantly, management answered direct questions from investors in a public forum.

Company Updates: Financing

Since the beginning of the year, the company has been securing financing through notes, private placements of common stock, bonds, and warrants. The company has been burning through cash to support their day-to-day operations and costs associated with Leronlimab. In addition, the company is dealing with legal issues and payments to Samsung Biologics. It is unclear what the company’s cash position is right now, but it looks as if the company is attempting to maintain their finances through a variety of methods.

The Impact

The removal of Nader Pourhassan, Ph.D. as the president and CEO of the company will have a major impact on CytoDyn, Leronlimab, and the stock’s performance. Say what you want about Nader Pourhassan’s leadership style and his decisions, but one cannot argue he was not committed to expanding Leronlimab to be a platform drug. Under Nader Pourhassan’s leadership, the company purchased Leronlimab in 2013 and took aim at HIV. Since then, the company has mobilized Leronlimab against, GvHD, mTNBC, NASH, COVID-19, with the potential of several other targets.

During Nader’s time as CEO, the company made regular press releases and participated in numerous investor presentations. These communications always appeared to move the share price and provided shareholders with some insight into the company’s efforts. Without Nader, the company has gone silent and has put shareholders in the dark. Keep in mind, CYDY is an OTC stock, so it is heavily dependent on retail investors to support the share price. Without news, retail investors will be less likely to be motivated to click the buy button. Obviously, the lack of enthusiasm around an OTC stock can crush both the share price and shareholder sentiment. I believe the stock’s recent performance validates this thesis.

Indeed, some of Nader’s tactics might have been interpreted as “promotional” and certainly unconventional. However, one has to remember that small-cap OTC stocks are not often invited to present at Wall St. investor conferences, so the company has to find their own way of reaching their investors… who are by and large not institutional. Certainly, I would have liked to see the company reach a major exchange and have exposure to institutional investors, but is clearly going to require support from retail investors on OTC to get there. Essentially, the company’s strategy matched where the company is at and who their investors are.

This leaves us with a company that shuttered the windows and has wiped the company’s website clean of past releases and presentations. Now, we don’t know if the company is going to go after their “eight tasks for 2022”, which includes:

- Leronlimab’s BLA Resubmission for HIV Combination

- Leronlimab’s HIV Phase III Pivotal Study Monotherapy

- Leronlimab’s Phase II Trial for COVID-19 Long-Hauler

- Leronlimab’s NASH Data with Decision on BTD or Phase III

- Leronlimab’s mTNBC Decision for BTD or Phase III

- Leronlimab’s Cancer Basket Trial

- Leronlimab’s Data from Brazil Studies with Potential EUA

- Leronlimab in Critically Ill COVID-19 Study in the U.S. with Potential EUA

The lack of communication and clarification of these unknowns has investors speculating about what is going to happen next. I came up with a few potential scenarios.

Scenario 1: SEC and DOJ Inquiries

CytoDyn has subpoenas from the U.S. SEC and DOJ requesting documents and information regarding Leronlimab, and the company’s public statements regarding the drug’s use, amongst other items. Although subpoenas do not signify that any violations of law have transpired and it is simply fact-finding investigations at this point in time. However, one cannot predict the eventual outcome and potential losses from these events.

I have to suspect these investigations are one of the primary reasons the company decided to let Nader go… especially considering the new chair for the company’s board of directors has “expertise in the conduct of securities offerings, securities litigation, corporate finance and business growth, corporate governance, and other corporate business and legal issues to the Board.” For me, this suggests the company is taking these subpoenas seriously and is probably the main cause for the removal of company press releases and presentations.

Scenario 2: Bankruptcy

Perhaps the most concerning issue I have is the likelihood the company is moving towards bankruptcy. The company has had substantial net losses over the past couple of years and it appears 2022 is not going to be different. Back on January 6th, Samsung sent CytoDyn a written notice that they had breached its agreements by failing to pay roughly $13.5M due by the year-end of 2021. An additional $22.8M was due on January 31st. The company has 45 days to make efforts to “commence curing the breach.” If the company fails, Samsung may terminate the agreements. Management intends on curing the breach prior to the expiration of the cure period, but we have yet to hear if that has been successful. These payments do raise the concern that the company will not be able to address their ~$44.5M of debt while also keeping the lights on.

Certainly, the company could address the issues with Samsung to relieve that threat. In addition, the company has already made some moves to secure financing at the beginning of this year. However, we don’t have a clear view of what the company’s current finances are and what are their plans moving forward.

Scenario 3: Acquisition

Another potential scenario is the company being acquired at a fair or discounted valuation. I believe that it is unlikely that the company might be acquired at such a weak position, but it is possible that a suitor might take advantage of a company that is down on its luck. In addition, CytoDyn management and the board might see a discounted acquisition to be an opportunity to preserve shareholder value and avoid their ongoing litigation, regulatory concerns, and commercial agreements.

Scenario 4: Proceed Forward

Of course, there is the possibility that the company decides to continue going forward in a “silent mode” with minimal updates through required SEC filings. It is possible to continue to execute these Band-Aid-style financial transactions to remain on life-support long enough to submit the final portion of the BLA along with pipeline updates. The company will have to address the issues I stated above, however, there is a major issue with the Amarex case that the company will have to address if they move forward. The court ruling that in order for CytoDyn to gain access to the Leronlimba HIV database, the company needs to post a $6.5M bond to cover a portion of disputed invoices for services… which could be a problem considering CytoDyn’s current financial position. If CytoDyn is unable to provide the $6.5M for the bond, Amarex could hold out for several months or longer, resulting in further setbacks in the BLA resubmission. It would appear some of the recent financings might have covered this… but since we don’t have any updates from the company, we don’t know the status of the surety bond.

Unfortunately, even if the company gets Leronlimab across the finish line this year, they are still going to have to deal with some commercialization issues. First, the company needs to figure out what they are going to do about their current partner… who is now Regnum Corp. (OTCPK:RGMP). It appears CytoDyn’s agreement with Vyera for use with HIV patients in the U.S., was reassigned from SevenScore Pharmaceuticals to Regnum in December. Vyera, SevenScore, and Regnum are affiliates of Phoenixus AG, so it appears the agreement is just changing banners. However, as of September 30th, Regnum only had $4,000 in assets and had no operations or revenues. Regnum is going to need a lot of capital to fund its commitments under the agreement following a potential approval. One could make a lot of speculations about why Phoenixus AG put Leronlimab’s agreement in Regnum, nonetheless, it is a concern that CytoDyn’s current partner does not have the capacity to market the drug in its current state.

So, even if the company continues to operate on “silent mode” and stay the course, it appears the company still has several other major hurdles to address.

My Plans

Unfortunately, it looks as if the days of CYDY being a great trading vessel are now over. We won’t have Nader and the company injecting volatility into the ticker with updates that provided numerous opportunities to buy at a discount and sell at a premium. Now, CYDY is becoming a true speculative ticker that will test the investor’s belief in the company and Leronlimab. On one hand, the company has several enormous hurdles to overcome in a short period of time. On the other hand, the company has a drug candidate that has shown incredible potential in a multitude of indications. Honestly, at this point, I don’t know if there is anything a longstanding investor can do to prepare for a potential outcome of these scenarios. Perhaps the company is already addressing these issues preemptively with the removal of Nader and purge of the company’s investor presentations online. As for the finances, the company appears to be scrambling to gather adequate capital to appease Samsung, pay the surety bond, and keep the company moving forward.

Personally, I stepped back from trading the ticker and I am sticking to more of an investment approach. However, I have pulled the plug accumulating more shares in order to preserve my profits from previous CYDY trades and will keep the position in a “house money” state. I have accepted that the drug’s potential is not going to outweigh the company’s current state. As a result, I would likely hold my remaining shares as we wait for one of my proposed scenarios transpires.

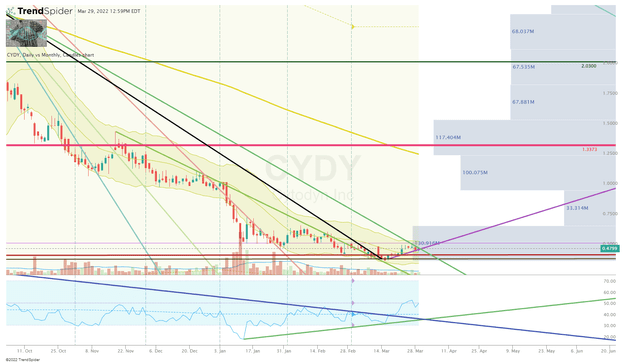

CYDY Daily Chart (Trendspider)

CYDY Daily Chart Enhance View (Trendspider)

For those who are still looking to trade CYDY, the ticker appears to be trading sideways and is showing some indications of bottoming. First, it appears the daily RSI broke its long-term downtrend. Second, we can see there is an uptrend ray that spawned from the March 15th low. However, the angle of attack from the downtrend rays is still fairly steep, which suggests the ticker is going to need a solid bump in buying activity to break the current trend.

Keep in mind, CYDY is an extremely speculative venture that could result in one losing most or all of their investment.

Be the first to comment