Avelina bo/iStock via Getty Images

Investment Thesis

Over the past six months, shares of the famous clogs maker Crocs (NASDAQ:CROX) have doubled in value and significantly outperformed the broader market and the consumer discretionary sector. Today, the company is trading at just 10x TTM earnings, which is still pretty cheap for a high-margin business that has increased its bottom line by more than 11x in the past five years and is still showing strong sales growth.

Several growth drivers can lead to an improvement in the company’s financial performance and ensure further growth in the share price, namely:

- The company retains the potential for core brand growth. Probably, international markets, digital sales, and the sandal business will make the main contribution to revenue growth in the coming years.

- The newly acquired HEYDUDE brand can extend the Crocs runway. Management predicted that the brand’s revenue would reach $1 billion in 2024. However, the goal seems to be achieved in 2023.

- Since 2014, Crocs has repurchased $1.7 billion worth of shares, resulting in a significant reduction in shares outstanding. The buyback program is expected to resume as early as 2023.

- We expect the company to continue to improve operating leverage as sales grow and SG&A expenses as a percentage of revenue decrease.

By comparable valuation, Crocs trades at a discount to the sector average despite double-digit growth and relatively high margins. According to our DCF model, the company is trading at a significant discount to our estimate of its fair market value. We rate shares as a Buy.

Potential For Further Expansion Of The Core Brand

Over the past years, the company has done an outstanding job with its core brand, Crocs. The reimagining of the brand and a new marketing strategy, including collaborations with famous fashion houses, have made the clogs a household name and put them on par with such iconic shoes as Converse, Dr. Martens, and Ugg. In Q3 2022, the company sold 30.3 million pairs of Crocs, up from 13.3 million in Q3 2018, while revenue increased from $261 million to $985 million in the same period.

Thanks to the comfort provided by clogs, the company became one of the pandemic winners and posted abnormally high growth (+66.9% year-over-year in 2021). While the low base effect has largely been exhausted, we believe that Crocs still has room for further expansion. We identify three main drivers that can ensure a high growth rate for the core brand:

- Expansion in international markets;

- Digital sales;

- The sandal business.

Expansion in international markets

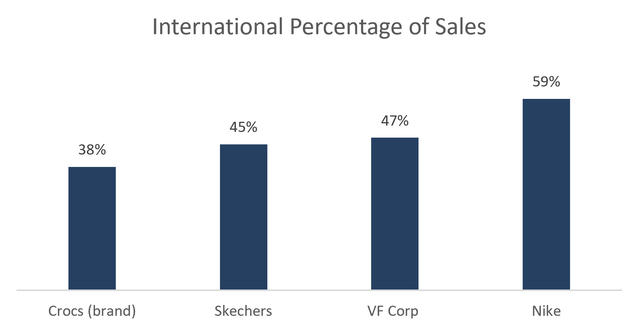

At the end of the last reporting period, Crocs brand revenue in North America increased by only 2% year-over-year, while in Asia Pacific sales jumped by 66% (82% in a constant currency), and in EMEALA (Europe, the Middle East, Africa, and Latin America) – by 26% (46% CC). The share of international sales in the revenue structure reached 38%. However, the figure is still lower than discretionary companies such as Nike (NKE), VF Corp (VFC), and Skechers (SKX), demonstrating the room for growth that Crocs has.

International percentage of sales (Created by the author)

It is worth noting that Crocs is implementing a whole range of marketing activities to gain a foothold in foreign markets. In China, the company has partnered with famous fashion influencers, Fan Chengcheng and Nana to launch its global Crush collection. And in Europe, the company launched a collaboration with the British brand Lazy Oaf.

Digital sales

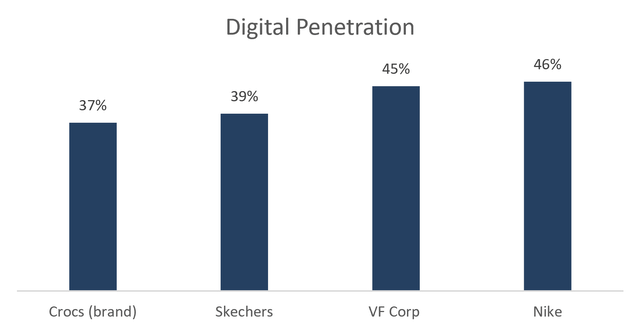

In the third quarter, digital sales grew by 22% and e-commerce penetration was 37%, which is also still lower than Nike, VF Corp, and Skechers. In our view, Crocs can achieve higher penetration than peers because clogs are easier to buy online. The probability of making a mistake with the size when placing an order for roomy and squishy clogs is far lower than when you are buying Nike sneakers or Timberland boots.

Digital Penetration (Created by the author)

The sandal business

The first half of the year was challenging for the sandal business, but things began to change in the third quarter as the segment grew 20% year-over-year to $88-89 million (~9% of enterprise revenues). Innovation and new product introductions have enabled the company to increase sales in regions with high sandal penetration: India, Southeast Asia, and parts of the Middle East.

The sandal market presents an intriguing opportunity as it is large and highly fragmented. Management estimates the market at $30 billion versus $8 billion for clogs. High brand awareness provides Crocs with a strong starting position for growth in this market. It is worth noting that management plans to quadruple sandal sales by 2026.

HEYDUDE Potential

Last year’s $2.5 billion cash and stock HEYDUDE deal was negatively received by the market. Today, however, HEYDUDE is an important growth driver capable of extending the Crocs runway. HEYDUDE is one of the fastest-growing casual footwear brands in the US market. According to Piper Sandler’s Fall Taking Stock with Teens survey mentioned above, HEYDUDE is the 7th most popular teen brand in the US. In our opinion, these shoes are custom and distinctive enough to get truly wide coverage. Notable is the September article from the WSJ, which refers to the brand as “The Beer Koozie-Like Shoe”.

Crocs paid for HEYDUDE at an EV/EBITDA multiple of 15x. Based on today’s figures, Crocs bought the fast-growing and profitable company for about 9.5x the next twelve months’ EBITDA.

In the latest quarter, the brand’s revenue grew by 87% YoY to $269 million. It looks like the brand could have grown even faster if it weren’t for the lack of distribution center capacity in the US. According to management’s long-term plan, HEYDUDE’s revenue was expected to reach $1 billion in 2024. Now it is clear that the company will be able to achieve this result a year earlier. It is worth noting that HEYDUDE is poorly represented abroad, and the brand potential in the US is probably not even half revealed.

Deleveraging And Capital Allocation

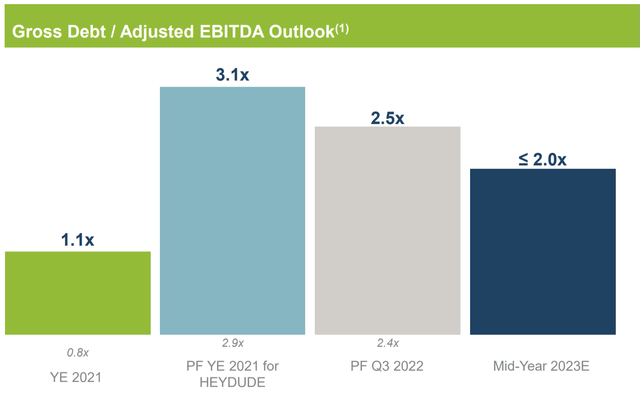

Since 2014, Crocs has repurchased $1.7 billion worth of shares, resulting in a significant reduction in shares outstanding. However, after the HEYDUDE deal, the company put the buyback on hold as total debt rose from $964 million to $3,107 million and Total Debt to Adjusted EBITDA ratio from 1.1x to 3.1x.

Management focused on deleveraging. This is a smart decision, as a strong balance sheet is a key to sustainable growth over the long term. It is expected that by mid-2023, the Total Debt / Adjusted EBITDA multiple will return to the target value of 2.0x.

Debt burden outlook (Company Presentation)

The buyback program is expected to resume once financial leverage returns to normal levels. Over the past six months, the company has reduced its total debt by about $260 million. Theoretically, if Crocs used this amount to buy back at current prices, shares outstanding would decrease by 4.5%. It’s worth noting that $260 million is less than half of the last 12 months’ net income [TTM]. This calculation shows that Crocs can become a real shareholder value machine in the short-term.

Financial Performance

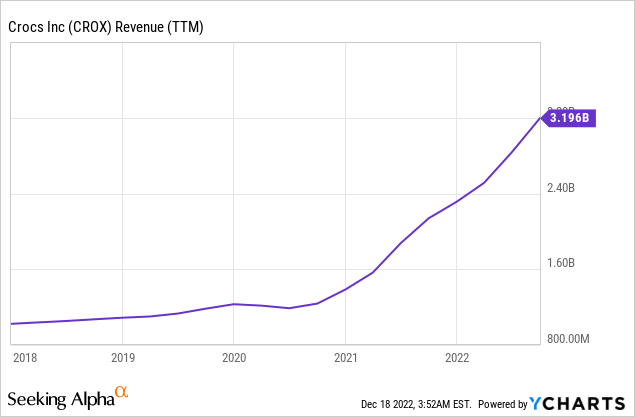

Over the past five years, Crocs’ revenue has grown at an average annual rate of 23%. The market was expecting a sharp slowdown in sales as lockdowns were lifted and comfy clogs were ditched in favor of more formal shoes. However, the slowdown is delayed. Revenue is expected to be $3.455 to $3.520 billion for FY 2022, implying 49-52% year-over-year growth.

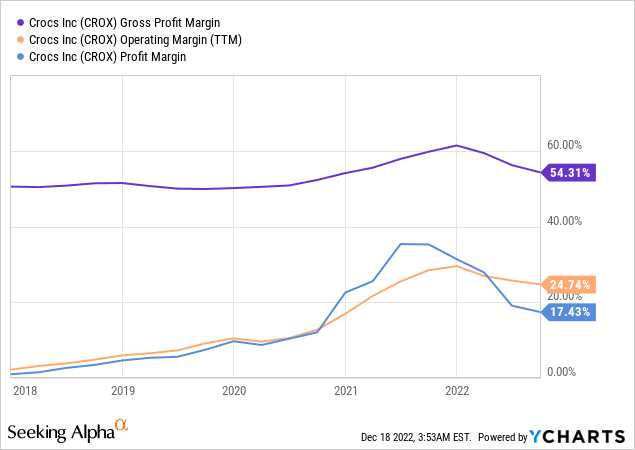

It is important that as the company grows, it demonstrates impressive efficiency. Thus, over the past four years, the gross margin has increased by almost 6 percentage points: from 50.53% in 2018 to 54.31% TTM. The operating margin increased from 2.13% to 24.74% over the same period, while the net margin increased from 1.00% to 17.43%.

High brand awareness gives a company significant pricing power. Crocs use this power: revenue has grown by 277.4% since 2018, while the number of pairs sold is only 127.8%. Although management has no plans to raise prices yet, the company is certainly able to increase the average selling price by at least the rate of inflation, which will help maintain margins in the long term.

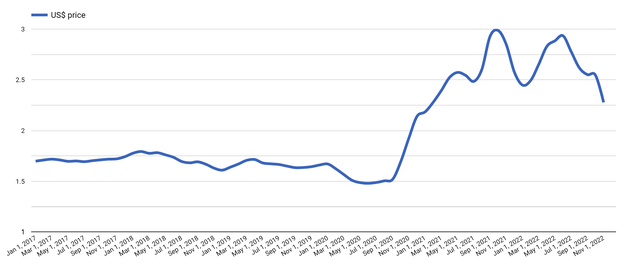

In terms of COGS, we also see positive signals. Clogs are a fairly simple product made from a single material – ethylene-vinyl acetate [EVA]. Over the past five months, the cost of EVA has decreased by 22%, driven by lower oil prices. The decline should be reflected in margins in the coming quarters as old inventory is processed.

EVA price per kg (datastudio.google.com)

Logistics should also be less costly. In autumn, the Global Container Freight Index more than halved from $5,286 to $2,528. According to the Indeed Index, wage growth is also slowing across the board.

We also expect operating leverage to improve as sales continue to grow. Crocs’ largest operating expense is Selling, general and administrative. Over the past 12 months, SG&A as a percentage of revenue amounted to 28.9% (27.9% excluding expenses associated with HEYDUDE acquisition) versus 45.5% in 2018.

| in $ mln | TTM | 2021 | 2020 | 2019 | 2018 |

| Revenue | 3,196.6 | 2,313.4 | 1,386.0 | 1,230.6 | 1,088.2 |

| SG&A expenses | 925.3 | 737.2 | 514.8 | 488.4 | 495.0 |

| SG&A as % of Revenue | 28.9% | 31.9% | 37.1% | 39.7% | 45.5% |

(Created by the author based on the company data)

CROX Stock Valuation

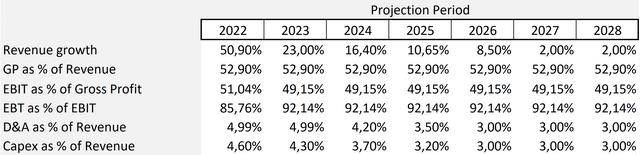

Our DCF model is built on several assumptions. We expect total revenue for the year to be $3.49 billion, which is in the middle of management’s guidance range and below the Wall Street consensus of $3.51 billion. We believe Crocs will be able to meet its $6 billion revenue guidance for 2026. Recall that initially it was assumed that the revenue of HEYDUDE will be $ 1 billion by 2024, but today it is clear that the goal will be achieved as early as 2023.

Although there are signs that the gross margin is improving, we believe that the figure will be 52.9% and will remain at this level until the end of the forecast period. This forecast looks quite conservative since over the past 10 years Crocs has reduced COGS as a percentage of revenue by an average of 0.8 percentage points annually, due to economies of scale.

We expect the operating margin to be 27% for the year. Further, the indicator will decrease to 26% and will remain at this level until the end of the forecast period, in line with management’s long-term projections.

Over the past five years, D&A expenses have averaged 5% of revenue, and we expect the figure to remain at that level. Capital expenditures are expected to be from $150 to $170 million in 2022, which corresponds to 4.6% of revenue in the middle of the range. The long-term forecast for CapEx as a percentage of revenue is 3%, which also corresponds to long-term projections.

The assumptions are presented below:

Assumptions (Created by the author)

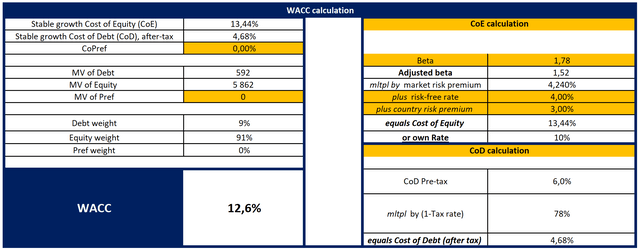

With the cost of equity equal to 13.44%, the Weighted Average Cost of Capital [WACC] is 12.6%.

With a Terminal EV/EBITDA of 6.02x, the model projects a fair market value of $8.70 billion, or $141 per share, above the Wall Street consensus estimate of $106, but below the Robert W. Baird’s target price of $150. The upside potential we see is about 48%.

You can see the model here.

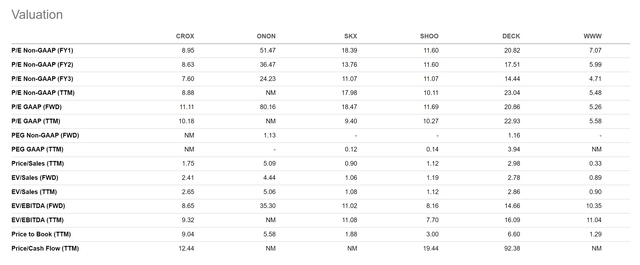

By comparable valuation, Crocs trades at a discount to the sector average despite double-digit growth and relatively high margins.

Comparable valuation (Seeking Alpha)

Key Risks

- Given the unusual appearance of clogs, there is a possibility that the rapid growth of recent years is due to a temporary fashion trend that is not sustainable. If Crocs fails to remain relevant to consumers, the company will miss analyst forecasts and its own long-term goals.

- Companies in the consumer discretionary sector are susceptible to economic cycles. If there is a sharp contraction in consumer spending, Crocs sales and share price could be hit much harder than the market as a whole.

Conclusion

Recently, the market has revalued Crocs shares and reduced the spread between the price and our estimate of fair value. However, in our view, Crocs shares can still provide solid gains. The potential for business development has not been exhausted yet. The company has room to grow its core brand, Crocs, and also has a second engine in HEYDUDE, the potential of which has not been revealed yet. Over the years, Crocs has demonstrated high growth rates and impressive performance. We expect this trend to continue. Probably, in the second half of the year, the company will return to share buybacks. According to our valuation, Crocs is trading at a significant discount to its fair market value. We are bullish on CROX.

Be the first to comment