Natal-is

Overview

Crocs (NASDAQ:CROX) has been a strong stock lately, shooting up by more than 50% from the recent low of $67 on November 2nd, reaching $101.42 at the close of November 18. This was after the stronger-than-expected earnings the company has reported alongside a positive future guidance. Crocs’ acquisition of HEYDUDE, which was completed earlier this year, has contributed to the success of this quarter’s earnings results, even as analysts and investors lamented the acquisition and caused the stock price to plummet almost 70% from the all-time high after the acquisition was announced. Still, despite positive results, with diluted earnings per share of $2.97, $0.35 above expectations, and revenue growth of 57.4%, the stock was recently downgraded by equities researchers from a “hold” rating to a “sell” rating, with some predicting a $59/share price objective. However, we think Crocs is not only a solid stock going forward, but that it is possibly undervalued at current levels.

We valued CROX using a discounted cash flow model under conservative, neutral, and optimistic assumptions, as well as using a relative valuation model. Under every scenario analyzed, we found CROX to be trading at a discount at its current price levels, even after the stock shot up by about 20% in just two days and despite the RSI approaching “overbought” levels.

Revenue Drivers

We formed the basis of our valuation assumptions by relying on three significant drivers of revenue that we believe are the most important factors in driving future growth for Crocs. The first one is the HEYDUDE acquisition. When Crocs announced the $2.5 billion acquisition with the Italian private casual footwear maker using a mix of cash and stock last year, the market did not view it favorably and sent the stock plummeting 50%. The market worried that since Crocs took out a $2 billion loan to fund the deal, Crocs’ long-term debt rocketed from about $771 million to about $2.7 billion. This was troublesome given that interest rates are rising and Crocs’ revolving credit has a variable rate, which means the company will face higher borrowing costs in the future. The market was also skeptical of the deal in its abilities to generate valuable synergies. In spite of that, however, HEYDUDE has been performing much better than expected, with second-quarter 2022 revenues up 96% compared to the first quarter of 2021. When Crocs announced the acquisition, it aimed for the new brand to cross $1 billion in sales in 2024, but it is now expected for that number to be reached by the end of this year alone. HEYDUDE is also expected to quadruple Crocs’ Total Addressable Market (TAM) to $160 billion, and, through global outreach and cost-cutting resulting from newly-enjoyed economies of scale, the acquisition is expected to be a major value creator for Crocs in the near future, diversifying is product lines and differentiating it even further from competitors. Even with such exceptional growth, HEYDUDE has still not fully capitalized on Crocs’ logistic networks, financial strength, and marketing power, and so there is still much more room for growth.

Another significant driver of revenue growth for Crocs is its rising popularity, which cannot be overstated. With an increased consumer focus on comfort and stylishness, especially as more people are working from home, Crocs is becoming more popular than ever. According to the Q2 2022 10Q filing, Crocs has sold 11.4% more units of shoes compared to Q2 2021, and 19.2% more in Q3 2022 compared to Q3 2021. It has also increased its average selling price by 2.5%, which amounted to $732.2 million in net sales, or a 14.3% year over year growth. Demand for Crocs is strong and, given its price point, is not expected to fall significantly any time soon, even in a case of a recession. A current industry trend is a desire for cheap but premium brands, and Crocs seems to be perceived as one. Consumers look for affordable prices but premium brands and fast fashion that combines comfort with chic. This is positive for Crocs, as Crocs sells affordable products ($15-$75) and has enough brand recognition to generate a ‘premium’. Its demand resiliency is also extraordinary: Despite fashion critics having laughed off the brand over the years, the company still enjoys strong popularity among consumers. Furthermore Crocs’ signature design and trademarked “Croslite” material of its classic clogs is something hard to fully imitate by competitors and thus presents a significant moat for potential new industry entrants.

A factor we took into account, however, was the supply chain issues Crocs, and the economy as a whole, is facing, which was evident by the declining gross margins, which went down from 61.7% to 57.7% year over year, indicating decreased efficiency in converting sales into profits. While this 4% decrease in gross margin seems troublesome at first, it should be noted that last year’s gross margins were at an all-time high, and despite the decrease, a 55% gross margin is still above the company’s historical gross margin range, as seen in the figure below.

Some competitors, on the other hand, have experienced much bigger drops in gross margin. Allbirds (BIRD), as an example, saw its gross margin drop 20% during the same time period. The factors affecting Crocs’ margins are, however, temporary, especially after synergies from HEYDUDE are fully capitalized on, increasing Crocs’ revenues even further. Crocs also still has room to increase its prices in line with increased inflation to recover lost margins, something which it had not done in Q3.

Another important driver of growth is that Crocs exists in a fast-growing market strongly influenced by customer perception and trends, and it is currently optimally positioned for future growth. Current trends positively affecting the industry include a rise in online sales, which have a CAGR of 11.35%. The resultant valuation implication for Crocs is favorable growth, albeit increased competition which increases risk. The second major trend is the expanding influence of social media through the presence of brand ambassadors, celebrity endorsements, and brand partnerships that target young demographics and increase brand awareness and popularity. This is strongly propitious for Crocs since Crocs heavily relies on such endorsers to maintain popularity. Recently, Crocs partnered with Balenciaga and Disney, and it continues to partner with influential celebrities around the world. Granted, in a more competitive environment, the costs for establishing and retaining such partnerships would increase, but given Crocs’ history of success with these partnerships, we hold that such added costs would be worthwhile to boost the company’s brand recognition and sales. Also, there is the trend of more efficient smartphone payment penetration. Easier mobile payment transactions including free shipping and hassle-free return polices drive growth and increase sales fast, but more importantly help with customer acquisition. Furthermore, there is a ripe opportunity for growth through full-fledged expansion into China. The company is intending to crack into the Chinese market by focusing on Chinese cities and areas that house affluent and influential Gen Z consumers. A current unfulfilled opportunity is that even though Crocs sells at a premium price in China, it still hasn’t had the right partner for retail stores there, which if found, could strengthen the brand there even further and drive strong future revenue growth.

Valuation

Given these revenue drivers, we have modeled out revenue projections for the next 10 years, with 2022 as the base year, using conservative, base-case, and optimistic assumptions, to come up with the intrinsic value of CROX through a discounted cash flow model. All three cases produced outcomes that suggest upside potential for CROX.

DCF Method: For the conservative case, we assumed cumulative revenue growth of 11.5% which would later fall down to 4% in perpetuity. The EBIT margin of 26% would fall down to 23%, Capex remains constant at 3% of sales, and D&A would be 70% of Capex. The WACC was calculated to be 10.2%, and with a terminal growth rate of 3% and a tax rate of 21%, the DCF produced a share price of $105.9. While only a 4.4% premium from the current share price of $101.4 at the time of writing, keep in mind that the stock has been on a long consecutive win streak, going up this month alone by 50%; the RSI is already approaching overbought levels and it is expected for the stock to cool down in the short term. For the base-case scenario, we assumed cumulative revenue growth of 18.5% which would later fall down to 4% in perpetuity. EBIT margin would remain constant at 26%, and Capex, D&A, and Terminal Growth rate would all be the same as the conservative case. For the tax rate, we assumed it would go down to 18%, and the WACC would go down to 9.2%. With these assumptions, the predicted share price value of CROX amounts to $158.0, which is a 56% upside from current price levels. For the optimistic case, we assumed cumulative revenue growth of 22.6% would later fall down to 4% in perpetuity; EBIT margin would increase from 26% to 30%. The WACC would remain the same at 9.2% and the tax rate would decrease to 15%, which is a possibility given the likelihood of a Republican-controlled government within the next ten years. This produces a DCF outcome of $268.2 share price, or a 164% upside from current price levels. Keep in mind that only our optimistic case scenario is in line with Crocs’ management’s goal to reach $5 billion in sales within the next 4 years. Given Crocs’ track record and its surprising performance with HEYDUDE, this is not far-fetched, and certainly achievable; however, we included it as an “optimistic-case” to show that even if that goal was not achieved, Crocs is still undervalued.

With this in mind, we conclude that Crocs remains undervalued across every valuation scenario, suggesting a strong implied premium between $150 and $201.

Relative Valuation: To conduct a comparable company analysis, we followed a set of criteria to determine the most relevant and similar set of companies with which to do comparisons. The first criterion is that the company must be engaged in footwear, with a focused product portfolio. The second is that it must have premium, though not luxury products, and the third is that it should have a relatively small enterprise value, since Crocs’ EV sits at about $6.7B. As a result, we chose the following companies for analysis: Wolverine World Wide, Inc (WWW), Deckers Outdoor Corp (DECK), Steve Madden, Ltd (SHOO), Skechers USA Inc (SKX), Carter’s Inc (CRI), and Nike Inc (NKE).

We calculated the Enterprise Value divided by Last Twelve Month EBITDA for each of the companies, and got the mean EV/LTM EBITDA to be 13.6x, with the median standing at 11.5x. Mean Price over LTM EPS (P/EPS) was 19.7x, and the median 17.9x. In comparison, Crocs’ EV/EBITDA and P/EPS trade at 8.6x and 7.5x, respectively, both of which is below the median. The takeaway is that Crocs trades at a severe discount relative to its peers, signaling the stock could be potentially undervalued. Nike could be considered an outlier in this case since it is a much bigger brand with a much higher Enterprise Value, worth 25 times Crocs and other comparable companies; however, it was included for the sake of analysis. Using a 75% mid-multiple assumption with 25% variance from the middle, we get a valuation range on the basis of EV/EBITDA comparables of $155.8 – $230.5, and on the basis of P/E comparables: $161.4 – $268.9.

Using a football field analysis looking at both the relative valuation and DCF valuation, we came up with the final valuation range of $154.1-$222.6, or a 52%-119% premium. In all cases, we can confidently rate Crocs as a strong buy.

Fundamentals

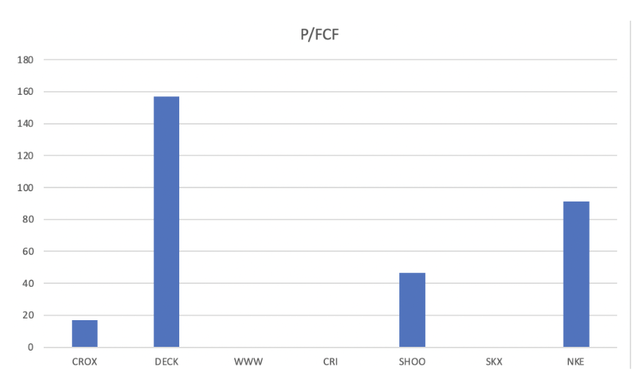

To solidify our valuation analyses, we analyzed CROX’s fundamentals and compared them to its most relevant competitors, and our findings indicate solid fundamentals and stronger than those of competitors. For starters, the company’s price to earnings (P/E) ratio stands at 10.66, and its forward P/E ratio stands at 9.11. A lower forward P/E ratio compared to a trailing P/E ratio indicates earnings growth in the future. In contrast, the US Footwear & Accessories industry averages a 27.21 P/E ratio, while the market as a whole averages a 19.77 ratio. While this alone is not enough to shape investment decisions, it adds support to our argument that CROX is trading at a lower value compared to its peers. This could, however, be an indication of poor investor sentiment that signals expectations that Crocs is to grow lower than the wider market. However, given our growth analysis and estimates, this is not the case. CROX’s PEG ratio, which takes into account the company’s expected earnings growth rate, is 1.07. While greater than one, it is much lower than the industry average of 2.18. Perhaps more interestingly, CROX has a price-to-free-cashflow (P/FCF) ratio of 16.94. As can be seen in the chart below, this is significantly lower than direct competitors’ P/FCF, as well as the industry as a whole, which averages at 77.9.

Own work from data from CapitalQ

When comparing to peers, the only red flag with CROX is its high debt to equity ratio, which is currently 4.15, whereas its peers have little-to-no debt. As mentioned before, this is due to the HEYDUDE acquisition since Crocs added $2 billion in debt to fund the deal. While a worrisome figure at first, this ratio has gone down from a high of 6.2, as management expected, and the quick ratio is greater than one, indicating a healthy ability to cover current liabilities using current assets.

Risk Assessment

Crocs faces a few risks, and existing ones have strong mitigations and do not considerably affect future expected growth, but they should be taken into account, nonetheless. The first one is a change in capital structure as a result of the HEYDUDE acquisition. Taking on $2 billion in debt to fund the deal, Crocs’ capital structure pushed the company’s debt/EV to 42% from 16%, increasing the gross leverage ratio above company target of 2.0. While this could present a risk, HEYDUDE is performing better than expected and improving Crocs’ top- and bottom-line numbers, hence quelling fears. Management guidance shows they expect to reduce debt below their target by mid-next year, allowing them to restart share repurchases, which have been suspended for the time being, and which, if restarted, would help increase the stock price even more. The greatest theoretical risk present is a drop in demand, which we currently deem unlikely given Crocs’ popularity and inimitable designs, which were discussed above.

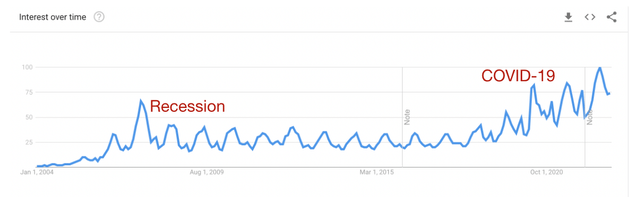

A second risk to keep in mind is the possibility of HEYDUDE synergies not being recognized. Different cultural and strategic management differences between Crocs and HEYDUDE may threaten value creation. Integration risk, as it is known, could be due to the increased dependency of the HEYDUDE brand on its founder in the past, which could present difficulties as Crocs attempts to scale the brand. However, given how well the acquisition has played out so far, with performance and earnings exceeding analyst expectations, we rate this risk as medium-low. The other two major risk factors are new entry from competitors creating similar products, as well as shortages, time-lags, and logistical issues resulting from supply-chain issues. The former risk is low given the sustainable competitive advantage that Crocs enjoys, having built a strong moat that lowers uncertainty and ensures consistent future growth. Crocs has a unique product, operates in a niche industry, has strong global brand recognition, and has solid pricing power. It is a competitive industry, but Crocs is dominant in the niche market. Clogs are unique products, and customers are willing to pay a premium for them, and there is lower risk exposure from big industry players, such as Nike & Adidas. Google Trends analysis for Crocs shows demand for Crocs has been consistently strong since the company’s founding in 2002, even during the recession in 2008-2009, meaning that a possible recession might not affect demand as much as people think. In fact, demand for Crocs has increased and formed a new support level following the Covid-19 pandemic, as more people worked from home and desired comfortable shoes.

Google Trends for ‘Crocs’ (Google Trends)

As for supply chain issues, which have been affecting the economy as a whole, the ameliorating factor for Crocs is that the company’s flagship clogs are easy to make, according to Chief Executive Andrew Rees in a past earnings call, and that “shifting production around when needed” is not difficult. Most of the classic clog’s production is made on site, and so not much external logistics is needed for production. Crocs has also been working on spreading out production facilities for diversification purposes so that no one location accounts for a chunk of the company’s production. There is also the problem of inflation which has affected the company’s gross margin, as mentioned before; however, as it stands, Crocs is able to offset the challenges of inflation and deal with cost pressures by raising prices without affecting demand much, thanks to the company’s strong brand and popularity as a result of years of marketing efforts, celebrity sponsors, and good management. Past price increases have not been too substantial, so new increases could be opportune at this moment.

Final Thoughts

While we believe that Crocs is an undervalued company that enjoys strong free cashflows, sales, and future growth prospects, and trading at a discount relative to its peers, we suggest caution moving forward in the short-term. While our analysis produced a final valuation range of $154.1-$222.6, the stock is currently advancing towards overbought levels according to the RSI, which is about to hit 70. The stock has been on an uptrend ever since the company reported earnings on November 3rd, going from $67/share to $101.4/share, a 51.37% increase in just 15 days. While it is still below our predicted valuation range, we think there will be a slight pullback in the short-term until RSI levels normalize, which is normal. That said, the company is still very strong, and investors could consider adding CROX to their long-term portfolio, expecting management to meet revenue guidance, tackle inflation and supply chain problems, and realize the full potential of their newly acquired HEYDUDE brand.

We would like to thank M. Abdelkhaleq for his contribution to this piece.

Be the first to comment