MF3d

Companies in the technology sector are among the worst performers in the past year, as relatively higher valuations, higher interest rates, increasing inflationary price pressure, bottlenecks in the supply chain, as well as pandemic-related restrictions, and geo-political tensions as well as the ongoing war in Ukraine, have formed significant headwinds. Although information technology services providers have suffered in the ongoing market turmoil, the industry could perform better than the more heavily affected semiconductor manufacturers.

finviz

finviz

The ongoing global digitalization and consequently the higher degree of dependency on technology, the accelerating adoption of cloud-based solutions, as well as the increasingly high demand for data volume transfer and storage, have massively increased the demand and challenges in the cybersecurity industry. While there are many interesting companies in this industry, this analysis specifically compares two major players and direct competitors Palo Alto Networks (NASDAQ:PANW), the industry leader serving more than 85,000 customers in over 150 countries, and CrowdStrike Holdings (NASDAQ:CRWD), the latter although smaller in size, has reported massive growth in the past few years, and offers highly advanced cloud-native solutions.

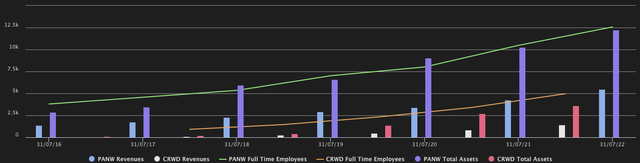

Author, using TIKR

The global cybersecurity market is forecasted to grow at 13.4% CAGR through 2029, driven by technologies such as Artificial Intelligence (AI) and Machine Learning (ML), cloud security, and fast-growing trends such as the adoption of the internet of things (IoT) which are of growing security concern as those items are becoming an increasingly integral part of everyone’s private and professional life. Gartner (NYSE:IT) estimated that about 25% of cyberattacks in enterprises will involve the IoT, while Kaspersky reported 1.51B IoT breaches in the first semester of 2021, up 236% from 2020. While in 2016 a business fell victim to a ransomware attack every 40 seconds, in 2021 this frequency was estimated at almost four times higher, with an attack every 11 seconds, while the average ransomware payment massively increased by 182% reaching $570,000, when compared to 2020.

An in-depth company comparison

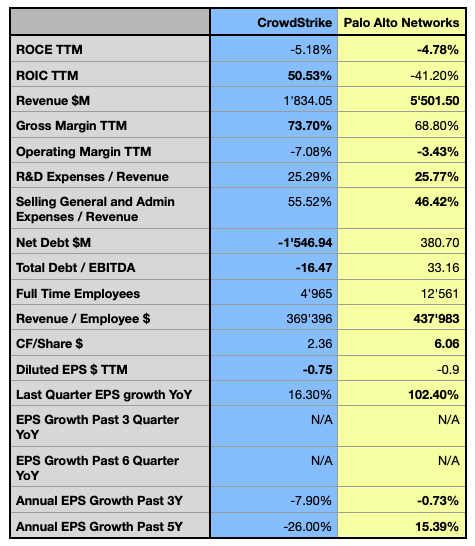

Author, using data from S&P Capital IQ

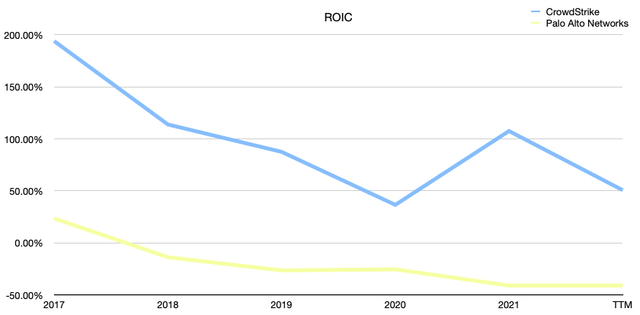

The financial comparison highlights the significantly different performance of the two companies in terms of their Return on Invested Capital (ROIC), a very important metric I consider when pondering an investment decision, as a company must be able to consistently create value to be a sustainable investment. While both companies still haven’t reached profitability, CrowdStrike is by far more efficient than its competitor in terms of capital allocation. The massive spread between its ROIC and the Return on Capital Employed (ROCE) indicates that despite the highly efficient core business, the company could significantly improve the returns to its investors by efficiently employing its massive idling cash position of about $2.3B. The negative and deteriorating ROIC consistently reported by Palo Alto Network in the past few years, is rather an alarming sign, as the company is seemingly destroying value for its investors instead of building it.

Author, using data from S&P Capital IQ

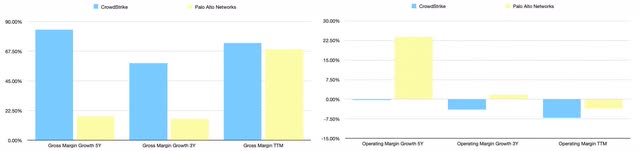

Although reporting a deceleration of this metric from 83.92% CAGR in the past 5 years to 58.48% CAGR in the past 3 years, CrowdStrike stands out for its significantly higher gross margin, while PANW’s gross margin growth decelerated from 18.36% CAGR in the past 5 years to 16.23% CAGR in the past 3 years, as the increasingly high competition in the industry impacts the pricing power. On the operational side, despite being recently closer to breakeven, both companies are reporting significant losses since their IPO, reporting approximately the same proportion in R&D expenses, while CRWD has relatively higher selling general and administrative expenses. The stronger dollar tends to harm the companies’ margins if the company does not mitigate that risk. CrowdStrike declared in its latest quarterly report, that nearly all of its sales contracts were denominated in USD and at this time, the company saw it unnecessary to enter into derivative or hedging transactions, as its operating expenses outside of the US were denominated in the local currency. Despite PANW’s sales contracts also being majority-denominated in USD, its operation expenses denominated in foreign currencies are increasing and the company declared being actively hedging its currency risk with currency derivative instruments.

Author, using data from S&P Capital IQ

Palo Alto Networks has a more cash-rich business, but as we saw before, the company has poor capital allocation efficiency and needs significant capital to grow as it is also heavily relying on debt in the last few years, reporting a massive leverage ratio. Its smaller competitor seems to manage its finances better and has a higher capacity to improve its returns, by using its substantial cash position.

The stocks’ performance

Considering both stocks’ performance since the IPO of CrowdStrike in 2019, CRWD returned a massive 329% performance, while PANW reported over 131%, still significantly outperforming the S&P 500 (SP500) and other major references such as the Invesco QQQ ETF (QQQ), the broader Vanguard Information Technology ETF (VGT), or the more specific First Trust Nasdaq CEA Cybersecurity ETF (CIBR), which is a good reference for the cybersecurity industry. It’s important to note how CRWD could perform better than its references over almost the entire analyzed period, with just a sporadic period of weakness since its IPO, largely compensated by extended periods of massive relative strength.

Author, using Seeking Alpha

While Palo Alto Networks may be the industry leader in the last few years, CrowdStrike offered much higher returns to its investors by greatly capturing its growth opportunities. In the next section, I will show how the next few years are forecasted to play out for both companies and if the actual stock price may offer even better opportunities, while also evaluating the possible risks in different scenarios.

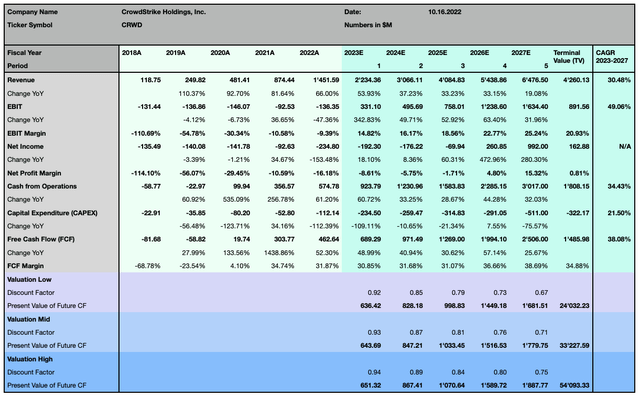

Valuation

To determine the actual fair value for both company’s stock prices, I rely on the following Discounted Cash Flow (DCF) model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the Weighted Average Cost of Capital (WACC) and the terminal value. As forecasted by the street consensus, CrowdStrike is anticipated to generate an impressive 38% Free Cash Flow (FCF) CAGR over the coming 5 years, with substantially increased operating profitability at 49% CAGR, while its revenue, despite decelerating from the last few years, is forecasted to grow at 30.48% CAGR, significantly over the expected market growth rate.

Author, using data from S&P Capital IQ

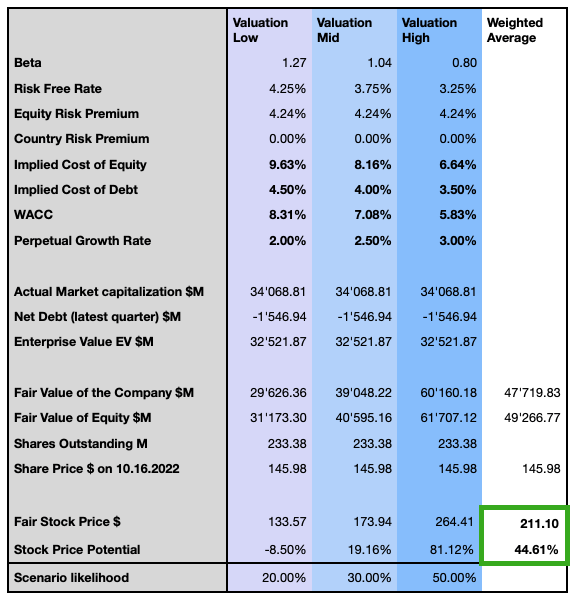

The valuation takes into account a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital.

Author

I compute my opinion in terms of likelihood for the three different scenarios, and I, therefore, consider the stock to be considerably undervalued with a weighted average price target with over 44% upside potential at $211.

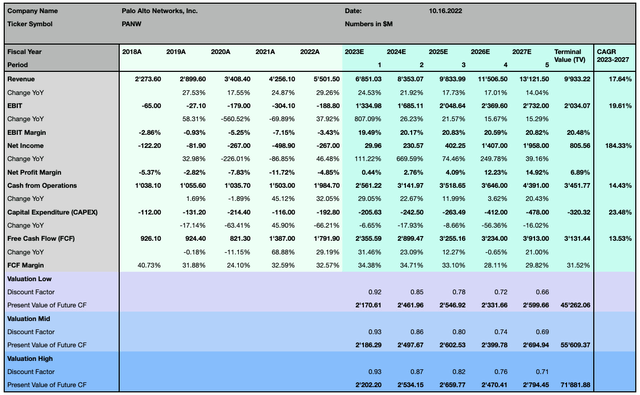

As a more established company, Palo Alto Networks is forecasted to expand relatively slower than its smaller competitor, with its sales growing at 17.64% CAGR over the next 5 years, while also generating relatively lower growth in terms of FCF, with an expected 13.53% CAGR. After many years of losses, its net profitability is projected to grow significantly by 184.33% CAGR.

Author, using data from S&P Capital IQ

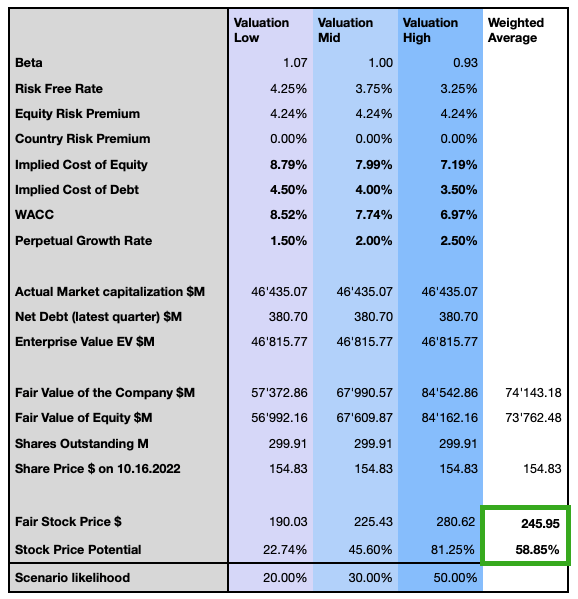

I then consider the same three scenarios affected by the company’s fundamentals and by the exogenous factors.

Author

This leads us to conclude that PANW may be the stock offering a higher return, with an upside potential of about 59% at $246, when considering the weighted average price target, and equal upside potential as for CRWD in the most optimistic scenario.

Investors should consider that those forecasts are based on relatively higher discount rates and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and value the company at a higher price.

Outlook and Risk discussion

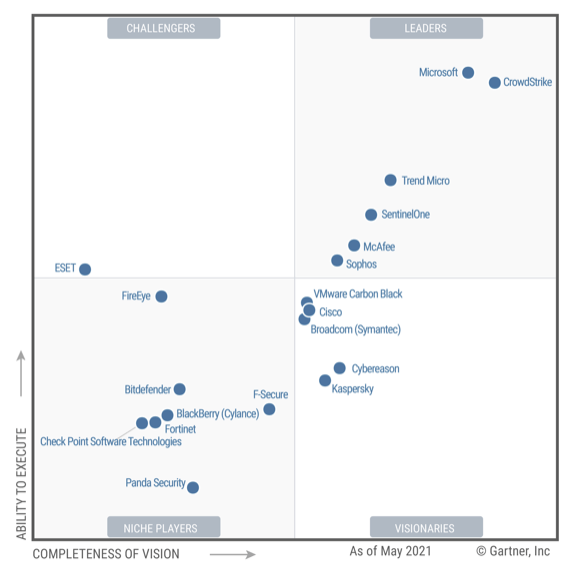

The cybersecurity market is among the most challenging industries in the technology sector, with high competition and a continuously changing and evolving demand. Being innovative and maintaining a high reputation is a must for cybersecurity providers, but companies also need to be constantly compliant with multiple government regulations such as data security and privacy laws, as they operate in a highly regulated industry. CrowdStrike was mentioned in a leader position in the 2021 Gartner Magic Quadrant for Endpoint Protection Platforms, as the company, together with technology giant Microsoft (NASDAQ:MSFT), excels in its ability to execute and its completeness of vision.

Gartner

While CrowdStrike has been in the cloud from the beginning, offering state-of-the-art security tools through its Falcon platform, which uses AI and ML to detect and respond to threats in real time, Palo Alto Networks has been broadly recognized for its efficient and sophisticated firewalls and has bought several cloud-native companies and technologies in the past few years to capture the potential in the secular trend of cloud computing. Consequently, PANW’s goodwill position has increased massively by 1,150% over the last 5 years, reaching $2.74B by the end of the last fiscal year, which could bear a significant risk in terms of future impairments. The latest announced acquisition of Israeli cybersecurity start-up Apiiro for $600M, while the company had received in total $35M in its series A funding, is hinting at an even further increase in its significant goodwill position. On the other side, CrowdStrike just announced buying Israeli cybersecurity start-up Reposify, which just received $8.5M in its seed funding in December 2021, for an undisclosed amount, and was rumored to be evaluating possible major acquisitions in Israel for as much as $2B, which would certainly affect its financial structure.

The lack of profitability of both companies is a major concern and the mentioned valuations are subject to the risk of the companies not being able to achieve the forecasted growth or profitability. Despite both companies being well positioned to take advantage of strong growing market trends, an extended global economic downturn or an unexpected event such as the recent pandemic, could postpone the forecasted breakeven in terms of profitability and therefore significantly change the discounted valuation.

As CrowdStrike’s success is almost completely relying on cloud-based SaaS-delivered endpoint security solutions, a slowdown in this trend could significantly impact the company’s business, although I consider this eventuality as highly unlikely when observing many other significant players in the technology industries, which are massively investing in cloud-based technologies or applications, and many future-oriented trends, as well as entire industry groups, are now highly dependent on the successful development and implementation of cloud-based solutions.

The Verdict: Which stock is the better buy?

Both analyzed companies are among the most meaningful providers in the cybersecurity industry. While fundamentally they both have their advantages and weaknesses, they also offer different risk profiles to investors. Palo Alto Networks is a more established company than CrowdStrike, yet the company is still not profitable and seems to be consistently unable to create value, as the company repeatedly reported a negative ROIC, despite having a more cash-rich business. CrowdStrike has a much healthier financial strength, as the company relies significantly less on debt than its competitor and could even increase its already high ROIC, if the company would efficiently use its huge cash position. Despite the past performance being in my opinion no guarantee for future results, we have seen that CRWD has been a massive outperformer and has shown to be highly resilient after pullbacks, reporting significant relative strength over extended time and high interest from institutional but also retail investors. Looking at the company’s setup, and the forecasted outlook, while also considering the individual risks, I consider CrowdStrike to be my favorite stock pick among the two analyzed companies. Despite Palo Alto Networks offering a relatively higher discounted opportunity, this valuation is also subject to relatively higher risk and takes into account that the recent acquisitions will play out well to achieve the projected returns. CrowdStrike has an excellent track record in terms of execution, is focused on a strongly growing core business that relies on massive secular trends, and its technology leadership hints at the ability to continue offering highly innovative solutions in the coming years with relatively higher margins.

Be the first to comment