Bitcoin, Ethereum, Coinbase Talking Points

Persistently high inflation remains at the forefront of risk sentiment proving that the days of Bitcoin being perceived as a hedge against inflation are long gone. In response to Friday’s US CPI report, a higher probability for the Fed to hike rates by 75bp resulted in broad sell-off in risk assets, dragging the crypto market cap with it.

Visit the DailyFX Educational Center to discover how central banks impact Forex

With the FOMC meeting currently underway, the crypto massacre has taken a slight breather, allowing Bitcoin to find support above the key $20,000 handle. Although fundamentals have been priced in (to a certain extent), the Fed interest rate decision and the accompanying Press Conference may still provide an additional catalyst for price action if further monetary tightening measures are announced.

DailyFX Economic Calendar

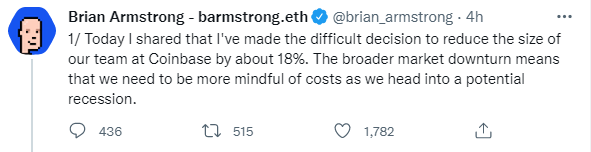

As digital assets remain vulnerable to wanning sentiment, Coinbase CEO Brian Armstrong announced that the largest US crypto exchange would be reducing their workforce by 18% bringing the health of the industry into question.

With Bitcoin currently trading at December 2020 levels, key technicals may provide additional layers of support and resistance for the imminent move.

For now, the key $20,000 psychological level remains as critical support with a break below opening the door for two major Fibonacci levels residing at $18,397 and $17,569 respectively. Meanwhile, the MACD (Moving Average Convergence/Divergence) remains below the zero line,suggestive that bears continue to drive price action, at least for now.

Bitcoin (BTC/USD) Daily Chart

Source: TradingView, Chart by Tammy Da Costa

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

Be the first to comment