Vladislav Chorniy

Investment Thesis

CS Disco (NYSE:LAW) announced its Q2 2022 results, which showed a sudden stagnation of revenues. This negative news has been amplified by management’s surprisingly large guidance cut for the full year, which resulted in the share price falling more than 50%. Although I think the fundamental picture is somewhat better than it looks at the first sight, the significantly increased level of uncertainty around the short- and medium-term fundamental picture justifies to step to the sidelines for now.

Business Overview

CS Disco is a legal tech company reshaping the legal services industry that has fallen behind in technological innovation. The main service the company provides is its Ediscovery solution, which is about collecting and preparing electronically stored data for litigations and legal disputes. It eliminates a lot of manual work for lawyers, making the process more efficient. This core service is extended by Disco Review, the AI-assisted legal document review service of the company. Finally, Disco Case Builder, a collaborative tool for lawyers to review testamentary evidence, Disco Hold, a legal hold service and Disco Request, a tool for automating response compliance make the product suite complete.

Soft Q2 Results With Surprisingly Large Guidance Cut

Until the release of its Q2 2022 earnings, the company showed strong growth momentum, with March being its strongest ever month for its leading Ediscovery product. However, based on Q2 2022 results and the accompanied management guidance for the rest of the year, the short-term fundamental picture has worsened remarkably.

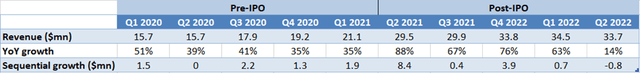

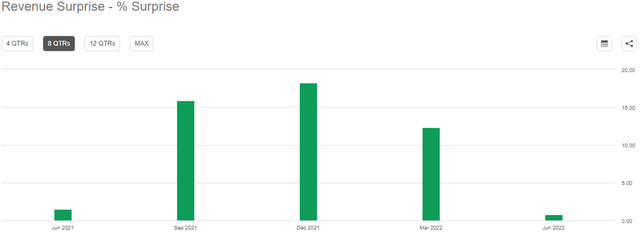

Disco reported revenues of $33.7 million for the Q2 2022 quarter, which was only slightly above consensus guidance after an average beat rate of 15.5% in the previous three quarters:

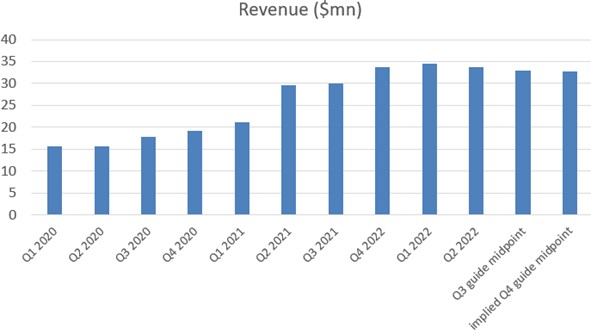

YoY growth decreased partly due to an unusually high base in Q2 2021, but this has been the first quarter since Disco’s IPO that revenue decreased on a sequential basis:

Created by author based on company fundamentals

Although top line results for the company can be quite volatile, partly resulting from its usage-based pricing model, in the last few quarters it seems that revenue growth has stalled. Based on the company’s guidance for Q3 2022 and the full year, it seems that even with a slight beat, no change is expected on that front:

Created by author based on company fundamentals

After the soft Q2 quarter, Disco has cut its full year 2022 revenue guidance from ~$151 million to ~$134 million, which would represent “only” 17% YoY growth for 2022. This would mean a huge deceleration from the 67% YoY growth in 2021. It seems that all of a sudden, the short- and medium-term growth path for the company turned upside down. But what’s driving these changes?

Disco Review – The Weakest Link

Management tried to give some more color on fundamentals than usual on its Q2 2022 earnings call, but in my opinion still couldn’t satisfy investors. The company blamed the soft quarter and the unexpectedly conservative guidance on the volatility of Disco’s Review product:

“I think the magnitude we’re talking about in the Review business and specifically what we saw a shortage of in the second quarter are a couple of, one, two or three, large reviews billing north of $1 million per quarter. The presence or absence of one to six of those reviews can take a quarter from good to great to a complete home run. And again, that is volatility that’s created by the big ticket sizes in Review, as well as the relatively small size of the Review revenue base today.” – Kiwi Camara, Founder and CEO

At quarterly revenues between $30-35 million, a few million dollars plus or minus can alter the big picture in a great extent indeed. What I miss is that management didn’t highlight this specific topic on previous earnings calls before (although they regularly called out possible revenue volatility due to the usage-based pricing model in general), only after the damage to the share price has been done. This was partly why I wanted to highlight in my previous article on the company by calling out lack of short-term visibility into fundamentals, although I must admit, I didn’t expect such a sudden change at all.

Another visibility problem is that management still doesn’t break out the exact contribution of Disco’s products to total revenue. However, in the Q2 earnings call they shared that they expect the Ediscovery product to reach revenues of more than $100 million this year, which based on full year guidance of ~$134 million puts its share around 75%. Based on this, Disco Review could generate around 20% of Disco’s revenues with significant volatility from quarter to quarter as other products are still early in monetization.

What makes things even worse from a visibility perspective in my opinion is that management made drastic cuts to expected Disco Review revenues for Q3 and Q4 2022, extrapolating its weaker than usual performance in Q2 for the whole year:

“Our revised 2022 revenue guidance is primarily attributed to the volatility in our Review business and conservatively incorporates the potential for incremental headwinds that may materialize in the back half of the year.” – Kiwi Camara, Founder and CEO

Let’s suppose that revenues from the product made out an average of $8 million in the past few quarters, before they sunk suddenly to $2 million in Q2. If management decided to extrapolate this sudden negative change into the Q3 and Q4 guidance (based on the $17 million cut to 2022 revenue guidance I think they did), it could have been perceived as a more dramatic negative fundamental change by investors than it really is. Based on Disco’s admittedly ultraconservative way of guiding, I think this has been the case.

Unfortunately, we don’t know whether this volatility in the Review business was simply due to the “bad” timing of large lawsuits, some temporary weakness related to the current macroeconomic slowdown or a structural change in the business. Management called out the first one, but cutting the full year guidance so drastically at the same time confuses investors, in my opinion.

Disco Ediscovery – The Stable Point

Although, as mentioned before, Disco doesn’t break out revenue by product categories, the company shared with investors for the first time that its leading Ediscovery product could reach revenues north of $100 million this year, growing more than 30% YoY. As this puts the product’s share of total revenue around 75%, it shows that the larger part of Disco’s business is still holding up well. Customer count grew 27% YoY as of the end of Q2 to 1,255, which also supports the fact that things are not as bad as the huge guidance cut could’ve implied.

Margins Deeper In The Red

Despite the large guidance cut, management didn’t materially change its investment plans for the year, which resulted in a -43% EBITDA margin guidance for 2022 after the previous quarter’s -31% guide. According to management, margins will gradually improve from 2023 as the company moves more towards its long-term margin profile. Based on this, I think it could take a few years until Disco makes profit, but with its gross margin of 74-76% in the last four quarters the longer-term profitability picture could be promising. However, investors will need a lot of patience until the company gets there.

Valuation And Short-Term Expectations

After the market cap of a company halves, I think the curiosity in investors arises, whether it has been just an overreaction by the market, and whether it would be a good time to buy for the long-term at a lower price. If my suspicion holds, and the large guidance cut was overly conservative by management (and it just frightened investors) perhaps this could be the case. However, I think as investors are currently left in the dark with the short-term fundamental picture, it would be prudent to wait until the fog around Disco’s real growth prospects clears.

After falling more than 50% on Friday, Disco’s shares trade around 5.4 times 12-month forward sales. Unfortunately, as there is a big question mark around the company’s current growth prospects, it’s hard to put this into perspective. In my previous analysis, I have considered a forward P/S ratio of 8.2 as cheap, but in the light of 30% growth for the next 3 years. Observing current stagnation in revenue and taking a large volatility premium into account, I am not sure that the current forward P/S ratio of 5.4 can be considered as cheap. For example, there is Smartsheet (SMAR) with its current ratio of 5.9 growing revenues stable above 40% YoY in the last few quarters. Compared to this, Disco’s current valuation doesn’t seem too compelling, even that I think that SaaS valuations should be higher in general.

Conclusion

Based on the above, I cut my rating of Disco from Strong Buy to Hold for two reasons: Firstly, there was an obvious slowdown in the company’s revenue growth momentum in Q2, and it’s currently not clear how this could affect short- and medium-term growth prospects. Management’s surprisingly large guidance cut makes this uncertainty only worse. Secondly, in the light of Disco’s unusually large revenue volatility within the software space, the current valuation of shares is not suppressed enough to take the risk associated with the company.

For those investors, who are rather risk seekers, it could be a possibility to buy the shares before Q3 earnings in anticipation that there could be a larger beat due to the seemingly low bar set currently by management. Otherwise, I don’t see a reason to get excited about the shares now, as investor confidence has been shaken, which doesn’t seem to heal quickly.

Be the first to comment