Fokusiert/iStock via Getty Images

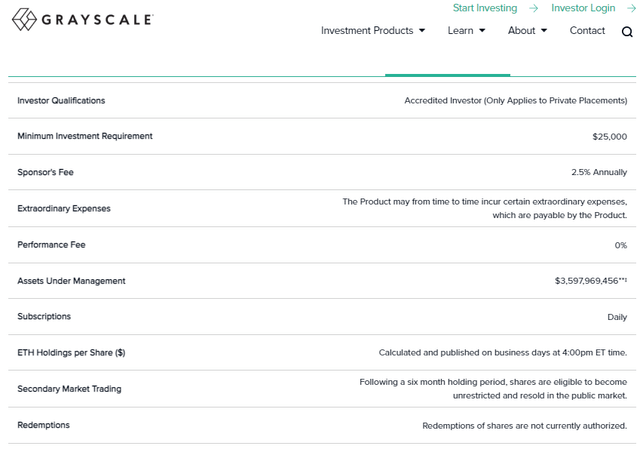

The Grayscale Ethereum Trust (OTCQX:ETHE) is a way to play moves in the world’s second-largest digital currency. According to Grayscale, the Trust is solely and passively invested in Ethereum (ETH-USD), enabling investors to gain exposure to ETH in the form of a security while avoiding the challenges of buying, storing, and safekeeping ETH, directly.

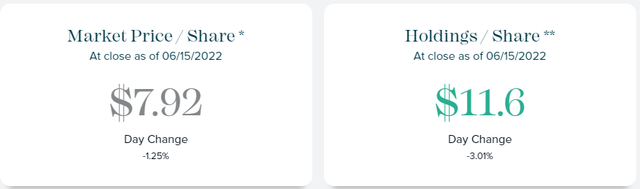

ETHE, with $3.6B in assets, comes with a hefty annual fee of 2.5%. The product trades at a severe discount to the value of its holdings per share, according to Grayscale. The fund is designed to track the CoinDesk Ether Price Index. This is not your typical exchange-traded product: You can learn more about ETHE specifics here.

ETHE Trades At A Discount To Holdings Value Per Share, Per Grayscale

Know What You Own And Why You Own It

Wild Moves In The Wildest Markets

Crypto finally plunged after a protracted consolidation from mid-May through early June. Four weeks of sideways price action felt like an eternity for crypto holders and those playing the space’s typically high volatility. Ultimately, the downtrend continued. On June 10, both Bitcoin (BTC-USD) and Ether plummeted to lows not seen since last year. Many risky assets endured sharp losses that Friday following the one-two punch of a troubling U.S. CPI report and then red-hot 5-10-year inflation expectations within the University of Michigan Consumer Sentiment survey. That forced the Fed’s hand to a 75-basis point rate hike this week.

Then came the weekend. As stock and bond traders likely put down a few hard drinks, the still-open crypto markets put in fresh lows. News that Celsius would no longer permit withdrawals led to further crypto losses. Then came news that Binance would do the same. At a broader level, job cut announcements from major crypto companies like Coinbase (COIN), Crypto.com, and BlockFi proved just how much turmoil is happening right now in the crypto and DeFi lands. Are we on the precipice of another so-called crypto winter? Let’s look at a few charts before going all doom and gloom.

Analyzing Crypto Price Action

I like to first review what’s happening with the total crypto market cap, according to Tradingview.com. It has sunk to the lowest value since January 2021. Now under $900 billion in market cap, a more than 70% haircut off the November all-time high above $3 trillion last year is no doubt rattling for hodlers.

Total Crypto Market Cap Plunges Below $1 Trillion, A 17-Month Low

The Technical Take

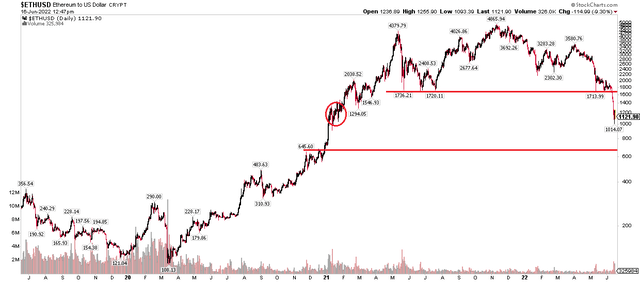

Ether itself is back to where it traded in early 2021. That was a time of incredibly bullish sentiment. That’s also when prices surged from around $600 to $1200 in short order. ETH then consolidated for several weeks before taking a leg higher. The $950-$1000 area could be supportive, but that is not a strong area of demand. Ultimately, a move toward $650 could be in the cards – that’s the late 2020 peak. Once support just above $1,700 was broken, all hell was set loose.

Ethereum: Weak Support Here, Bigger Demand Likely Near $650. Upside Resistance at $1700.

The Bottom Line

ETHE is a complicated way to play moves in ETH-USD. It is a costly product that has major stipulations. I would advise caution when transacting and holding it. You could simply buy and sell Ether on the most established exchanges but expect volatility. As a technical analyst, further downside might lie ahead if $1,000 is broken. Next support is at $650. On the upside, $1,700-$1,740 will be significant resistance. Keep those spots in mind when trading ETHE.

Be the first to comment