Larysa Shcherbyna/iStock via Getty Images

Year to date, Culp (NYSE:CULP) has lost more than half of its market cap. As a result, this stock has become so undervalued in my view that it is reminiscent of a cigar butt stock, which has become rare in modern-day investing. The cigar butt approach is an old deep-value investing strategy where investors look for companies selling for less than their net current asset value. At current prices, Culp is trading at a deep discount to book value, which offers a terrific opportunity for old-school value investors.

What Is Cigar Butt Investing?

Seasoned value investors have probably come across the cigar butt style of investing at some point in their careers. The cigar butt approach to investing was popularized by Warren Buffett and his mentor, the founder of value investing, Benjamin Graham. The name is an analogy for finding an old soggy cigar butt and lighting it up for one last puff – it might not be a pleasant experience, but, hey, the puff was free. This approach was how Benjamin Graham invested – he looked to buy stocks that were so beaten down that they were selling for less than their net current asset value, which is current assets less total liabilities. At these price levels the company could, in theory, shut down, sell off all the assets, and pay off all the liabilities, and investors would be left with a modest profit. Therefore, the business is essentially worth more dead than alive.

Warren Buffett made a fortune investing in businesses like this early in his career. However, as time passed, he made too much money to continue using this niche strategy. Also, cigar butt opportunities became scarce as the market stopped valuing businesses for less than net current asset value. Of course, it’s much harder to find these opportunities today. But sometimes in bear markets, like what we’re currently seeing, some stocks get beaten down to the point where they are trading for less than net current asset value. One such stock is CULP.

Background Info For CULP

Founded in 1972, CULP manufactures, sources, and markets mattress and upholstery fabrics for the furniture and bedding industries. CULP is a small business with a market cap of $56 million. However, it has multiple manufacturing operations across the globe, including operations in the U.S., Canada, China, Haiti, Vietnam, and Turkey. CULP has two business segments: mattress fabric manufacturing and upholstery fabric manufacturing. The mattress fabrics business accounts for 52% of sales. By contrast, the upholstery business accounts for 48% of sales. CULP has multiple big-name clients, including Ashley Furniture, Casper, Corsicana, Flexsteel, Fusion Furniture, Kuka Home, La-Z-Boy, Resident Home, Serta Simmons Bedding, Tempur+Sealy, and others.

Income Statement Analysis

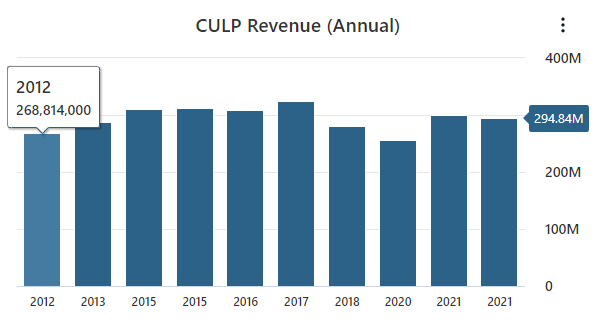

To begin the analysis of CULP, we need to look at the income statement to get a feel for how CULP has performed over the last few years. Starting with the top line, over the last 10 years CULP has increased its sales from $268 million in 2012 to $294 million in 2021, good for a 9% revenue increase over those 10 years. These are not exactly earth-shattering numbers.

CULP data by Stock Analysis

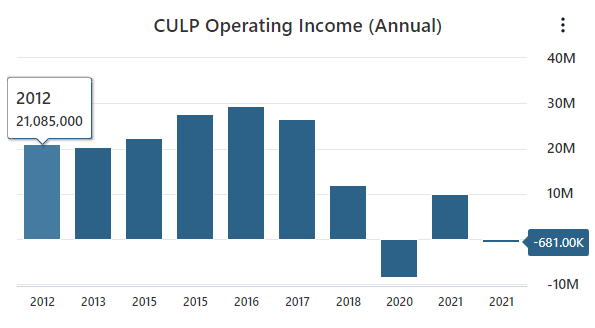

Turning to the operating income, CULP recorded an operating income of $21 million in 2012, compared to an operating income of -$681,000 in 2021. Unfortunately, last year was a lousy year for CULP as it reported an operating loss. However, it wasn’t just one bad year, as CULP has failed to grow its operating income yearly since 2016.

CULP data from Stock Analysis

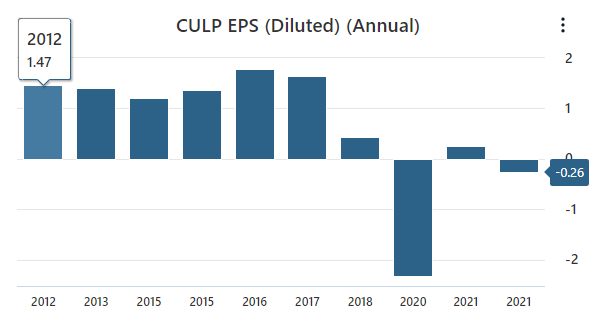

CULP has not faired any better in terms of the bottom line either, recording a net loss of $3.21 million and -$0.26 per share in 2021.

CULP data by Stock Analysis (CULP data by Stock Analysis)

Over the past few years, the economics of CULP’s business has indeed eroded to the point that CULP is no longer profitable. There have been numerous headwinds to CULPs business, including increased competition from imported Chinese mattresses, inflationary pressures, labor issues, and supply chain issues. CULP’s management has had to make difficult decisions during these years as they’ve tried to right the ship. They’ve furloughed employees, suspended merit pay increases, cut their share repurchase program, and reduced executive pay. Shareholders have also suffered during this period, and the share price has cratered from $37 in 2016 to $4 earlier this year.

As you can see, there is hardly any value that can be found on CULP’s income statement. It might seem counterintuitive to invest in a business that has struggled as much as CULP has; you can start to see why this business resembles a soggy cigar butt.

Analysis Of CULP’s Balance Sheet

When evaluating cigar butt stocks, the value is found on the balance sheet. When I look at cigar butt stocks, I like to put them in three buckets in terms of valuation. The first bucket is the cheap bucket, which includes cigar butt stocks selling for less than book value. The second bucket is the cheaper bucket, which includes stocks selling for less than working capital. The third bucket is the cheapest bucket. These stocks are the Benjamin Graham specials, and they are the stocks trading for less than net current assets. Let’s look at the balance sheet and see which bucket CULP falls into.

Bucket No. 1: Stocks Selling at Less Than Book Value

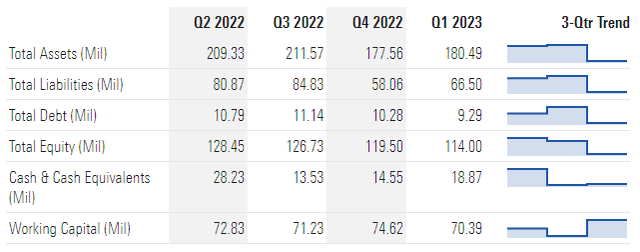

To find book value we need to start with the total assets of $180 million and subtract out the total liabilities of $66.5 million, which leaves us with a total equity of $114 million. From here we can see that CULP is a cheap stock because CULP’s market cap is $55.4 million. Therefore, the equity in the business is more than twice what the price is for all of CULP’s outstanding shares.

Now there is a caveat to this: Are these assets worth what CULP has reported their value as on the balance sheet? This is a difficult question, but it’s fair to say that if CULP were to liquidate all its assets, it would likely not receive full value for its receivables and inventory. There is likely no way for CULP to receive full value for any goodwill or intangible assets on the balance sheet. This is why it’s essential to have a margin of safety, and CULP has a price-to-book value ratio of 0.49, which gives us that margin of safety. Also, there is only $2.53 million worth of goodwill and intangible assets on the balance sheet. Therefore, most of CULPs assets have tangible value.

Bucket No. 2: Stocks Selling for Less Than Working Capital

CULP selling for less than its book value suggests to me that it’s a cheap stock. Still, when evaluating cigar butts, we must have an adequate margin of safety. So, let’s look at CULPs price in relation to its working capital. CULP currently has $112 million in current assets, including $18.8 million in cash, which compares favorably to the current liabilities of just $41.6 million and $3.13 million of current debt. This gives us a working capital of $70.3 million, and since CULP’s market cap is currently $55.4 million, CULP is trading for less than working capital. However, CULP has a much smaller margin of safety when comparing the price to working capital as opposed to book value.

Bucket No. 3: Stocks Selling for Less Than Net Current Assets

The best-case scenario for deep value investors is to find a cigar butt stock that is trading for less than net current asset value. To find net current asset value we will take the $112 million worth of current assets and subtract the $66.5 million of total liabilities, leaving us with a net current asset value of $45.5 million. Since CULPs current market cap is $55.4 million, this means that CULP is not selling for less than net current asset value. Despite this, I still feel CULP is very cheap at these prices. You just can’t find many companies currently trading for less than net current asset value. It’s also worth noting that CULP has $9.59 million more cash than debt, making CULP’s enterprise value roughly even with its net current asset value.

CULP Valuation

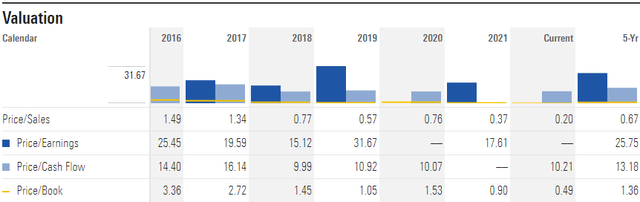

Typically, when I value a company I do a discounted cash flow analysis, or a comparative analysis based on the company’s P/E relative to its industry and five-year average P/E. However, I don’t think we’ll get much insight into CULP’s intrinsic value using these valuation methods. That’s because CULP has recorded a loss of $22.4 million in free cash flow and -$0.26 in EPS in 2021. In this case, I think it’s better to value CULP based on its assets.

CULP is currently trading at a significant discount to book value. Its price/book ratio is presently 0.49, which compares favorably to its five-year average of 1.36. CULP has fallen to these cheap price/book levels because of increased competition from China and current inflationary pressures on consumer spending. Still, CULP is working to fight these headwinds with several initiatives. CULP has invested in a new production facility in Haiti, which will increase its capacity to produce cut and sewn upholstery kits, allowing CULP to support demand.

Image from CULP 2023 Q1 Earnings Call Presentation

CULP is also strategically implementing price increases to help offset higher freight and raw material costs. Finally, CULP recently opened an innovation campus in High Point, N.C., which should help unlock innovation and help develop new products and showcase them to its customers.

Image from CULP 2023 Q1 Earnings Call Presentation

If these initiatives pan out, the market could value CULP closer to its five-year average price/book ratio. With a current book value of $9.31, CULP’s price would be $12.66, a 179% increase from CULP’s current share price.

CULP’s price/book ratio has been relatively low before. During the pandemic, CULP’s price/book ratio hit a low of 0.52 on May 19, 2020.

From these low levels over the next six months, CULP outperformed the S&P 500 by seven times, 160.67% to 22.06%.

Now, I’m not saying investors can expect that type of return again – especially over such a short time period. If CULP’s book value takes a hit, I’d expect its share price to fall even further. However, cigar butt stocks like CULP are prone to pop on any sign of good news, whether it be a good earnings report, favorable macroeconomic conditions, or perhaps becoming an acquisition target from a larger company. We just need a catalyst for the market to value CULP at a price-to-book value ratio of 1.0, and investors will realize a 107% return.

CULP Risk Factors

There is money to be made if CULP’s stock starts trading at an average P/BV ratio, but there is an inherent risk with all cigar butt stocks. CULP, in particular, carries significant risk. We’ve seen that CULP has struggled to increase sales over the last decade. Also, CULP’s margins have come under pressure from a litany of headwinds, including increased competition from low-priced imports from China, inflationary pressures on consumer spending, and reoccurring labor challenges that have resulted in increased employee training costs. These headwinds have been so significant that CULP recorded a free cash flow of -$23.14 million in 2021, which CULP has never done in the preceding decade.

CULP has been dealing with increased competition from low-priced mattress imports for a couple of years, but consumers are increasingly concerned with how sleep affects their health. As a result, the mattress industry is becoming a more innovative business. CULP has recently opened a new innovation center to capitalize on this trend.

The inflationary pressures and labor challenges are relatively new obstacles. Inflationary pressures hurt CULP in two ways. First, there’s been an increase in raw material and freight costs. Second, it affects consumer spending. CULP has implemented strategic price increases to help offset these rising costs, but there’s no telling how long this current inflationary environment will last. Regarding the labor challenges, management did seem optimistic that the worst of the challenges are behind them. Still, if these headwinds persist, CULP could see more years of negative free cash flow ahead. But with the stock price selling for less than half of book value, I maintain my stance that CULP is undervalued.

Cigar Butt Investing Strategy

Investors need to tread lightly with cigar butt stocks like CULP. Although cigar butt investing can be lucrative, investors need to understand why they buy these companies. CULP is not a compounding company that investors can hold for decades. CULP is a special situation where the market is so overly pessimistic that it’s resulted in a market cap that is less than CULP’s working capital.

Investors can mitigate this risk by finding five or six more companies like CULP and investing in each rather than putting all their eggs in one basket. Remember, they are failing companies, and most of them will not work out. However, there’s a chance that one of them has one last puff that will cover the losses from the others. In CULP’s case, if the market can value CULP at its current book value of $9.31, investors will have over a 100% return from its current share price.

Another thing I like about investing in cigar butt stocks is that there is usually a clear exit point. Normally, when you invest in a company you hope to be a compounder – it’s hard to figure out when to sell. I try to sell when I find something better to buy or when the economics of the business no longer makes sense. However, there is a lot of grey area in this approach. When it comes to selling cigar butts it’s pretty clear that these companies are not going to the moon, so I try to buy these businesses at a deep discount to book value and sell when the stock is trading on par with book value, and then move on to the next one.

Summary

If you like to smoke cigars, occasionally you come across an old soggy cigar butt that might have one good puff left in it – not always pleasant, but it’s free. Sometimes you find a similar situation in investing. You see an old run-down company with one good run before it goes out of business. Again, it might not be a great experience, but it’s selling for pennies on the dollar. CULP is deeply discounted to book value, and I believe it has one last run left in it.

Be the first to comment