D-Keine

Investment Thesis

It is evident that CVR Partners’ (NYSE:UAN) stock has been unnaturally elevated in the past year, due to the massive demand post-reopening cadence. This we could understand, since many other well-performing stocks were also boosted then. However, it is also essential to note that much of these rallies have been digested, with peers such as Mosaic (MOS) and ICL (ICL) also losing much of their gains by now.

Therefore, those who have yet to lock in their gains should do so over the next one or two weeks as these companies report their Q2 earnings, since we may see a moderate stock recovery then. Nonetheless, we do not expect these to hold due to the pessimistic market – thereby triggering another slow decline over the next three months. The S&P 500 Index had also fallen by 21.8% in H1’22, the most it had plunged in the past fifty years. Analysts predicted either another plunge of 22% or a steep rebound of 24% by the end of the year as well. In the meantime, do not be trapped by UAN’s dividends.

UAN’s Windfall Have Directly Contributed To Its Deleveraging

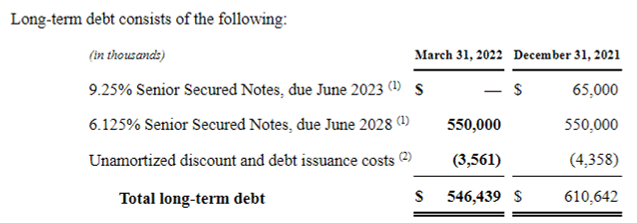

Post reopening cadence, UAN definitely benefited from the massive global appetite and reported a notable jump in its revenues and EBITDA in FY2021. Given the Ukraine war in February 2022, the company reported a further boost in its revenues to $694.5M and gross margins to 52.3% in the LTM, representing excellent increases of 71.8% and 18.4 percentage points from FY2019 levels, respectively.

In addition, UAN also reported EBITDA of $332.28M and EBITDA margins of 47.8% in the LTM, representing an impressive increase of 300.3% and 20.4 percentage points from FY2019 levels, respectively. These massively improved financial performances are obviously attributed to its elevated selling prices and robust demand for Nitrogen and Ammonia thus far – thereby triggering a sustained stock rally since early 2021.

Nonetheless, it is also evident that there is a strong disconnect between UAN’s fundamental performance and stock price action since April 2022, since the stock continued its free fall post exemplary FQ1’22 earnings call in May 2022.

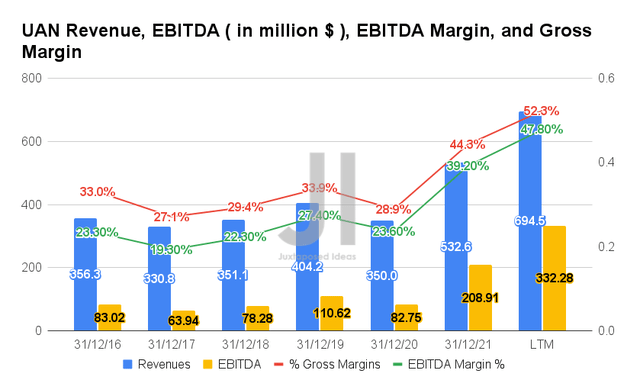

In the meantime, UAN has also kept its operating costs relatively stable thus far, with total expenses of $109.45M in the LTM, broadly in line with FY2019 levels of $106.09M. Nonetheless, the ratio to its growing gross profits had also moderated from 77.5% in FY2019 to 30.2% in the LTM, thereby temporarily boosting its profitability.

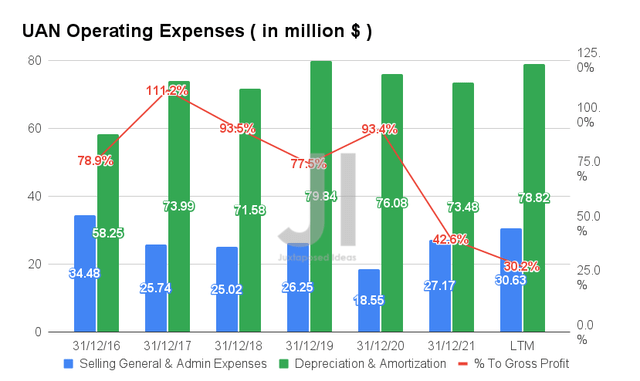

Therefore, it is easy to see why UAN’s Free Cash Flow (FCF) generation was very robust in the past few quarters. By the LTM, the company reported a record-breaking FCF of $304.6M and FCF margins of 43.9%, representing massive improvements of 1485.8% and 38.8 percentage points from FY2019 levels, respectively. Thereby, bringing its cash and equivalents on its balance sheet to a high of $137.4M in the LTM.

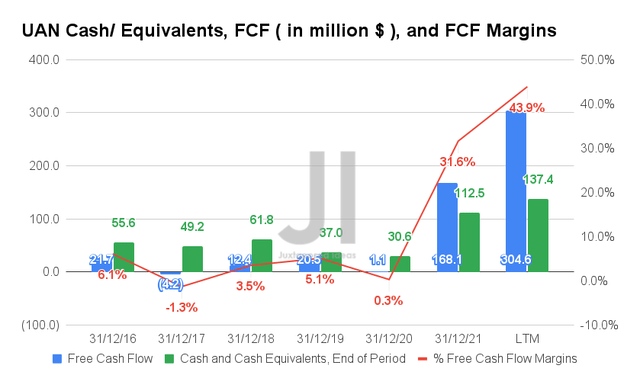

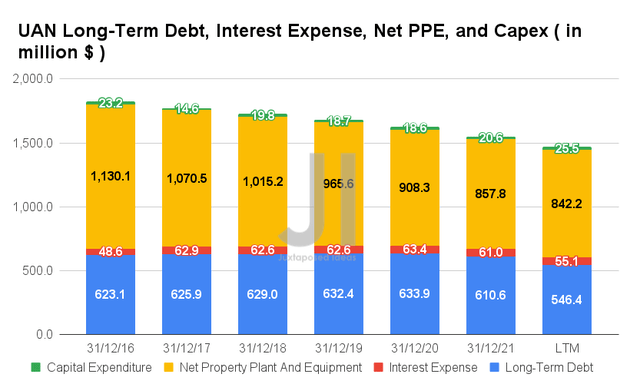

UAN’s robust FCF generation has directly contributed to its capability in reducing some of its long-term debts to $546.4M in the LTM, indicating a reduction of $87.5M from FY2020 levels. This helps to bring down its interest expenses to $55.1M in the LTM as well. Given that its next debt maturity is in 2028, it is evident that UAN is well poised for growth and expansion over the next few years, assuming sustained elevated fertilizer prices.

Similarly, UAN is also looking into improving its output capacity over the next few years with a capital expenditure of $25.5M in the LTM, representing an increase of 36.3% from FY2019 levels. This investment may prove to be a catalyst for long-term revenue and profitability growth indeed.

UAN Debt Maturities

Seeking Alpha

UAN’s Revenue and Profitability Will Likely Normalize From FY2023 Onwards

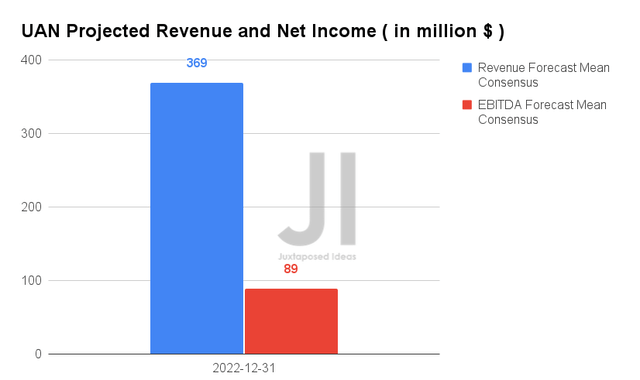

For FY2022, consensus estimates that UAN will report revenues of $369M and EBITDA of $89M, representing a YoY decline of 30.7% and 57.3%, respectively. It is evident that these numbers from the S&P Capital IQ were estimates done prior to the Ukraine war, since the company had reported exemplary numbers in FQ1’22.

Therefore, assuming a similar performance ahead, we may expect UAN to report FY2022 revenues of up to $890M and EBITDA of $490M, representing impressive YoY growth of 67.1% and 234.5%, respectively. Thereby, indicating massive improvements in its EBITDA margin, from 27.4% in FY2019, to 39.2% in FY2021, and finally, to a projected 55% in FY2022. For investors who remain bullish, the speculatively handsome dividends in the next three quarters will help cushion the ongoing plunge in its stock price.

In the meantime, analysts will be closely watching UAN’s FQ2’22 performance, in comparison with FQ1’22 revenues of $222.97M and EPS of $8.78. We expect its upcoming earnings call to be similarly positive, though unlikely enough to trigger long-term recovery. It is evident that Mr. Market is overly bearish, since the stock had plunged by 32.7% by now, after a brief uptick of 5.6% for its overwhelmingly positive FQ1’22 earnings call.

Therefore, given the Fed’s recent hike in interest rates and the farmers’ continued refusal to pay sky-high prices, we do not expect UAN’s windfall to last long, since the US International Trade Commission recently also decided to revoke duties on Russian fertilizers. Thereby, indicating the forward-looking, though unfortunately, bearish stock performance ahead.

UAN’s Long-Term Investors Were Rewarded With Handsome Dividends, Only For Now

UAN 10Y Stock Price

UAN has had a long downtrend stock behavior since hitting the peak in 2012. The post-re-opening cadence had unnaturally boosted its stock price from 2021 onwards, further inflated due to the Ukraine war in February 2022. Nonetheless, it is evident that UAN is trading based on a mix of fundamental performance and hype, which would prove to be unsustainable in the potential recession.

UAN 5Y Dividend Yields and Dividend Payouts

Nonetheless, long-term UAN investors may cheer for now, since the company restarted its dividend payouts from 2021 onwards. Its current yield stands at an impressive 11.56% while also distributing $12.15 of dividend payouts in the LTM. Assuming continued windfall for the next two or three quarters, we expect to see similarly impressive returns ahead. However, investors should not bank on these, since it is also evident that UAN’s dividend payouts were historically sporadic.

So, Is UAN Stock A Buy, Sell, or Hold?

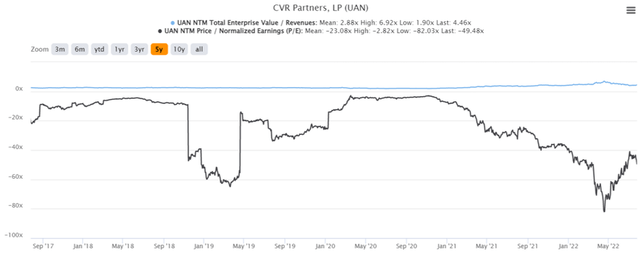

UAN 5Y EV/Revenue and P/E Valuations

UAN is currently trading at an EV/NTM Revenue of 4.46x and NTM P/E of -49.48x, higher than its 5Y mean of 2.88x and -23.08x, respectively. The stock is also trading at $105.14, down 41.5% from its 52 weeks high of $179.74, though at a premium of 206.1% from its 52 weeks low of $51. It is evident that UAN is still trading at a premium due to the massive demand and reduced availability of fertilizers for now, since the stock had always traded at $30s since 2017.

UAN 5Y Stock Price

Given the potential relenting to Russian fertilizers, we do not expect UAN’s current stock prices to hold for long, since its financial performance will likely be impacted from FY2023 onwards.

In the meantime, investors looking to cash out may want to do so after its FQ2’22 performance, since we expect a moderate stock recovery afterward, before continuing its downwards slide as it had in the past three months. This would be the perfect time to lock in the remaining gains, which may whittle down further over the next few quarters.

Those who are still bullish about the stock should not add now as well. Wait for the momentum to be digested before adding at the $80s. Even then, UAN still looks relatively over-valued, given its historical price action and the stock market’s forward-looking pessimism.

Therefore, we rate UAN stock as a Sell for now. Secure the gains.

Be the first to comment