Oleksandra Troian

About Cronus Group

Cronos Group Inc. (CRON) was founded in 2012 and is based in Toronto, Canada. The company describes itself as an innovative global cannabinoid company focusing on four core strategic priorities:

YTD Stock performance

As the above chart shows, CRON has decreased 33.57% YTD. However, this is much better than the other constituents in The Canadian Cannabis LPs Index which consists of the 5 largest pure-play vertically integrated (i.e., seed-to-sale) Canadian Licensed Producers (LPS) as follows:

ACB CGC CRON OGI TLRY

-76.52% -66.48% -33.57% -47.38% -49.12%

On a sector-wide basis, many Canadian cannabis stocks have decreased more than 50% in 2022 per New Cannabis Ventures, a leading industry newsletter. On 11/7/22 CRON reported a Q3 revenue miss of $2.95M ($24.75M vs. $21.80M) and a GAAP EPS miss of $0.04 (-$0.10 vs. -$0.06). The stock closed at $2.79, down 9.42% on volume of 4.1M, which is more than twice its 90 day average volume of $1.9M.

Quant and factor grades

CRON has a Seeking Alpha quant rating of 3.5 and is the only cohort member other than OGI to earn a “buy” rating. The company’s factor grades of valuation, growth, profitability, momentum and revisions also compare favorably to the other stocks in The Canadian Cannabis LPs Index. CRON has a beta of 1.45, which is the 2nd lowest to OGIs beta of 1.30, which is a favorable indicator.

Analysts’ price targets

According to the ten analysts who follow CRON, the average price target is $4.01, which would be an increase of 30.1% based on the closing price of $2.79 on 11/7/22.

Q3 10-Q

Key takeaways from my review of CRON’s three core financial statements filed with the SEC on 11/7/22 are as follows:

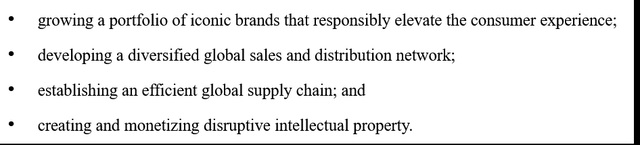

Balance sheet

As shown above, CRON had ~$8.9M in cash and cash equivalents and short-term investments as of 9/30/22. They have a fortress balance sheet with an ungodly current ratio of 25.4.

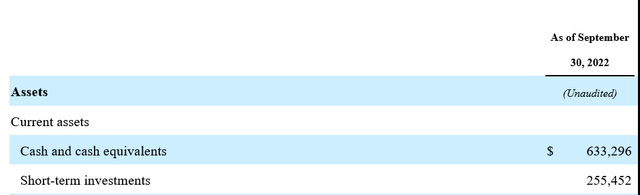

Income statement

As shown above, CRON has made good progress in reducing their net loss by ~$173.4M or 65.9% Y/Y.

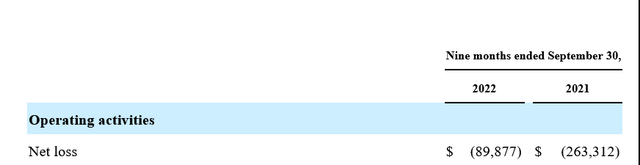

Cash flow statement

![]()

As shown above, CRON has made good progress in reducing their cash flow used in operating activities by ~$53.1M or 45.1% Y/Y.

As shown above, CRON has made good progress in reducing their cash flow used in operating activities by ~$53.1M or 45.1% Y/Y.

Earnings conference call

My key takeaways from CRON’s 11/7/22 earnings conference call are as follows:

- Israel net revenue from the PEACE NATURALS brand increased 88% year-over-year to $7M, or 88% Y/Y.

- Strong financial results from Cronus Australia (AUX:CAU). In my view, CRON should strongly consider increasing their ownership interest in CAU.

- CRON is on track to hit the cost savings target of $20-$25M in operating expenses in 2022.

- Product line expansion bodes well going forward.

Macro and micro risks

The cannabinoid industry is still in its formative stages and subject to continued froth. CRON is up against competitors which have much more financial firepower. But in my view, the resolution of the SEC and OSC accounting issues announced on 10/24/22 was a bellwether event. On 3/25/20 I published a bearish article on CRON, and this issue took over 2 ½ years to be settled. Now that it has, I believe CRON will be able to focus their efforts on executing their business plan.

Conclusion

Based on the foregoing financial and operational analysis, Cronos Group Inc. faces challenges as it attempts to carve out a niche in the emerging cannabinoid sector. The disappointing Q3 results of operation may hamstring the stock price for the foreseeable future. But significant progress has been made to remediate their P&L issues and management is committed to “rightsizing” their cost structure in their mission to reach profitability. I believe that investors with a high risk tolerance should strongly consider taking a starter position in CRON with a nominal portion of their “mad money” as there are green shoots amid the weeds.

Be the first to comment