Spencer Platt/Getty Images News

After the market closes on October 20th, the management team at CSX Corp. (NASDAQ:CSX) is expected to report financial results covering the third quarter of the company’s 2022 fiscal year. Naturally, this quarterly release will be an important one. Not only are there mounting concerns about a union strike; But also there exists some uncertainty about the state of the economy. Although risks remain, the company does look to be attractively priced, especially relative to similar peers. Given this relative performance, as well as the underlying quality of the company, I do believe that it represents an attractive ‘buy’ opportunity at this point in time.

CSX – A great stock at a good price

It has been a while since I have written about CSX Corp. But that doesn’t mean that I haven’t followed the company rather closely. Back in 2015, I published an article on the firm, calling it an attractive prospect. I based this on the company’s historical financial performance as well as how shares were priced at that time. This led me to rate the company a ‘buy’, reflecting my belief that it would likely outperform the broader market for the foreseeable future. Since then, things have played out quite nicely. While the S&P 500 is up by 78.2%, shares of CSX Corp have generated a return for shareholders of 182.2%.

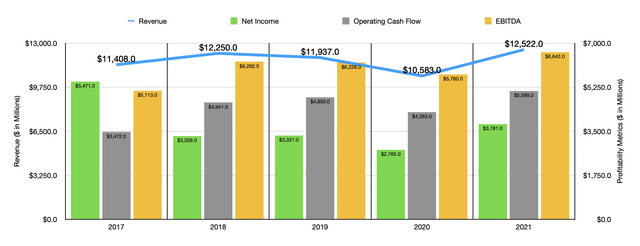

This return disparity has not been without cause. To see what I mean, we need only look at recent financial performance achieved by the company. Consider the past five years. From 2017 through 2021, revenue for the business expanded from $11.41 billion to $12.52 billion. Admittedly, the trend for the company was quite lumpy. From 2018 through 2020, sales of the firm decreased, with the 2020 fiscal year particularly impacted by the COVID-19 pandemic. The roughly 18% increase in sales between 2020 and 2021 was driven by a combination of factors. For instance, in July of 2021, the company acquired Quality Carriers in a deal valued at $544 million. Having said that, that represented only one component of the sales increase. Overall, the firm benefited from higher shipment volumes, including an 11% increase in coal, a 9% increase in intermodal, and a 1% increase in total merchandise. Combined, volume for the company rose by 6%. The company also benefited from higher revenue per unit. Under the total merchandise category, revenue grew by 5%. For intermodal, that increase was 9%, while for coal it was 16%. All combined, pricing jumped by 12% for the company from $1,796 to $2,003.

Author – SEC EDGAR Data

As revenue has risen, profitability has largely followed suit. But this comes with a qualifier. Actual net income for the company has been very volatile from year to year. This can be seen in the chart above. But if you look at other profitability metrics, the picture is much clearer. Operating cash flow rose from $3.47 billion in 2017 to $4.85 billion in 2019. In 2020, the metric dipped to $4.26 billion before spiking to $5.10 billion last year. Another profitability metric to pay attention to is EBITDA. It ultimately increased from $5.11 billion in 2017 to $6.64 billion in 2021.

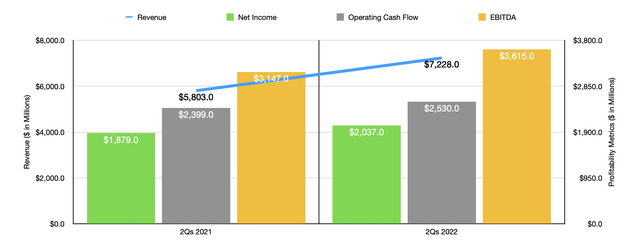

Performance for the company has continued to be robust in the current fiscal year. Revenue for the company in the first half of the 2022 fiscal year totaled $7.23 billion. That represents an increase of 24.6% over the $5.80 billion generated the same time one year earlier. In addition to benefiting from the aforementioned acquisition being on the company’s books a full year, the firm also benefited from its acquisition of Pan Am Systems that was completed on June 1st of this year in exchange for $601 million. In all, the company actually experienced a 1% drop in volume, but this was more than offset by a 26% increase in revenue per unit, with a rise from $1,860 to $2,338. Most of that increase, it should be said, was related to coal, with revenue per unit up 56%. By comparison, intermodal revenue per unit rose just 15%, while total merchandise revenue was up 9%.

Author – SEC EDGAR Data

This increase in sales brought with it improved profitability. Net income rose from $1.88 billion to $2.04 billion. Operating cash flow rose from $2.40 billion to $2.53 billion. And EBITDA for the company increased from $3.15 billion to $3.62 billion. Management has used this opportunity to significantly step up share repurchases. In addition to increasing its dividend by 7%, the company acquired 76 million shares in the first half of the 2022 fiscal year for a combined price of $2.52 billion. Compared to the second quarter of the company’s 2021 fiscal year, the share count of the business declined by 4.9%, or 112 million in all.

For the third quarter, analysts expect growth for the company to continue. Revenue is currently forecasted to be $3.77 billion. If this comes to fruition, it would translate to a year-over-year increase of 14.5% compared to the $3.29 billion generated one year earlier. Earnings per share are forecasted to be $0.49. This compares to the $0.43 per share generated in the third quarter of 2021. Given the share count the company had as of the end of the second quarter, that would translate to net income of $1.06 billion. This stacks up against the $968 million in net profits generated in the third quarter last year. No estimates could be found when it came to other profitability metrics. But we should expect those to increase as well. For context, operating cash flow in the third quarter last year was $1.42 billion. And EBITDA totaled $1.77 billion.

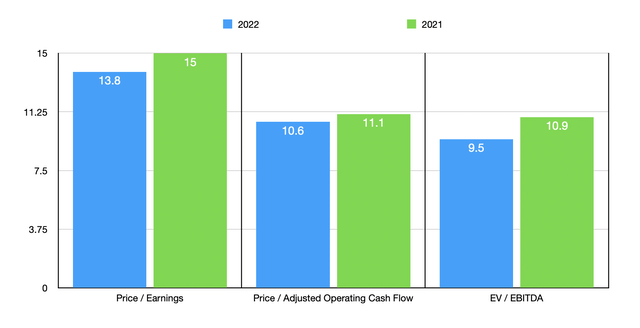

Author – SEC EDGAR Data

We don’t really know what to expect for the entirety of the 2022 fiscal year. We do know that management forecasted revenue growth and operating income growth to be in the double-digit range. A simple approach is to annualize the results experienced for the first half of the year. That would give us net income of $4.10 billion, operating cash flow of $5.38 billion, and EBITDA of $7.63 billion. Based on these figures, the company is trading at a forward price-to-earnings multiple of 13.8. The forward price to operating cash flow multiple is 10.6, while the forward EV to EBITDA multiple should be 9.5. Using data from 2021, these multiples would be 15, 11.1, and 10.9, respectively. As part of my analysis, I also compared the company to four similar firms. As you can see in the table below, using the data from 2021 even, shares of CSX Corp. are cheaper than its peers.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| CSX Corp | 15.0 | 11.1 | 10.9 |

| Norfolk Southern (NSC) | 24.6 | 17.4 | 14.8 |

| Canadian Pacific Railway (CP) | 21.4 | 16.7 | 21.2 |

| Union Pacific (UNP) | 25.3 | 18.3 | 16.0 |

| Canadian National Railway (CNI) | 22.3 | 15.7 | 14.0 |

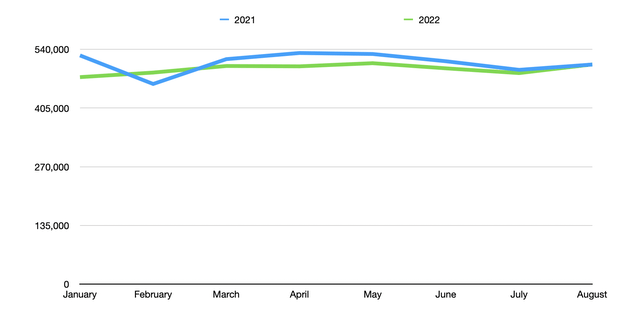

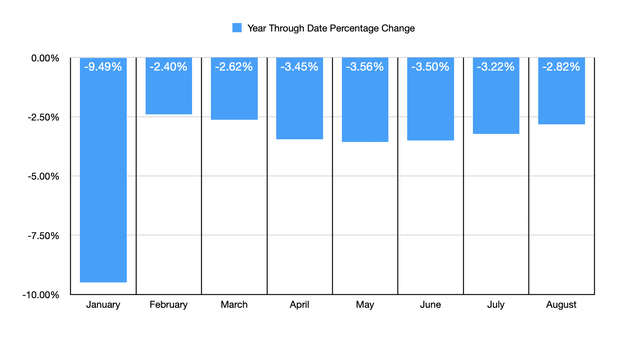

This is not to say that things are going to go great for the quarter or that the company is going to experience significant upside. There are certain risks involved right now. First and foremost, overall railroad volume in the US has been down relative to the 2021 calendar year. According to one source, total rail volume is down over 2.8% through the month of August. Though as one of the charts below illustrates, the aggregate year-over-year change has been improving for a few months. This trend can be seen when looking at the most recent weekly estimates provided as well. For the week ending October 8th, total rail volume in the US was down 2.4% year over year, with carload volumes flat while intermodal volumes were down 5%. Despite broader economic concerns, the overall trend for volume does look to be improving. Another concern would be the threat of union strikes. Despite the Biden Administration stepping in, the most recent bargaining contracts between some unions and railroad operators ended up being voted down. With 76% of its workforce unionized, CSX could face some interesting ramifications should union demands not be met or compromised on to some degree.

Author – Association of American Railroads

Author – Association of American Railroads

Takeaway

Based on the data provided, I do believe that CSX is a best-of-breed prospect right now. The company does face some risks at this point in time. But fundamentally, the firm is solid and generates significant cash flow. Shares are also cheap, both on an absolute basis and relative to similar players. But I wouldn’t say that shares are so cheap that the company could be considered a deep-value play. All things considered, the data does suggest a solid ‘buy’ rating leading into its third-quarter earnings release. But investors would be wise to see how the firm performs in this environment and would be wise to continue to keep an eye out on union issues.

Be the first to comment