jetcityimage

Things are getting really exciting for investors in CVS Health (NYSE:CVS). On November 2nd, the management team at the drugstore chain and integrated healthcare company reported financial results covering the third quarter of its 2022 fiscal year. Revenue and profits for the company significantly exceeded the expectations of analysts. On top of that, we saw a number of other interesting developments that should add value to investors and remove uncertainty for the enterprise moving forward. While it is true that shares of the company are more expensive than the shares of their largest rival, this premium might very well be worth it considering how high quality the operations are and the direction management is taking the business moving forward. Due to these factors, I feel entirely comfortable keeping my ‘buy’ rating on the stock, even though shares are down slightly from when I last wrote about it.

Great developments

Back in September of this year, I wrote an article discussing CVS Health’s decision to acquire Signify Health (SGFY) in a deal valued at nearly $8 billion. Although The acquisition looked rather pricey for CVS Health, I felt as though it could help the company further grow into the integrated healthcare business it has been seeking to grow into. Overall, my conclusion was that shares probably offered upside potential moving forward that was greater than what the broader market could achieve. And as a result, I ended up rating it a ‘buy’. Since then, shares are down, but not by as much as the market. While the S&P 500 has dropped by 7.9%, shares of CVS Health have generated a loss for investors of only 5.1%.

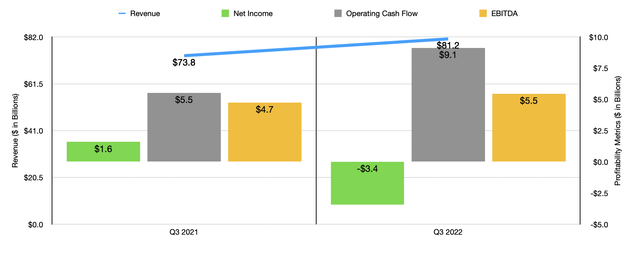

Author – SEC EDGAR Data

Although any sort of decline is bad to see, it’s important to note that the market is probably not properly rewarding the company for its most recent development. You see, on November 2nd, the management team at the firm announced financial results covering the third quarter of the company’s 2022 fiscal year. Simply put, the performance of the company was stellar. Revenue, for starters, came in at $81.16 billion. In addition to representing an increase of 10% over the $73.79 billion reported the same time one year earlier, the firm also beat analysts’ expectations by $4.42 billion. Such a large increase year over year was driven by a variety of factors.

For starters, under the Pharmacy Services segment of the company, which focuses on providing pharmacy benefit management solutions to its customers, sales increased by 10.8%, climbing from $38.74 billion to $42.91 billion. This increase was driven by multiple factors. One of the biggest though involved the revenue associated with its mail choice distribution channel. Even though the number of claims processed under it declined by 0.8% year over year, revenue shot up by 18% from $15.20 billion to $17.94 billion. It’s important to know that, if we were to exclude COVID-19-related activities, overall claims processed would have risen by around 5%. Revenue growth under the pharmacy network operations of the company grew a more modest 5.7%, driven largely by a 4.4% rise in pharmacy claims processed. We could spend an entire article dedicated only to the revenue picture of the company. But the important thing to note is that most aspects of the enterprise looked better this year than they did the same time last year. One other example to give would involve the Retail/LTC portion of the company. Revenue here increased by 6.9%, climbing from $24.99 billion to $26.71 billion. This segment benefited from pharmacy same-store sales climbing by 11.3% and front-store same-store sales climbing by 5.1%. Pricing certainly had a role to play in this. But at the same time, overall prescription volume was up by 3.8% year over year.

As revenue rose, profits for the company followed suit. Or at least most profits did. The company went from generating a net profit of $1.60 billion in the third quarter of 2021 to a loss of $3.42 billion the same time this year. This may look concerning at first. But the fact of the matter is that the company recorded a charge on its opioid settlement of $5.7 billion. At the end of the day, this is actually good news. You see, according to management, this arrangement will help to settle substantially all of its opioid-related cases, including those associated with various tribes the company has been in court with. Although the pre-tax amount is around $5.2 billion, management would not need to pay it out all at once. Instead, it will be distributed over 10 years. In addition to giving the company time to pay out this amount, the maneuver also removes the vast majority of uncertainty associated with what the company might have to pay. On an adjusted basis, the company reported profits per share of $2.09. That topped analysts’ expectations by $0.10 per share. Because of the one-time event I mentioned, a better way to look at the company is through the lens of its other cash flow metrics. Operating cash flow, for instance, jumped from $5.52 billion in the third quarter of 2021 to $9.12 billion the same time this year. Meanwhile, EBITDA for the company increased from $4.74 billion to $5.46 billion. Naturally, these results were also instrumental in helping results for the entirety of the first nine months of the year coming strong compared to what they were at the same time one year earlier. This much can be seen in the chart below.

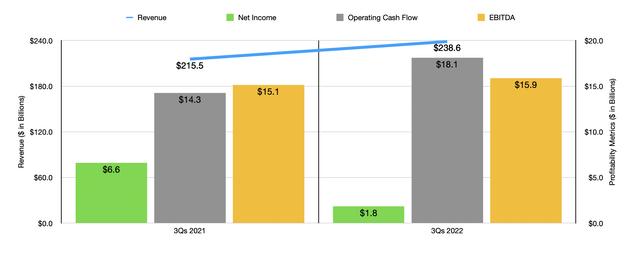

Author – SEC EDGAR Data

Outside of the core fundamentals, the company also announced some other interesting developments. For starters, overall leverage for the company has fallen considerably. At the end of the 2021 fiscal year, net debt at the firm came in at $43.65 billion. This dropped to $39.82 billion by the end of the second quarter before plunging to $32.22 billion as of the end of the third quarter. That implies a decrease in debt of $11.43 billion from the end of last year. And in the first nine months of the 2022 fiscal year, the company also repurchased 19.1 million shares of stock for a combined $2 billion. Yet another positive is that management also increased guidance for the year. At present, earnings per share should be between $3.12 and $3.22. This is significantly lower than the prior expected range of between $7.23 and $7.43. If, however, we make certain adjustments such as removing the aforementioned opioid settlement, then adjusted earnings per share of between $8.55 and $8.65 should be higher than the prior expected range of between $8.40 and $8.60. On a per-share basis, this translates to profits of between $11.35 billion and $11.49 billion. Operating cash flow is now expected to be between $13.5 billion and $14.5 billion. Previously, that guidance which for a reading of between $12.5 billion and $13.5 billion. Guidance was given when it came to EBITDA. But a reasonable assumption would be for it to total about $17.9 billion for the year.

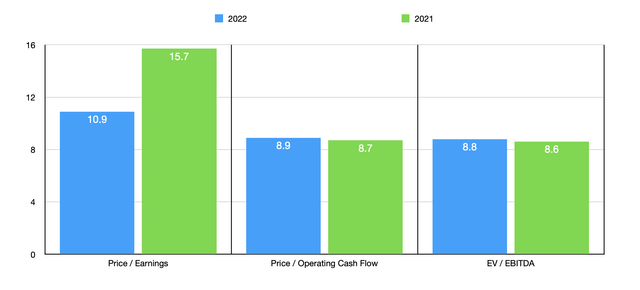

Author – SEC EDGAR Data

Taking the data we have, I decided to value the company. On a price-to-earnings basis, the forward multiple on the firm is 10.9. That’s down from the 15.7 reading that we get using data from the 2021 fiscal year. The forward price to adjusted operating cash flow multiple should be 8.9. That stacks up against the 8.7 reading that we get using data from last year. Meanwhile, the EV to EBITDA multiple of the company should rise from 8.6 to 8.8. As part of my analysis, I also compared the company to its largest competitor in the US. That is Walgreens Boots Alliance (WBA). At present, its trading multiples are 7.2, 8, and 7.2, respectively.

On an absolute basis, I do believe that both companies look quite affordable at this time. Though obviously, from a valuation perspective, Walgreens is the cheaper of the two. Even with that being the case though, I believe that CVS Health is the better prospect. For starters, the firm is more integrated into the healthcare space than Walgreens currently is. But outside of that, you also have just how rapid CVS Health has grown. Over the past five years, for starters, revenue at the enterprise expanded a total of 57.4% while operating cash flows shot up 128.1%. By comparison, Walgreens saw its revenue climb only 0.9% (10.5% if we move the start date forward a year), while cash flows have not shown much of a real trend.

Takeaway

Based on the data available, I will say that I find myself to be rather happy with the results achieved by CVS Health. Management did a remarkable job during the quarter, with sales and profits easily surpassing expectations. Fundamentals remain robust and leverage continues to fall. Although more expensive than a player like Walgreens, the company does look cheap on an absolute basis. For all of these reasons, I feel very comfortable with my ‘buy’ rating.

Be the first to comment