Kenishirotie/iStock via Getty Images

About the Company

CTS Eventim (OTC:CEVMY) is a leading German company in the industry of tickets for concerts, theater and sporting events as well as a promoter of live events. A total of around 250 million event tickets are marketed annually throughout Europe via the systems of the EVENTIM Group.

The company is divided into two segments: Ticketing and Live Entertainment.

The Ticketing segment includes the marketing and distribution of tickets for concerts, theatre, sports and similar events. To market the tickets, CTS Eventim uses a network of ticket agencies, call centers and, in particular, internet platforms such as eventim.de, oeticket.com, ticketcorner.ch, ticketone.it and entradas.com.

The Live Entertainment segment includes the planning, organization and handling of concert events, concert tours and open-air festivals. The company cooperates with or owns stakes in numerous well-known regional and national concert event companies.

It currently stands as Europe’s leading concert promoter and the world’s third largest.

Recent History

Years of growth and acquisitions throughout Europe has brought CTS to its leading position of today.

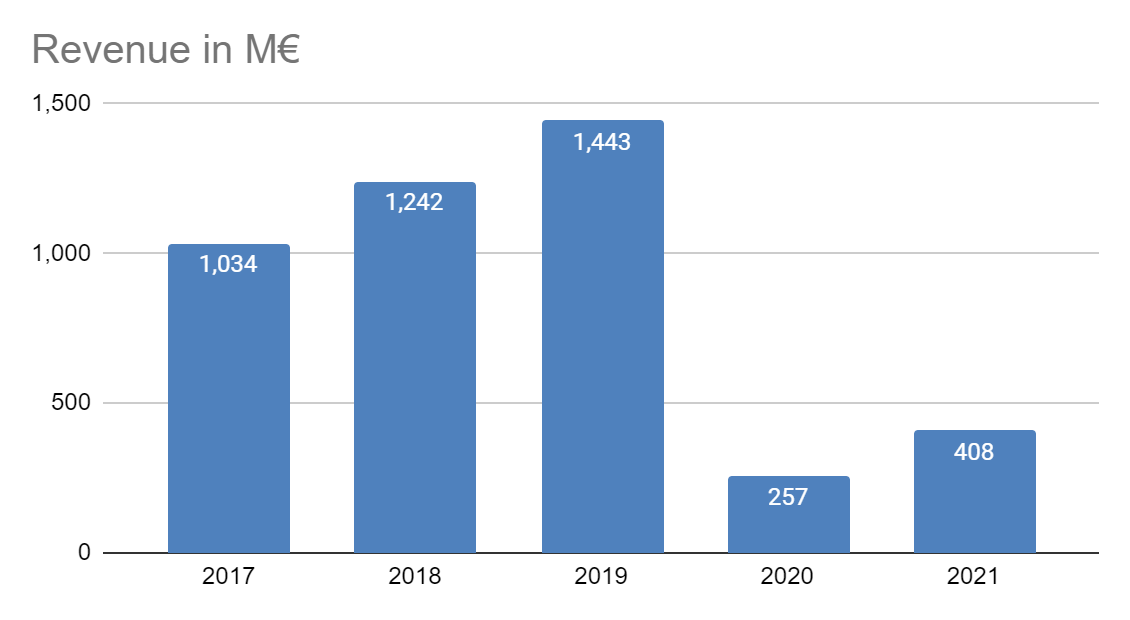

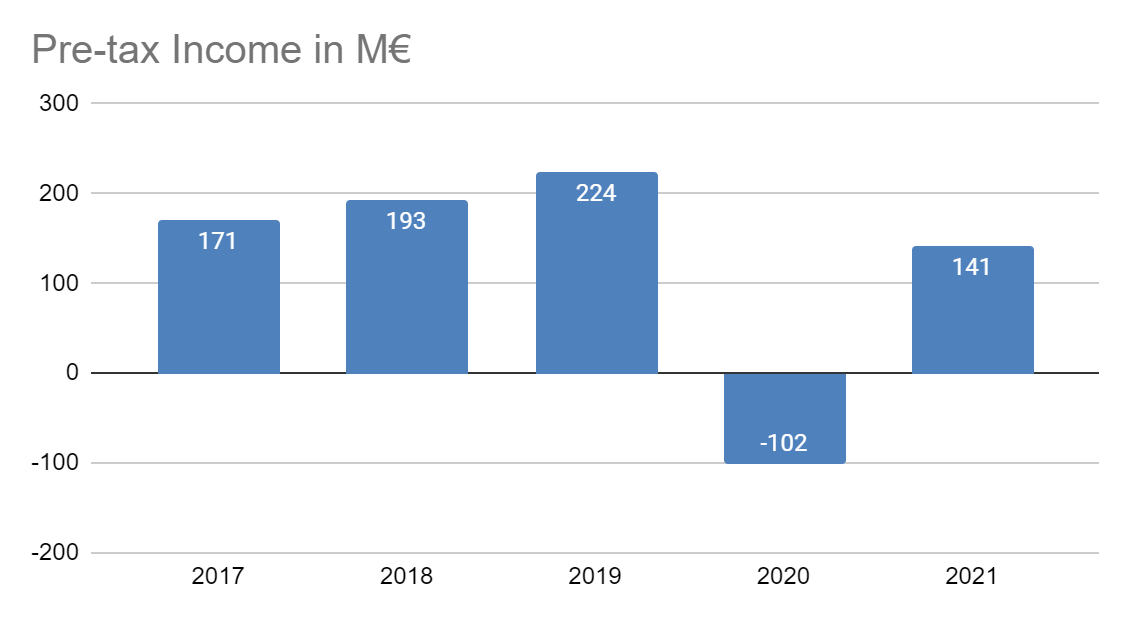

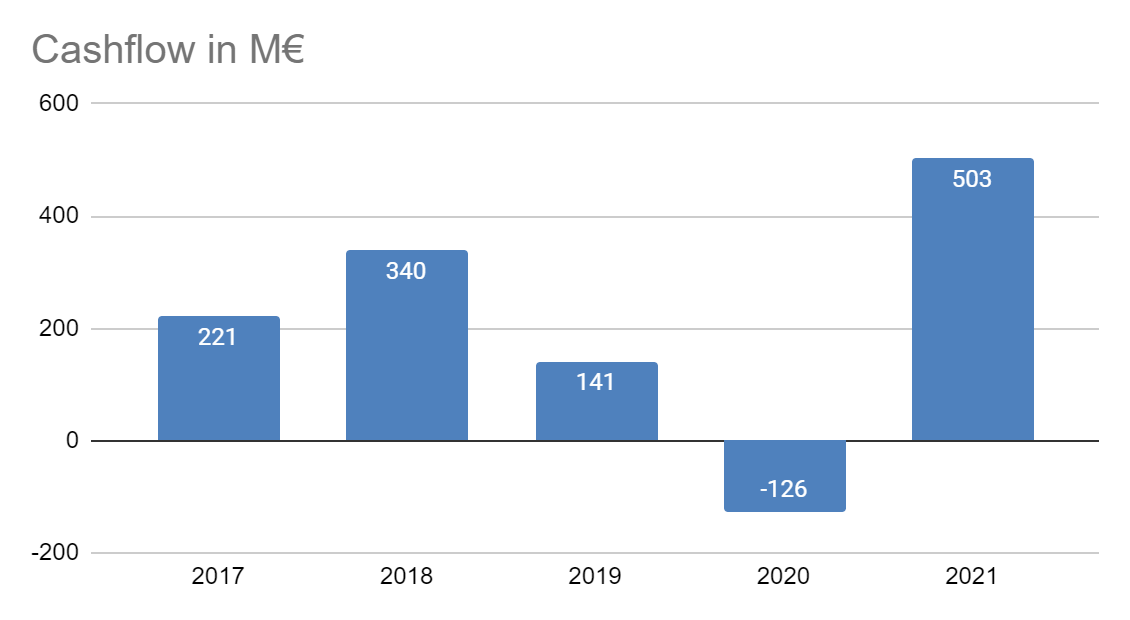

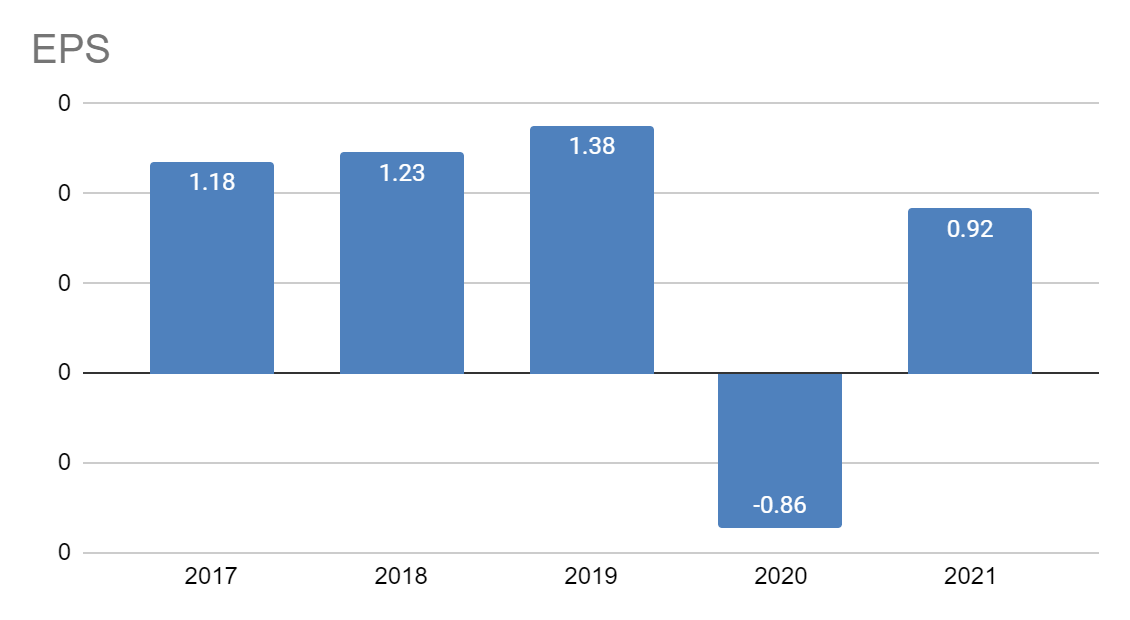

However, in the end to get a view on the progress of the firm, we’ll take a look at the development of some key KPIs.

Revenue in M€ (Morningstar)

Pre-tax Income in M€ (Morningstar)

Cashflow in M€ (Morningstar)

EPS (Morningstar)

As can be seen, the pandemic massively negatively affected the company which, of course would be expected.

However, pre-pandemic we can see that the yearly tendency was towards steady growth with rising revenue, EPS and cash flow.

Incidentally, the out of sorts 2021 cash flow figure can be explained due to the increased presales for events as well as the economic aid programs provided in Germany and abroad in connection with the COVID-19 pandemic.

In general, we see that the company has shown consistent growth over the years which is again reflected in their share price.

5 year share price development (Google Finance)

The past 5 years has shown a share price growth of 50%.

Outlook

Quite why this company is worth looking at lies in its dominant position in Europe and the benefits any market dominance brings, namely the price they can offer as well as the services.

This is best explained through two examples. Firstly, in the ongoing fight against ticket touting Eventim sold tickets for Ed Sheeran’s European tour exclusively via their proprietary digital ticket, the EVENTIM.Pass. Tickets could only be displayed in the app on the buyer’s phone. This pushing out of ticket touts is a trend that is desired not only by major artists but by almost all event organizers in order to avoid secondary markets with inflated prices.

One could be kind and look at this as a consideration towards loyal fans but I am inclined to believe that by closing this black market eventually the event organizer will try to maximize income. If there is someone willing to pay more, then why allow a ticket tout to take that sum.

Secondly, CTS plans to build Italy’s biggest, multifunctional arena in Milan. Scheduled for completion in autumn 2025, it will accommodate up to 16,000 people and will also offer a piazza consisting of more than 10,000 square meters of open space for holding open-air events. The arena’s inaugural event will be the 2026 Olympic Winter Games, which will also be when the CTS Group takes over operation of the arena. By also owning live event places, which they do in other cities around Europe, they are per default the ticketing choice. CTS Eventim was the exclusive ticketing partner for the Olympic Games in 2006, 2014, and 2016 and the 2006 FIFA World Cup.

Their market strength allows them economies of scale and through ownership of arenas- they are the default ticketing choice whenever events are held there.

This coupled with the fact that after a two year hiatus, both fans and event organizers are eager to return to live events this bodes well for the near-term.

But this is not all. The firm has plans to expand into Asia as well as the lucrative North American market. Breaking America will not be easy and the competition against incumbent Ticketmaster (LYV) will be worth watching. This foray into North America will be done in a joint venture together with former Live Nation Chairman Michael Cohl. Key to the future success of CTS Eventim will be its ability to break into this market. Signs are that competition is desired and so perhaps if venues are willing to partner with CTS Eventim if only to break the dominance of Ticketmaster, this could be very promising for the firm.

One last notable future development comes through CTS Eventim’s purchase of simply-X, a provider of event management products. This further provides the company with new areas of monetization (through payment and customer loyalty solutions), together with the accompanying hardware such as scanning pedestals and turnstiles.

With a 2023 expected revenue of 1.7 billion euros, EBIT approaching 300 million and EPS of 1.9 the growth seems set to continue. This could even be an under-expectation that may not fully capture the returning demand. This should be seen with the net debt of, at the end of 2021, -336m€. This value seems one that the company is able to handle for now but expansion takes money as well, but at least the debt is not overwhelming for now.

The future looks bright, the question is how to value the stock.

Valuation

CTS Eventim currently holds a P/E of 45. Historically, the high expectations and growth of the company has meant a consistently high P/E which has often deterred investment. In the past 5 years the P/E hit a low of 26 but has often found itself at over 30. At current valuations it would not be desirable to take a stake in the firm but it would be worth keeping an eye on the stock development as well as its progression into the North American market. Positive signs that it can make headway in the U.S. could be a catalyst for further stock growth and the current overall market weakness may provide a decent opportunity to take a stake.

Dividend

Understandably, the dividend was suspended for the years 2020 and 2021 but is expected to return for the current fiscal year. The expectation would be for a payout in line with pre-pandemic figures.

|

Payout Year |

Yield % |

Dividend |

Currency |

|

2021 |

— |

0 |

EUR |

|

2020 |

— |

0 |

EUR |

|

2019 |

1.90 % |

0.62 |

EUR |

|

2018 |

1.52 % |

0.59 |

EUR |

|

2017 |

3.27 % |

0.98 |

EUR |

|

2016 |

1.25 % |

0.46 |

EUR |

|

2015 |

1.63 % |

0.4 |

EUR |

Source: Investing.com

The dividend has shown growth in its payout years but it’s not a yield to write home about, nor is it really possible to draw any conclusions. One could make the estimation that if earnings continue to grow and the dividend consequently also, then in the future this could hold an attractive spot in any dividend-centric portfolio. However, dividend growth is not something the company has indicated is of importance to them and so such an expectation would only be speculation at the moment.

Overall

This is a stock with good growth potential and a track record of being best in class in its industry. No wonder then that the stock price reflects this. The expected return of live events in 2022 and the pent up demand should mean a return to highly profitable ways for the company for the foreseeable future.

Furthermore, the company should be relatively isolated from inflation issues given the price elasticity for in-demand events and that ticketing pricing would rise in-step.

Future expansion into North America and Asia as well as desires to further monetize within the value chain through its takeover of simply-X, show that continued growth is central to its plans.

At current valuations I would not be tempted to dip my toe but this is a stock I will actively keep an eye on in order to purchase on any weakness or positive indications of its expansion in the U.S.

It does seem to have a small trading volume in the US, but despite this has availability in etoro.

Be the first to comment