Lawrence Glass

The Senate Democrats finally releasing a bill gives some slim hopes of Federal legislation on cannabis. Curaleaf Holdings (OTCPK:CURLF) stands to benefit from such legislation while still holding the wild card of significant growth from Northeast markets without Federal approval. My investment thesis remains ultra bullish on the stock after the inexplicable dip to $5 recently.

Senate Democrat Bill

While a lot of Americans and even politicians agree on the legality of cannabis consumption, most politicians don’t agree on the legal aspects of Federal approval. Republicans generally prefer a bill focused on the business side of cannabis with related businesses having access to the banking system and stock exchanges. On the other side, Senate Majority leader Chuck Schumer (D-NY) used this tweet, and others, to announce the introduction of the bill to highlight the focus of Democrat leaders.

On July 21, Schumer introduced his bill after promising to release one before the August recess. The Cannabis Administration and Opportunity Act, or CAOA, is a comprehensive bill focused on both criminal justice reforms and de-scheduling cannabis so that marijuana is no longer illegal from a federal level opening up the banking system to multi-state operators (MSOs) and other cannabis related companies.

A big part of the disagreement comes on criminal justice reform. Not all politicians are in agreement with letting past criminals out of jail. Schumer, along with Senate Finance Committee Chairman Ron Wyden (D-OR) and Sen. Cory Booker (D-NJ), worked with Republican Senators to sculpt a comprehensive bill, but a lot of questions exist on actual approval of the bill.

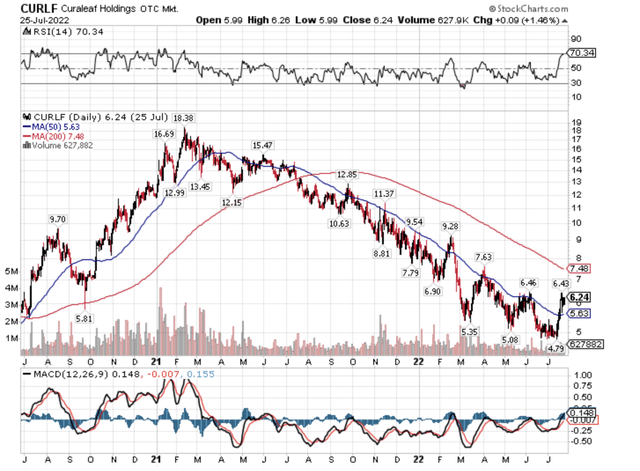

Curaleaf traded up to $18 back in early 2021 after Joe Biden won the presidential bid and the Democrats took control of the Senate. Along with other MSOs, the stock surged on the expected approval of cannabis legislation allowing Curaleaf to trade on major stock exchanges and entertain buyout offers from traditional CPG, tobacco and alcohol companies. Currently, these companies are prevented from owning cannabis related businesses due to the business not being federally legal.

Massive Opportunity Ahead

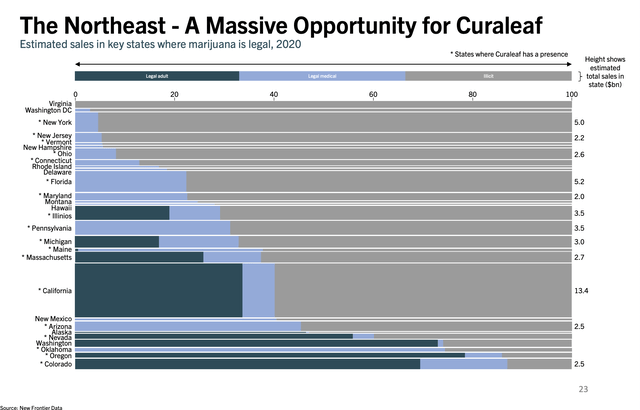

Due to some weak results recently, the market has suddenly forgotten that the cannabis sector still has strong growth ahead. The Northeast states are only beginning to open up with an expected flood of recreational cannabis legalizations set to unleash over $10 billion in new revenue streams.

Curaleaf remains of the best ways to play both the opening of the Northeast markets of New York (early 2023), New Jersey (launched in April), Connecticut (July 1, 2023) and Maryland, amongst others. Unlike other potential recreational cannabis markets like Florida and Pennsylvania with robust medical cannabis markets, the tri-state area of New York, New Jersey and Connecticut offer the biggest upside with combined market sizes of nearly $10 billion while the medical programs have limited existing sales.

Source: Curaleaf Q1’22 presentation

The Bellmawr store in New Jersey was already clocking in at a nearly $100 million annual revenue rate and the Edgewater Park store launched on May 24 as only the 13th open dispensary in the state. Curaleaf still has the Bordentown store in New Jersey to open.

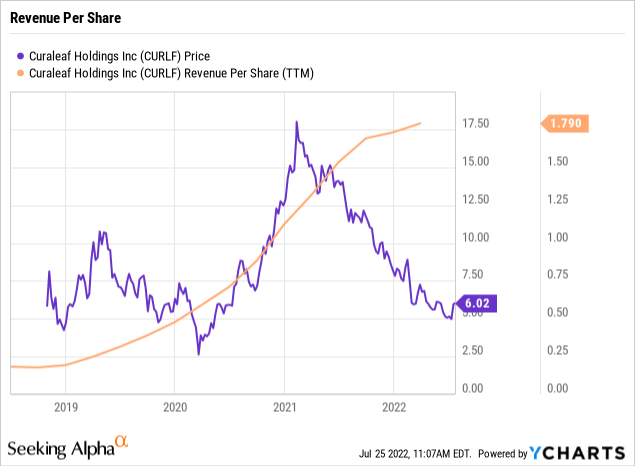

The company gets slammed for higher share counts due to acquisitions, but Curaleaf has long increased revenues far in excess of the shares paid for the accretive deals. The MSO has increased the revenue per share nearly 10 fold since just generating ~$0.20 per share in revenues prior to 2019.

The stock recently bottomed near $5 and was only trading at 6x adjusted EBITDA targets near the lows. Curaleaf still expects to generate up to $420 million in adjusted EBITDA profits on up to $1.5 billion in revenues this year before even the massive New York recreational cannabis market launches in early 2023.

Analysts have the MSO hitting 2023 revenues of $1.8 billion with these other Northeast state markets launching. With EBITDA margins only recaching 30%, Curaleaf would produce adjusted EBITDA of $540 million next year. The stock only trades at 8x these targets with plenty of upside potential to adjusted EBITDA from higher margins.

Takeaway

The key investor takeaway is that Curaleaf definitely faces a tough period where consumers are facing inflation likely cutting into discretionary purchases of weed. Ultimately though, the MSO will see better days ahead as larger Northeast states launch recreational cannabis and the Federal government takes steps towards legalizing cannabis. The stock is poised for a rally back to previous highs while risks definitely exist over the short term.

Be the first to comment