Abstract Aerial Art

Launched in 2020 as a pegged asset decentralized exchange, or DEX, Curve.Finance almost immediately proved there was market demand for their platform. Curve’s governance token, (CRV-USD), is used to operate the Curve DAO, spawning a pseudo crypto economy with innovative financial tools. The protocol currently has a total value locked (TVL) of around $5.5 billion, and $1 billion in monthly trading volume according to Defi Llama. As we’ve come to learn in the crypto space, the user growth and adoption that Curve has exhibited are crucial when evaluating potential crypto investments, but they are certainly not the only factors. This report will dive into the protocol’s key metrics and the CRV token’s valuation.

The TL;DR: We are bullish on CRV-USD in the short term (2-3 years), and we recommend staking it using Curve and boosting staking rewards using Convex. When opportunities arise to take profits, we recommend doing so. Over the long term, we have our concerns which are covered in this report.

Curve Background

Curve Finance was founded by Michael Egorov and launched in January 2020 for the purpose of providing a decentralized exchange built with an automated market maker (AMM) architecture, optimizing the swapping of digital assets with identical pegs. This was followed by the establishment of the Curve DAO in August 2020. The CRV token is not only the governance token for this DAO, but retains functionality within the protocol itself. Just months after launching, Curve was the largest decentralized exchange by TVL, beating out blue chip DEX names like Aave (AAVE-USD) and Compound (COMP-USD).

The most common pegged assets are stablecoins, such as USCoin USD (USDC-USD) and Tether USD (USDT-USD). They are both pegged to the United States dollar, and therefore markets for stablecoins could be combined to increase liquidity and reduce slippage. Curve started out as a decentralized exchange for just stablecoin trading pairs, but later expanded to other pegged token such as wETH and renBTC, which are pegged to Ethereum (ETH-USD) and Bitcoin (BTC-USD). Besides the low swap slippage, part of what made Curve so attractive to early adopters was its high yield for liquidity providers. When providing liquidity for stablecoin trading pairs, the liquidity provider faces minimal impermanent loss and has historically been rewarded with high staking rewards.

Following this early success, Egorov developed Curve V2 in mid-2021. This new version of the protocol would expand Curve to allow trading of non-pegged assets. Curve now has several dozen liquidity pools to trade in, and can easily see daily volume ranging from $100 million to several billion dollars. It’s also on all the popular Ethereum virtual machine, or EVM, compatible networks such as Ethereum, Arbitrum, Polygon (MATIC-USD), and Avalanche (AVAX-USD).

How does the CRV token derive value?

The CRV token derives its value by being the governance and revenue sharing token for the Curve protocol. From a governance perspective, users need the CRV token to vote on protocol changes within the DAO. From a revenue sharing perspective, CRV gets distributed to liquidity providers as an added incentive on top of 50% revenue share of trading fees entitled to stakers. Stakers pre-select a time period they would like to stake their CRV, and as this time period chosen by the staker gets longer, so does the reward rate. At the time of writing, 29% of the current supply is locked for an average of 3.6 years, reducing the circulating supply and benefiting the token price.

Tokenomics

The CRV token has a maximum supply of 3.3 billion tokens, with 60% (1.8 billion) released so far. However, approximately 18% (586 million) of the maximum supply is locked up in staking. Due to CRV being constantly minted to incentivize liquidity providers, inflation has been an adoption tool used by Curve to attract user growth. This inflation will continue forever, exponentially decreasing in rate, making the next 5 years the most significant in terms of total supply released.

To be blunt, the release schedule in the image below is not attractive. CRV is well known to be one of the highest inflating “blue-chip” DeFi tokens, beating ChainLink (LINK-USD), Uniswap (UNI-USD), Aave, and Compound. Starting with the circulating supply of approximately 531 million CRV tokens and the total CRV issuance expected to be approximately 500 million tokens through mid-2026 based on the below chart, the annualized inflation rate over the next 4 years is roughly 18%. This also assumes that stakers continue to stake, but the amount of CRV staked or unstaked can drastically change this projected circulating supply and thus the inflation rate. This 18% inflation rate should be viewed as a hurdle rate for an investment in CRV. Thus, for the CRV token to appreciate in value the combination of the demand for CRV and the growth in staking (reducing the circulating supply) needs to outpace the 18% inflation rate over the next 4 years in order for the token to appreciate in value. This is why these high staking rewards have a bit of “ponzi-nomics”, but more importantly requires CRV token holders to stake their tokens to reduce the impact of inflationary pressure.

Token distribution is detailed below. The only major concern is the 26% with the core team, depending on vesting schedule this could provide additional sell pressure down the road.

-

Community – 57%

-

Early Users – 5%

-

Core Team – 26%

-

Investors – 4%

-

Employees – 3%

-

Reserve – 5%

Volume Analysis

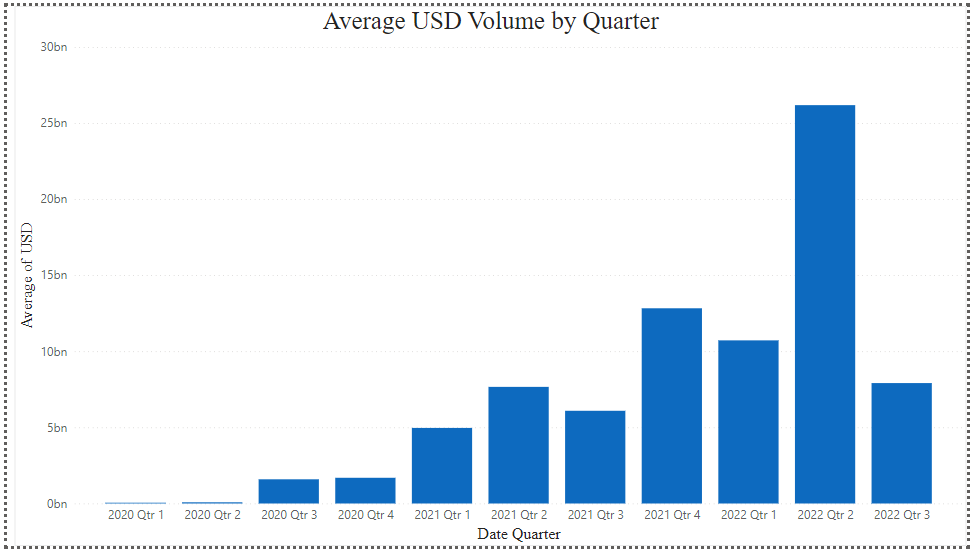

Volume across all crypto platforms is heavily dependent on market sentiment; as the market grows so too does volume across major platforms. Curve’s volume closely follows the general market trends. So far, Curve is on track to see around $100 billion in total volume for the year 2022, up around 5x from 2021.

CRV Trading Volume (Curve Finance)

This volume gives Curve an average market share of DEX volume of around 10% which is dominated by Uniswap. However, it has some of the highest TVL in the entire space.

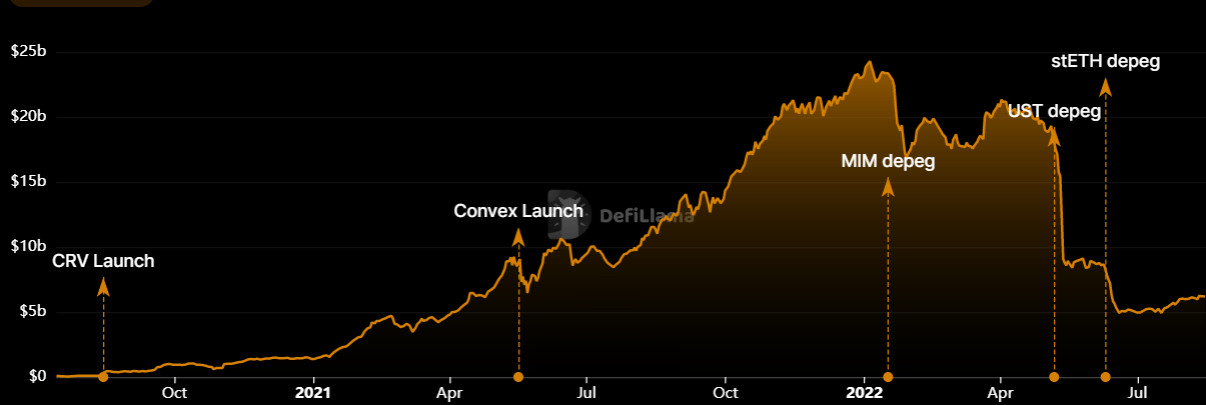

Convex Finance

Convex and Curve have a unique relationship. In a nutshell, Convex was created to boost rewards for those that stake CRV or provide liquidity to the Curve liquidity pools. Curve had experienced steady growth in TVL for the first year of existence, then Convex finance launched in mid-2021 in the height of the crypto mania. This catapulted TVL on Curve with the boosted yield provided by Convex, peaking at the start of 2022 at just under $25 billion. Since then, TVL has seen a steep decline coinciding with the crypto bear market.

Curve Finance Trading Volume (Defi Llama)

Convex Finance played a significant role in Curve’s maturity following its initial growth. It has over $1 billion in TVL and generates upwards of $10 million in fees annually. Part of the reason why such a high percentage of CRV tokens are locked up in staking is because of Convex. It essentially increases or boosts a Curve liquidity provider’s normal earnings. Stakers deposit CRV in Convex and get cvxCRV token in return, a liquid representation of their stake. Liquidity Providers (LP) deposit their Curve LP tokens and earn CRV with a boost supplied, and the boosted reward yield and withdrawals are fully liquid. Given the high inflation rate of Curve mentioned earlier, we recommend boosting the yield by utilizing Convex.

Curve’s Long-Term Viability

It is a sad truth that many DeFi and crypto investments will likely be worthless in 5+ years. In the context of Curve, we see some possible issues down the road. Regardless of growth, innovation, or adoption, how does Curve sustain staking yield once the token approaches its maximum supply? Can demand be sustained long-term, regardless of inflation? More frankly, is Curve dependent on some level of ponzi-nomics that have been seen all too often in the crypto space to create demand for their token and platform?

Sustainability for a DEX is primarily based on 2 factors, liquidity and volume; as volume, and thus trading fees, increase, so too does liquidity. LPs are incentivized to jump into underserved pools to get higher fees, and traders are more incentivized to trade with high liquidity to reduce slippage as much as possible. However, traders who pay the fees also need incentive to trade on a given DEX over another. SushiSwap (SUSHI-USD) was infamous during its debut, and serves as a good example. It managed to suck tens of millions of dollars from Uniswap’s (UNI-USD) liquidity pools with its attractive incentives. LPs could earn the SushiSwap governance token SUSHI-USD on top of normal trading fees, plus a flashy UI with more features for traders. Traders preferred SushiSwap, even though it is a fork of Uniswap, because it integrated features that the community had been asking for. It had stolen liquidity and volume. Uniswap survived, but the point was made that the protective moats around blockchain applications can be difficult to maintain compared to legacy models like Charles Schwab (SCHW) or TDAmeritrade which are much more difficult to transfer assets between than in the blockchain universe.

Curve has laid the foundation to keep liquidity and volume even after CRV rewards dry out, although this is not guaranteed by any means. Currently, liquidity providers are incentivized by two things: earning LP rewards and trading fees. When CRV emissions run dry, LPs will only rely on trading fees. These fees must grow as CRV emissions decrease in order for the platform to last long term.

The Bull and Bear Case for Curve

The bullish case for Curve is that volume will continue to grow at the pace it’s been growing, leading to a sustainable level of trading fees to both maintain liquidity and keep CRV stakers content with their yield. Based on our volume analysis, we see volume has clearly grown year over year but retaining that volume will be a challenge long term as emissions will mostly run dry within 5 years. Will crypto investors continue their unquenchable thirst for yield wherever it is being offered or will the space mature and investors begin to value quality platforms like Curve? The bull case is liquidity providers won’t leave just because CRV emissions dry up, they can rely on trading fees from a larger, more mature protocol several years down the road. There is also the brand name and trust that goes with the protocol, likely keeping some LPs regardless of better yield elsewhere. Curve can also launch new features that could provide additional revenue streams for the protocol, like the announced Curve Stablecoin.

However, volume growth is not a guarantee. Curve could suffer a major hack at anytime, lose market share to more innovative competitors, or lose liquidity from simply not maintaining volume. Major de-pegs, such as Tether’s de-peg in mid 2022, can also bring the platform down and cause volume to spiral down as users migrate to safer pools.

Investment Recommendation

The Curve.Finance platform is a useful platform for gathering additional yield on stablecoins and other tokens. However, the CRV token itself is only attractive over the next 2-4 years because the rewards for staking CRV will likely continue to attract the volume necessary to align the interests of traders and liquidity providers. The combination of the available yield and the substantial liquidity for traders should sustain volume over this period. It is recommended to stake the CRV token and utilize the yield boost through Convex Finance. Beyond this time period there are simply too many uncertainties, primarily that the risk a competitor will divert demand from Curve by offering an elevated yield as the CRV token distribution begins to dwindle.

Bonus Content: Additional Risks & News

Governance

Incentives for pools are dictated by CRV voters. There have been governance attacks in the past that enlisted unreasonable amounts of incentives to certain pools, causing the protocol developers to manually intervene and reduce incentives. Any kind of governance attack is possible again in the future if a malicious party takes hold of enough CRV tokens.

Competition

The world of blockchain is a disruptive technology, and within the space there is a lot of moving fast and breaking things. New protocols are always being created, each building off the last iteration of success. While Curve has shown to be resilient and innovative, there is always a risk that better AMMs and DeFi solutions come to fruition and take Curve’s market share. If so, Curve would get less overall volume, and thus less revenue from trading fees.

Hacks

Curve recently encountered a front-end DNS cache poisoning attack on its Web2 website that caused investors to lose around $600,000. The issue was with their domain that hosted the front-end UI for the protocol. This risk could have been mitigated by using ENS instead of DNS, and it goes to show any protocol dealing with large amounts of money is being constantly stalked by hackers. Any vulnerability will eventually come to the surface, and there is always a risk that a protocol-breaking bug is present that we are not yet aware of.

Be the first to comment