jimfeng

Elevator Pitch

My investment rating for CRH Plc’s (NYSE:CRH) stock is a Buy.

I analyzed CRH’s financial performance for the first half of 2021 in my earlier update for the stock written on September 3, 2021. This current article shines the spotlight on CRH’s most recent 1H 2022 financial results and its capital allocation approach.

I raise my rating for CRH from a Hold previously to a Buy now. CRH has managed to deliver decent top line and bottom line growth in a challenging operating environment. Its good financial performance should be sustainable in the near future, as price hikes haven’t affected demand and rising gas prices in Europe shouldn’t be a big issue for the company. In addition, CRH has performed well in terms of capital allocation, given that it continues to invest in future growth without comprising on shareholder capital return.

Good Interim Results

CRH reported the company’s 1H 2022 earnings on August 25, 2022 before the market opened.

Headline revenue for CRH expanded by +14% YoY from $13,167 million in the first half of the prior year to $14,998 million in the most recent interim period, Adjusting for divestitures, acquisitions and foreign exchange, CRH’s adjusted organic revenue still rose by an impressive +12% YoY in 1H 2022.

The company’s top line growth for the first half of this year was comparable to that of its peers. As a reference, HeidelbergCement AG (OTCPK:HLBZF) (OTCPK:HDELY) [HEI:GR] and Holcim Ltd. (OTCPK:HCMLF) (OTCPK:HCMLY) [LHN:SW] delivered organic revenue increases of +11.6% YoY and +12.7% YoY, respectively for 1H 2022.

Notably, CRH was still able to translate strong top line growth into an improvement in profitability and higher operating earnings in the most recent interim period. CRH’s headline EBITDA margin expanded by +0.9 percentage points to 14.7% in 1H 2022, and its headline EBITDA rose by +21% YoY to $2,210 million over the same period. The company still achieved an excellent +13% YoY increase in its adjusted organic EBITDA for the first half of 2022, after excluding the impact of foreign exchange and mergers & acquisitions.

In a nutshell, CRH’s announced a reasonably good set of 1H 2022 financial results.

In the subsequent two sections of the article, I touch on the key drivers of CRH’s operating profit growth in the interim period.

Price Hikes

Price hikes have been the main reason for CRH’s robust top line and bottom line expansion in 1H 2022.

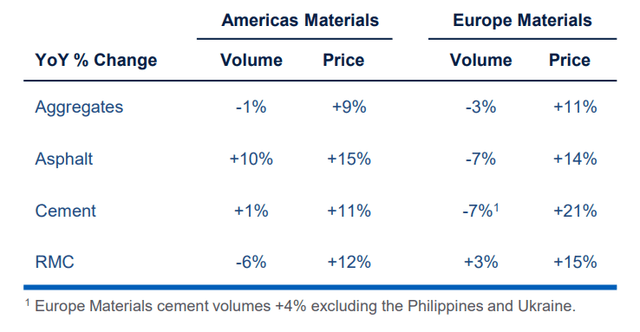

CRH’s Price Hikes Across Geographic And Product Segments

CRH’s 1H 2022 Earnings Presentation

As per the chart presented below, CRH has had a mixed performance in terms of volume growth across the different product segments and geographic regions. But the company has consistently been able to raise prices for its various products in both Americas and Europe. With the exception of the aggregates product segment in Americas, CRH has increased its product prices in all of its other product segments by a minimum double-digit percentage in the recent interim period.

CRH attributed its ability to raise prices to its business transformation. At its 1H 2022 earnings briefing on August 25, 2022, CRH explained that the company has “transitioned from being a commodity producer of base materials to a fully integrated provider of end-to-end solutions.” This change enabled CRH “to price based on a value-added full service offering rather than simply providing base materials alone”, and integrated solutions now represent approximately 65% of its revenue. It is also reassuring that CRH highlighted at its recent interim investor call that “we haven’t really seen demand destruction” notwithstanding price hikes.

I discuss about another key factor that has helped CRH to offset inflationary cost pressures, or more specifically higher energy costs.

Energy Costs

Expenses relating to energy have historically accounted for between 9% and 11% of CRH’s revenue, and bitumen usually makes up half of these energy-related costs, as disclosed by CRH at its first-half 2022 results call. As such, energy cost management is critical for the company, as these expenses have a significant impact on its profitability.

In that respect, CRH has done a decent job in managing its energy needs and related costs. CRH revealed at the company’s interim results briefing that “we buy upwards” or “north of 40%” of “our total bitumen requirements” in advance, and it also highlighted that “rolling forward contracts” ensure that “we’re about 50% covered in any of the main (energy raw material) categories going forward for about 6 months.”

Also, it is noteworthy that the spike in gas prices in Europe shouldn’t have a significant impact on CRH. CRH isn’t dependent on either liquefied petroleum gas or natural gas, and Europe is a relatively smaller market for the company as compared to North America. CRH stressed at its 1H 2022 earnings call that “we are not major users of gas.” Also, CRH derives the majority of its earnings outside of Europe. In its 1H 2022 results presentation slides, CRH highlighted that the EBITDA contribution split between North America and Europe for the company is roughly 3:1.

In summary, rising energy costs have been less of a headache for CRH, and this has allowed CRH to grow its operating income even in tough times like these.

Striking A Good Balance Between Capital Investment And Capital Return

CRH has maintained a good balance between investing to drive future growth and returning excess capital to the company’s shareholders, as evidenced by recent actions that it has taken.

Earlier on July 11, 2022, CRH disclosed that it has concluded the takeover of Barrette Outdoor Living, which it refers to as “North America’s leading provider of residential fencing and railing solutions” in its press release. The consideration for the Barrette Outdoor Living acquisition was $1.9 billion, and this was funded with the sale of its building envelope business for $3.8 billion in May 2022. Year-to-date in 2022, CRH also spent another $0.9 billion on 15 bolt-on M&A transactions.

CRH was disciplined as it didn’t overpay for its acquisitions. The 15 bolt-on deals were concluded at an average EV/EBITDA multiple of 8 times, while Barrette Outdoor Living was acquired at less than 8 times EV/EBITDA incorporating the effects of expected synergies.

More importantly, CRH also continued with its shareholder capital return initiatives, on top of its inorganic growth plans.

The company raised its interim dividend by +4% YoY for 1H 2022, and this translates into a five-year historical dividend CAGR of +12% for CRH. More significantly, CRH has an impressive track record of having either maintained or grew its annual dividends for the past 38 years. With the recent interim dividend raise, the company is certainly on track to increase its dividends for full-year FY 2022.

CRH also allocated $800 million to share repurchases in 2022 year-to-date. These share buybacks certainly make a lot of sense, as CRH is currently trading below its historical averages. The market currently values CRH at consensus forward next twelve months’ normalized EV/EBITDA and P/E multiples of 6.1 times and 12.4 times, respectively as per S&P Capital IQ. In comparison, CRH boasts relatively higher 10-year historical mean forward EV/EBITDA and P/E multiple of 9.0 times and 16.5 times, respectively. CRH has created value for its shareholders by buying back its own undervalued shares.

Closing Thoughts

CRH warrants a Buy rating. The stock’s current valuations are undemanding, and the company’s recent interim financial results and capital allocation actions have been good.

Be the first to comment