greenbutterfly CryoPort

“Price is what you pay, value is what you get. – Warren Buffett

Author’s note: This is an abridged version of our flagship article (IBI Portfolio Research/Action) on Cryoport that was published in advance for IBI members on November 12.

In biotech investing, you are certain to encounter great volatility. That is to say, you can expect your stock drops 20% only to rebound higher within days. Hence, you should not allow volatility to scare you out of the investing game. Rather, you can leverage it to your biggest gains. Amid volatility, you should instead reassess the stock’s fundamentals to ascertain that the drops are only temporary. In other words, you want to make sure that the tumbling is either market sentiment or temporary difficulty.

Post-earnings report, Cryoport (NASDAQ:CYRX) shares tumbled over 20% in one trading session only to rebound higher in the following days. I strongly believe that despite the macroeconomic headwinds, the investing fundamentals remain intact. In this research, I’ll feature a fundamental analysis of Cryoport and share with you my expectation of this intriguing grower.

Figure 1: Cryoport chart

About The Company

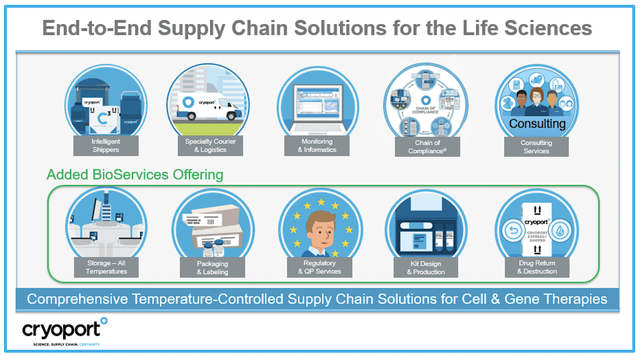

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. I noted in the prior research,

Operating out of Nashville, Tennessee, Cryoport provides logistic solutions for the CAR-T, cell/gene-based therapy, and regenerative-medicine innovators. That is to say, the company offers strict temperature-controlled transport and storage of biological specimens to ensure their livelihood, efficacy, and safety. As you can see, these biological specimens are sensitive to temperature and other environmental factors. As such, it’s crucial to transport and store them in a highly controlled environment like what Cryoport is providing.

Figure 2: Logistic business

Latest Operating Results

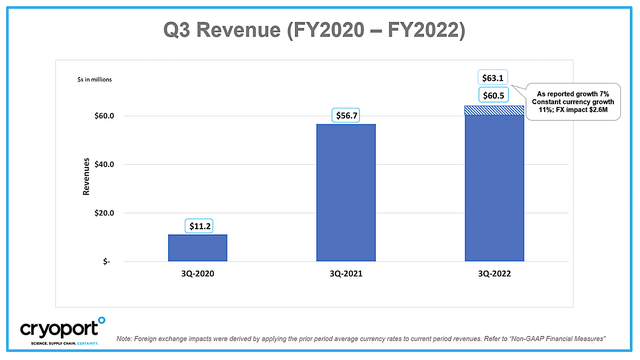

Shifting gears, let us analyze the latest operating results. For Q3, Cryoport enjoyed the 60.5M in revenue compared to $56.7M for the same period a year prior. As such, this represents a 7% year-over-year (YOY) increase. If you assume a constant currency exchange, the YOY improvement would have been 11%. According to the management,

During the third quarter, we saw a shift in cryogenic freezer sales through distributors to smaller, lower cost units. Other macroeconomic pressures that impacted revenue included: industry capacity limitations; a negative foreign exchange impact of $2.6 million; re-occurring COVID lockdowns in China; supply chain related issues; and the Russia/Ukraine war and its ripple effect throughout Europe.

Figure 3: Cryoport latest quarterly sales

As you can see, the macroeconomic factors hamper growth which caused investors to be skittish about Cryoport. In my view, investors believe that we are heading into an economic recession. And, you can expect the chances of us going into a recession are high. Therefore, companies reduced their focus on buying smaller-priced items due to liquidity concerns.

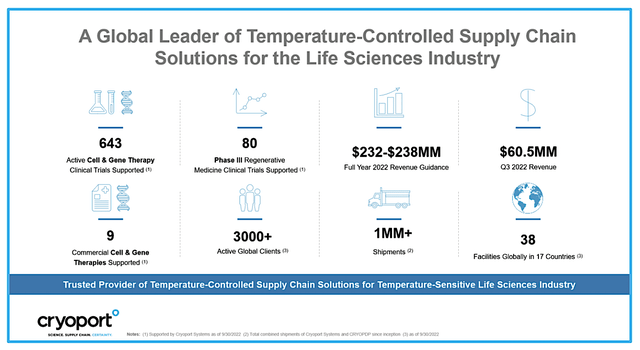

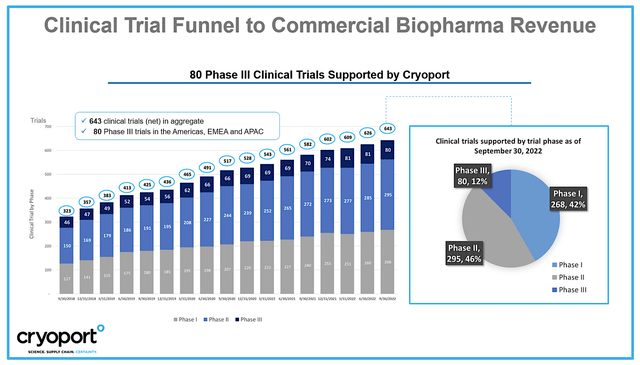

Nevertheless, the big picture is that these innovators will always need logistics support for their biological specimens. They can’t simply drop all clinical trials. From the figure below, you can see that Cryoport is now supporting a total of 80 Phase 3 studies, 643 active cell/gene therapy investigations, 9 commercial products, and over 1M shipments. Instilling confidence in investors, the CEO (Jerrell Shelton) transparently remarked,

We have not seen erosion in demand from our key cell and gene therapy customers as Cryoport Systems grew over 25% year-over-year and as we continued to increase the number of clinical programs that Cryoport supports, adding another 17 clinical trials during the quarter … However, the impact from the previously mentioned macroeconomic factors affected other parts of our business and prompts us to reevaluate our annual guidance for 2022. Based on these factors, we are now anticipating full year 2022 revenue to be in the range of $232M to $238M.

Figure 4: Robust operational performance

Putting it all together, you can expect that this is simply temporary. Companies would indeed continue to utilize Cryoport services. Though at a slower pace, the trend for an increasing number of clinical trials being supported will continue to rise. You can imagine that halting such services would be like starving yourself in the face of an economic crisis. That simply won’t happen. Against the macros headwinds, you can bet that Cryoport is still generating the remarkable 7% YOY growth.

Figure 5: Increasing studies being supported by Cryoport

The other thing you should keep in mind is that a growth stock like Cryoport usually tumbles most drastically during economic downturns. That’s just the nature of the beast. Notwithstanding, they will rebound the most vigorously at the next economic prosperity to give you an overall alpha. Pertaining to Mr. Shelton,

… We continue to position ourselves for anticipated rapid growth in the cell and gene industry, through product and service developments including our newly commissioned Cryoport Systems Global Supply Chain Center Network, the expected launches of the Cryoportal Logistics Management System 2.0, SkyTrax, a revolutionary condition monitoring system, the CryoSphere, a revolutionary Elite shipper that reduces shipping risks for cell and gene therapies, new model launches of MVE Vario and MVE Fusion freezers, and our Direct-to-Patient service over the next few quarters. These new products and services are expected to further expand our market presence, create new future revenue streams, and enable us to support the growing number of commercial cell and gene therapy products more broadly.

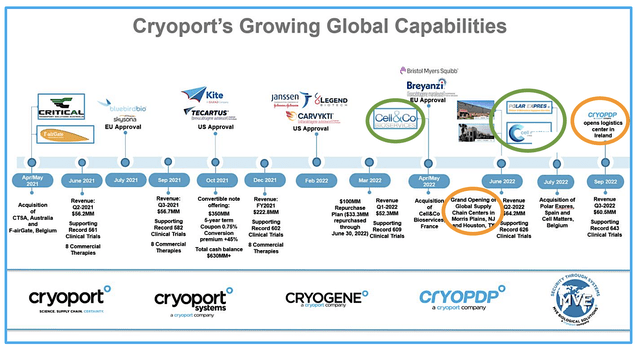

Growth Catalysts

Beyond what we discussed, there are several recent acquisitions and centers opening to boost additional sales growth in the coming years. If you recall from the prior article, Cryoport bought out Polar Express to gain a presence in Spain back in July. Therefore, that deal now gives Cryoport access to the largest reproductive medicine in Continental Europe. In April, Cryoport also acquired Cell&Co BioServices to gain the largest storage/bio-bank in France and Europe.

That aside, the company recently put its logistics center in Ireland on the map. Through its strategic partnership with Takeda’s BioLife Plasma Services, Cryoport is also building its facility in Houston. As such, this proactive approach positioned the company to enjoy growth sooner than you might expect. Mr. Shelton enthused,

Our efforts to proactively address our macroeconomic challenges are far ranging. We are entering the market for apheresis collection to answer the industry need for better starting materials in cell and gene therapies through our recently announced strategic relationship with Takeda’s BioLife Plasma Services. This partnership is expected to generate new revenues for Cryoport beginning in 2023 and stretching over years to come. We believe Cryoport has never been stronger with significant industry changing business development initiatives underway. We feel that these strategic actions will strengthen our business and position us to begin to take advantage of opportunities in 2023 and beyond. The commitment of our team is resolute and its commitment to deliver solutions that support life-saving cell and gene therapies is second to none.

Figure 6: Growth catalysts to boost Cryoport’s global capability

Management Transparency

As you know, I place heavy emphasis on management. Over the years, I learned that most executives of a public company typically have tremendous experience and an esteemed educational background. Therefore, you won’t get much insight by focusing on that. It’s more strategic for you to pay attention to whether management is transparent and open with investors during difficult times.

A management that clams up during periods of turmoil isn’t worthwhile your time. That is to say, they don’t have the character and thick skin needed to overcome obstacles in leading your company to prosperity.

On this front, you can appreciate that Cryoport’s management lets you know exactly the difficulty they are facing. More importantly, they have solid solutions to handle the macroeconomic issues while positioning the company to enjoy robust growth at the next economic upturn.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 3Q 2022 earnings report for the period that ended on June 30.

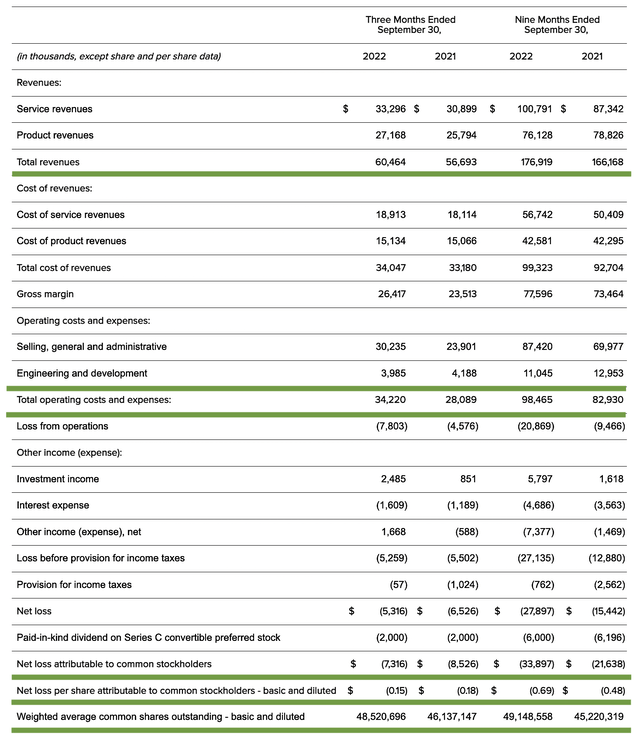

As you know, Cryoport procured $60.4M compared to $56.6M for the same period a year prior which is a 7% YOY growth. That aside, the engineering and development (i.e., E&D) for the respective periods registered at $3.9M and $4.1M. I typically like an increasing trend in research and development or E&D. After all, the money invested today can translate into billions of dollars in profits in the future.

Additionally, there were $7.3M ($0.15 per share) net losses versus $8.5M ($0.18 per share) declines for the same comparison. Hence, the bottom line is improved by 20%. You can see that this makes sense because Cryoport is spending less on E&D.

Figure 7: Key financial metrics

About the balance sheet, there were $530M in cash, equivalents, and investments. Against the $34.2M quarterly OpEx (and on top of the $60.4M), there should not be any concern about cash flow constraints. Simply put, the cash position and revenue are extremely robust relative to the spending rate.

Shares Repurchase Program

As you can appreciate, Cryoport’s Board approved the repurchase of $100M of their stocks from March this year through December 31, 2025. During the first nine months, Cryoport repurchased 1.3M shares at the average price of $24.84 for a total of $33.3M. As such, you still have another $66.7M left in this program. I elucidated,

A “quick and dirty” way to know if a stock is trading at a deep bargain is by looking at the company’s share repurchase program. Unless it’s a deep bargain, a company usually won’t execute shares buy back.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this stage in its growth cycle, the biggest risk for Cryoport is whether the company can continue to either increase or maintain its revenue trends. Moreover, there is a concern that not all acquisitions will bear fruits.

Conclusion

In all, I maintain my buy recommendation on Cryoport with a 5/5 stars rating. Cryoport is a special company for various reasons. As a logistic service provider, the company leverages the strong industry tailwind of cell/gene therapy innovators. Second, Cryoport grows aggressively both organically and through mergers and acquisitions. Despite the recent macroeconomic issues, the long-term future of Cryoport is brighter than ever. The company continues to ramp ups its revenues, clinical trials being supported, the opening of new centers, and acquisitions. If you are patient and leverage volatility to your advantage, Cryoport is most likely to give you a 10-bagger return in the next few years.

Be the first to comment