CRUDE OIL PRICE OUTLOOK:

- WTI crude oil prices extended higher to a two-and-half year high of $71.24

- This week’s EIA crude inventory data and Iran nuclear talks will be in focus

- WTI may attempt to challenge a key chart resistance at $73.50/bbl in the weeks to come

Crude oil prices extended higher during the Asia-Pacific mid-day session, marking a 3-week gain of 11.7%. The energy market is riding the tailwind of a global reflation theme, rapid rollouts of Covid-19 vaccines and a calibrated OPEC+ output plan. WTI is trading at the highest level seen in more than two and half years, extending its bullish trend with an eye on $73.50 – a key chart resistance.

More US residents are going outdoor and resuming their normal lifestyle as the pandemic eases. More than half of American adults have been fully vaccinated against Covid-19 and the government is aiming to have more than 70% of adults receiving at least 1 shot before July 4th. US daily air travelers surpassed 2 million for the first time since the pandemic, underscoring strong demand for fuel as the peak of the summer travel season arrives.

On the other hand, a strengthening US Dollar may exert downward pressure on commodity prices, limiting upside potential for oil. This may be attributed to heightened tapering fears as demand for the Fed’s reverse repo hit an all-time high on Friday, reflecting swelling liquidity at financial institutions. This strengthens the case for the Fed to taper asset purchases and put the spotlight on this week’s FOMC meeting.

Meanwhile, oil traders will eye this Wednesday’s EIA report for the latest update on fuel inventories. Last week, a surprisingly large build in gasoline fuel stockpiles dented prices, even though crude oil inventories fell more than expected (chart below). The agency also predicted that global oil demand will recover to pre-pandemic levels by the end of next year, painting a rosy outlook for energy prices.

Nuclear talks between Iran and world powers on reviving the 2015 nuclear accord resumed on Saturday. It appears that more time is needed to work out the details, and Iranian Deputy Minister Abbas Araghchi said a deal is unlikely to emerge in the coming week. Lack of clarity and progress in the nuclear talks may further strengthen oil prices as markets become less worried about additional Iranian oil output in the near term.

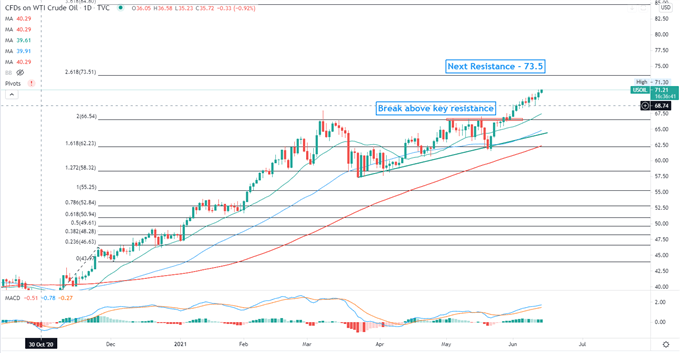

Technically, WTI breached above a psychological resistance of 70.00 last week and thus opened the door for further upside potential. The next key resistance can be found at around $73.50 – the 261.8% Fibonacci extension. The overall trend remains bullish-biased as suggested by the upward sloped SMA lines and rising MACD oscillator.

WTI Crude Oil Price – Daily Chart

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter

Be the first to comment