FatCamera

A Quick Take On Cue Health

Cue Health Inc. (NASDAQ:NASDAQ:HLTH) went public in September 2021, raising approximately $200 million in gross proceeds from an IPO that was priced at $16.00 per share.

The firm has developed an integrated diagnostics platform for health monitoring and delivery in the United States.

Until management can gain approval for its standalone flu test and begin demonstrating demand for it, I’m on Hold for Cue for the near term.

Cue Health Overview

San Diego, California-based Cue was founded to first develop a COVID-19 test kit and integrated information platform for processing and patient communication.

Management is headed by co-founder, Chairman and CEO, Ayub Khattak, who has been with the firm since inception and holds a B.S. in mathematics from UCLA.

The company’s primary offerings in its Cue Integrated Care Platform:

-

Health monitoring system

-

Reader

-

Cartridge

-

Wand

-

Data

-

Delivery apps

-

Enterprise dashboard

-

Ecosystem integrations

The company pursues healthcare provider relationships through its in-house direct sales team focused healthcare providers, large enterprises and public sector clients.

Cue Health’s Market & Competition

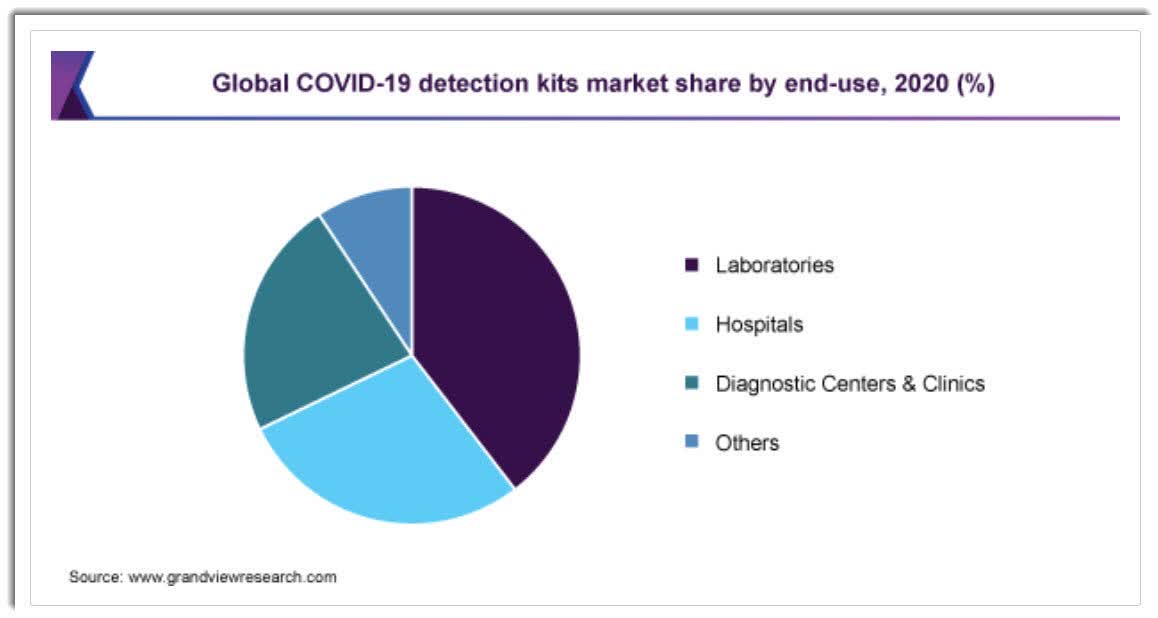

According to a 2020 market research report by Grand View Research, the global market for COVID-19 detection kits was an estimated $3.28 billion in 2020 and is expected to reach $5 billion by 2027.

This represents a forecast CAGR of 5.05% from 2021 to 2027.

The main drivers for this expected growth are a strong growth in demand for testing services of all types on a global basis.

Also, below is a chart showing the market share of use of detection kits by end-user type:

COVID-19 Detection Kit Market (Grand View Research)

Major competitive or other industry participants include:

-

Abbott Laboratories

-

Becton, Dickinson

-

BioMerieux

-

Bio-Rad Laboratories

-

Danaher

-

Ellume Limited

-

Everly Health

-

Roche

-

Fluidigm

-

GenMark Diagnostics

-

Others

The healthcare information software market is expected to grow by nearly $12 billion from 2021 to 2026, according to a report by Technavio.

If achieved, this would result in a CAGR of 7.9%, with North America accounting for 41% of the global market’s growth during this period.

Cue’s Recent Financial Performance

-

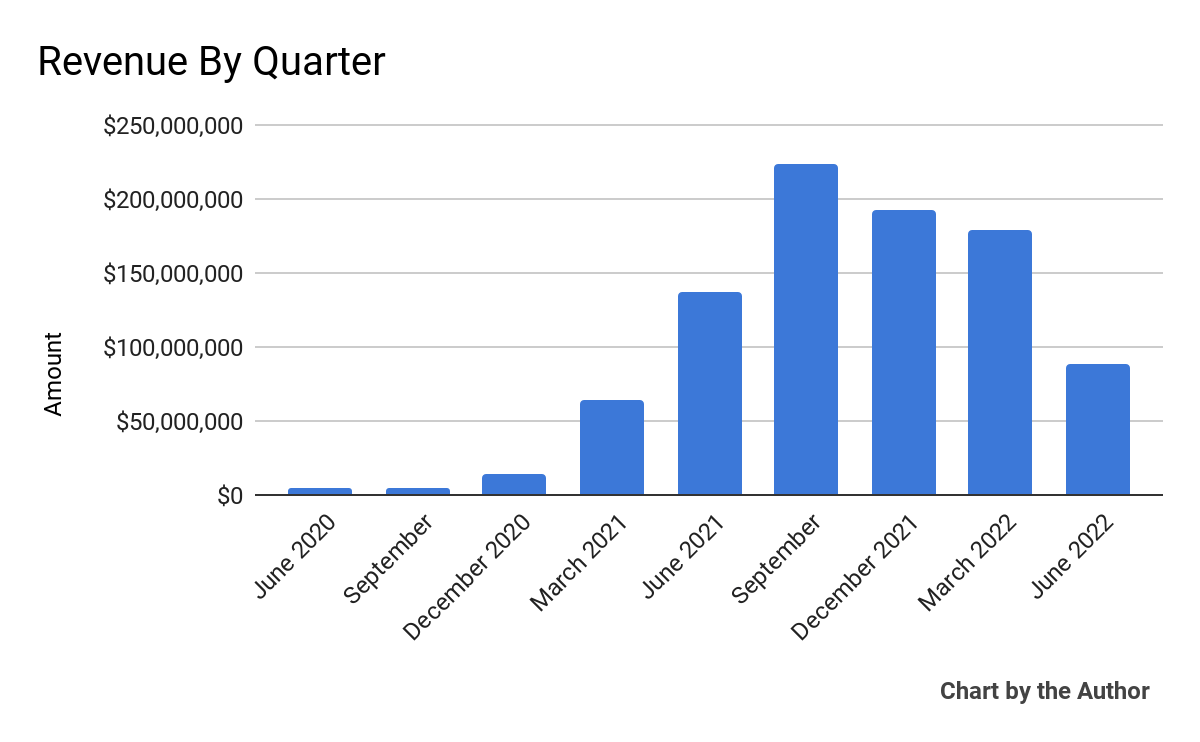

Total revenue by quarter has produced the following trajectory over the past 9 quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

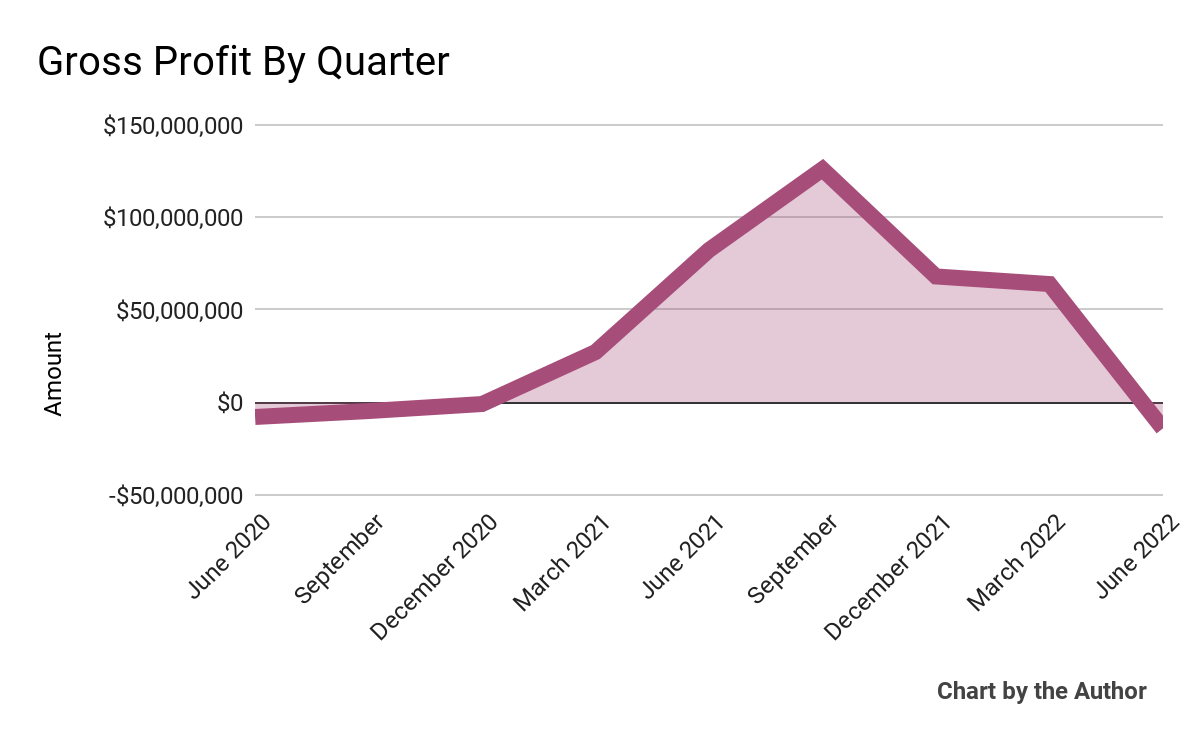

Gross profit by quarter has followed a similar trajectory as that of total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

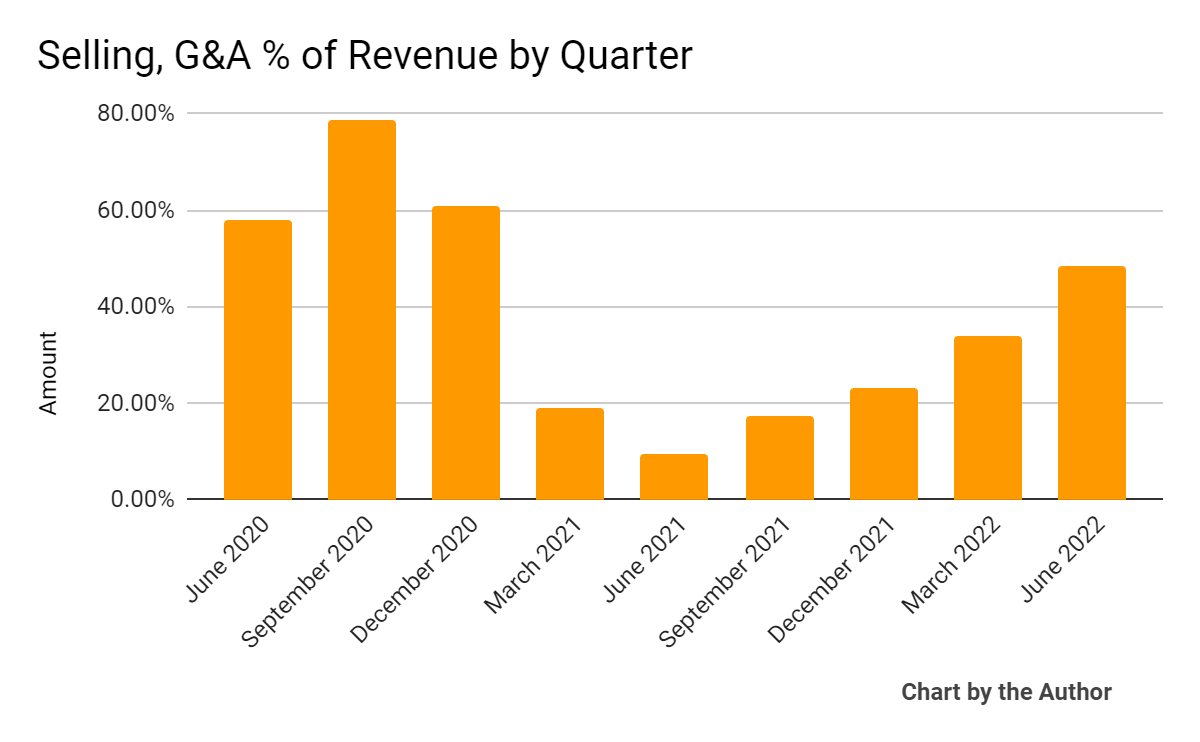

Selling, G&A expenses as a percentage of total revenue by quarter have been highly variable, as the chart shows below:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

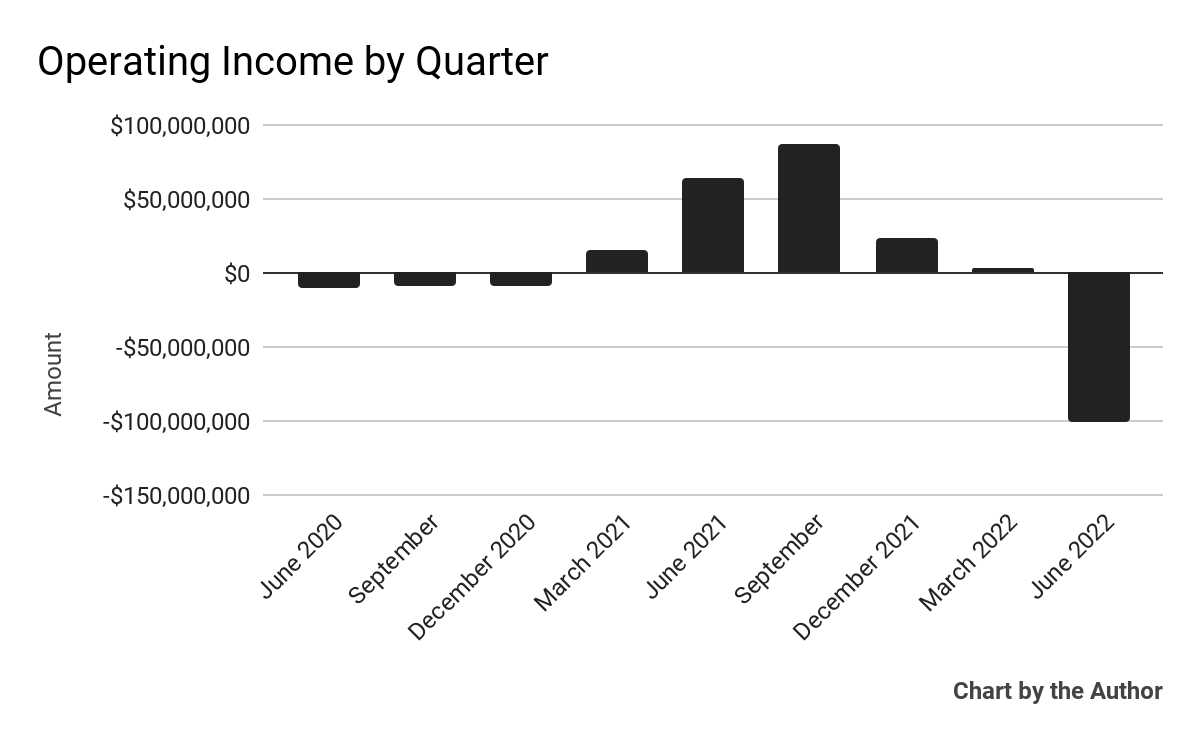

Operating income by quarter has turned sharply negative in Q2 2022, due to a large inventory write-off:

9 Quarter Operating Income (Seeking Alpha)

-

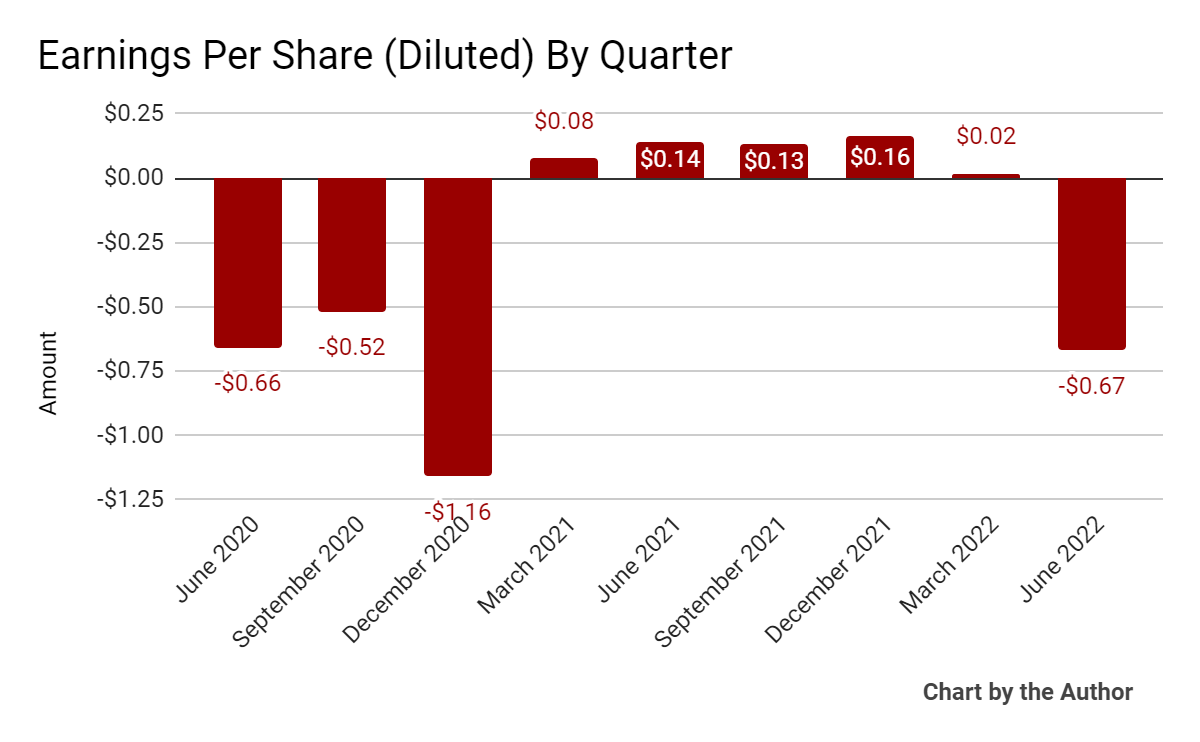

Earnings per share (Diluted) have also turned negative in Q2 2022:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

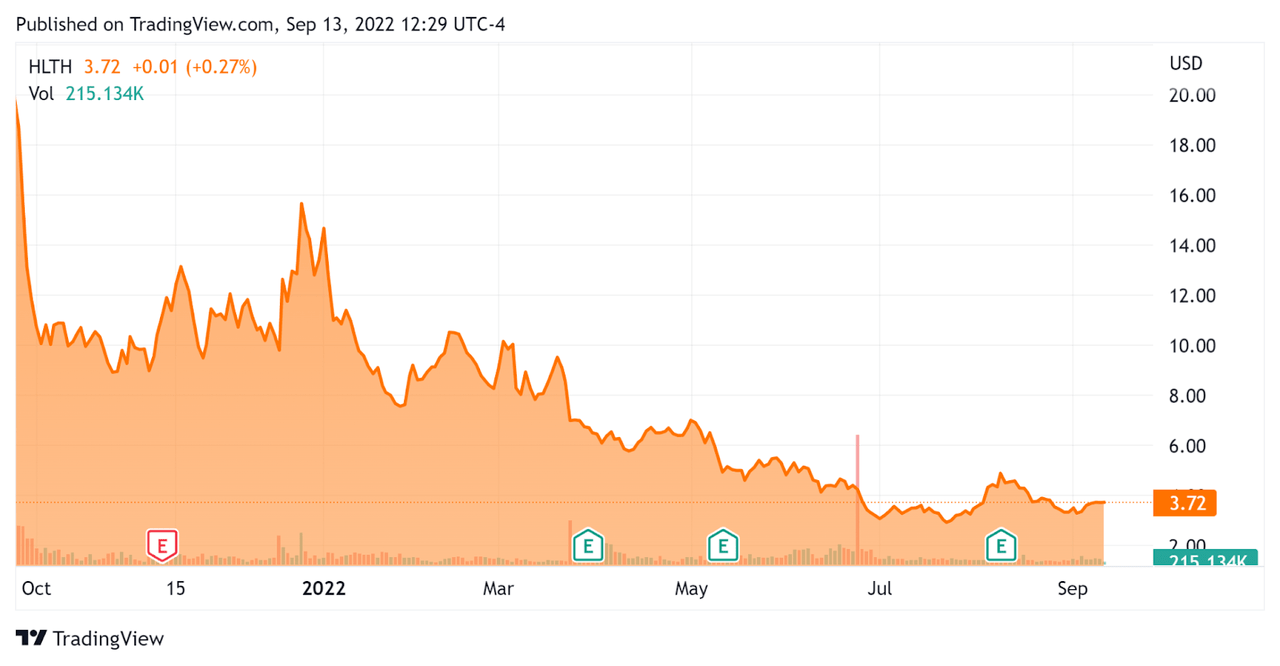

Since its IPO, HLTH’s stock price has fallen 81.4% vs. the U.S. S&P 500 index’ drop of around 3.1%, as the chart below indicates:

Stock Price Since IPO (Seeking Alpha)

Valuation And Other Metrics For Cue Health

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

0.36 |

|

Revenue Growth Rate |

210.7% |

|

Net Income Margin |

-6.2% |

|

GAAP EBITDA % |

7.5% |

|

Market Capitalization |

$549,650,000 |

|

Enterprise Value |

$245,250,000 |

|

Operating Cash Flow |

$8,050,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.36 |

(Source – Seeking Alpha)

Commentary On Cue Health

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted shipping 15,000 of its Cue Readers as part of its ongoing strategy to broaden its customer base.

Also, the firm submitted its application for its COVID-19 molecular test and continues to pursue its “plans for flu standalone and flu + COVID multiplex molecular tests.”

The company has completed clinical studies for its flu standalone test and is preparing its FDA application for Q3 submission.

Other tests are expected to begin clinical studies in the remaining part of 2022.

As to its financial results, total revenue was ‘better than expected’, but still down sequentially as the COVID-19 pandemic waned.

Adjusted gross profit margin was 30% despite higher supply chain costs and lower production volume.

However, the company booked an inventory write-off of $42.8 million for obsolete inventory and warranty reserves. This charge, combined with a nearly $2 million restructuring charge to reduce its manufacturing headcount, produced a large loss for the quarter.

For the balance sheet, the firm finished the quarter with cash of $363 million and entered into a $100 million secured revolving credit facility.

Over the past 12 months, the company has used $75 million in free cash, mostly due to capital expenditures.

Looking ahead, management limited its guidance to just Q3, where it expects revenue of $57.5 million at the midpoint of the range. This figure is down sharply from $87.7 million in Q2.

Regarding valuation, the market is valuing HLTH at an EV/Revenue multiple of just 0.36x.

The primary risk to the company’s outlook is the time for approval of its next test submissions as the firm continues to use cash.

A potential upside catalyst to the stock could include a return of COVID-19 in the U.S. in the winter period ahead.

Given the high vaccination rates in the U.S., I don’t foresee a high probability of a meaningful growth in COVID-19 cases and pull-through demand for its related test.

Until management can gain approval for its standalone flu test and begin demonstrating demand for it, I’m on Hold for Cue in the near term.

Be the first to comment