deyangeorgiev/iStock via Getty Images

Investment Thesis

Crown Castle’s (NYSE:CCI) shares have dipped by 30% over the past three months. Rising rates have pushed valuations down and increased the company’s interest expense. But I believe that the business is still strong on a fundamental level. It is well positioned to benefit from positive 5G trends. I think that this is a good opportunity for dividend growth and income investors.

Crown Castle Third Quarter Results And Guidance

In its third quarter earnings announcement, Crown Castle reported strong continuing demand. The company grew its top line by 8% year over year. Tower leasing grew 6% year over year, and the company has continued to rapidly grow its small cell segment. Small cells are small radio networks that are useful in high density locations. These are key to the rollout of 5G technologies.

Crown Castle Q3 2022 Earnings Presentation

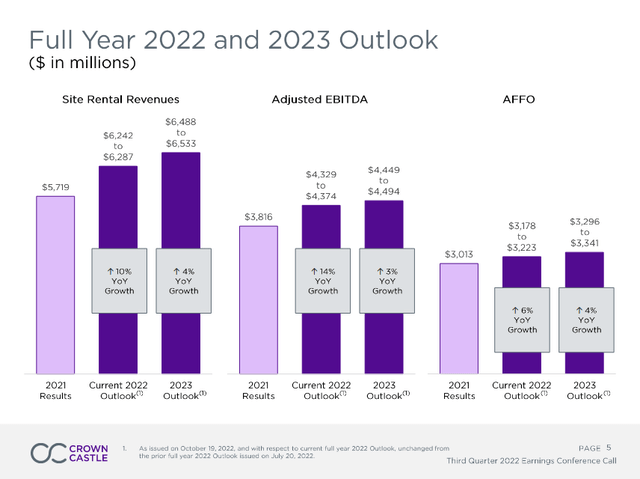

The company also released its 2023 guidance for the first time. Management’s forecast calls for 4% organic revenue growth next year. It also calls for 5% organic growth in the company’s core towers segment. The business’s fiber solutions segment is expected to be flat due to near term headwinds.

Management also discussed their growth plans for Crown Castle’s small cell business. They believe that the business is the largest opportunity for long term outperformance. Current guidance calls for 8% growth in the segment in 2023.

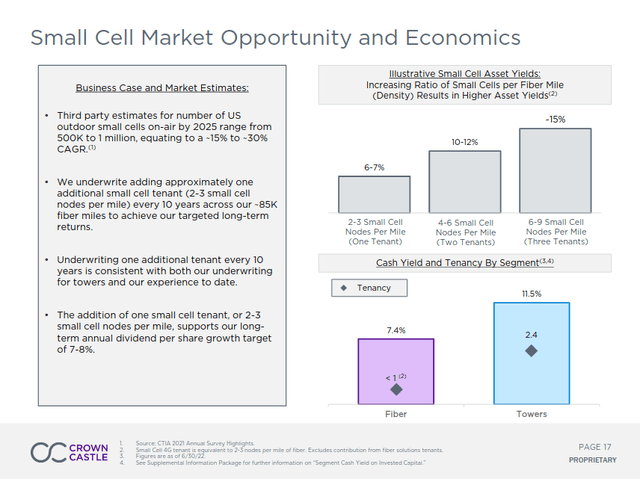

Crown Castle is ramping up its small cell deployment very quickly. It is on track to deploy 5,000 small cells this year and 10,000 next year. The company has a large backlog as well. T-Mobile (TMUS) contracted Crown Castle to build 35,000 small cells. Verizon (VZ) has a contract for 15,000 small cells. A lot of these small cells can take advantage of the business’s fiber assets. Additionally, Crown Castle can rent small cells to multiple clients at the same time. This can increase the return far above the company’s initial 7% yield target.

Crown Castle 2022 Investor Presentation

Crown Castle has a very resilient revenue base. The company primarily sells its services to the telecommunications sector. Phone and internet services are nondiscretionary expenses for most people and businesses. It’s a very defensive revenue base. Crown Castle’s other customers include large enterprises, healthcare providers, universities, and government institutions. These are also very stable customers. Crown Castle’s clients are continuing to invest in capital expenditures and infrastructure. Increased 5G spending is an ongoing tailwind for all the company’s segments.

I believe that Crown Castle is well positioned in the current environment. The company has clear growth drivers. Its customers are very resilient to economic headwinds.

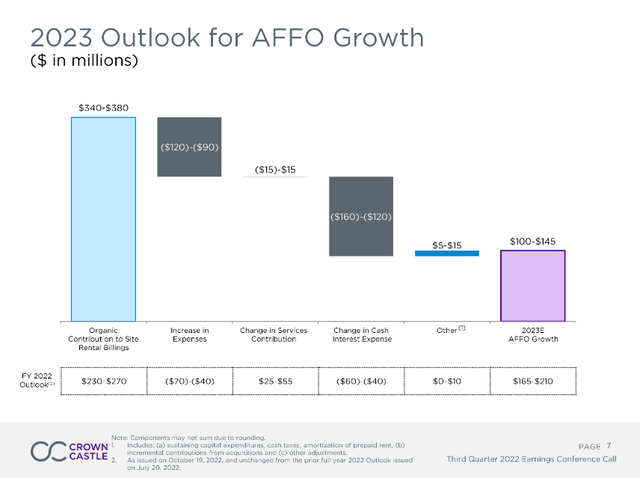

Rate Hikes & Balance Sheet

The primary headwind the company is experiencing is the Fed’s rate hikes. The sudden increase in interest rates has pushed down share prices across REITs. It has also increased Crown Castle’s interest expenses. The company forecast a $140 million increase in its interest expenses in 2023.

Crown Castle Q3 2022 Earnings Presentation

This is expected to be the primary AFFO headwind for the next year. Management said that they had prepared for rate hikes, but they were surprised by how quickly rates increased.

The company has very high leverage. The company’s debt to adjusted EBITDA has increased to 4.9 times. Management expects this to go over five turns. At a recent investor conference, the company’s CEO discussed the business’s leverage.

A couple of things on the debt side. I think the right leverage ratio is somewhere in that 5 to 5.5x leverage. Again, to my earlier comments, we think about that more in terms of the long-term cost of the debt rather than the short term that was abnormally low. The debt obviously is much cheaper than the equity, particularly given our view of where the world is heading and how well our business is going to do over time. We want to make sure we protect the equity because that’s expensive relative to the cost of the debt even in this — in the current period where rates have gone up.

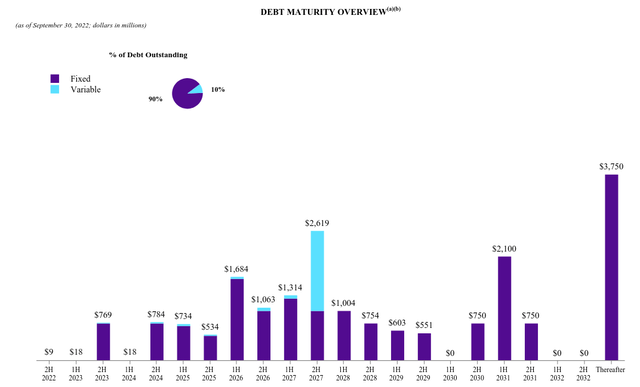

It’s promising that the company is focused on protecting equity. Management has also been clear that they will not use the capital markets to fund their dividend. Because of this, a lot of the business’s debt is fixed at low interest rates. These borrowings are tied to investments that have a yield higher than the debt’s coupon rate.

Crown Castle Q3 2022 Supplemental Information Package

Crown Castle used the low rate environment to clear most of its upcoming maturities. But there is still $3.5 billion in variable rate debt on its balance sheet. Management is assuming a “low to mid 4s” forward interest rate for its projections. Persistent inflation or unexpected rate hikes could create cash flow problems.

Sprint Decommissioning

There are also some major headwinds due to the merger between Sprint and T-Mobile. The merger has made some of T-Mobile’s wireless assets redundant. Because of this, the telecom canceled $75 million of small cells and fiber assets. Crown Castle will receive a $165 million payment due to the cancellation.

Crown Castle expects to lose another $200 million in annual tower rental revenue in 2025 because of the merger. All of this churn will be another headwind to growth and profitability. The company seems to be moderating its outlook beyond 2023 due to the merger.

Dividend Growth Outlook And CCI Stock Valuation

Crown Castle shares are trading at a forward P/AFFO of 16.6 times, or an AFFO yield of 6%. This is a premium valuation, but I think that the company’s strong fundamentals justify this. The business has plenty of growth opportunities. It plans to compound its dividend at a steady rate.

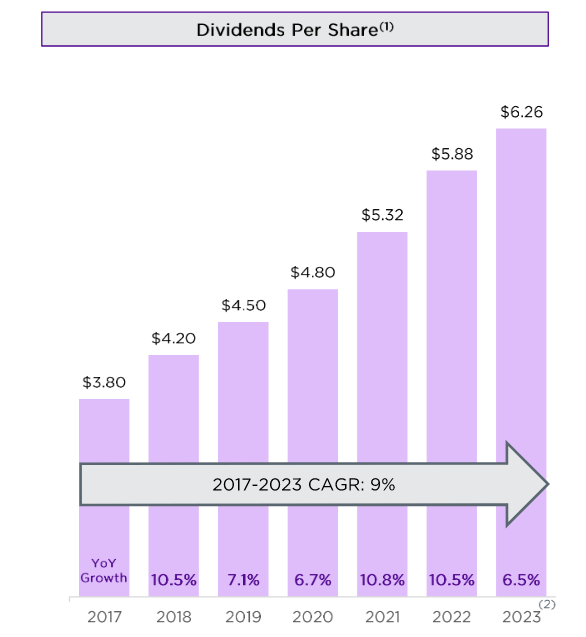

Crown Castle Q3 2022 Earnings Presentation

The company boosted its quarterly dividend to $1.565, a 6.5% hike. This is solid, but still below its long term target of 7% to 8% annual dividend growth. The company’s increased interest expense is a major reason for the lower dividend growth. Churn related to the T-Mobile merger will become an issue in the next few years. Because of this, management guided for dividend growth below their long term expectations in 2024 and 2025.

This dividend growth guidance is somewhat disappointing. But these slightly soft dividend growth projections come after two years of 11% hikes. In the long term, I’m still confident in Crown Castle’s outlook as a dividend growth stock. The 5G investment cycle is likely to be a long term tailwind for the company’s small cell segment.

Final Verdict

Rate hikes have been a major headwind to both Crown Castle’s stock price and its profitability. The company is also expecting increased churn due to corporate consolidation. This has resulted in a slightly softer dividend growth outlook in 2024 and 2025.

But I still believe the company has solid long term prospects. The business is set to benefit from the strong 5G investment cycle. It is well positioned across its fiber and small cell segments. I think that shares are a good pick for income and dividend growth investors.

Be the first to comment